FINRA Reminds Firms of Their Sales Practice Obligations With Reverse Exchangeable Securities (Reverse Convertibles)

Executive Summary

Reverse exchangeable securities, commonly called "reverse convertibles," are popular structured products with retail investors, due in large part to the high yields they offer. However, reverse convertibles are complex investments that often involve terms, features and risks that can be difficult for retail investors and registered representatives to evaluate. Firms that sell reverse convertibles are reminded to ensure that their promotional materials or communications to the public regarding these products are fair and balanced, and do not understate the risks associated with them. Firms are also reminded to ensure that their registered representatives understand the risks, terms and costs associated with these products, and that they perform an adequate suitability analysis before recommending them to any customer.

General questions concerning this Notice should be directed to:

Questions relating to communications with the public should be directed to Amy C. Sochard, Director, Programs & Investigations, Advertising Regulation, at (240) 386-4508.

Background & Discussion

A reverse convertible is a structured product that typically consists of a high-yield, short-term note of the issuer that is linked to the performance of an unrelated reference asset, usually common stock, a basket of stocks, an index or another instrument. The initial investment for most reverse convertibles is $1,000 per security, and most have maturity dates ranging from three months to one year. The coupon rate on the note component of a reverse convertible is usually higher than the yield on a conventional debt instrument of the issuer with a similar maturity, or of an issuer with a comparable debt rating. Some recently issued reverse convertibles have annualized coupon rates of 30 percent or more.

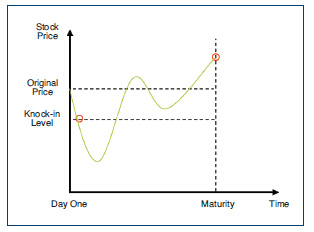

The higher yield reflects the risk that, instead of a full return of principal at maturity, the investor could receive less than a full return of principal if the value of the reference asset has fallen below a certain level, often referred to as the "knock-in" or "barrier" level. Depending on the underlying asset, the investor could receive a predetermined number of shares of common stock (or cash equivalent), which would amount to less than the investor's original investment. Each reverse convertible has its own terms and conditions, but, generally, if the price of the reference asset remains above the knock-in level throughout the life of the note, the investor will receive a full return of principal. In some cases, the investor will also receive a full return of principal if the price of the reference asset ends above the knock-in level at maturity, even if it has fallen below it during the term of the investment; in other cases, any breach of the knock-in level will trigger repayment of less than the original principal (e.g., in shares of stock). However, the investor typically will not participate in any appreciation in the value of the reference asset during the life of the note.

In effect, the investor in the reverse convertible is selling the issuer a put option on the reference asset in exchange for an above-market coupon during the life of the note. Generally speaking, the higher the coupon rate, the higher the expected volatility of the reference asset, which in turn means a greater likelihood that the knock-in price will be breached and the investor will receive less than a full return of principal at maturity.

Reverse convertibles can have complex pay-out structures involving multiple variables that can make it difficult for registered representatives and their customers to accurately assess their risks, costs and potential benefits. For example,1 the pay-out structure of reverse convertibles with common stock as the reference asset could result in the following scenarios:

| Scenario2 | Stock Price Visual | At maturity, the investor gets |

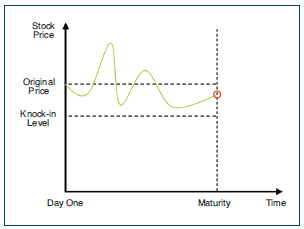

| 1. The stock price never declines below the knock-in level, but ends below the original price. |  |

Full return of principal in cash (despite the decline in the stock price), plus any fixed coupon payments. |

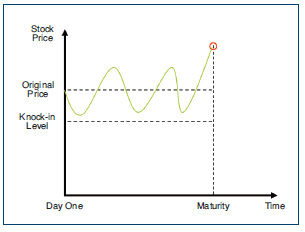

| 2. The stock price never declines below the knock-in level, and ends above the original price. |  |

Full return of principal in cash, plus any fixed coupon payments, but no participation in the increase in the stock price. |

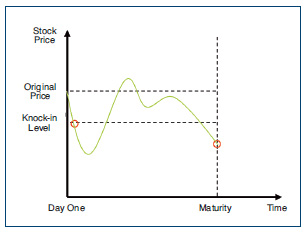

| 3. The stock price ends below the knock-in level. |  |

Predetermined number of shares of stock (or cash equivalent), worth less than the principal amount, plus any fixed coupon payments. |

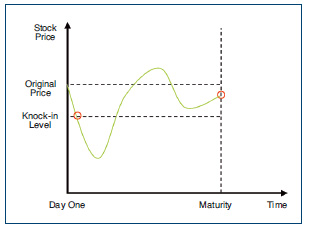

| 4. The stock price declines below the knock-in level, but ends between the original price and knock-in level. |  |

Predetermined number of shares of stock (or cash equivalent) worth less than the principal amount, plus any fixed coupon payments; or full return of principal in cash, plus any fixed coupon payments, depending on the issuer and product. |

| 5. The stock price declines below the knock-in level, but ends above the original price. |  |

Full return of principal in cash, plus any fixed coupon payments, but no participation in the increase in the stock price. |

Because the note component of a reverse convertible is an unsecured debt obligation of the issuer, the payment of the coupon is subject to the credit risk of the issuer. While the note component carries the issuer's rating, that rating does not reflect the product's market risk, including the risk that the price of the reference asset will fall below the knock-in level. Some reverse convertibles have call provisions that give the issuer the option to require redemption of the investment before maturity. There may also be complex tax implications associated with reverse convertibles, with tax treatment depending on whether the investor receives a return of principal or stock at maturity.

Communications With the Public and Other Sales Practices

Reverse convertibles are complex investments that may be difficult for investors to understand. Before recommending a reverse convertible to a retail customer, a registered representative should discuss the product with the customer to ensure that the customer makes an informed decision about whether to purchase the reverse convertible. The registered representative and retail customer should discuss such matters as the following:

Under NASD Rule 2210, firms must ensure that all communications with the public are based on principles of fair dealing and good faith, fair and balanced, and provide a sound basis for evaluating the facts about any particular security or type of security, industry or service. No firm may omit any material fact or qualification if the omission, in the light of the context of the material presented, would cause the communications to be misleading. For example, communications with the public should disclose the product and liquidity information noted above to the extent reasonably necessary to balance any discussion of the benefits and advantages of a reverse convertible. In addition, no firm may make any false, exaggerated, unwarranted or misleading statement or claim in any communication with the public, or publish, circulate or distribute any public communication that the firm knows or has reason to know contains any untrue statement of a material fact or is otherwise false or misleading.

Firms are reminded that providing risk disclosure in a prospectus or supplement does not cure otherwise deficient disclosure in sales material, even if that sales material is accompanied or preceded by the prospectus or prospectus supplement.

Firms and their registered representatives should not suggest that reverse convertibles are ordinary debt securities. If a firm or registered representative refers to the product's credit rating, they may not suggest that the rating has any bearing on the expected performance of the reference asset, nor may they exaggerate the probability that the investor will receive a full return of principal.

Firms must not present annualized yield or coupon information for reverse convertibles in a misleading manner. For example, a 10 percent per annum coupon provides an actual return of roughly 2.5 percent (based on a 360-day year) over a three-month term. For products that mature in less than a year, firms must balance any communication that promotes or touts annualized yield with prominent disclosure of the actual percentage return and the term of the note.

Suitability

NASD Rule 2310 requires that, before recommending the purchase or sale of a security, firms must have a reasonable basis for determining that the product is both suitable for at least some investors, and suitable for each specific customer to whom it is recommended. To assess the general suitability of a reverse convertible for at least some investors, firms must carefully review and understand the risks, costs, terms and conditions of the product. The firm must fully understand a reverse convertible's terms and features, including its payout structure, call features, the conditions under which the investor would and would not receive a full return of principal, the volatility of the reference asset and the product's credit, market and other risks. Because each reverse convertible is unique, firms must perform this analysis for each reverse convertible they recommend.3

To assess the suitability of an investment for a specific customer, Rule 2310 requires that firms "shall make reasonable efforts to obtain information concerning: (1) the customer's financial status; (2) the customer's tax status; (3) the customer's investment objectives; and (4) such other information used or considered to be reasonable by such member or registered representative in making recommendations to the customer. "The firm's consideration of the benefits of the product to a particular customer (such as the promise of an above market coupon rate) must take into account the potential volatility of the reference asset, the risk that the investor may receive less than the value of the principal upon maturity, and the other risks and costs associated with the product. Depending upon the terms of a specific reverse convertible, even an above market coupon rate may not be reasonable given the risks and costs associated with the product for a particular customer. Firms should also consider the equity position that would result should the customer receive shares in the reference asset instead of a return of principal, and whether that position would be suitable for the customer.4

In addition, NASD IM-2310-2(e) (Fair Dealing with Customers with Regard to Derivative Products or New Financial Products) emphasizes the obligation of firms to deal fairly with customers when making recommendations or accepting orders for new financial products. The IM states that "[a]s new products are introduced from time to time, it is important that firms make every effort to familiarize themselves with each customer's financial situation, trading experience, and ability to meet the risks involved with such products and to make every effort to make customers aware of the pertinent information regarding the products."

Eligible Accounts

Given the put option component of reverse convertibles, firms should also consider whether purchases of reverse convertibles should be restricted to investors whose accounts have been approved for options trading, and whether it would be appropriate to apply the suitability requirements for option trading to those products, including the requirement for firms recommending opening transactions in option contracts to have reasonable grounds for believing that the customer has such knowledge and experience in financial matters that he may reasonably be expected to be capable of evaluating these risks.5 Firms that do not limit reverse convertibles to accounts approved for options trading should develop other comparable procedures designed to ensure that reverse convertibles are only sold to persons for whom the risk of such products is appropriate. These firms should be prepared to demonstrate the basis for allowing investors with accounts not approved for trading options to purchase reverse convertibles. Firms also are reminded that approving an account to trade reverse convertibles is not a substitute for a thorough suitability analysis.6

Supervision and Training

FINRA firms must have adequate written supervisory procedures and supervisory controls that are reasonably designed to ensure that sales of reverse convertibles comply with the federal securities laws and FINRA rules.7 Firms must also adequately train employees who sell, or who supervise those who sell, reverse convertibles. Among other things, that training should emphasize the need to understand and consider:

1 The examples in this Notice are hypothetical composites based on terms and structures of real notes, and are included for illustrative purposes only.

2 These scenarios assume that the reverse convertibles are not callable. If one is called, generally the investor would receive the principal amount plus accrued interest.

3 See NTM 05-59.

4 Ibid.

5 See FINRA Rule 2360(b)(19).

6 See NTM 05-59. Also see NTM 05-26 regarding vetting new products.

7 See NASD Rules 3010; NASD Rule 3012; and Incorporated NYSE Rule 342 and its related supplementary material and interpretations. The current FINRA rulebook consists of (1) FINRA Rules; (2) NASD Rules; and (3) rules incorporated from NYSE (Incorporated NYSE Rules) (together, the NASD Rules and Incorporated NYSE Rules are referred to as the Transitional Rulebook). While the NASD Rules generally apply to all FINRA member firms, the Incorporated NYSE Rules apply only to those member firms of FINRA that are also members of the NYSE (Dual Members). The FINRA Rules apply to all FINRA member firms, unless such rules have a more limited application by their terms. For more information about the rulebook consolidation process, see Information Notice 3/12/08 (Rulebook Consolidation Process).