On Behalf Of (OBO)

On This Page

What's New

FINRA offers the capability for one organization to submit certain filings and perform reporting On Behalf Of (OBO) another member firm by establishing a relationship in the FINRA Entitlement Program between two organizations. To date, two applications are participating in OBO though more systems will be added in the future. OBO functionality supports both human accounts and machine (File Transfer) accounts. Read the details below and see relevant FAQs for more information.

Overview

FINRA developed centralized "On Behalf Of" (OBO) functionality to support member firms that use vendors* for regulatory and compliance services. OBO functionality allows a firm to designate a vendor to perform designated regulatory filing and reporting activities when the vendor agrees to the OBO Relationship. OBO functionality permits member firms to authorize delegation of certain regulatory filing and reporting activities to a selected vendor while maintaining member firm accountability.

Key Features

- Firm Administrator Control: Firm administrators with ‘Create On Behalf Of Relationship’ entitlement are able to grant entitlements to designated vendors/organizations that will provide the firm with its services.

- Vendor* Access: Allows a vendor authorized by a member firm to submit regulatory filings and reports on behalf of the member firm once the OBO Relationship is set up.

- Enterprise-wide Solution: Designed as a comprehensive solution to address current and future OBO needs of member firms.

*Vendor = Service Provider or organization working on behalf of other firms.

The OBO functionality establishes a relationship between a member firm and another organization (a vendor or another firm). A member firm must initiate an OBO Relationship and selects an organization to delegate certain filing and regulatory services on its behalf. An OBO Relationship maintains the proper chain of responsibility while allowing firms to efficiently outsource compliance functions.

This solution streamlines the delegation process and provides a consistent framework for managing third-party reporting relationships across participating FINRA systems.

User Guide

Frequently Asked Questions

Q1: What is OBO?

A1: FINRA established the On Behalf Of (OBO) functionality to provide more flexible filing and reporting options through an OBO Relationship created between a firm and a vendor (or another firm) through a series of streamlined workflows.

- The OBO functionality allows a firm administrator, with ‘Create On Behalf Of Relationship’ entitlement, the ability to grant entitlement to a designated vendor or other firm to submit regulatory filings and reports on their behalf.

- Once entitled to use OBO functionality, a firm user selects a vendor to provide services and sends a request to the vendor to create an OBO Relationship.

- The OBO Relationship workflow guides a firm and vendor through the process and the request will process automatically once approved by each organization.

- OBO Relationships can be established for human accounts and/or File Transfer (FTP) accounts.

- The OBO Relationship functionality enables vendors/organizations to perform regulatory filings and reporting duties for multiple firms using a single unique account. This increases efficiency for firms by reducing the time required to manage a single OBO Relationship as opposed to multiple accounts.

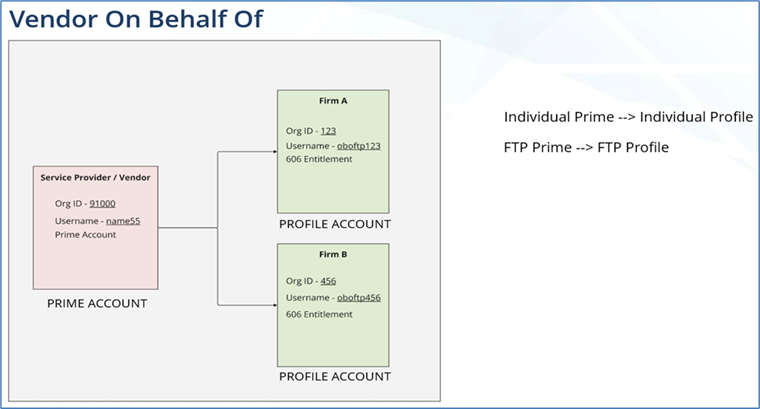

Q2: How does an OBO Relationship work?

A2: An OBO Relationship allows a firm administrator, with ‘Create On Behalf Of Relationship’ entitlement, the ability to grant entitlement to a designated vendor* to submit regulatory filings and reports on their behalf. An OBO Relationship can be established for one-to-many human accounts or File Transfer (FTP) accounts. The delegated vendor has the option to select an existing account or create a new account to be used to perform OBO activities for the firm, but the vendor account must have the ‘Enable On Behalf Of” entitlement.

Q3: What systems does OBO functionality support?

A3: Member firms will be able to authorize third-party vendors to submit SEC Rule 606(a) Reports on their behalf required under FINRA Rule 6151 (Disclosure of Order Routing Information for NMS Securities) and Advertising Regulation File Transfer.

Q4: Will OBO functionality expand to different activities?

A4: Yes, OBO functionality will expand to other organizations, regulatory filings, and reporting activities in future phases.

Q5: Who is identified as a Vendor* in the OBO functionality?

A5: Vendor* = A service provider or other organization submitting regulatory filings and reports on behalf of other firms. A firm that is performing filing and reporting services for another firm is considered a ‘vendor’ in an OBO Relationship.

Q6: What is the difference between a Prime Account and a Profile Account?

Prime account: This account allows a vendor to act on behalf of a firm and permits the account to engage in the authorized activities covered by the OBO Relationship. This account must be entitled with ‘Enable On Behalf Of’ to be selected as a Prime account in the Requests and Filings OBO Workflow. See Entitlement Reference Guide Section 6 - How to Create an Account.

Profile account: This account is systematically created for the firm after an OBO Relationship is agreed to by the vendor and permits the vendor to perform specific filing and/or reporting services on the firm’s behalf. The Profile account name is associated with the Prime account owner.

Q7: Can a firm using Single Sign On (SSO) use OBO?

A7: With the initial October 1, 2025, initial launch:

- If you are a firm accessing FINRA Gateway using SSO and a human account that will be used as the OBO account, you cannot participate in OBO.

- If you are a firm accessing FINRA Gateway using SSO and an FTP account that will be used as the OBO account, you can participate in OBO.

Q8: Can I create an OBO account that will be shared by multiple users?

A8: No, a unique user account must be created for each individual who requires access to the FINRA Entitlement Platform. Sharing account credentials significantly increases the risk of security breaches and social engineering attacks. The sharing of human account credentials is prohibited.

When the account is a machine-to-machine or File Transfer Protocol (FTP) account, FINRA provides the credentials to the account owner.

Q9: Can I, as the SAA or AA, create an FTP account for an OBO Relationship?

A9: No, due to the unique environment of FTP accounts, FINRA solely maintains account administration rights to create FTP accounts (e.g., OBO Prime account). Super Account Administrators (SAA) or Account Administrators (AA) cannot create this type of account.

The File Transfer Applications and Downloads Entitlement Agreement is not available on the website and must be requested by an Authorized Signatory of your organization by contacting the FINRA Support Center at 301-590-6500.

Q10: Where can I locate a user guide for performing OBO activities through fileX as an FTP account?

A10: For instructions on using FileX, see the FileX User Guide.

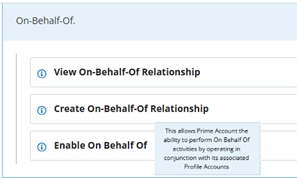

Q11: Who will be entitled to the OBO functionality?

A11: Access to OBO functionality will be granted to the SAA role and the Certification Representative (CREP) with the new ‘Create On Behalf Of Relationship’ entitlement. The SAA may designate this privilege to other users at the organization. Any user with ‘Create On Behalf Of Relationship’ will be entitled to the OBO Relationship functionality and will be able to access the workflow to:

- Create an OBO Relationship

- Agree to or approve an OBO Relationship

Q12: How is an OBO Relationship created?

A12: An online workflow will enable a firm to create an OBO Relationship with a vendor. The workflow guides the requester and the recipient of the OBO request step-by-step through a workflow in the Request and Filing process.

Q13: How will SAAs and CReps be notified during the OBO workflow?

A13: The 3-step online workflow process enables a firm to create an OBO Relationship with a vendor. The workflow guides the requester and recipient step-by-step through the process and will provide notification emails to alert the participants of the next step.

- After Step 1 is submitted by the firm, an email of request is sent to the CRep of the Vendor Organization.

- After Step 2 is Agreed to by the vendor, an email of Prime account nomination is sent back to the Firm SAA.

- After Step 3 is Approved by the firm, an email is sent to both organizations of the On Behalf Of Relationship with the Prime and Profile account User IDs.

Q14: How long will an OBO request stay open?

A14: OBO Relationship requests expire and are no longer available after 30 days if the workflow isn't finished. This expiration policy keeps requests current and helps prevent unintended approvals.

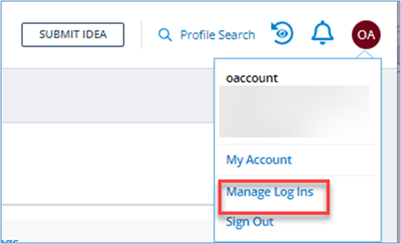

Q15: Does OBO eliminate the need for multiple log ins?

A15: Yes, OBO functionality eliminates vendors managing separate logins for each firm. By using OBO, vendors can login to their account with a single username and password and switch profiles through Manage Logins. Although multiple logins are not needed, each time a vendor switches profiles between firms, the vendor will need to use MFA. For more information on MFA, see the MFA User Guide.

Q16: How many Profile accounts can be associated with one (1) Prime account?

A16: For human accounts, there is no limit to the number of Profile accounts to 1 Prime account.

For machine to machine accounts, the maximum limit is 400 Profile accounts to 1 Prime account.

Q17: Is OBO mandatory?

A17: No. FINRA highly recommends firms with vendors/organizations to use OBO to avoid multiple accounts and log-ins for the applications that support OBO functionality.

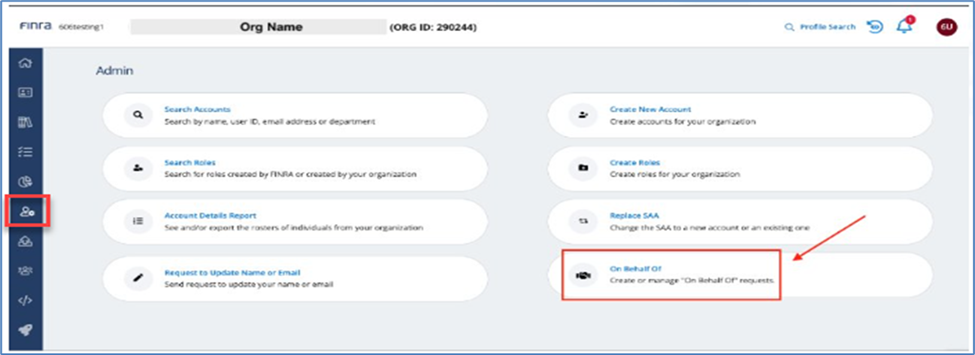

Q18: Who can create an OBO request?

A18: The firm users that have been granted ‘Create On Behalf Of Relationship’ entitlement by their Super Account Administrator (SAA) will select On Behalf Of on the FINRA Gateway Admin screen and be directed to the Create OBO Request screen.

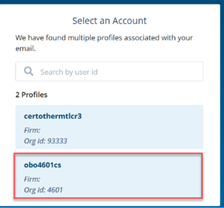

Q19: Once the OBO Relationships are created, how can I (a vendor) change from one account to another?

A19: Click on your User Profile in the upper right-hand corner and select ‘Manage Log Ins’. You will be presented with the list of OBO Profile accounts (accounts starting with obo) to choose from.

Q20: Can an organization see their OBO Relationship(s)?

A20: Yes, an SAA, CREP or any account entitled with OBO functionality can see their OBO Relationship(s). From your Prime or Profile account, click on your User ID. You will see a new section ‘On Behalf of Relationship’. Click on this section to see your account’s OBO Relationship Information.

Q21: How can a user view existing OBO Relationships?

A21: Account administrators must grant users the “View On Behalf Of Relationship” entitlement with User privilege to enable users to view existing OBO Relationships in the FINRA Entitlement Program.

Q22: Will MFA authentication be required for each selected account?

A22: Yes, for security reasons, when a vendor accesses or switches between firms by selecting a profile account, the vendor will need to complete MFA verification. MFA is required each time the vendor switches firms. As a best practice and to simplify MFA for accounts managing OBO responsibilities for multiple firms, vendors should consider using a security key to complete MFA. For more information on MFA, see the MFA User Guide.

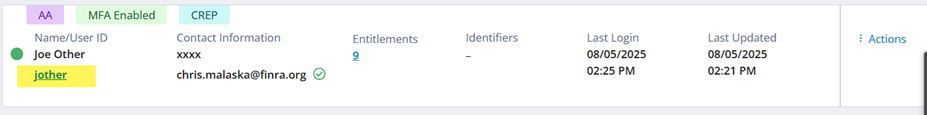

Q23: Are OBO accounts included in the FINRA Entitlement User Accounts Certification Process?

A23: Yes, all accounts associated with an active OBO Relationship will be included in the annual FINRA Entitlement Program Certification.

- The firm OBO (Profile) accounts will be included. See Annual Certification Process.

- The vendor OBO (Prime) accounts will be included. See CREP Certification Process.

Q24: How can I terminate an OBO Relationship? (Initial Launch)

A24: For the initial launch, a firm or vendor that needs to terminate an OBO Relationship will need to contact [email protected]. Only one of the two organizations needs to terminate the OBO Relationship. Each organization will receive a notification that the OBO Relationship is terminated. In the future, terminating an OBO Relationship will be automated.

Q25: How can I disable/delete a Profile account? (Initial Launch)

A25: If a firm needs to delete its Profile account, contact [email protected].