SEC Approves Rule 3160 Regarding Submission and Reporting Requirements for Regulation T and SEC Rule 15c3-3 Extension of Time Requests

GUIDANCE

Extension of Time Requests

|

SUGGESTED ROUTING |

KEY TOPICS |

| Legal & Compliance Senior Management Operations |

Extension of Time Requests NASD Rule 3160 Regulation T SEC Rule 15c3-3 |

Executive Summary

On September 15, 2006, the Securities and Exchange Commission (SEC) approved new NASD Rule 3160 that requires: (1) all clearing firm members for which NASD is the designated examining authority (DEA) pursuant to Rule 17d-1 under the Securities Exchange Act of 1934 (Exchange Act) to submit to NASD requests for extensions of time under Regulation T promulgated by the Federal Reserve Board (FRB) or pursuant to Rule 15c3-3(n) under the Exchange Act; and (2) each clearing firm member for which NASD is the DEA to file a monthly report with NASD indicating all broker-dealers for which it clears that have overall ratios of requested extensions of time to total transactions for the month that exceed 2%.1

In addition, this Notice serves to remind members that extensions of time under Regulation T and SEC Rule 15c3-3 may only be requested in exceptional circumstances.

Rule 3160, as approved, is set forth in Attachment A of this Notice. The form of the new monthly report is set forth in Attachment B of this Notice. Rule 3160 will become effective on March 1, 2007.

Questions/Further Information

Questions regarding this Notice may be directed to Susan M. DeMando, Associate Vice President, Financial Operations, Member Regulation, at (202) 728-8411; or Kathryn M. Moore, Assistant General Counsel, Office of General Counsel, at (202) 974-2974.

Background and Discussion

Regulation T, issued by the Board of Governors of the FRB pursuant to the Exchange Act, among other things, governs the extension of credit to customers by brokerdealers for purchasing securities.2 Rule 15c3-3 under the Exchange Act, among other things, requires broker-dealers to promptly obtain and maintain physical possession or control of customer securities and designates periods of time within which brokerdealers must cure any deficiency by buying-in or otherwise obtaining possession or control of the securities.3

Under SEC Rule 15c3-3(n), a self-regulatory organization (SRO) may extend certain specified periods to buy-in a security, for one or more limited periods commensurate with the circumstances, where the SRO: (1) is satisfied that the broker-dealer is acting in good faith in making the request; and (2) exceptional circumstances warrant such action.4 Regulation T has a similar standard to allow an extension of time for payment for purchases of securities.5

Required Submissions of Requests for Extensions of Time to the DEA

New Rule 3160(a) requires all clearing firm members for which NASD is the DEA to submit to NASD requests for extensions of time under Regulation T and SEC Rule 15c3- 3(n).6 Since the SRO designated as a member's DEA has responsibility for examining its members for compliance with applicable financial responsibility rules such as Regulation T and SEC Rule 15c3-3, requiring a member to submit extension requests to its DEA helps to ensure that the DEA receives complete extension information to assist it in performing this function. This information, among other things, can serve as an early indicator of operational or other difficulties.

Monthly Reporting Requirement Regarding Introducing Firm Extensions

New Rule 3160(b) requires each clearing firm member for which NASD is the DEA to file a monthly report with NASD indicating all broker-dealers for which it clears (i.e., introducing or correspondent firms) that have overall ratios of requests for extensions of time as contemplated by Sections 220.4(c) and 220.8(d) of Regulation T and SEC Rule 15c3-3(m)7 to total transactions for the month that exceed 2%.8 The monthly report will require clearing firms subject to Rule 3160(b) to identify, among other things: (1) the introducing broker-dealer's name; (2) the number of extension requests for the introducing broker-dealer for the calendar month; (3) the number of transactions for the introducing broker-dealer for the calendar month; and (4) the ratio of the number of extensions requested to total transactions.9 The monthly report must be submitted no later than five business days following the end of the preceding calendar month. For months when no introducing broker-dealer for which it clears exceeds the criteria, the clearing firm should submit a report indicating such.10

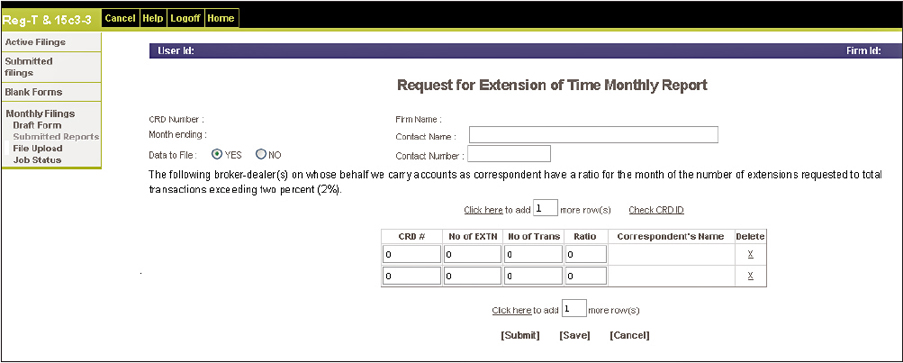

NASD has a new template within its electronic filing platform to permit clearing firms to submit the required reports regarding their introducing firms' extension requests. The form is set forth in Attachment B of this Notice.

Prohibition on Further Extensions when Thresholds are Exceeded

NASD will monitor the number of Regulation T and SEC 15c3-3 extension requests for each firm to determine whether to impose prohibitions on further extensions of time. As further detailed below, NASD will prohibit further extensions of time for introducing firms that exceed a 3% ratio of the number of extension requests to total transactions for the month (notwithstanding the fact that the monthly report described above identifies introducing firms that have ratios of extensions of time requests to total transactions exceeding 2% for the month).11 In addition, NASD will prohibit further extensions of time for clearing firms that exceed a 1% ratio of extensions requested to transactions.12

More specifically, to the extent that firms exceed the applicable threshold limits (1% for clearing firms and 3% for introducing firms), NASD will inform them that their ability to receive extensions for their customers will be stopped for a 90-day period if the firm does not reduce the number of subsequent requests below the applicable limit by the next reporting period.13 NASD, however, will not prohibit further extensions of time for any introducing firm that engages in less than 25 transactions for the reported month. NASD believes that these limits are appropriate in light of the standard set forth in Regulation T and SEC Rule 15c3-3 that extensions of time may only be granted under "exceptional circumstances." While NASD does not at this time contemplate any changes to the thresholds referenced herein, any future changes to these parameters will be published in a subsequent Notice to Members.

Extension Requests Only in Exceptional Circumstances

As noted above, extensions of time under Regulation T and SEC 15c3-3 may only be requested in exceptional circumstances. When a firm requests an extension of time due to a customer failing to pay for securities purchases or to deliver securities sold, a written record of the contact with the customer regarding the transaction and the basis for requesting an extension must be retained. Without such documentation, members will not be in a position to demonstrate why exceptional circumstances existed to warrant the extension request. Members are reminded that NASD may review this documentation during the course of NASD examinations or may periodically request this documentation.

Customer Test Environment (CTE) Available

The requirements referenced in this Notice will become effective on March 1, 2007. However, to assist members in preparing to submit this additional report, NASD will provide a Customer Test Environment (CTE) available for testing purposes beginning on February 1, 2007. Member may access CTE at https://regfilingtest.nasd.com. To access CTE, a user will need to have a Regulation Filing Applications user ID and password. Questions regarding CTE may be directed to (800) 321-NASD.

Effective Date

As noted, for purposes of implementation of Rule 3160(a), if any member requests an extension of time under Regulation T or SEC Rule 15c3-3 on or after March 1, 2007, the member must submit the request to NASD if it is the firm's DEA. For purposes of implementation of Rule 3160(b), the member will submit its first report to NASD by April 6, 2007 (i.e., within five business days of the end of the month) reflecting extensions to transactions for the month of March 2007; i.e., March 1, 2007 through March 31, 2007.

1 See Exchange Act Release No. 54456 (September 15, 2006), 71 FR 56203 (September 26, 2006) (File No. SR-NASD-2006-064).

2 12 CFR 220.4(c) and 220.8(d). Regulation T provides that a customer has one payment period (currently five business days) to submit payment for purchases of securities in a cash account or in a margin account.

3 17 CFR 240.15c3-3.

4 See SEC Rule 15c3-3(n), authorizing SROs to extend the periods of time to buy-in a security specified in SEC Rules 15c3-3(d)(2), (d)(3), (h), and (m).

5 Under Regulation T, a firm's examining authority may grant an extension unless the examining authority believes that the brokerdealer is not acting in good faith or that the broker-dealer has not sufficiently determined that exceptional circumstances warrant such action.

6 This is consistent with the New York Stock Exchange (NYSE) Rule 434 which requires each firm for which the NYSE is the DEA to submit extensions of time requests to the NYSE.

7 SEC Rule 15c3-3(m) (Completion of Sell Orders on Behalf of Customers) requires that if a security sold long by a customer has not been delivered within 10 business days after the settlement date, the broker-dealer must either buy-in the customer or apply for and receive an extension from the SRO.

8 Self-clearing firms that do not also clear for other firms are not required to file these reports because such firms do not have any introducing broker extension information to provide to NASD.

9 Members should calculate the ratio by rounding to the nearest tenth of a percent. For example, if an introducing firm has 7 extension requests and 150 transactions in a calendar month, the ratio is equal to 4.7%.

10 See the report form set forth in Attachment B. For a report when one or more introducing firm(s) exceeds the 2% threshold for the reported month, the member should answer "yes" to the Data to File field. The member should complete the required information only for an introducing firm(s) that exceeded the 2% extensions to transactions ratio for the reported month. For a report where no introducing firm exceeds the 2% threshold, the member must still submit the report, however, the firm would answer "no" in the Data to File field.

11 The 2% threshold provides NASD with an "early warning" notice as to the concentrations of extension requests for introducing firms. NASD will use the information submitted by the clearing firms in the Rule 3160(b) monthly report to monitor introducing firms' compliance with the 3% threshold.

12 NASD will calculate the 1% ratio using the number of extensions requested pursuant to Regulation T and SEC Rule 15c3-3(m) to transactions as reported by the clearing firm on field 4980 of the FOCUS II Report.

13 For example, if an introducing firm exceeds the applicable threshold for the month of March 2007, its clearing firm would report that fact to NASD by April 6, 2007 (i.e., the date that is five business days after the end of the month). NASD would advise the introducing firm that it had exceeded its threshold and that it must reduce the number of subsequent requests below the limit by the end of April 2007. If the introducing firm exceeds the applicable threshold for the month of April 2007, its clearing firm would report that fact to NASD by May 7, 2007 (i.e., the date that is five business days after the end of the month) and the 90-day suspension would start at that time.

ATTACHMENT A

New language is underlined.

* * * * *

3160. Extensions of Time Under Regulation T and SEC Rule 15c3-3

* * * * *

ATTACHMENT B