For purposes of this Rule, the following terms shall have the following meanings:

(1) The term "Consultation" means one or more meetings or consultations between the Department and a member that meets the Preliminary Criteria for Identification.

(2) The term "Covered Pending Arbitration Claim," for purposes of this Rule 4111, means an investment-related, consumer initiated claim filed against the member or its associated persons in any arbitration forum that is unresolved; and whose claim amount (individually or, if there is more than one claim, in the aggregate) exceeds the member's excess net capital. For purposes of this definition, the claim amount includes claimed compensatory loss amounts only, not requests for pain and suffering, punitive damages or attorney's fees, and shall be the maximum amount for which the member or associated person, as applicable, is potentially liable regardless of whether the claim was brought against additional persons or the associated person reasonably expects to be indemnified, share liability or otherwise lawfully avoid being held responsible for all or part of such maximum amount.

(3) The term "Department" means FINRA's Department of Member Regulation.

(4) The term "Disclosure Event and Expelled Firm Association Categories" means the following categories of disclosure events and other information:

(A) "Registered Person Adjudicated Events" means any one of the following events that are reportable on the registered person's Uniform Registration Forms:

(i) a final investment-related, consumer-initiated customer arbitration award or civil judgment against the registered person in which the registered person was a named party or was a "subject of" the customer arbitration award or civil judgment;

(ii) a final investment-related, consumer-initiated customer arbitration settlement, civil litigation settlement or a settlement prior to a customer arbitration or civil litigation for a dollar amount at or above $15,000 in which the registered person was a named party or was a "subject of" the customer arbitration settlement, civil litigation settlement or a settlement prior to a customer arbitration or civil litigation;

(iii) a final investment-related civil judicial matter that resulted in a finding, sanction or order;

(iv) a final regulatory action that resulted in a finding, sanction or order, and was brought by the SEC or Commodity Futures Trading Commission (CFTC), other federal regulatory agency, a state regulatory agency, a foreign financial regulatory authority, or a self-regulatory organization; or

(v) a criminal matter in which the registered person was convicted of or pled guilty or nolo contendere (no contest) in a domestic, foreign, or military court to any felony or any reportable misdemeanor.

(B) "Registered Person Pending Events" means any one of the following events associated with the registered person that are reportable on the registered person's Uniform Registration Forms:

(i) a pending investment-related civil judicial matter;

(ii) a pending investigation by a regulatory authority;

(iii) a pending regulatory action that was brought by the SEC or CFTC, other federal regulatory agency, a state regulatory agency, a foreign financial regulatory authority, or a self-regulatory organization; or

(iv) a pending criminal charge associated with any felony or any reportable misdemeanor.

(C) "Registered Person Termination and Internal Review Events" means any one of the following events associated with the registered person at a previous member that are reportable on the registered person's Uniform Registration Forms:

(i) a termination in which the registered person voluntarily resigned, was discharged or was permitted to resign from a previous member after allegations; or

(ii) a pending or closed internal review by a previous member.

(D) "Member Firm Adjudicated Events" means any one of the following events that are reportable on the member's Uniform Registration Forms, or are based on customer arbitrations filed with FINRA's dispute resolution forum:

(i) a final investment-related, consumer-initiated customer arbitration award in which the member was a named party;

(ii) a final investment-related civil judicial matter that resulted in a finding, sanction or order;

(iii) a final regulatory action that resulted in a finding, sanction or order, and was brought by the SEC or CFTC, other federal regulatory agency, a state regulatory agency, a foreign financial regulatory authority, or a self-regulatory organization; or

(iv) a criminal matter in which the member was convicted of or pled guilty or nolo contendere (no contest) in a domestic, foreign, or military court to any felony or any reportable misdemeanor.

(E) "Member Firm Pending Events" means any one of the following events that are reportable on the member's Uniform Registration Forms:

(i) a pending investment-related civil judicial matter;

(ii) a pending regulatory action that was brought by the SEC or CFTC, other federal regulatory agency, a state regulatory agency, a foreign financial regulatory authority, or a self-regulatory organization; or

(iii) a pending criminal charge associated with any felony or any reportable misdemeanor.

(F) "Registered Persons Associated with Previously Expelled Firms" means any Registered Person In-Scope who was registered for at least one year with a previously expelled firm and whose registration with the previously expelled firm terminated during the Evaluation Period.

(5) The term "Evaluation Date" means the date, each calendar year, as of which the Department calculates the Preliminary Identification Metrics to determine if the member meets the Preliminary Criteria for Identification.

(6) The term "Evaluation Period" means the prior five years from the Evaluation Date, provided that for the Registered Person Pending Events and Member Firm Pending Events categories and pending internal reviews in the Registered Person Termination and Internal Review Events category, it would correspond to the Evaluation Date (and include all events that are pending as of the Evaluation Date).

(7) The term "Former Member" means an entity that has withdrawn or resigned its FINRA membership, or that has had its membership cancelled or revoked.

(8) The term "qualified security" has the meaning given it in SEA Rule 15c3-3(a)(6).

(9) The term "Preliminary Criteria for Identification" means meeting the following conditions:

(A) Two or more of the member's Preliminary Identification Metrics are equal to or more than the corresponding Preliminary Identification Metrics Thresholds, and at least one of these metrics is among the following metrics:

(i) Registered Person Adjudicated Event Metric;

(ii) Member Firm Adjudicated Event Metric; and

(iii) Expelled Firm Association Metric; and

(B) The member has two or more Registered Person and Member Firm Events during the Evaluation Period.

(10) The term "Preliminary Identification Metrics" means the following six metrics that are based on the number of disclosure events (defined above) per Registered Persons In-Scope or percent of Registered Persons In-Scope associated with previously expelled firms:

(A) "Registered Person Adjudicated Event Metric" would be computed as the sum of Registered Person Adjudicated Events that reached a resolution during the Evaluation Period, across all Registered Persons In-Scope and divided by the number of Registered Persons In-Scope.

(B) "Registered Person Pending Event Metric" would be computed as the sum of Registered Person Pending Events as of the Evaluation Date, across all Registered Persons In-Scope and divided by the number of Registered Persons In-Scope.

(C) "Registered Person Termination and Internal Review Event Metric" would be computed as the sum of Registered Person Termination and Internal Review Events that reached a resolution during the Evaluation Period and pending internal reviews by a previous member as of the Evaluation Date, across all Registered Persons In-Scope and divided by the number of Registered Persons In-Scope.

(D) "Member Firm Adjudicated Event Metric" would be computed as the sum of Member Firm Adjudicated Events that reached a resolution during the Evaluation Period, divided by the number of Registered Persons In-Scope.

(E) "Member Firm Pending Event Metric" would be computed as the sum of Member Firm Pending Events as of the Evaluation Date, divided by the number of Registered Persons In-Scope.

(F) "Expelled Firm Association Metric" would be computed as the sum of Registered Persons Associated with Previously Expelled Firms, divided by the number of Registered Persons In-Scope.

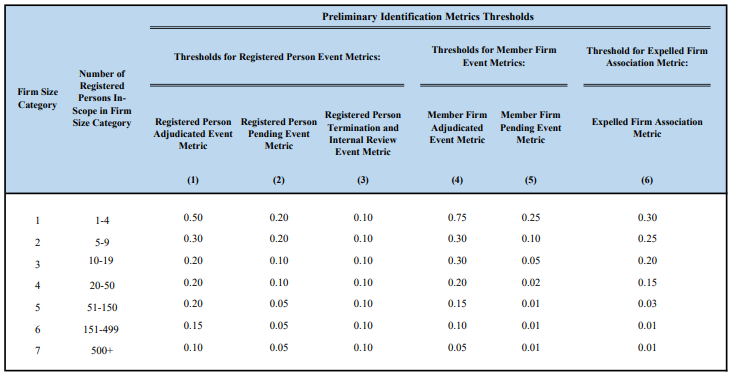

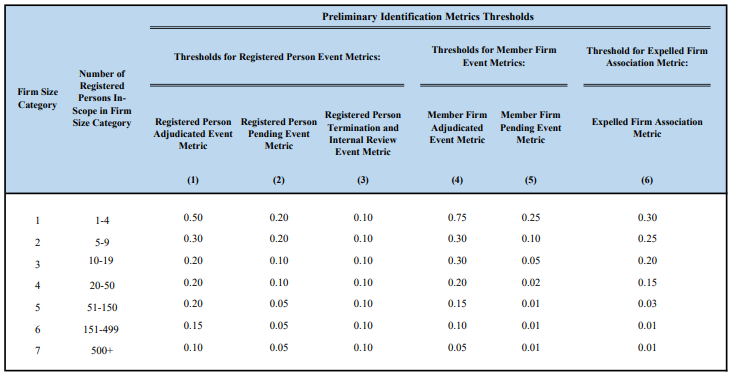

(11) The term "Preliminary Identification Metrics Thresholds" means the following thresholds corresponding to each of the six Preliminary Identification Metrics.

(12) The term "Registered Person and Member Firm Events" means the sum of the following categories of defined events during the Evaluation Period:

(A) Registered Person Adjudicated Events;

(B) Registered Person Pending Events;

(C) Registered Person Termination and Internal Review Events;

(D) Member Firm Adjudicated Events; and

(E) Member Firm Pending Events.

(13) The term "Registered Persons In-Scope" means all persons registered with the firm for one or more days within the one year prior to the Evaluation Date.

(14) The term "Restricted Deposit Account" means an account in the name of the member:

(A) at a bank (as defined in Section 3(a)(6) of the Exchange Act) or the member's clearing firm;

(B) subject to an agreement in which the bank or the member's clearing firm, as applicable, agrees:

(i) not to permit withdrawals (other than withdrawals of interest or the withdrawal of qualified securities or cash after and on the same day as the deposit of cash or qualified securities of equal value) from the Restricted Deposit Account without the prior written consent of FINRA;

(ii) to keep the account separate from any other accounts maintained by the member with the bank or clearing firm;

(iii) that the cash or securities on deposit in the account will at no time be used directly or indirectly as security for a loan to the member by the bank or clearing firm and will not be subject to any set-off, right, charge, security interest, lien, or claim of any kind in favor of the bank, clearing firm or any person claiming through the bank or clearing firm;

(iv) that if the member becomes a Former Member, the assets deposited in the Restricted Deposit Account to satisfy the Restricted Deposit Requirement shall be kept in the Restricted Deposit Account, and the bank or clearing firm will not permit withdrawals from the Restricted Deposit Account without the prior written consent of FINRA as set forth in paragraphs (f)(1) and (f)(3) of this Rule; and

(v) that FINRA is a third-party beneficiary to such agreement and that such agreement may not be amended without the prior written consent of FINRA; and

(C) not subject to any right, charge, security interest, lien or claim of any kind granted by the member.

(15) The term "Restricted Deposit Requirement" means one of the following amounts:

(A) the specific maximum Restricted Deposit Requirement for a member, determined by the Department taking into consideration the nature of the firm's operations and activities, revenues, commissions, assets, liabilities, expenses, net capital, the number of offices and registered persons, the nature of the disclosure events counted in the numeric thresholds, insurance coverage for customer arbitration awards or settlements, concerns raised during FINRA exams, and the amount of any of the firm's or its associated persons' Covered Pending Arbitration Claims, unpaid arbitration awards or unpaid settlements related to arbitrations. Based on a review of these factors, the Department would determine a maximum Restricted Deposit Requirement for the member that would be consistent with the objectives of this Rule, but would not significantly undermine the continued financial stability and operational capability of the firm as an ongoing enterprise over the next 12 months; or

(B) the amount, adjusted after the Consultation, determined by the Department; and

(C) with respect to a Former Member, the Restricted Deposit Requirement last calculated pursuant to paragraph (i)(15)(A) or (15)(B) of this Rule when the firm was a member.

(16) The term "Restricted Firm" means each member that is designated as such in accordance with paragraphs (e)(1)(B) and (e)(1)(C) of this Rule.

(17) The term "Uniform Registration Forms" means the Forms BD, U4, U5 and U6, as applicable.

(a) limitations on business expansions, mergers, consolidations or changes in control;

(g) limiting approvals of registered persons entering into borrowing or lending arrangements with their customers;

(h) requiring the member to impose specific conditions or limitations on, or to prohibit, registered persons' outside business activities of which the member has received notice pursuant to Rule 3270; and

(i) requiring the member to prohibit or, as part of its supervision of approved private securities transactions for compensation under Rule 3280 or otherwise, impose specific conditions on associated persons' participation in private securities transactions of which the member has received notice pursuant to Rule 3280.