Disclosure Innovations in Advertising and Other Communications with the Public

Summary

This Notice responds to questions that FINRA has received from members about how they can comply with FINRA rules when communicating with customers—particularly when using websites, email and other electronic media—while ensuring fair and balanced presentations. Our goal is to facilitate simplified and more effective disclosure in communications with the public.

FINRA welcomes the opportunity to consult with members about expanding their use of alternative and innovative design techniques—such as technology that offers customized information—in their marketing communications to help investors better understand their products and services. We are interested in ways that members can make communications more interesting and informative and how, together, we can improve the effectiveness of disclosure. Firms are encouraged to contact the Advertising Regulation Department directly at (240) 386-4500 to discuss these approaches.

Questions concerning this Notice should be directed to:

- Joseph E. Price, Senior Vice President, Corporate Financing/Advertising Regulation, at (240) 386-4623;

- Thomas A. Pappas, Vice President, Advertising Regulation, at (240) 386-4553; or

- Amy C. Sochard, Senior Director, Advertising Regulation, at (240) 386-4508.

Background and Discussion

FINRA’s communications rules—Rules 2210 through 2220—are based on the principles of ensuring that member communications are fair and balanced, and that investors do not receive misleading information. FINRA recognizes that there are many different approaches for achieving this goal in member communications, particularly as technology continues to transform media, and we encourage firms to consider which ways will best convey relevant information to investors.

FINRA members, for example, now often market and advertise their products and services using websites, email, social media, search advertisements, mobile apps and other electronic media. FINRA has offered guidance on the application of the communications rules to social media and electronic communications in Regulatory Notice 17-18 (Social Media and Digital Communications); Regulatory Notice 11-39 (Social Media Websites and the Use of Personal Devices for Business Communications); and Regulatory Notice 10-06 (Social Media Websites). In this Notice, we respond to questions from members regarding approaches intended to make disclosures more compelling, particularly in electronic media.

We recognize there may be other approaches and design concepts to be considered beyond those described below. The responses below are not intended to foreclose other approaches to member communications, nor are they intended to create new requirements for communications. These responses also do not change FINRA’s existing interpretations or applications of Rules 2210 through 2220.

Questions & Answers

The following questions and answers provide guidance only with respect to FINRA rules and do not interpret the rules of the SEC or any other federal or state agency. The examples provided are for illustrative purposes only and are not drawn from or related to actual communications.

Q1. Technology and advances in communication have provided members with new ways of communicating with investors. How does FINRA view innovative design techniques in member communications?

A. FINRA welcomes the use of innovative design techniques in member communications to help investors understand the member’s products and services. Members may use technology to customize the level of explanation and information provided in communications. For example, the introductory screen of a mobile app might show a user where to find information on the app. When the user returns to the app, it may offer a choice of whether to view that screen again or access the information on demand. With such an app the user can customize the information according to his or her interests and avoid having to read the same information twice.

FINRA recognizes that many members are developing communications that enable investors to choose how to access information. For example, some electronic communications offer the user the choice of whether to view information in narrative or tabular format. Other communications may allow the recipient to choose a video, audio recording or transcript of the same information. These approaches allow investors to receive information in ways that are most relevant to them.

Members also use icons, illustrations, cartoons, animations, short videos, pictograms and other media or emerging technologies to alert investors about important information, such as disclosure required by FINRA rules. For example, an icon could help an investor navigate to information that he or she wants to read. Members also might use audio signals such as chimes or tactile methods such as vibrations to alert investors about the availability of important information.

Q2. Many disclosures in marketing materials have become quite extensive. Are all of these disclosures required by FINRA?

A. No. FINRA encourages members to be precise and succinct in their explanations and disclosures. Members often include in their communications disclosures that are not required by the rules, and FINRA does not object to additional explanations or information beyond what is required for rule compliance. However, consistent with the requirements of Rule 2210(d)(1)(C), members must ensure the additional information does not inhibit an investor’s understanding of the required information.

Electronic media and design innovations may open new ways to present information to investors and focus a communication on the most relevant parts. For example, sometimes advertisements include rote or prescriptive boilerplate that is irrelevant to the marketing message, or disclosure for purposes other than compliance with rule requirements, such as disclaimers related to business relationships or disclosure about intellectual property. Combining this additional text with more important and relevant disclosure—such as in a single block of fine print text—can detract from the impact of information required for the investor to understand the product or service. FINRA encourages members to consider how electronic media and design innovations can help direct investors to the information required for a fair and balanced communication.

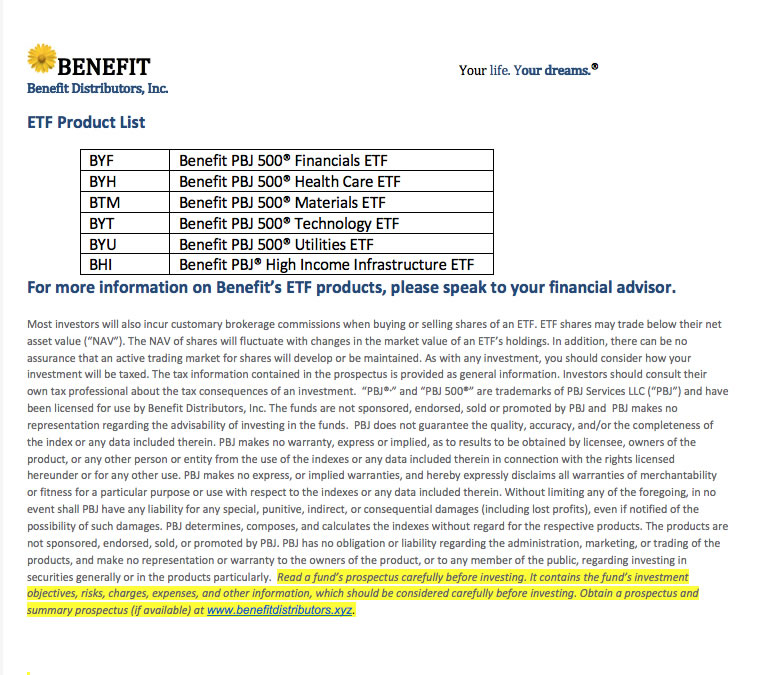

Example: Required and additional information combined in a single disclosure.

In this example, the only information required for compliance is the highlighted text. The other information is not required by FINRA and may detract from the presentation of the required information. FINRA recognizes that there are multiple ways to address the prominence of required information, and electronic media and design innovations may open new possibilities.

Q3. Is it necessary to disclose risks, costs or other drawbacks in a communication that are unrelated to its content?

A. No. FINRA rules require that communications be fair and balanced, but don’t require them to be exhaustive lists of all possible risks and warnings associated with a product or service. Information about risks, costs or drawbacks is more effective when it is related to the benefits that the communication promotes.

Example: Limited disclosure appropriate to the content of the communication

This advertisement promotes innovative companies and the disclosure is sufficient: “Innovative securities are subject to significant risks, including loss of principal.”

Q4. If disclosures are integrated into the body of a marketing message or other communication, must they be as extensive as disclosures presented in a separate footnote or disclaimer?

A. No. Integrated messages may enable members to use shorter disclosures that are more relevant to investors. For example, communications promoting a benefit of a product or service may require a discussion of related risks. However, a reader might overlook or ignore a separate description of the risks, particularly when it is bundled with other extensive disclosures. In some cases, members may be able to more effectively convey important information in the body of the communication rather than in a separate, longer disclosure, which could improve investor understanding. We encourage members to consider whether information traditionally provided in footnotes, hedge clauses or disclaimers can be woven into the marketing message.

Example: Disclosure included within the marketing message

By including the phrase “While not guaranteed” in the main body of the text, this example illustrates how a short disclosure can be incorporated into the marketing message.

Q5. Members communicate with the public in a number of ways in addition to marketing messages. How does FINRA consider disclosures for non-promotional communications like educational materials or reference resources?

A. The extent of disclosure needed depends on the type of communication and how it is used in the sales process. Communications that promote or offer specific securities, types of securities, or securities services generally require disclosure. Promotional communications discuss the benefits of a particular product, type of product, or service and, under the rules, require balancing discussions of the risks or drawbacks.

In contrast, non-promotional communications including the following may not require the same level of detail.

- Brand communications: Brand communications that only acquaint investors with a firm’s name and the fact that it offers financial services generally require no additional information in order to be fair and balanced.

- Educational communications: FINRA encourages members to use educational communications that promote financial literacy. For example, a member might develop a website that explains different types of securities and how markets work, but because it does not promote specific securities or services it may only require a simple statement noting that securities involve risks and an offer to provide additional information. Another example is educational content that only provides basic information about what mutual funds are and does not include information that relates to the desirability of a specific product; such a communication would not need to disclose the specific risks associated with a particular fund.

- Reference resources: Some members provide websites, apps or other reference resources that do not promote a specific product or service; instead, they provide information intended to assist investors with investment decisions. In general, investors must choose to access these resources and interact with them to find the information (e.g., by downloading an app or creating an online account on the firm’s website). A resource that does not promote specific products or services might need little or no disclosure under FINRA rules.

- Post-sale communications: Once a sale has occurred, members may provide communications to investors that discuss the product, such as changes to its portfolio or information about how the product has responded to changes in market conditions. These subsequent communications typically do not require the same extent of disclosure as communications leading up to a sale. Of course, a post-sale communication that recommends additional purchases or another product would be a promotional communication.