The information below will help you get the most out of all aspects of the conference. Over the next two-and-a-half days, you can choose from over 30 sessions to attend and with numerous opportunities to network with peers, interact with FINRA staff, and learn about products and services designed to help you comply with FINRA rules.

Agenda

*This agenda is subject to change.

Monday, May 12

2:00 p.m. – 4:30 p.m.

Cyber Tabletop Exercise - pre-registration required (University of DC/Catholic University)

Join us for a Cyber Tabletop Exercise (TTX)! As the complexity and prevalence of cyber threats grow, it is more essential than ever for CCOs and firm leaders to understand how to prepare for and respond to cyber-attacks. This session will be facilitated by FINRA staff and covers key aspects of the types of cyber threats and risks firms can encounter, Incident Response frameworks, 3rd party risk considerations, and an interactive cyber TTX with actionable tips firms can leverage to strengthen their cyber posture.

5:00 p.m. – 6:30 p.m.

New Attendee Reception - pre-registration required

5:00 p.m. – 7:00 p.m.

Registration & Information

Tuesday, May 13

7:30 a.m. – 6:00 p.m.

Registration & Information

8:00 a.m. – 9:30 a.m.

Senior Investor Financial Exploitation Case Study Workshop– pre-registration required (University of DC/Catholic University)

Financial exploitation of vulnerable adults is an ongoing threat. Join us for an interactive workshop that focuses on how to identify, aid and manage this threat targeting investors. This hands-on session facilitates active discussions of current elder fraud trends through a series of practical case studies. Learn from FINRA staff and work with industry practitioners to help increase investor protection.

8:30 a.m. – 10:00 a.m.

Breakfast

10:00 a.m. – 5:00 p.m.

FINRA IDEA Booths

10:00 a.m. – 10:30 a.m.

Plenary Session – Welcome Remarks and a Conversation With FINRA CEO and President Robert Cook (Marquis Ballroom)

Join FINRA’s CEO and President, Robert Cook, and Kayte Toczylowski, Vice President for FINRA Member Relations and Education as they discuss the regulatory landscape, impacts on member firms and how FINRA is helping member firms stay compliant.

10:30 a.m. – 11:30 a.m.

Plenary Session – Fighting Fraud: A Paradigm Shift (Marquis Ballroom)

Learn about the latest developments in the way FINRA gathers, coordinates, analyzes and shares intelligence related to cybersecurity and fraud risks, as well as information about tools and resources to mitigate these threats. This session focuses on FINRA’s strategic infrastructure, collaborative efforts and real-time data sharing at work to help advance the fight against fraud and cybersecurity threats.

11:30 a.m. – 12:00 p.m.

Networking Break

12:00 p.m. – 12:50 p.m.

Breakout Sessions:

A View Into FINRA’s Member Supervision Programs (Liberty Ballroom)

Join FINRA's Member Supervision staff as they provide transparency into their operations, initiatives, priorities and industry trends and discuss top observations of effective strategies used by firms to create strong compliance programs and protect investors.

Filing Requirements and Due Diligence Obligations for Public Offerings and Private Placements (Independence A – D)

During this session, FINRA staff and industry professionals navigate the regulatory landscape, filing requirements for unregistered and registered offerings, due diligence strategies and ways to reduce and eliminate conflicts of interest.

Keeping Credentials Current: The Ins and Outs of Continuing Education (Independence E – H)

Improve your understanding of continuing education (CE) requirements for investment professionals and resources available to train firm staff. During this session, panelists discuss Regulatory and Firm Element requirements, available resources and programs, including the Maintaining Qualifications Program (MQP) and the Financial Learning Experience (FLEX), and address other CE efforts including NASAA’s Exam Validity Extension Program.

12:50 p.m. – 1:40 p.m.

New Attendee Luncheon - pre-registration required (Salon 12 and 13)

Firm Grouping Networking and General Lunch (Marquis Ballroom)

1:40 p.m. – 2:15 p.m.

Dessert With Exhibitors

2:15 p.m. – 3:05 p.m.

Breakout Sessions:

Communication Supervision Trends and Effective Practices (Liberty Ballroom)

Join this informative discussion on key communications supervision topics including the latest in off-channel, social media trends and more. Hear from panelists as they provide insight into supervisory challenges, share examination observations and explore strategies firms can adopt to strengthen their programs.

Keeping Current With Fixed Income Securities (Independence A – D)

Attend this session to hear from FINRA and MSRB staff on the most recent trends, developments, guidance and effective practices firms can employ when engaging with the fixed income securities markets.

The Rise of Self-Directed Investors: Investing Trends and Compliance Risks (Independence E – H)

The population of self-directed investors is growing exponentially, changing the dynamics of many firms’ client bases. Participate in this session to learn about the identity of self-directed investors today, where they are obtaining investment guidance, opportunities for firms to market to and educate new clientele and effective practices member firms can employ with self-directed investors.

3:05 p.m. – 3:30 p.m.

Networking Break

3:30 p.m. – 4:15 p.m.

Breakout Sessions:

A View Into FINRA’s Enforcement Program (Liberty Ballroom)

Hear directly from FINRA Enforcement staff as they share the latest trends, noteworthy cases, priorities and critical insights member firms can leverage to strengthen their compliance programs and increase investor protection and market integrity.

Strengthening Your Vendor Risk Management Programs (Independence A – D)

Hear from FINRA and industry professionals as they provide insight into ways firms can strengthen third-party risk management. Learn more about mitigating risk through the vendor lifecycle, current issues in the industry, steps FINRA has taken to support member firms, and how firms are approaching vendor management.

Market Structure Regulatory Developments (Independence E – H)

FINRA staff and industry professionals share their perspectives on FINRA's role in promoting market integrity and evolving regulatory updates including Regulation NMS, extended hours and other market structure developments. Learn how peers prepare and adapt their compliance and surveillance programs in response to market developments.

4:15 p.m. – 4:30 p.m.

Break

4:30 p.m. – 5:00 p.m.

Plenary Session – A Conversation With House Financial Services Committee Chairman French Hill and Former FINRA Chairman Jack Brennan (Marquis Ballroom)

Join this discussion to hear insights from Congress on the current legislative landscape and the impact on the financial industry. Introduction is provided by FINRA’s CEO and President, Robert Cook.

7:30 p.m. – 9:30 p.m.

Opening Night Reception (The Anthem)

Wednesday, May 14

6:15 a.m. – 7:15 a.m.

FINRA 5K – pre-registration required (meet in lobby at 6 a.m.)

7:30 a.m. – 6:00 p.m.

Registration & Information

7:30 a.m. – 8:45 a.m.

Breakfast

8:45 a.m. – 10:00 a.m.

Plenary Session – Artificial Intelligence: Opportunities and Use by Member Firms (Marquis Ballroom)

Attend this dynamic session to learn more about the transformative impact of generative Artificial Intelligence (AI) has on the financial industry. Hear from industry professionals on the uses, opportunities, implementation and resources firms have leveraged to evaluate, implement, govern and enhance AI in their businesses. Introductory remarks are provided by Steve Randich, Executive Vice President of FINRA’s Office of the Chief Information Officer.

10:00 a.m. – 6:15 p.m.

FINRA IDEA Booths

10:00 a.m. – 10:15 a.m.

Break

10:15 a.m. – 10:45 a.m.

Plenary Session – A Conversation With Scott Curtis, Chair, FINRA Board of Governors (Marquis Ballroom)

Join FINRA CEO and President Robert Cook and Scott Curtis, the Chair of FINRA’s Board of Governors, for a discussion on today’s regulatory landscape and how FINRA and firms can work together to promote vibrant capital markets and empower member firm compliance. Introduction is provided by Marcia Asquith, Executive Vice President of FINRA Board and External Relations.

10:45 a.m. – 11:15 a.m.

Networking Break

11:15 a.m. – 12:15 p.m.

Breakout Sessions:

Effective Practices in Remote Supervision and Inspections (Liberty Ballroom)

Hear from FINRA staff and member firms who share perspectives on remote supervision and changes to regulation that allow for residential supervisory locations and remote inspections. Learn more about common challenges and how member firms across different business models are addressing them and continue to prepare for longer-term changes in the modern workforce.

Insights Into Trade Surveillance Reporting Obligations and Risk Detection (Independence A – D)

Hear from FINRA staff and firms who will share perspectives on best practices in trade surveillance and risk detection. Learn about current trends, challenges and how firms and FINRA are addressing them. Gain an understanding of tools and resources available to assist member firms with surveillance and hear about new tools being developed.

Financial Management Regulatory Developments (Independence E – H)

Participate in this insightful session focused on the latest regulatory developments that impact financial management and gain insights into effectively adapting firm practices to ensure adherence to guidelines.

12:15 p.m. – 1:15 p.m.

Lunch With the Regional Committees - pre-registration required (Salon 12 and 13)

Trending Topics Networking and General Lunch (Marquis Ballroom)

1:15 p.m. – 1:45 p.m.

Desserts With Exhibitors

1:45 p.m. – 2:30 p.m.

Breakout Sessions:

Strengthening Compliance of Regulation Best Interest and Form CRS (Liberty Ballroom)

Join for an in-depth discussion on Regulation Best Interest where panelists provide guidance and share effective practices for compliance in an effort to further cultivate trust and transparency in client relationships.

A View Into FINRA’s Market Regulation and Transparency Services Program (Independence A – D)

Join FINRA staff for an exclusive view into Market Regulation and Transparency Services and learn about new initiatives, rulemaking developments, proposed SEC rules and perspectives on what firms should consider to refine and strengthen securities compliance programs.

Foundations of Building Strong Business Continuity Plans (Independence E – H)

In an unpredictable business environment, establishing robust business continuity programs is essential to resiliency and sustainability. Hear from panelists as they discuss what to do in the event of an emergency or significant business disruption such as a cyber event, common pitfalls and effective practices for building quick response plans to sustain investor protection and business operations.

2:30 p.m. – 2:45 p.m.

Break

2:45 p.m. – 3:45 p.m.

Breakout Sessions:

Financial Crimes: Getting Ahead of the Adversaries (Liberty Ballroom)

In an evolving threat landscape, staying one step ahead of the adversaries is crucial. This session explores the latest fraud and money laundering trends targeting the markets and firms as well as tools and practices firms can leverage to strengthen prevention and detection.

Mitigating Impacts of Fraud and Scams Targeting Customers (Independence A – D)

Gain knowledge needed to safeguard your customers in an era of evolving fraud threats. In this informative session, panelists trace the full lifecycle of a fraud scheme targeting investors and address how to engage with potential victims and outside parties, manage fraud events and safeguard investors against recidivism. Learn about tools and resources available to strengthen investor protection.

Complex Products: New Developments and Compliance Considerations for Retail Firms (Independence E – H)

Gain FINRA and industry insights into the latest products and emerging issues impacting the retail space and learn more about top concerns, supervisory challenges and strategies your firm can adopt.

3:45 p.m. – 4:00 p.m.

Break

4:00 p.m. – 5:00 p.m.

Breakout Sessions:

Cybersecurity: Trends and Building Strong Programs (Liberty Ballroom)

In this session, panelists explore the latest trends in cybersecurity, highlighting the emerging threats and technologies used to perpetrate cyber-attacks and discuss effective practices for firms. Join this session to learn practical strategies for building effective cyber programs to strengthen your firm’s security posture. The session is introduced by SEC’s Acting Director of the Division of Examinations, Keith Cassidy, who provides perspectives on the importance of Regulation SP in protecting customer information.

How to Use Data to Drive Effective Oversight (Independence A – D)

This session ties data analytics and governance together to provide you with effective practices to use data for informed reviews. Hear perspectives from firms of various sizes and resources as they discuss risk-based, outcome-driven approaches and learn about the intel that FINRA provides to member firms.

Capital Formation Developments (Independence E – H)

Join this discussion on the opportunities and developments in capital formation and capital raising in today’s dynamic financial environment. Learn about the latest regulatory and industry developments impacting firm processes for raising capital, including proposed amendments and potential implications for firms.

5:00 p.m. – 6:15 p.m.

Networking Reception

Thursday, May 15

7:30 a.m. – 12:15 p.m.

Registration & Information

7:30 a.m. – 9:00 a.m.

Breakfast

9:00 a.m. – 9:45 a.m.

Plenary Session – The Vital Role of Member Engagement for the Self-Regulatory Organization

In this session, panelists explore the various ways FINRA actively engages with member firms to understand their perspectives and to leverage their expertise. This session highlights how FINRA uses its position as an SRO to respond to changes in the regulatory landscape; describes the various opportunities for member firms to contribute to the process; provides examples of how FINRA uses member firm engagement to shape regulatory programs, compliance solutions, and to quickly identify and respond to new risks.

9:45 a.m. – 10:00 a.m.

Break

10:00 a.m. – 11:00 a.m.

Plenary Session – Compliance & Legal Trends (Marquis Ballroom)

Join industry leaders as they discuss trends and key focus areas that are shaping the industry. Panelists share insights on how these changes will affect compliance and how firms are evolving and responding to business, regulatory and technology issues.

11:00 a.m. – 11:15 a.m.

Break

11:15 a.m. – 12:15 p.m.

Plenary Session – Ask FINRA Senior Leaders (Marquis Ballroom)

During this session, FINRA senior staff provide updates on key regulatory issues and initiatives. Panelists address questions relating to FINRA’s risk-based examination program, Enforcement trends, market regulation programs and new and anticipated rules, among other topics.

12:15 p.m.

Conference Adjourns

Receive CRCP, CFP, and CLE CE Credits

The FINRA Annual Conference is eligible for Certified Regulatory and Compliance Professional (CRCP)® and Certified Financial Planner (CFP) continuing education (CE) credits – and depending on your jurisdiction, Continuing Legal Education (CLE) credits. CLE credits may only be available for sessions lasting 50 minutes or longer.

To receive CFP/CLE CE credits, you must:

- Provide the required CE information at the registration desk, if it wasn’t already provided in the registration system.

- Make sure your notifications are turned on under profile settings in the app.

- Then, using the conference app, check in to each session.

- Attend the entire session.

- At the end of the session, immediately enter the verification code into the CE field in the app.

For CRCP credits, attendees must self-report their credits. Visit the CRCP section of FINRA’s website at www.finra.org/crcp for more information.

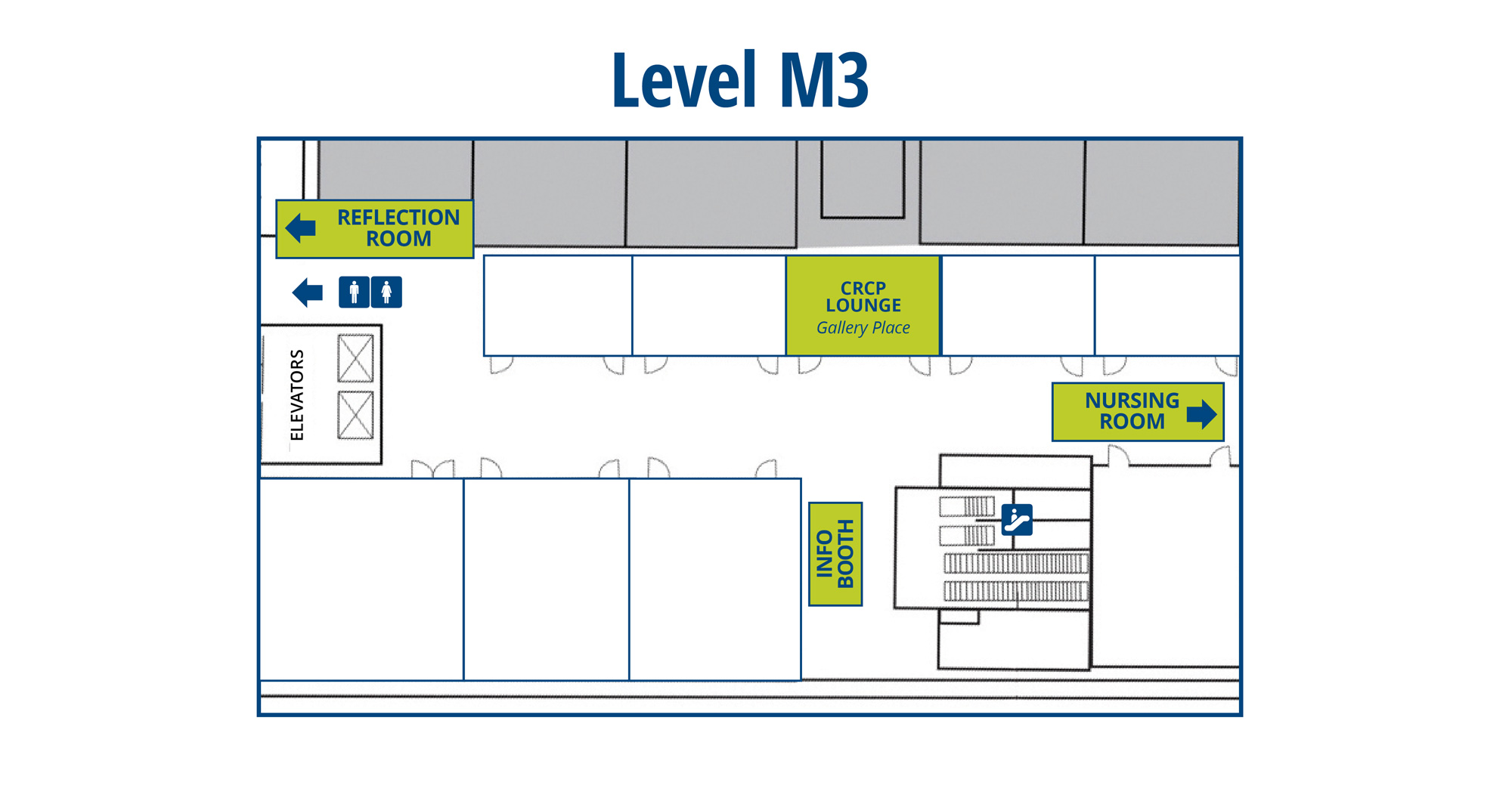

Information Booth

The Information Booth is located on Level M3 where you can find general information about the event, ask CE questions, get help navigating the app and the event.

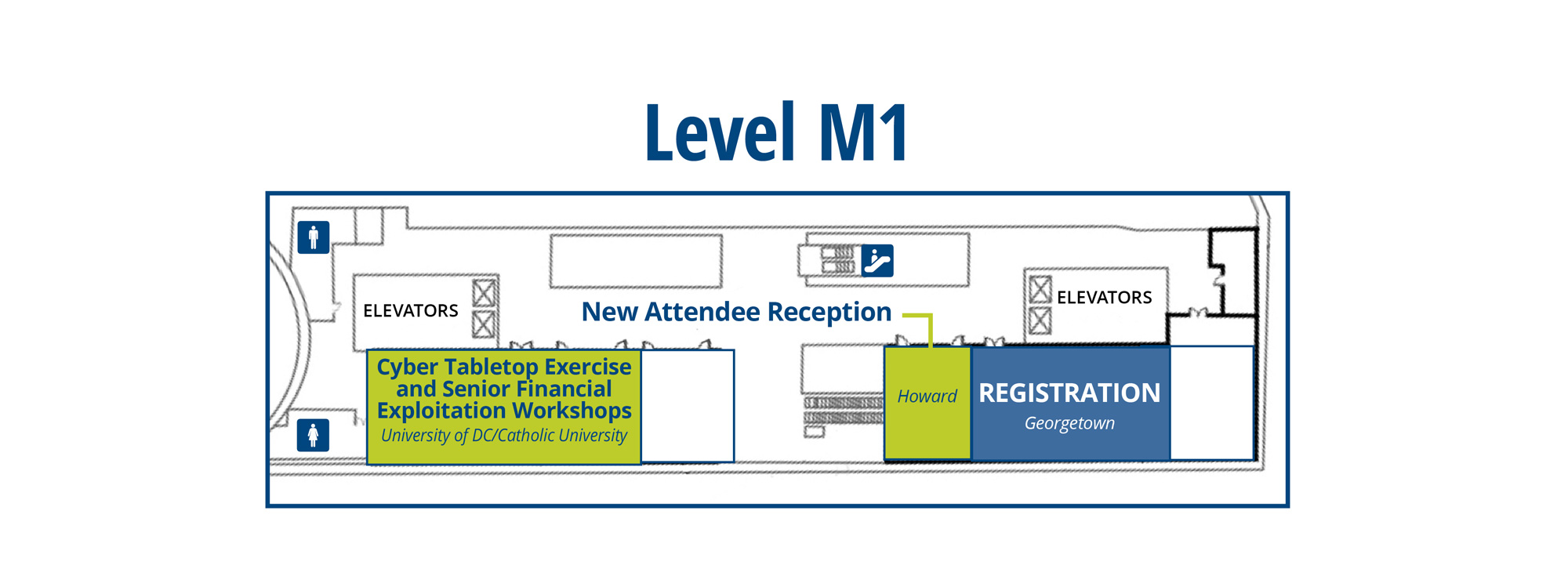

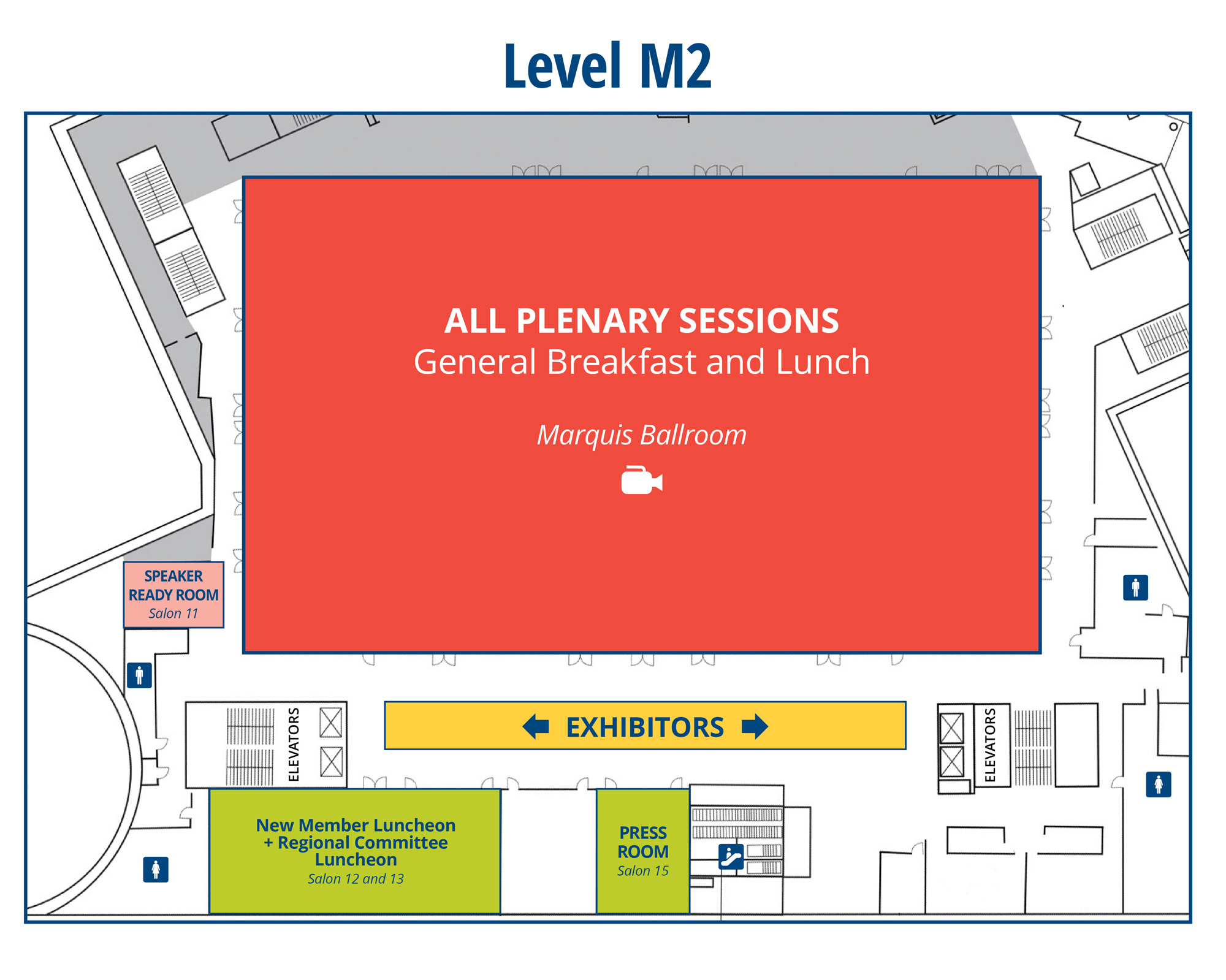

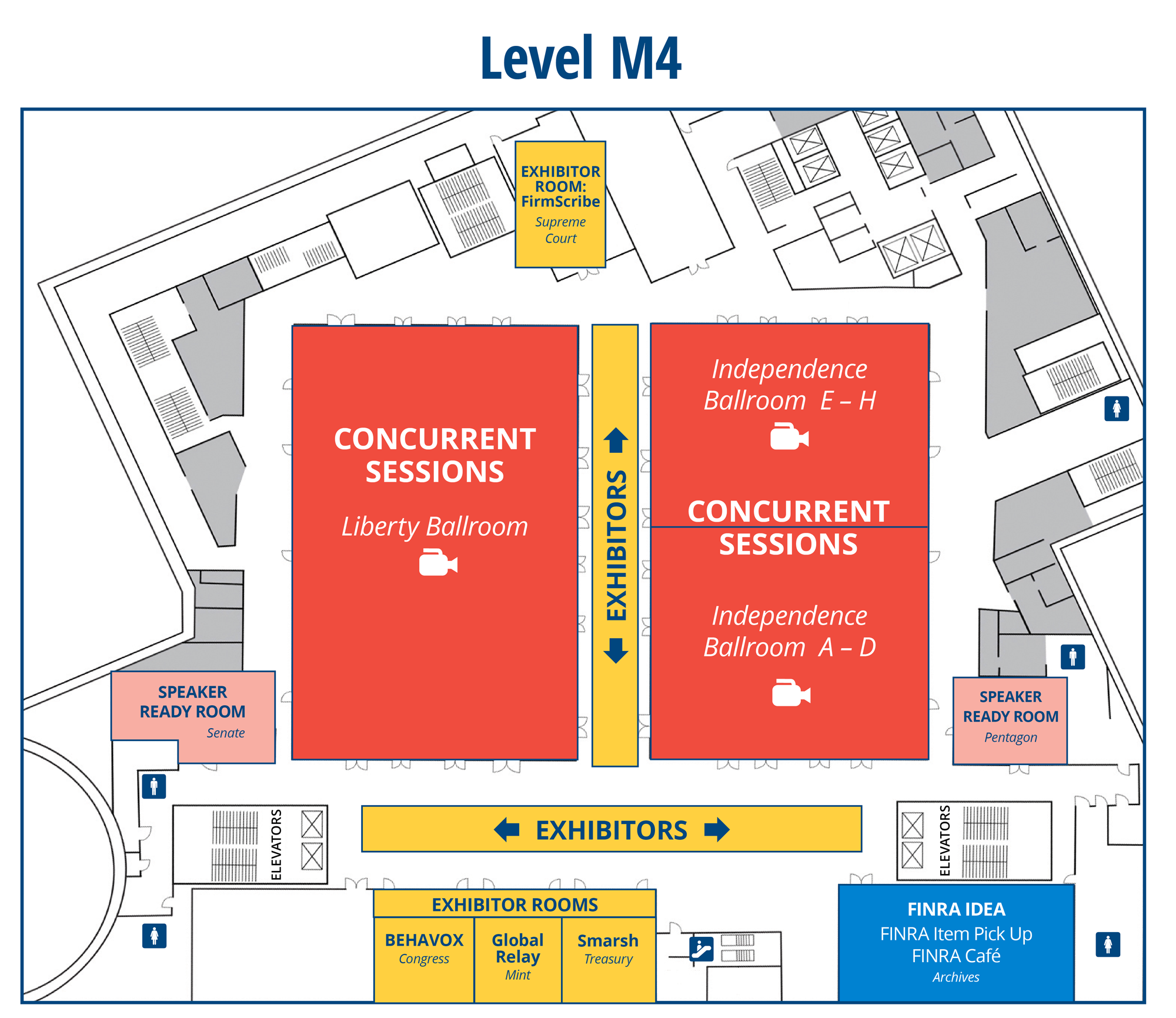

Conference Map

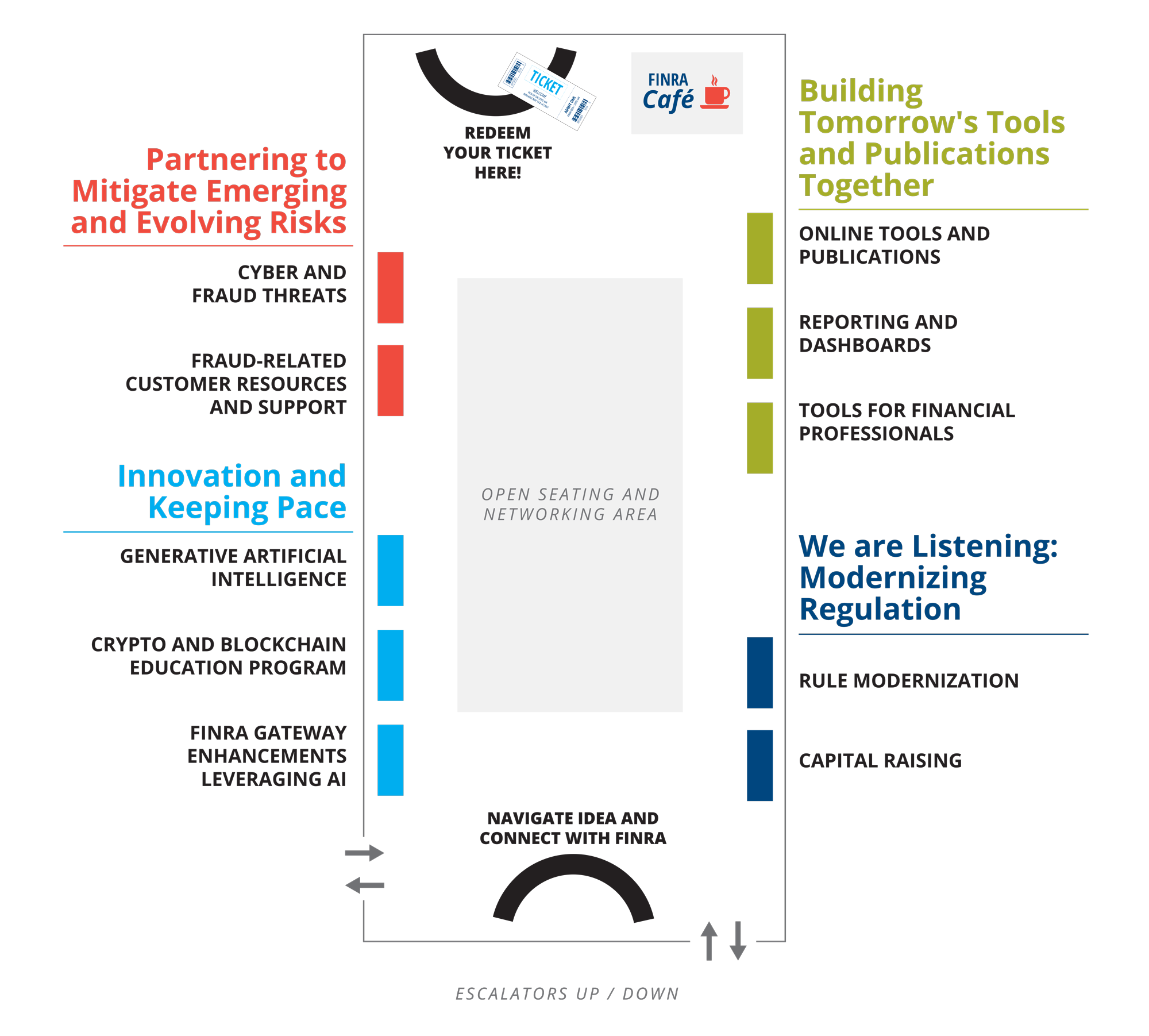

FINRA IDEA – Innovation, Demonstration and Engagement Area

FINRA is committed to continuous improvement that draws on deep engagement with member firms. Step inside FINRA IDEA, located on level M4, to engage with FINRA staff by getting answers to questions and sharing ideas and feedback on FINRA initiatives.

Don’t forget to stop by and pick up your FINRA-branded item and a specialty coffee from FINRA Café.

Areas include:

Area: Partnering to Mitigate Emerging and Evolving Risks

Booths:

- Cyber and Fraud Threats

- Customer Resources and Support

Area: Innovation and Keeping Pace

Booths:

- Generative Artificial Intelligence

- Crypto and Blockchain Education Program

- FINRA Gateway Enhancements Leveraging AI

Area: We are Listening: Modernizing Regulation

Booths:

- Rule Modernization

- Capital Raising

Area: Building Tomorrow’s Tools and Publications Together

Booths:

- Online Tools and Publications

- Reporting and Dashboards

- Tools for Financial Professionals

For guidance on areas in IDEA or help identifying and connecting with FINRA staff at the conference, stop by the Navigate IDEA and Connect With FINRA booth.

IDEA Map

Networking Opportunities and Special Events

- Pre-Event Workshop: Cyber Tabletop Exercise – University of DC/Catholic University | Level M1

Monday, May 12 | 2 p.m. – 4:30 p.m.

(pre-registration required) - New Attendee Reception – Howard and Foyer | Level M1

Monday, May 12 | 5 p.m. – 6:30 p.m.

(pre-registration required) - Pre-Event Workshop: Senior Investor Financial Exploitation Case Study Workshop – University of DC/Catholic University | Level M1

Tuesday, May 13 | 8 a.m. – 9:30 a.m.

(pre-registration required) - Certified Regulatory and Compliance Professionals (CRCP)® Program Lounge for Graduates – Gallery Place | Level M3

Open Tuesday – Wednesday - New Attendee Luncheon – Salon 12 & 13 | Level M2

Tuesday, May 13 | 12:50 p.m. – 1:40 p.m.

(pre-registration required) - Firm Grouping Networking and General Lunch – Marquis Ballroom | Level M2

Tuesday, May 13 | 12:50 p.m. – 1:40 p.m. - Dessert With Exhibitors | Level M4

Tuesday, May 13 | 1:40 p.m.– 2:15 p.m. - Opening Night Reception at The Anthem

Tuesday, May 13 | 7:30 p.m. – 9:30 p.m.

(conference badges are required at this event) - FINRA 5K Run/Walk

Wednesday, May 14 | 6:15 a.m. – 7:15 a.m. | Meet in lobby at 6 a.m.

(pre-registration required) - Lunch With the Regional Committees – Salon 12 & 13| Level M2

Wednesday, May 14 | 12:15 p.m. – 1:15 p.m.

(pre-registration required) - Trending Topics Networking and General Lunch – Marquis Ballroom | Level M2

Wednesday, May 14 | 12:15 p.m. – 1:15 p.m. - Dessert With Exhibitors | Level M4

Wednesday, May 14 | 1:15 p.m.– 1:45 p.m. - Networking Reception – Liberty and Independence Ballroom Foyers | Level M4

Wednesday, May 14 | 5:00 p.m. – 6:15 p.m. - PLUS—take advantage of the designated break times to network with peers, FINRA staff and conference exhibitors.

Ribbon Key

Conference Exhibitors

Conference exhibitors showcase a range of products and services for broker-dealer firms. Be sure to toggle the “Share my information with exhibitors” option on under the My Profile settings in the app. This allows you to share your contact information with conference exhibitors.

Exhibitors include:

Platinum Level

Smarsh

Gold Level

Behavox

FirmScribe

Global Relay

Silver Level

Arctera

Greenboard

Saifr

Solidus Labs

StarCompliance

Full Exhibitor List

ACA Group

Archive Intel, Inc.

Arctera

BDO USA

Behavox

Business Information Group (BIG)

CapitalROCK

Cartana Consulting

CellTrust Corporation

CeriFi

Charles Schwab

Compliance Risk Concepts

ComplianceEdge

eflow Global

ExamFX

FMG

Global Relay

Greenboard

Hadrius

Hilltop Securities Inc.

Kaplan

Knopman Marks Financial Training

Kroll

LeapXpert

MirrorWeb

MCO (MyComplianceOffice)

n-Tier

Norm Ai

Proofpoint

Quest CE

Red Oak Compliance

RegEd

RegVerse

Saifr

Smarsh

Solidus Labs

StarCompliance

STC

Theta Lake

Turnberry Solutions

WebCE

Withum

Download the Conference App

Download the conference app for access to all conference materials—including session descriptions, presentations and handouts, and speaker information. PLUS—you can use the conference app to connect with FINRA staff and other attendees via direct message.

- Search MeetingPlay Hybrid Events in either the Apple or Google Play App stores and download the app.

- Once downloaded, click on the MeetingPlay app icon.

- At the home screen, click on “passcode” and enter: FINRAmay25!

- At the log in page, enter the email address you used to register for the event. The password is your registration confirmation number located in the Important Details email you received before the event. If you cannot locate your confirmation number, please visit the Registration Desk

- You now have access to the app! You will stay logged into the app unless you click “Log Out.”

Navigate the App

- Click the My Profile icon on the main screen, where you can choose to edit your attendee profile.

- Make sure your profile is set to Public and the “Share my information with exhibitors” option is toggled on to use the networking features in the app.

- View the general Agenda and select sessions you don’t want to miss by using the heart icon. Sessions you select can be found under My Agenda on the main dashboard or under My Followed Items.

- Send direct messages through the app to other attendees by using the message feature next to an attendee’s name.