Regulation M Notifications User Guide

On this Page

- Creating a New Deal

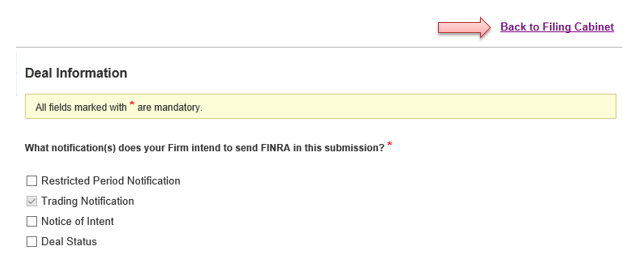

- Deal Information

- Restricted Period Notification

- Trading Notification

- IPOs

- ATMs

- All other transaction types

- Notice of Intent

- Deal Status Notification

- Submitting Notifications

- Subsequent Notifications for an Existing Deal

- Unable to Locate a Deal?

Creating a New Deal

The first step in submitting notifications for an offering for the first time is to select Create Filing.

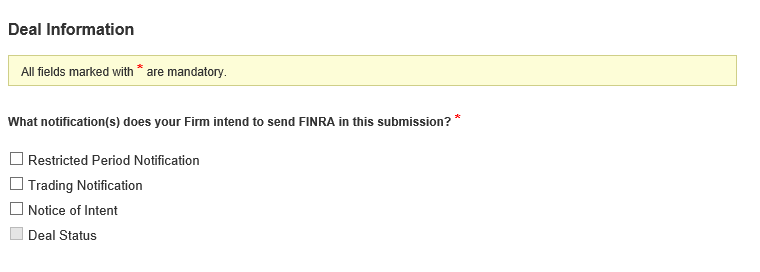

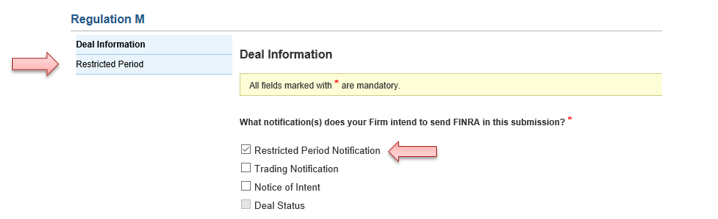

This will establish an automated numeric Filing ID and navigate you to the Deal Information screen where you will be able to select the appropriate notification(s) you intend to submit at that time.

*You will no longer need to create a unique Firm Deal ID when you create a deal. Please note the numeric Filing ID for your records as this will be the best way to identify the specific offering.

- Restricted Period Notification – You should only select this notification to the extent the subject security of the offering, or any applicable reference security, is subject to a Restricted Period as defined in SEC Regulation M Rule 100.

- Trading Notification – The purpose of this notification is to provide FINRA with the details of the offering upon the determination of the offering price.

- Notice of Intent – You should only select this notification to the extent the firm intends to engage in one of the following activities: Syndicate Covering Transactions, Stabilizing Bids, or Penalty Bids.

- Deal Status – The purpose of this notification is to provide information about the status of the firm’s participation in the offering. This will be selected and submitted to FINRA when 1) the firm is reflecting its completion of participation in the offering, or 2) the offering was cancelled or postponed and the firm is no longer acting as a distribution participant.

*For more information regarding the notification submission timelines as prescribed by FINRA Rule 5190 and related Exchange rules, please see Frequently Asked Questions

After you select a notification by checking the corresponding box, a list will populate on the right hand side of your screen that you will use to navigate to each section of data. The Deal Status section will be greyed out until information has been submitted to FINRA.

Deal Information

Please provide the following, as applicable:

- Information about your firm - These fields should prepopulate based on your FINRA Gateway Log-In information.

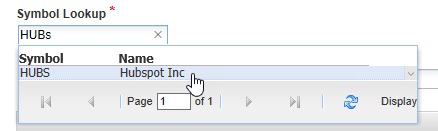

To the extent that the firm has more than one MPID, please choose your firm’s primary MPID from the drop down list. - Symbol Lookup/Security Name/Security Symbol – Use the “Symbol Look Up” field to identify the subject security of the offering.

Type the symbol and choose the correct entry from the list.

This will automatically populate the Security Symbol and Security Name fields.

- If your security name does not appear in the drop down list, select Symbol is not listed and you will be able to manually type in the Security Symbol and Security Name fields.

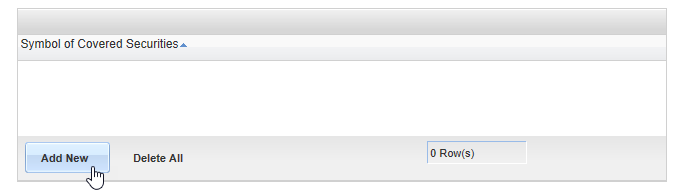

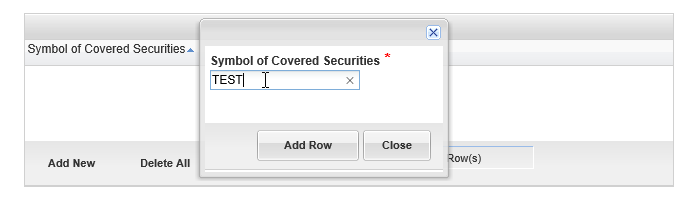

- Symbol of Covered Securities – Enter each security symbol(s) for all reference securities associated with the security that is the subject of the distribution.

Add each covered security into the table by selecting Add New.

Then type in the security symbol of any applicable security symbol and select Add Row.

- Type of Transaction – The method by which the securities of this distribution are being offered to investors.

- Is the offering a concurrent convertible – This field pertains to whether or not there are two distinct securities being distributed concurrently, while not contingent upon one another, where one distribution is in the common equity of the Issuer and the other is in a convertible product. In this instance, a separate deal should be created with a distinct Filing ID and notifications will be submitted separately for each distribution.

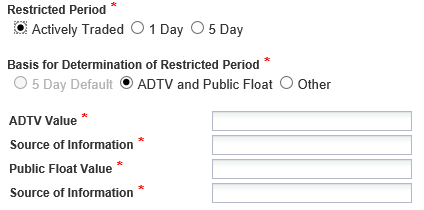

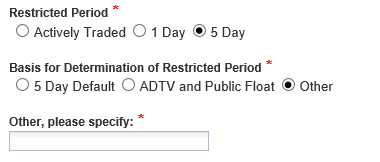

In an offering where one or more distinct securities of the Issuer are being distributed simultaneously or as a unit per the same offering documents, the firm should not create a separate Deal for each security as this is considered one distribution. - Restricted Period - This field pertains to whether the security itself is subject to a restricted period based on the calculation of 1) the value of the Issuer’s Average Daily Trading Volume (“ADTV”) and 2) the value of the public float.

- Please select Actively Traded if the ADTV value is over $1M and value of the public float is over $150M

- Please select 1 Day if the ADTV value is at least $100,000 and value of the public float is at least $25M

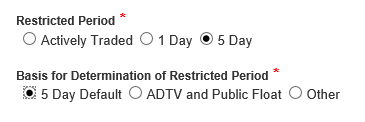

- Please select 5 Day for all other issues that do not meet the criteria for either an actively traded security or a 1 day restricted security.

Please note that if there is a restricted period associated with a distribution, these values are significant in determining when the restricted period begins prior to the pricing of an offering. That period will always end upon the firm’s completion of participation in the offering. For this reason, a 1-day or 5-day restricted period determination in the Deal Information section will not necessarily reflect the length of the full restricted period adhered to by all members of the syndicate and selling group.

In the case of a distribution involving a merger, acquisition, or exchange offer, per Regulation M Rule 100 the restricted period begins on the day proxy solicitation or offering materials are first disseminated to security holders. - Basis for Determination of Restricted Period

If the determination of the restricted period associated with the subject security is based on the firm’s internal calculation, please select the applicable choice and provide the calculations, as well as the source of the information provided.

If the firm selects 5 Day, you will have the option of 5 Day Default and firm is not required to provide calculations to support this determination. Please note that 5-day Default is the applicable restricted period for IPO’s.

The firm also has the ability to select Other and will then be prompted to specify the details of the basis for that determination.

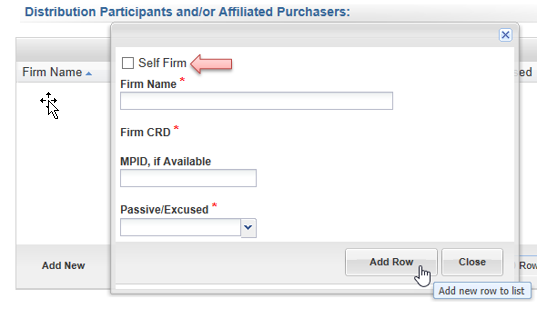

- List of Distribution Participants

Provide the name and CRD number of all affiliated purchasers, syndicate and selling group members participating in the offering, regardless of whether or not the firms are a market maker in the security. This field should be updated to the extent any additional distribution participants added to or removed from the deal after an initial submission.- Select Add New. In order to populate your firm’s information in this table click Self Firm and Add Row.

- For all other distribution participants that are FINRA members, begin typing in the Firm Name field and choose the firm from the drop down list.

- Enter in the primary Market Participant ID (“MPID”) of each listed firm. You can find this MPID on any of the Exchange websites.

- If no MPID exists for the firm, leave this field blank.

- Select whether each firm will be acting in either an excused or passive market making capacity from the drop down list

- Please note that most participants will be Excused. You should only designate a firm as Passive if said firm is a market maker in a NASDAQ listed security and is choosing to act in a passive capacity per Regulation M Rule 103 rather than the standard excused withdrawal.

- If the firm is not a market maker, please choose a default Excused status

- Enter in the primary Market Participant ID (“MPID”) of each listed firm. You can find this MPID on any of the Exchange websites.

- Non Member firm? - Select “Yes” if any affiliated purchaser, syndicate or selling group member is not a FINRA member firm and list the names of the firms below.

- Select Add New. In order to populate your firm’s information in this table click Self Firm and Add Row.

Restricted Period Notification

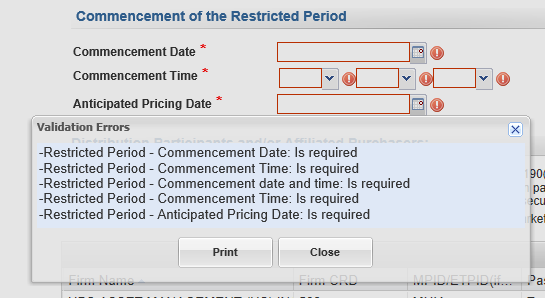

- Commencement Date/Time of the Restricted Period – Enter the date and time the restricted period will begin.

The Commencement Date should typically be either the 1 full trading day or 5 full trading days prior to the determination of the offering price. In the case of a distribution involving a merger, acquisition, or exchange offer, per Regulation M Rule 100 the restricted period begins on the day proxy solicitation or offering materials are first disseminated to security holders. - Anticipated Pricing Date – Enter the date that your firm expects that the offering price will be determined. This date does not necessarily reflect the final pricing date, which will be provided on the Regulation M Trading Notification.

Please note that you do not need to amend this date if the anticipated pricing date changes.

Trading Notification

*If you selected At-The-Market (“ATM”) as the transaction type in the Deal Information section, follow the directions below:

- Type of Security Offered - The type of security being offered (e.g. common stock, preferred stock, etc.)

- Pricing Basis – This field will default to “ATM” as the shares are being sold at market prices.

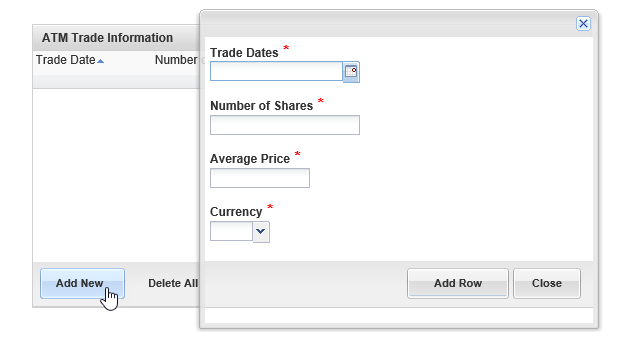

- ATM Trade Information – You will need to enter each date where a transaction in connection with the ATM offering took place, as well as the aggregate number of shares for that date, average price of the shares for that date, and the applicable currency.

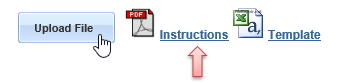

The firm can add the data to the ATM Trading Information table in one of two ways:- Uploading a formatted file of trade data. Please see the Instructions PDF for further assistance

- Manually entering each trade date into the table. Within the ATM Trade Information table, click “Add New”, enter the data for each field and click “Add Row”

Rows can be deleted or updated by clicking on the line item.

- Uploading a formatted file of trade data. Please see the Instructions PDF for further assistance

- End of the Restricted Period – This field is only required if the subject security of the offering, or any applicable reference security, is subject to a Restricted Period as defined in SEC Regulation M Rule 100. This entry should reflect the date and time that the firm is no longer a distribution participant in the offering and is lifting its restriction.

Please note that there will be instances when the firm submits a Trading Notification upon the first trade date of an ATM and does not wish to list its restriction, as the Regulation M restricted period does not end until the firm completes its participation. In this situation, the firm can choose to enter an anticipated end date in order to reflect its continued restriction. You can then amend this date at the appropriate time when ATM is complete and the firm is ready to submit a completed Deal Status notification.

*If you selected IPO as the transaction type in the Deal Information section, follow the directions below:

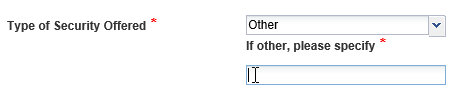

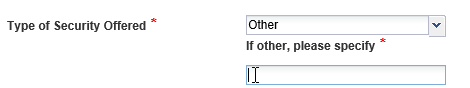

- Type of Security Offered – The type of security that is being offered (e.g. common stock, preferred stock, etc.) In the event you do not see the best description of the security in the drop down list or there are multiple securities being offered, you may select Other and type in a description.

- Number of Securities Offered – The total number of shares that are being sold or placed in connection with the offering. Please note that this field should be amended to the extent the over-allotment option is exercised.

- Offering Price – The price at which the shares are being distributed

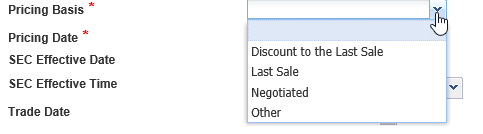

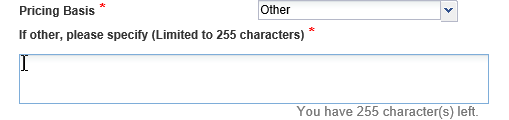

- Pricing Basis – The basis used to determine the price at which the shares are being distributed.

- Pricing date – The date of the determination of the offering price. Please note that that this date should reflect when the offering price is agreed upon, whether or not the agreement is memorialized in writing.

- SEC Effective Date and Time – The date and time that the SEC declared the offering effective.

- Trade Date – The first trade date that the shares from the offering are available for trading in the aftermarket.

- Syndicate Covering Transaction/Imposition of Penalty Bid/Stabilizing Bid - To the extent the firm has engaged in any of the listed activities, select “Yes” to confirm that activity and provide the date(s) the activity occurred. For each applicable trade date, provide the aggregate number of shares executed.

- End of the Restricted Period – The date and time that the firm is no longer a distribution participant in the offering and is lifting its restriction. Please note there will always be a 5-day default restricted period for initial public offerings, which will continue until the firm’s completion of participation in the offering.

*If you selected a transaction type other than ATM or IPO in the Deal Information section, follow the directions below:

- Type of Security Offered – The type of security being offered (e.g. common stock, preferred stock, etc.) In the event you do not see the best description of the security in the drop down list or there are multiple securities being offered, you may select Other and type in a description.

- Number of Securities Offered – The total number of securities that are being sold or placed in connection with the offering. Please note that there are instances in which this field should be amended to reflect an updated total, including but not limited to:

- After exercising the over-allotment option

- After an additional closing of an offering if securities are being offered at the same terms and conditions

- Offering Price – The price at which the security is being distributed

- Last Sale price before distribution – The closing price of the subject or reference security on the date of the last complete trading session prior to the determination of the price of the offering

- Date of Last Sale before distribution – The date of the last complete trading session prior to the determination of the price of the offering

- Pricing Basis – The basis used to determine at which price the offering is being distributed

Please choose from the drop down list of options. Select Other to provide an additional basis not provided.

- Pricing date – The date of the determination of the offering price. Please note that that this date should reflect when the offering price is agreed upon, whether or not the agreement is memorialized in writing.

- In the case of a merger or acquisition, you can populate this field with the date that the shareholders voted on whether or not to approve the transaction.

- SEC Effective Date and Time - The date and time that the SEC declared the offering effective, if applicable

- Trade Date - The first trade date that the shares from the offering are available for trading, if applicable

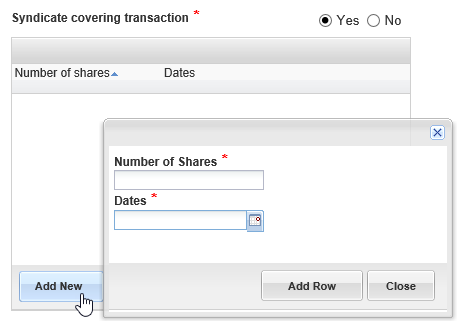

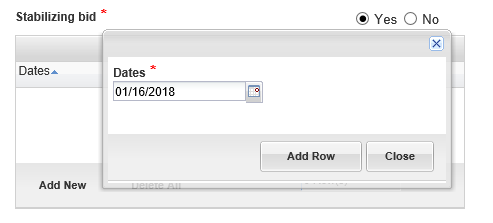

- Syndicate Covering Transaction/Imposition of Penalty Bid/Stabilizing Bid - To the extent the firm has engaged in any of the listed activities, select “Yes” to confirm that activity and provide the date(s) the activity occurred. For each applicable trade date, provide the aggregate number of shares executed and “Add Row”

- End of the Restricted Period – This field is only required if the subject security of the offering, or any applicable reference security, is subject to a Restricted Period as defined in SEC Regulation M Rule 100. This entry should reflect the date and time that the firm is no longer a distribution participant in the offering and is lifting its restriction.

Please note that there will be instances when the firm submits a Trading Notification upon the pricing of an offering but does not wish to list its restriction, as the Regulation M restricted period does not end until the firm completes its participation. In this situation, the firm can choose to enter an anticipated end date in order to reflect its continued restriction. You can then amend this date at the appropriate time when the firm is ready to close the deal and submit a completed Deal Status notification.

Notice of Intent

- Activity – If the firm intends to engage in a syndicate covering transaction, impose a penalty bid and/or enter a stabilizing bid, select the type of activity in which the firm intends to engage.

- Date - The first date on which the firm intends to engage in the activity selected.

Select Add New, enter the applicable date manually or using the calendar and click Add Row.

- Please note this notification is used simply to reflect the firm’s intention to engage in the applicable activity and you should submit this notice prior to the activity itself. You will then report these details on the Trading Notification to the extent the activity occurs.

Deal Status Notification

Status

- Complete – Select this status only when you have submitted all applicable notifications related to the offering and the firm deems its participation in the offering to be complete. Once you have submitted the completed Deal Status, no further amendments are expected.

- Postponed/Cancelled – Select this status to the extent that offering has been cancelled or postponed indefinitely.

- Should the offering once again become active after notification of the cancellation or postponement, please create a new deal and submit notifications under a new Filing ID

- Please note it is unusual to submit a postponed or cancelled Deal Status Notification after the submission of a Trading Notification that reflects to FINRA that the terms and conditions of an offering have been agreed upon and pricing has been determined. A cancelled or postponed Deal Status should not be submitted for any offering that occurred in which the firm participated.

Submitting Notifications

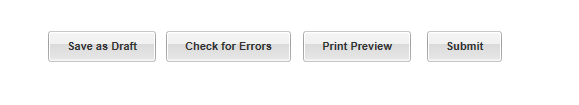

After filling out the Deal Information and notification(s) that you intend to send to FINRA in this submission, you can select one of the following options:

- Save as Draft – Select to save your work without submitting to FINRA

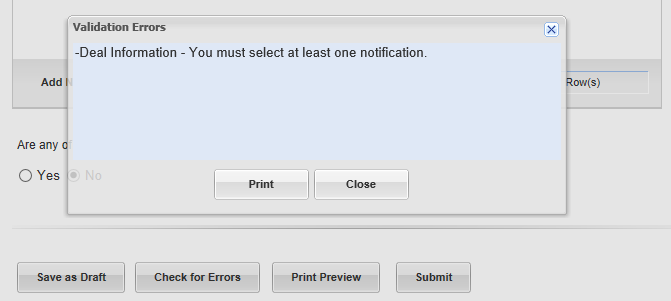

- Check for Errors – Select to view any Validation Errors that you need to address before you can successfully submit the notification to FINRA. Each error will be listed and the fields that need to be adjusted will be highlighted

- Print Preview – Select to preview a copy of how FINRA will receive the notification in its current draft status

- Submit – Select to submit the notification(s) to FINRA

Please note that you cannot submit only the Deal Information. You must select at least the Restricted Period Notification, Trading Notification and/or Notice of Intent before the system will accept your submission. If you attempt to only submit Deal Information, you will receive an error.

If you want to exit the Deal you are currently working on, click on Back to Filing Cabinet which will navigate you back to the main screen listing of all Regulation M Deals.

If you select Back to Filing Cabinet without saving or submitting your notification, all changes will be lost.

Subsequent Notifications for an Existing Deal

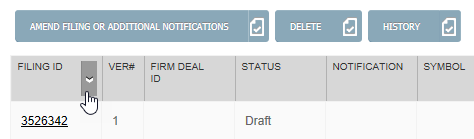

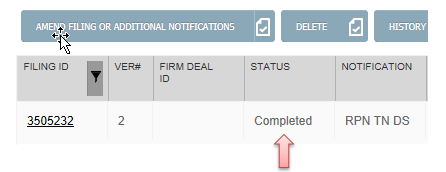

If you need to update information for a notification that was already submitted or submit a subsequent notification for the same offering, the first step is to locate the correct deal.

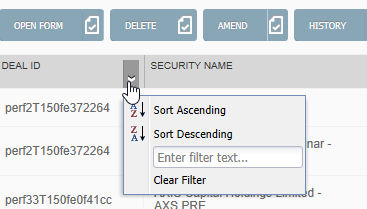

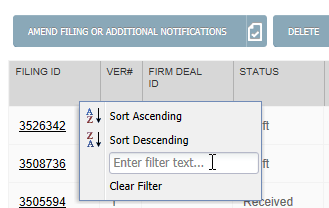

You are able to search by Keywords

OR you can filter any of the columns in your list of deals. Hover your mouse over any column header and click the small arrow that appears on the right hand side.

You are then able to sort each column ascending/descending or you can fill the Enter filter text field with specific information about your Deal.

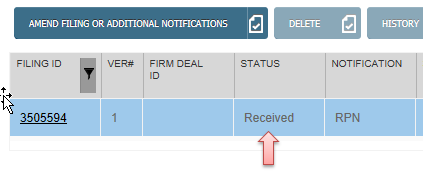

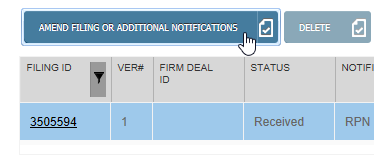

Please note that each offering or Deal is identified by a Filing ID and all related notifications are viewed and accessed in a single row within the list of deals. Once you locate the Deal you want to work on, highlight the row and first review the “Status” of the deal. This column is populated with one of three statuses:

Received – The status will show as Received if the last action taken by the firm was the submission of any notification. If you’d like to view the version of the submission that was sent to FINRA, click on the Filing ID which will navigate you to a read only copy.

If you’d like to update information for a notification that was already submitted or submit a subsequent notification, highlight the row and select “Amend Filing or Additional Notifications”

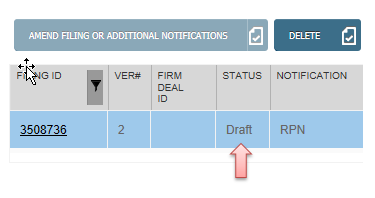

Draft – The status will show as Draft if 1) the firm began creating a filing but saved the information without submitting it to FINRA or 2) since the firm’s last submission, the deal was opened and a draft has been saved without a subsequent submission.

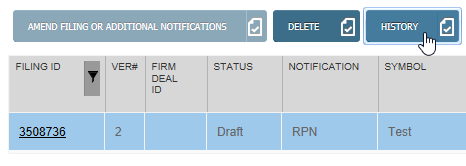

This does not mean any previously submitted notification(s) were not received by FINRA. The system will not allow you to delete something that has already been submitted. If you would like to view the submission history and confirm the date/time of any previous submission, highlight the row and click on History

If you’d like to continue working on your draft, click on the underlined Filing ID. If you have saved a draft at any point and do not wish to continue with those changes, any draft can be deleted by highlighting the Row and selecting Delete. This will only delete the updates that you have made since your last submission. The status of the Deal will revert to Received.

Completed – The status will show as Completed once the firm has submitted a Deal Status notification noting that its participation in the offering is complete.

Unable to locate a Deal?

Select Click Here in the top right of your screen which will take you to the previous version of the RegM Filing cabinet. Please note that you will no longer be able to submit Regulation M notifications through the previous version of the RegM Filing cabinet. If you need to submit an Unregistered Secondary Distribution Transaction (“USDT”) Notification, you will need to go into the previous Filing cabinet.

Filter by Deal ID in order to locate the appropriate notifications