What Is Momentum Investing?

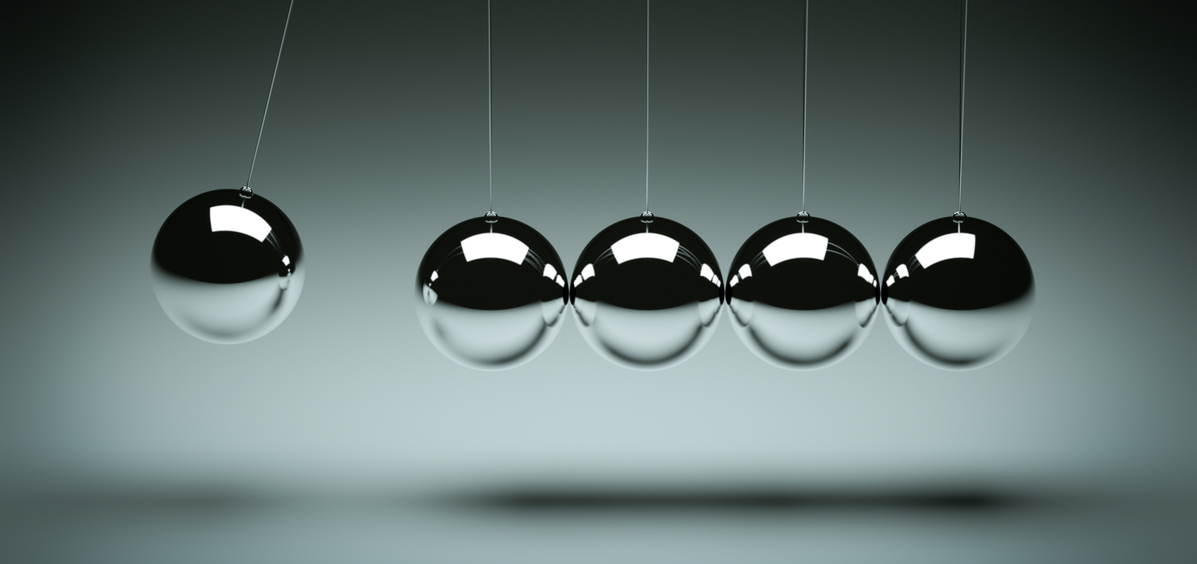

In physics, momentum refers to the tendency of an object to continue moving in a particular direction due to its mass and velocity. The velocity, or direction, of momentum can change due to an external force and is governed by laws like Newton’s laws of motion.

Momentum investing is a trading strategy that involves trading stocks that are moving rapidly higher—or lower—and then exiting positions before the prices begin to move in the opposite direction. A form of market timing, momentum investing seeks to exploit short-term price movements in stocks. But just like with physics, external forces can rapidly change the momentum, as well as the direction in which a stock is moving. Among other things, world events, economic factors, and industry shifts and developments can all have an impact on a stock’s price.

Defining a Momentum Stock

In the fast-moving environment of stock trading, momentum investing can provide a way to capitalize on short-term opportunities. Fundamental analysis and technical analysis are two common methods used to analyze stocks. Fundamental stock analysis looks at a stock’s growth potential and involves researching a company’s financial records, industry trends and macro-economic events. A momentum strategy typically focuses primarily on technical analysis, including examining trends using sophisticated mathematical calculations in the hopes of predicting future price moves.

Momentum investing involves buying shares of a security as its price rapidly appreciates and then attempting to sell before shares begin to trend downward. The strategy can also be applied to a security that is depreciating by shorting the shares and exiting the position before its share price begins to recover. Followers of this strategy believe that once a stock starts moving upward (or downward), it will gain momentum and continue in that direction for a period of time.

Trying to figure out when a stock is nearing its peak—or trough—is a big challenge. As noted above, momentum investors use technical indicators based on the price, volume, or open interest of a security or contract to try to assess whether a stock’s momentum will continue upward or downward.

In addition to individual stocks, some exchange-traded funds (ETFs) can be used to pursue a momentum investing strategy.

The Risks of Changing Momentum

Momentum investing might seem enticing when markets are trading higher (or lower in the case of a short strategy), but it can be highly risky. Remember that past performance doesn’t guarantee future returns. Also, a momentum strategy depends upon more and more investors following trends and, in turn, driving share prices higher. This can sometimes lead to prices rising to levels far above the stock’s intrinsic value and, therefore, becoming unsustainable.

Market trends can sway like a pendulum, and investor sentiment can quickly pivot based on a variety of factors. For example, macroeconomic and geopolitical forces can impact stocks across sectors. Likewise, sector-specific news can impact stocks within a particular sector, such as price caps on certain prescription drugs influencing share prices of many pharmaceutical firms. And company-specific news, such as a negative earnings report, can impact both the company issuing the report and its peers.

Determining the right time to enter—and exit—a position is inherent to momentum investing. Buying a position too early or selling too late can have a direct impact on your profits. Considering the interconnectedness of global equity markets, you should consider monitoring events around the world and be prepared to trade quickly based on price changes at all hours of the day. Keep in mind, though, that even the most experienced investors using sophisticated algorithms can’t predict unexpected geopolitical or macroeconomic shocks.

Developing the ability to skillfully adhere to a momentum investing strategy can require years of study and practice. Even then, momentum indicators can give false signals in volatile markets and aren’t guaranteed. Consider working with an investment professional to help you determine the best investment strategy to achieve your individual financial goals.

Learn more about investing.