Firm Guidance – Private Placement Filings

This reference guide covers a range of private placement topics, from the basic question of "What is a private offering?" to more technical discussions on broker-dealer compliance with FINRA's private placement rules.

On this Page

2.1. In general, when must a member firm make a private placement filing?

2.4. What is the distinction between a Rule 5122 filing and that of Rule 5123?

2.5. Is a Rule 5122 offering subject to any additional requirements?

2.6. Who should I contact if I'm unsure about a filing requirement?

3.3. Can a member firm file on behalf of another participating firm?

3.5. Does a member firm have to answer every question on the form?

4.1. Does a member firm need clearance from FINRA to participate in a private placement?

1. The Basics – What Is a Private Placement?

Private placements are unregistered, non-public securities offerings that rely on an available exemption from registration with the Securities and Exchange Commission (SEC). Unregistered offerings of securities must rely on an exemption from registration under either Sections 3 or 4 of the Securities Act of 1933 (the '33 Act[1].) Most private offerings, however, are sold pursuant to three "safe harbor" rules promulgated under the '33 Act; Regulation D, Rules 504,[2] 506(b),[3] and 506(c).[4] These rules provide issuers with a clearer and more objective set of requirements for which their offerings may qualify for exemption from registration.

Of the approximate 4,000 FINRA-registered member firms, nearly a quarter (or 23%) have reported revenue from private placement activities during the past five years. Many of these firms are not frequent filers, having submitted fewer than five filings. The following information provides guidance which may be helpful to member firms that are either first-time or infrequent filers or have limited compliance resources.

1.1. What are the types of Regulation D offerings?

- Rule 504:

Provides an exemption from registration requirements for issuers that offer and sell up to $10 million of securities in any 12-month period.- May use general solicitation under certain conditions.

- No limit on non-accredited investors.

- No disclosure requirement for non-accredited investors.

- Rule 506(b):

Provides an exemption to issuers under the following conditions:- No general solicitation.

- Offer to an unlimited number of accredited investors[5] and up to 35 non-accredited purchasers; all investors must be sophisticated.

- Disclosure requirement for non-accredited investors.

- Issuer must be available to answer any questions by prospective purchasers.

- No limit on amount raised.

- Most commonly used exemption.

- Rule 506(c):

Allows an issuer to broadly solicit and generally advertise the offering; however, the following requirements must be met:- All purchasers must be accredited investors.

- The issuer must take reasonable steps to verify that the investors are accredited.

- No limit on amount raised.

All three Rules (504, 506(b) and 506(c)) are subject to "bad actor"[6] disqualification provisions (506(d) and (e) of Regulation D), and information provided by the issuer must not contain false or misleading statements and omissions that may be material to investors. Further, issuers relying on a Regulation D exemption must file a "Form D" with the SEC via EDGAR.[7]

1.2. What are other types of unregistered offerings?

- Interstate offerings made pursuant to SEC Rule 147 and Rule 147A[8]:

Rules 147 and 147A are "safe harbor" provisions under Section 3(a)(11) of the '33 Act, providing a registration exemption for issuances made to residents of a particular state in which the issuer conducts business or is domiciled (securities offering that takes place within one state). Recently effective Rule 147A allows an issuer, under certain restrictions, to incorporate or extend offers outside of the state provided that all investors are residents of the same state in which the issuer is located or conducting business. - Regulation A+[9] offerings:

This type of offering is a capital-raising option for smaller companies seeking an alternative to a traditional initial public offering (IPO). Regulation A+ issuers can raise up to $50 million in a 12-month period with a reduced amount of disclosure requirements when compared to the obligations of publicly reporting companies. Regulation A+ issuers can utilize the SEC’s confidential process for review of the offering circular. Offerings conducted pursuant to Regulation A are considered public offerings under FINRA Rule 5110. Filing Guidance related to the Public Offering Review process is available here. - SEC Rule 144 and 144A[10] offerings:

Allow for public resale of restricted and control securities (typically from an unregistered offering) if a number of conditions are met. - Regulation S[11]:

Exempted offerings sold to non-U.S. investors located "offshore" with resale restrictions back to the U.S. - Non-Regulation D offerings sold pursuant to SEC 4(a)(2):

A general exemption from registration for private offerings of securities. The exemption allows the issuer to offer or sell only to sophisticated investors who do not need the protections provided under the SEC's registration and disclosure regulations. There is no bright line test for sophistication and financial risk tolerance under this statute.

For further information, please see FINRA's Topic Page for Industry Professionals[12] and SEC Small Business[13] page.

2. The Rules and Filing Requirements

The filing requirements for FINRA Rule 5122[14] became effective on June 17 2009. The filing requirements for FINRA Rule 5123[15] became effective on December 3, 2012.

Member firms that participate in the sale or offer of private placements must make a filing through FINRA's Firm Gateway[16] unless the offering is exempt from filing under the rules.

This module explains the filing requirement for member firms that sell or offer a private placement.

2.1. In general, when must a member firm make a private placement filing?

Member firms that participate in the sale of a private placement made to at least one retail investor must file the offering documents with FINRA, provided there is no filing exemption available.

Member firms that offer a private placement of its own securities (Member Private Offering) or that of a "control entity"[17] must file prior to the offering or using offering materials.

All other private placements sold by a member firm must be filed within 15 calendar days of the date of first sale.[18]

2.2. Must I file if my firm is serving as a consultant or advisor to a private offering? What about as an Alternative Trading System (ATS)?

The rules' filing requirements apply to member firms conducting a sale or offer of a private placement; therefore, a member firm acting strictly in the role of a consultant or advisor will not have to submit a filing with FINRA. The same applies to firms acting in a custodial capacity.

However, a member firm acting in the capacity of placement agent, selling agent, ATS, broker-dealer, finder or any other role that promotes or facilitates the sale or offer of private placements must make a filing, unless an exemption from filing is available.

2.3. When are offerings exempted from filing?

The following is a list of private offerings exempted from the filing requirements of Rule 5123 (the exemptions for Rule 5122 are largely similar).

Offerings sold solely to a certain type of purchaser:

- Institutional accounts;

- Qualified purchasers;

- Qualified institutional buyers;

- Investment companies;

- An entity composed exclusively of qualified institutional buyers;

- Banks;

- Employees and affiliates of the issuer;

- Knowledgeable employees;

- Eligible contract participants; and

- Accredited investors that are not natural persons.

Note: These investors are typically either highly sophisticated or have access to information about the issuer or offering.

Types of offerings that are exempted from filing:

- Offerings made pursuant to Securities Act Rule 144A or SEC Regulation S;

- Offerings of exempt securities with short-term maturities and debt securities sold by members pursuant to Section 4(2) of the Securities Act, so long as the maturity does not exceed 397 days and the securities are issued in minimum denominations of $150,000 (or the equivalent thereof in another currency);

- Offerings of securities issued in conversions, stock splits and restructuring transactions that are executed by an already existing investor without the need for additional consideration or investments on the part of the investor;

- Offerings of non-convertible debt or preferred securities that meet the transaction eligibility criteria for registering primary offerings of non-convertible securities on Forms S-3 and F-3;

- Offerings of securities of a commodity pool operated by a commodity pool;

- Business combination transactions;

- Offerings of registered investment companies; and

- Offerings filed with FINRA under Rules 2310, 5110, 5121, and 5122 or exempt from filing thereunder in accordance with Rule 5110(b)(7).

Offerings of certain types of securities are not required to be filed:

- Offerings of exempted securities, as defined in Section 3(a)(12) of the Exchange Act;

- Offerings of subordinated loans under SEA Rule 15c3-1;

- Offerings of "variable contracts;"

- Offerings of modified guaranteed annuity contracts and modified guaranteed life insurance policies; and

- Standardized options.

Note: Member firms may apply for an exemption from the filing requirements of either rule under the Rule 9600 Series.

Citations and references to definitions can be found in the rule text.

2.4. What is the distinction between a Rule 5122 filing and that of Rule 5123?

A Member Private Offering is a proprietary private offering of unregistered securities issued by a member firm or a control entity and filed under Rule 5122.

All other non-proprietary private offerings filed with FINRA do not have specific disclosure requirements in offering documents pursuant to FINRA rules, but may have obligations under SEC requirements.

2.5. Is a Rule 5122 offering subject to any additional requirements?

Yes. At least 85 percent of the offering proceeds raised in a Member Private Offering must be used for business purposes. Any disclosures concerning the offering's use of proceeds should be consistent with this requirement.

Private placement memorandums, offering documents or a term sheet must be provided to prospective investors and include disclosures addressing the intended use of proceeds, offering expenses and the amount of selling compensation that will be payable to the member firm and its associated persons.

For further information, see FINRA Rule 5122.

2.6. Who should I contact if I'm unsure about a filing requirement?

Please contact FINRA Corporate Financing at (240) 386-4623 or the member firm's Risk Monitoring Analyst.

For further information, please see FINRA's Corporate Financing Department web page.[19]

3. The Filing Process

3.1. What are the steps to the filing process?

Step 1: Account Set-Up: In order to make filings, a member firm must have entitlement rights to the Private Placement Filing System through the Firm Gateway.

Step 2: Log in to the Firm Gateway, select "My Account" and determine whether your firm has a Super Account Administrator (SAA).

Step 3: While on the Firm Gateway home screen, select the "Forms & Filings" tab and open the "Private Placement" form.

Step 4: Select "Begin New Form" to enter information regarding the private placement. At this point, you must indicate if you are submitting a FINRA Rule 5122 or 5123 filing, as applicable.

Note: Every field preceded by a red asterisk must be completed to submit a filing.

Step 5: Member firms are required to submit a Filer Form, which is located in the Firm Gateway. If you need assistance with the Firm Gateway, you may call the FINRA Support Center at (301) 869-6699.

3.2. What information is submitted in the filing?

Filers must submit offering documents and complete a Filer Form.

Documents

An offering document is any document used in connection with the offer and sale of the security that sets forth the terms of the offering. Examples of offering documents include:

- Private Placement Memorandum;

- Term Sheet;

- Offering Memorandum;

- Offering Summary;

- Purchase Agreement;

- Communications or Sales Materials; or

- Any other type of document that sets forth the terms of the offering.

Note: If no offering documents are used, firms must indicate so on the Filer Form when filing through the Firm Gateway.

Filer Form

The Filer Form contains three main sections:

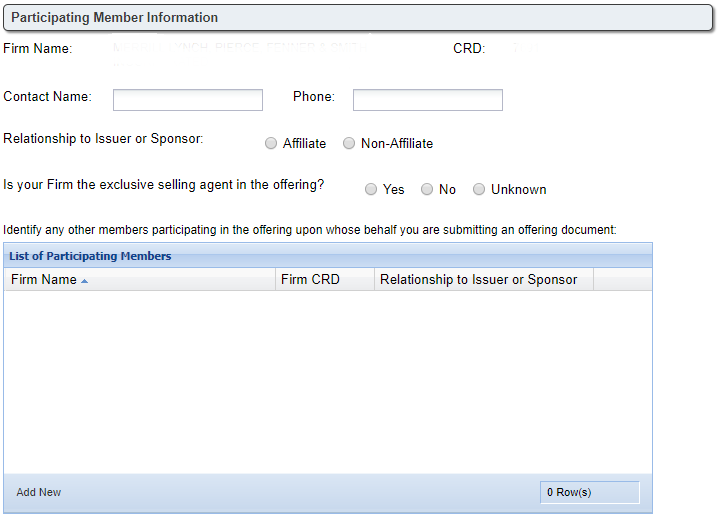

1. Participating Member Information

This section contains information about the filing firm and any other selling firm identified in the filing. The filer is asked about the role of member firms participating; for instance, whether the firm is involved as the exclusive selling agent and whether there is any affiliation between the issuer and/or sponsor and the firm.

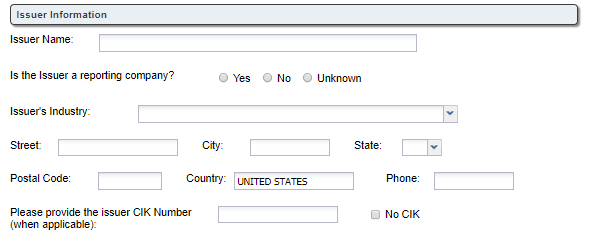

2. Issuer Information

This section captures general information about the issuer, such as whether it is a reporting company, and its industry, address and CIK number.

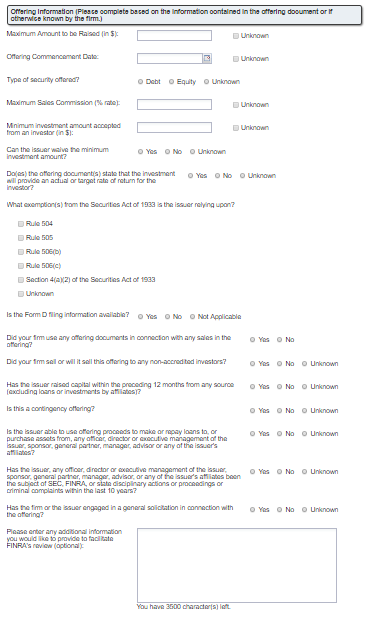

3. Offering Information

This section requires the filer to submit information about the offering terms, such as (i) the type of security offered; (ii) the minimum investment amount that the issuer will accept from each investor; (iii) whether the issuer sold or will be sold to non-accredited investors; (iv) the exemption the issuer is relying upon; and (v) for contingency offerings, whether the contingency has been met as of the date of the filing.

The filer is also asked to provide the date for which the firm first offered or sold the private placement, and a confirmation as to whether the issuer or firm has engaged in general solicitation.

Please note that the rules require member firms to file documents that were used to sell private placements in searchable PDF format. It is also important to note that if the offering is a contingent offering, even though it is not required by the rules, a filer may submit the escrow agreement or similar document, if applicable, to potentially reduce the need for a follow-up information request the Corporate Financing Department's staff.

3.3. Can a member firm file on behalf of another participating firm?

As mentioned above, if more than one member firm is selling a private offering, one member firm can make the filing on behalf of the other firms.

Note: A filer may enter other participating members by selecting "Add New" on the "List of Participating Members" grid in the Participating Member Section of the Filer Form.

3.4. How does a filer amend a filing?

While in the private placement filing queue in Firm Gateway, simply highlight the applicable offering and select "Amend." Afterwards, the Filer Form will be available to make edits to the original file.

Any amendments of the offering document must be filed within 10 days of being provided to any investor.

3.5. Does a member firm have to answer every question on the form?

In general, yes. However, the Filer Form allows the filer to also answer "Unknown" for most questions.

4. The Review Process

4.1. Does a member firm need clearance from FINRA to participate in a private placement?

No. Offerings submitted under FINRA Rules 5122 and 5123 are "notice" filings that do not require a FINRA clearance or approval.

4.2. What is the review process?

All filings received in the Private Placement Filing System are electronically assessed and evaluated for a possible comprehensive review. Some filings are assigned to a staff member for further review if necessary.

During the course of a review, the department may contact the filer for clarification on information submitted in the Filer Form or request documents not submitted.

4.3. Who sees the filing?

FINRA treats all private placement filings submitted under Rules 5122 and 5123 confidentially, and only individuals who have been granted access to the Private Placement Filing System have the ability to see the filing.

4.4. How can I keep track of my firm's filings?

You are able to review your current and historical filings via the Firm Gateway. FINRA will also deploy a "Report Card" tool in in the future that enables a member firm to view all of its filings.

For further information, see FINRA's Corporate Financing Private Placement page.

5. Additional Informational Resources

5.1. Filing resources

5.2. Relevant Regulatory Notices

- 09-05 - FINRA Reminds Firms of Their Obligation to Determine Whether Securities are Eligible for Public Sale

- 09-27 - SEC Approves New FINRA Rule 5122 Relating to Private Placements of Securities Issued by a Member Firm or a Control Entity

- 10-22 - Obligation of Broker-Dealers to Conduct Reasonable Investigations in Regulation D Offerings

- 11-04 - FINRA Requests Comment on Proposed Amendments to FINRA Rule 5122 to Address Member Firm Participation in Private Placement

- 12-40 - SEC Approves New FINRA Rule 5123 Regarding Private Placements of Securities

- 13-26 - FINRA Updates Form for Filing Private Placements of Securities Pursuant to FINRA Rules 5122 and 5123

- 16-08 - Private Placement and Public Offerings Subject to a Contingency

- 17-17 - Updated Private Placement Filer Form

5.3. Designated contact for member firms:

For a member firm making its first filing, FINRA encourages the filer to contact the Corporate Financing Department at (240) 386-4623 or [email protected] to receive personalized guidance on the filing of either public or private offerings. FINRA staff is available to answer any filing, technical or rule-related questions.

Footnotes

[1] See P. 7 http://legcounsel.house.gov/Comps/Securities%20Act%20Of%201933.pdf.

[2] See 17 CFR 230.504 (https://www.ecfr.gov/current/title-17/chapter-II/part-230/subject-group-ECFR6e651a4c86c0174/section-230.504.)

[3] See 17 CFR 230.506(b) (www.ecfr.gov/cgi-bin/text-idx?SID=cd6d4f96f78e70b89d687c7892c9f6a9&mc=true&node=pt17.3.230&rgn=div5#se17.3.230_1506.)

[4] See 17 CFR 230.506(c) (www.ecfr.gov/cgi-bin/text-idx?SID=cd6d4f96f78e70b89d687c7892c9f6a9&mc=true&node=pt17.3.230&rgn=div5#se17.3.230_1506.)

[5] The term accredited investor is defined in Rule 501 of Regulation D. See www.ecfr.gov/cgi-bin/retrieveECFR?gp=&SID=8edfd12967d69c024485029d968ee737&r=SECTION&n=17y3.0.1.1.12.0.46.176.

[6] See Securities Act Release No. 9414 (July 10, 2013), 78 FR 44730 (July 10, 2013) (Disqualification of Felons and Other "Bad Actors" from Rule 506 offerings). See also www.sec.gov/info/smallbus/secg/bad-actor-small-entity-compliance-guide.htm.

[7] EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, that performs automated collection, validation, indexing, acceptance, and forwarding of submissions by companies and others who are required by law to file with the US Securities and Exchange Commission (SEC). (See www.sec.gov/edgar/aboutedgar.htm.)

[8] See 17 CFR 230.147.

[9] See 17 CFR 230.251 et seq. See also www.sec.gov/smallbusiness/exemptofferings/rega.

[10] See 17 CFR 230.144 and 17 CFR 230-144A. See also www.sec.gov/reportspubs/investor-publications/investorpubsrule144htm.html.

[11] See 17 CFR 230.901 – 230.905 and Preliminary notes. See also www.sec.gov/rules/final/33-7505.htm.

[12] See www.finra.org/rules-guidance/key-topics/private-placements.

[13] See www.sec.gov/smallbusiness.

[14] See FINRA Rule 5122 (www.finra.org/rules-guidance/rulebooks/finra-rules/5122.)

[15] See FINRA Rule 5123 (www.finra.org/rules-guidance/rulebooks/finra-rules/5123.)

[16] The FINRA Firm Gateway is an online compliance tool that provides consolidated access to FINRA applications and allows firms to submit required filings electronically to meet their compliance and regulatory obligations.

[17] A "control entity" means any entity that controls or is under common control with a member, or that is controlled by a member or its associated persons. (See www.finra.org/rules-guidance/rulebooks/finra-rules/5122.)

[18] This 15-day time period corresponds with the filing requirement for issuers under SEC Form D. See SEC Form D (Notice of Exempt Offerings of Securities) General Instructions. See also SEC Release 33-8891.pdf (p. 30).

[19] See www.finra.org/about/how-we-operate/corporate-financing.