Underwriter Financial Status Report

The Underwriter Financial Status Report is a monthly report designed to help firms evaluate the timeliness of financial disclosures made to EMMA, for issuances previously brought to market.

The purpose of this report is to highlights issuances lacking current audited financial filings (LCF) and the lateness of these missing financial filings, based on their anticipated filing time line.

The report offers two alternate views:

-

The Summary view, containing a monthly view of statistics on the number of missing financial filings and timeliness of issuances submitted by your firm; and

-

The Detailed Data view, which shows the details of these issuances.

Please note that you will not see 12 months of ‘Underwriter Financial Status Report’ data until you have been submitting for over 12 months. Also, each monthly report card displays a compliance snapshot at a particular point in time and will not be updated to reflect submissions made after the report card is published. Please see the Summary View and Detailed Data View sections for more information.

The information in this report is provided to assist FINRA members in assessing and monitoring compliance with certain reporting obligations. All filing information contained in this report has been provided by the MSRB and its accuracy has not been verified by FINRA. If inaccuracies are discovered or if you have questions regarding the content of this specific report, please send an email to the Report Center administrator at [email protected] or contact FINRA Regulatory Operations at (202) 728-8011.

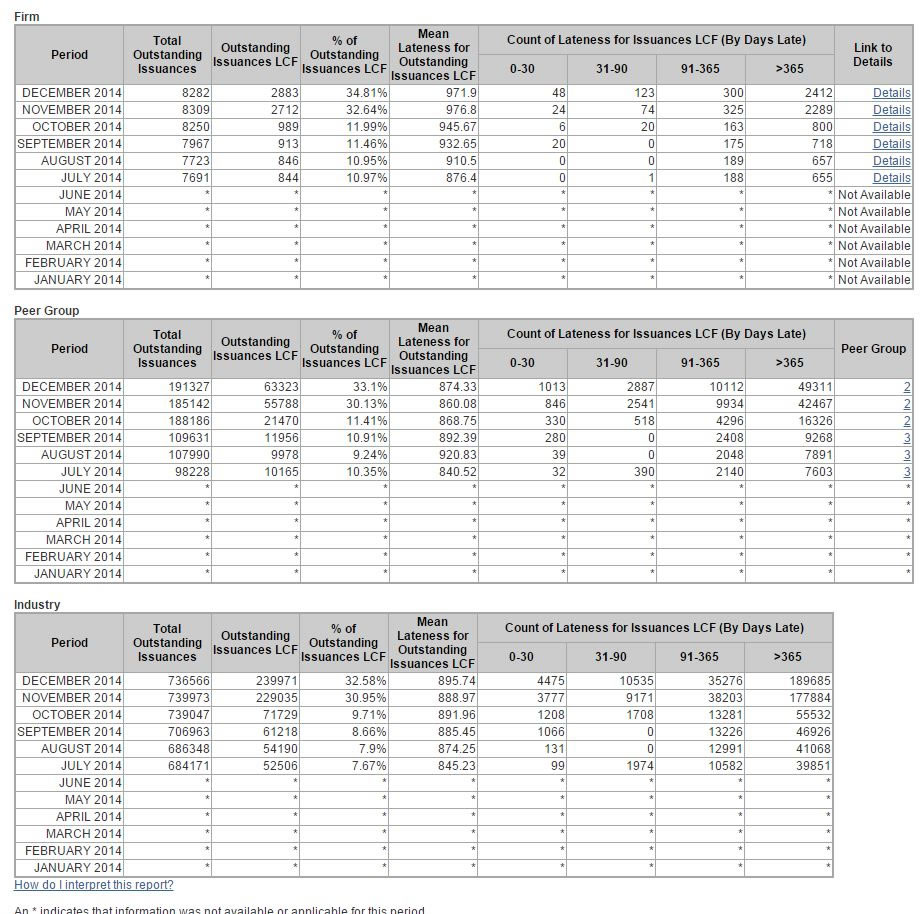

Summary View

The Summary view of the Underwriter Financial Status Report provides monthly statistics related to the financial reporting disclosure related to outstanding issuances brought to market by a firm, and available on EMMA.

The table below provides a reference description for the elements found in the Summary View of the Underwriter Financial Status Report (See Underwriter Financial Status Report Summary Figure 1 for a sample report). The definitions in the below table are applicable for firm, peer, and industry tables found in the report.

|

Term |

Description |

|---|---|

| Total Outstanding Issuances | Count of submissions previously made to EMMA, that did not reach maturity by the end of the reported period, and were underwritten. |

| Outstanding Issuances LCF |

Count of submissions underwritten (taken from G-32 data) where at least one associated CUSIP has been identified as Lacking Current Financials (LCF). Lacking Current Financials (LCF): Underwriters of most municipal securities must enter into a written agreement or contract with the issuer to ensure that the issuer provides financial information to EMMA on an annual basis. If the bond the firm sold closed more than a year ago and no annual or audited financial statements has been submitted to EMMA, you firm’s transactions of that bond will be flagged as lacking current financials. Additionally, if the effective date of the financial data is more than 17 months prior to the transaction, the financial information is no longer considered current. Sales of that bond will be flagged as lacking current financials. |

| % of Outstanding Issuances LCF | This is the percentage of outstanding issuances LCF out of the total outstanding issuances for the reported period. |

| Mean Lateness for Outstanding Issuances LCF | The average value of issuances (having not yet reached maturity) that are LCF.. |

| Count of Lateness for Issuances LCF (By Days Late): 0-30 | Count of submissions LCF (underwritten by the reported firm) that are late from 0-30 days during the displayed period. |

| Count of Lateness for Issuances LCF (By Days Late): 31-90 | Count of submissions LCF (underwritten by the reported firm) that are late from 31-90 days during the displayed period. |

| Count of Lateness for Issuances LCF (By Days Late): 91-365 | Count of submissions LCF (underwritten by the reported firm) that are late from 91-365 days during the displayed period. |

| Count of Lateness for Issuances LCF (By Days Late): >365 | Count of submissions LCF (underwritten by the reported firm) that are late >365 days during the displayed period. |

| Link to Details | This link is used to obtain the specific issuances determined to be lacking current financial filings. This is only available for the selected firm. |

| Peer Group | This value identifies the group of firms with similar underwriting activity over the preceding 3 months. Peer groups are determined based on the number of OS filings a firm submitted to MSRB's EMMA system during the current month and previous 2 months (i.e. rolling 3 month period). Peer groups are defined as:

|

Underwriter Financial Status Report Summary Figure 1

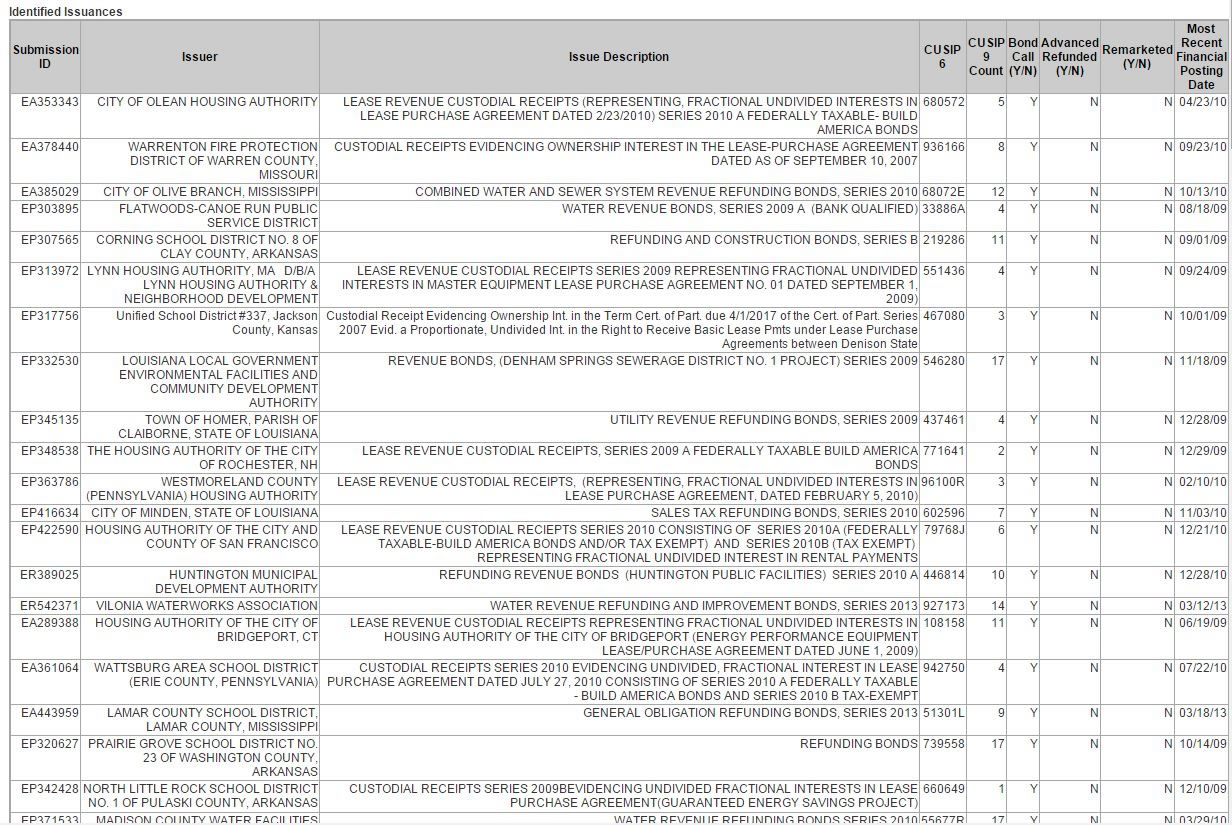

Detail Data

The Detailed Data view of the Underwriter Financial Status Report displays details about the issuances included in the Summary counts. To access the Detailed Data view, click on the ‘Link to Detailed Data’ hyperlink, or use the View drop-down at the top of the report to navigate from the Summary view to the Detailed Data view.

The table below provides a reference description for the elements found in the Detailed Data View of the Underwriter Financial Status Report (See Underwriter Financial Status Report Detail Data Figure 1 for a sample report).

|

Term |

Description |

|---|---|

| Submission ID | This is the unique identifier assigned by EMMA at the time of the first data submission related to this offering. The same Submission Identifier should be used for all follow-up events (document submission, amendment submissions and/or cancellation) related to a single offering. |

| Issuer | This is the name of the issuer of this offering. |

| Issue Description | This is the description of the issue(s) included in the offering . |

| CUSIP 6 | The CUSIP base for the issuer. |

| CUSIP 9 count | A count of the unique securities for the issue that are lacking current financial filings at the time of analysis. |

| Bond Call (Y/N) |

Indicates if this CUSIP was subject to a Bond Call (per filing on EMMA). |

| Advanced Refunded (Y/N) | Indicates if the CUSIP was subject to advanced refunding (per filing on EMMA). |

| Remarketed (Y/N) | Indicates if the CUSIP was subject to remarketing (per filing on Emma). |

| Most Recent Financial Posting | This is the date of the annual or audited financial information that was most recently filed on EMMA for this issue. If this date is more than 365 days prior to the execution date of the transaction, the transaction will be marked "LCF" (i.e., Lacking Current Financials). Please note: this field will only be populated if this trade has the LCF alert code. However, if the trade has the LCF alert code and no financials have ever been posted for this bond, no date will be displayed. Note: Since individual securities for the issue (CUSIP 9) may have different values, the Report Card will show the most recent financial filing posting date. |

| Most Recent Financial Effective Date | This is the most recent effective date of the annual or audited financial information available on EMMA for this security. For transactions marked "LCF" (i.e., Lacking Current Financial Filings), this date will either be more than 17 months prior to the execution date of the transaction or absent. Please note: this field will only be populated if this trade has the LCF alert code. However, if the trade has the LCF alert code and no financial filings have ever been posted for this bond, no date will be displayed. Note: Since individual securities for the issue (CUSIP 9) may have different values, the Report Card will show the most recent financial filing effective date. |

| Type of Unaudited Financial Events (If any) | If there is any event filing included in the above count, this column will contain information about what type(s) of event(s) filed. If more than one type of disclosure has been filed within the last 6 months, the types of disclosure will be separated by dashes. |

| Date of Evaluation |

This is the date on which FINRA imported the data. This date is the time basis for the lateness calculations being conducted |

Underwriter Financial Status Report Detail Data Figure 1