Manage Your Debt

Most people carry debt in one form or another, and you are probably one of them. Your debts, also called liabilities, can include the mortgage on your home, loans for automobiles or education expenses and, of course, credit card balances. Virtually all of these debts come with an obligation to pay monthly interest on the balance you still owe. As you prepare to invest, take stock of your current debts and try to pay them down. The less money you put towards paying off outstanding debts and interest charges, the more you will have to save and invest for your future.

If you use a credit card to make purchases, you should know that they have advantages and disadvantages. If you spend within your means and pay off your balance on time—and in full—each month, credit cards can serve as a safe and convenient substitute for cash. And there is the added bonus that they can help you establish and maintain a solid credit history. But if you use them to purchase items you couldn't otherwise afford—or max out your cards to cover routine monthly expenses—credit cards can quickly compound your debt and hurt your credit score.

Few money-management strategies pay off as well as, or with less risk than, paying off all high interest debt you may have. Let's say you have a $3,000 balance on a credit card that charges 18 percent APR and requires a minimum payment of 2.5 percent each month. Assuming you charge nothing else, it will take you 263 months—nearly 22 years—to pay off your debt! In addition, the total amount you pay for that $3,000 charge will be $4,115.44—an amount that you could have saved or invested. If you can't pay off credit card debt immediately, work out a structured plan to pay off the balance as quickly as possible. You'll save money in the long run.

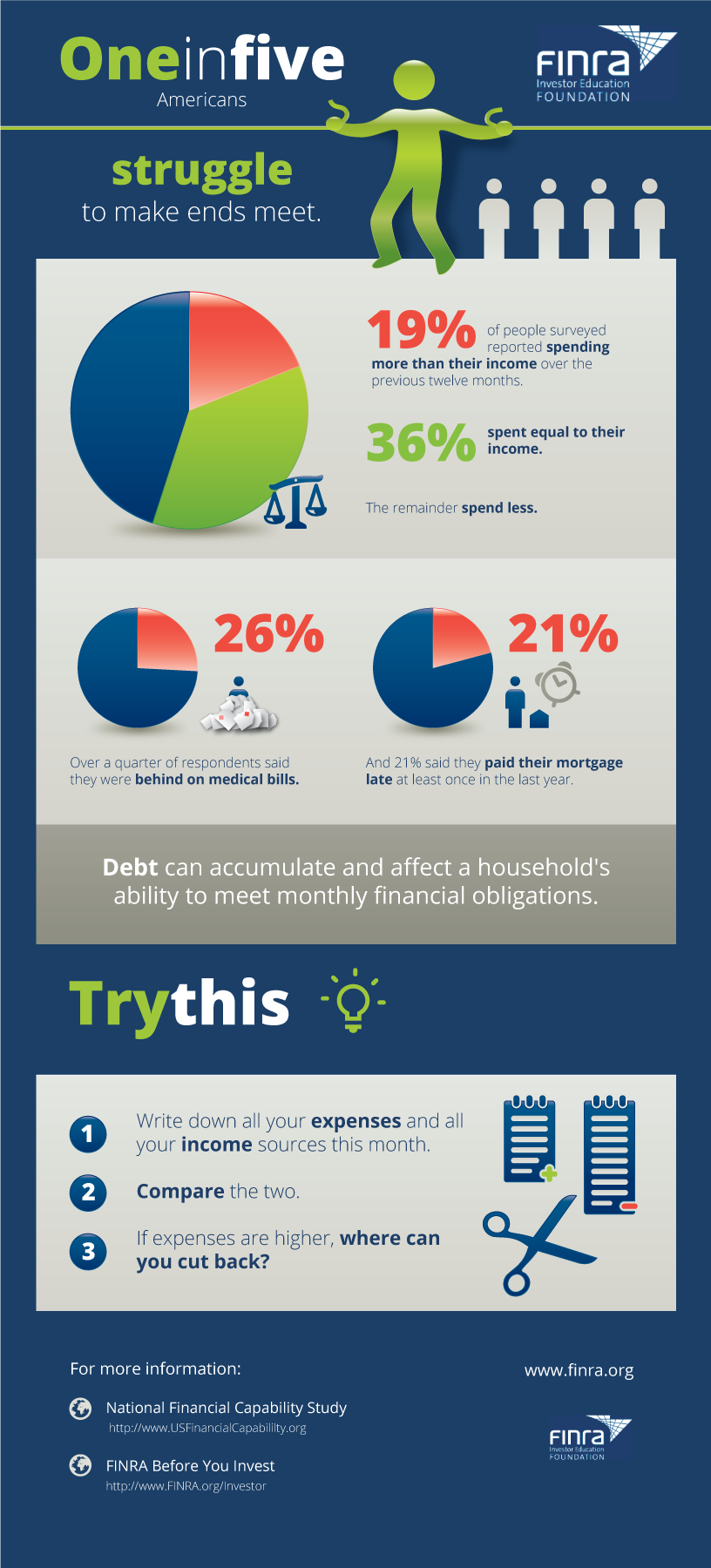

Here’s a sobering statistic: In a recent survey, nineteen percent of respondents reported spending more than their income over the previous twelve months and many were behind on medical bills or paid their mortgage late. The good news is that in most cases spending can be controlled.