Identity Verification

FINRA Enhances the FINRA Entitlement Platform with Identity Verification

Effective May 11, 2026

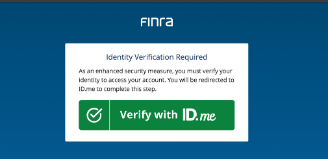

FINRA is enhancing security on the FINRA Entitlement Platform by introducing identity verification through ID.me. This requirement will be phased in for Super Account Administrators (SAAs), Account Administrators (AAs), and users with access to sensitive information.

On This Page

- What is Identity Verification?

- Who Needs to Complete Identity Verification

- Rollout Timeline

- Verification Methods

- User Guides and Resources

- How to Prepare

- Frequently Asked Questions

What is Identity Verification?

Identity verification is an additional security layer that confirms you are the legitimate account owner when logging into the FINRA Entitlement Platform – not an imposter attempting unauthorized access. This protects both your account and the sensitive data you access.

Why ID.me? FINRA selected ID.me to perform identity verification services as ID.me is certified to federal standards for identity verification.

Who Needs to Complete Identity Verification

The following account types will need to complete identity verification:

- Super Account Administrators (SAAs)

- Account Administrators (AAs)

- Users with access to view specific sensitive data:

- FBI fingerprint results

- Criminal History Record Information (CHRI)

- Social Security Numbers (SSNs), or

- Reports or queues containing this sensitive data

Note: IA-only organizations only have SSN-related requirements.

Exclusions: FinPro accounts and machine accounts are currently excluded.

Rollout Timeline

- Identity verification will roll out over four months from May 11, 2026 through September 14, 2026 in weekly waves

- Each week, a group of in-scope users will be selected to complete verification

- Individuals within the same organization may have different verification weeks

Communication Schedule:

- Late February – early May 2026: FINRA will send initial and reminder emails to in-scope individuals

- SAAs will receive:

- A report of in-scope accounts

- A list of entitlements (privileges) requiring identity verification

Verification Methods

It is important to note that FINRA system users should not create multiple accounts with ID.me. One ID.me account will be used to verify your FINRA Entitlement accounts and users should use their personal email address and not their business email.

- Self-Service Verification (Most Users):

Identity verification is accomplished through self-service identity verification for those individuals who have an existing pre-verified ID.me account and those individuals who need to create an ID.me account.- Existing, pre-verified ID.me users: Users with a pre-verified ID.me account will login to ID.me and upload a selfie. ID.me will match the uploaded selfie to your profile to complete the identity verification requirement.

- New ID.me users: Users will create an account with ID.me to upload their documents and selfie. As part of this process, users will need to provide their social security numbers and personal information for automated verification.

- Video Chat Verification (Some Users):

Users who cannot complete self-service verification, including those living outside the United States, will verify their identity through a live video chat with an ID.me trusted agent who will review their government-issued documents in real time. - In-Person Verification (Rare Cases):

In limited circumstances, users may complete identity verification at one of over 700 ID.me locations nationwide by presenting their government-issued documents to a trusted operator.

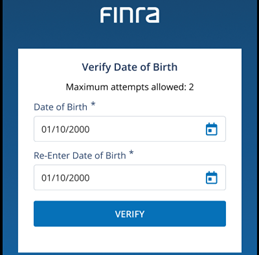

To complete the FINRA Entitlement Platform identity verification, users must provide their date of birth to FINRA. This information serves as a matching identifier between the FINRA Entitlement Platform and ID.me. FINRA does not store or retain any personal information submitted to or provided by ID.me during the verification process.

For details of the identity verification options, please refer to the User Guides and Overview material below.

User Guides and Resources

Step By Step Guide – Verifying Your Identity with Self Service (PDF)

Step By Step Guide – Verifying Your Identity on an Extended Video Call (PDF)

How to Prepare

To prepare for identity verification:

- Gather required documents: Have a valid government-issued ID ready (driver's license, passport, or state ID) and your social security number available.

- Prepare your technology: Ensure access to a smartphone with a camera and stable internet connection for capturing selfies or participating in a live video call.

- Set up your environment: Position yourself in a well-lit area with a solid, dark background to capture clear photos of your ID.

- Verify your account information: Review your FINRA Entitlement account to confirm your account name is correctly associated with you.

- Review user access permissions: SAA or AA should verify that in-scope individuals require the access to perform their current job functions. If the level of access is not needed, the SAA or AA should remove the entitlement from their account.

- Firms using service providers: If a firm uses a service provider and they have a FINRA Entitlement account, the SAA or AA should work with the service provider to verify that the FINRA Entitlement account is assigned to an individual person and that the person’s information is current and accurate.

- When creating an ID.me account, do not create multiple accounts with ID.me and only one ID.me account should be used to verify each of your FINRA entitlement accounts.

- Use their personal email address and not a business email.

Frequently Asked Questions

Understanding the Requirement

Q1: Why has FINRA implemented ID.me?

A1: FINRA is requiring identity verification to protect certain data from being exposed to security vulnerabilities and to evolve its cybersecurity controls to mitigate fraud.

Q2: What are the benefits of using ID.me as FINRA's identity verification method?

A2: Identity verification offers the following benefits:

- Provides 24/7 U.S.-based support - Access round-the-clock customer support for any login assistance you may need. Visit help.id.me for more information.

- Prevents fraud - ID.me has a robust identity verification service to help prevent fraud and identity theft by ensuring the appropriate user accesses the account.

- Offers bank-grade security - ID.me uses advanced encryption to keep your personal information safe and secure.

- Meets federal standards - ID.me meets the requirements for Identity Assurance Level 2 (IAL2) verification.

Q3: What sensitive data access will require identity verification?

A3: Accounts with access to FBI fingerprint results, RAP sheet data, fingerprint-related data in reports and queues, or the ability to view Social Security numbers (SSNs) will require identity verification.

Q4: Is there a cost for an ID.me account?

A4: No. There is no cost assessed to FINRA users for identity verification.

Implementation Timeline and Scope

Q5: How do I begin the identity verification process for FINRA?

A5: Beginning May 11, 2026, with a phased 4-month rollout period, FINRA will present a screen to in-scope users after login to a FINRA system that offers a button to "Verify with ID.me." The button will systematically transfer the user to ID.me.

Q6: What events require me to verify identity?

A6: Identity verification is currently required:

- Upon initial enrollment

- Every two years

- When a new account is created or modified that meets the identity verification criteria

- As required by FINRA

Q7: Do users that meet the identity verification criteria and are with organizations that use single sign-on (SSO) to access a FINRA system need to complete identity verification?

A7: Yes. Users that meet the identity verification criteria and who are with organizations leveraging SSO must complete identity verification when prompted to access FINRA systems.

Q8: As a firm or service provider, do I need to verify my identity for each of my accounts?

A8: Yes. You will need to verify your identity for each of your FINRA Entitlement accounts. Service providers should verify that their FINRA Entitlement account name is correct and work with the firm's SAA or AA to update the account name as appropriate.

Preparing for Verification

Q9: As a U.S. citizen, what do I need to complete the identity verification process through ID.me?

A9: You will need:

- A smartphone with a camera or computer with a webcam

- A photo ID (U.S. driver's license or state ID, U.S. passport, or U.S. passport card)

- Your Social Security number

At times, a secondary document may be required. If so, you will need an artifact such as a Social Security card, utility bill, or vehicle registration information to verify residency.

Q10: What do I need to complete verification through ID.me Self-Service (i.e., no video call or human intervention)?

A10: You will need:

- A smartphone with a camera or computer with a webcam

- A photo ID (U.S. driver's license or state ID, U.S. passport, or U.S. passport card)

- Your Social Security number

- A live photo of your face with your phone camera or a webcam

Q11: As a non-U.S. resident living in the USA, what do I need to complete the ID.me verification process?

A11: You will need:

- A smartphone or computer with a webcam

- A valid foreign (non-U.S.) passport or state-issued driver's license or ID

- A video call with ID.me to complete identity verification

Q12: As a non-U.S. citizen living internationally, what do I need to complete the ID.me verification process?

A12: You will need:

- A smartphone or computer with a webcam

- A valid foreign (non-U.S.) passport

- Proof of your international address

- A video call with ID.me to complete identity verification

Q13: My state-issued driver's license or identification card (ID) has expired. Can I still verify my identity through ID.me?

A13: Yes. You can use your expired driver's license or state-issued identification card as evidence to prove your identity through ID.me. Depending on individual circumstances, you may be able to complete identity verification through standard verification or be required to upload additional documents.

- For standard verification: If your license expired recently (often within 12 months), upload the expired ID plus a photo of your valid temporary license or renewal confirmation from the applicable state licensing agency (e.g., Department of Motor Vehicles).

- If rejected for being expired: Choose the "Expired U.S. State Driver's License" option in ID.me, upload the expired ID, then upload your temporary/renewal document.

- For other documents: If you have other valid government IDs (like a passport or current state ID), use one of those instead as a primary document.

Q14: What tips or best practices are there for taking pictures with a phone?

A14: You can locate tips and best practices for taking pictures with your phone on the ID.me website. For the best results, take pictures in a well-lit area with no glare, ensuring your face is clearly visible and centered in the frame.

Completing the Verification Process

Q15: How do I know if I have an ID.me account?

A15: You can login or recover any existing ID.me user account from the ID.me website by entering the email you used to set up the account and complete the recovery process. If you have an ID.me account, when you login it should also display to which ID.me partners you have connected your account.

Q16: I already have an ID.me account to access the Social Security Administration or IRS site. Can I use this account?

A16: Yes. A user only has one ID.me account. If you already have an ID.me account, you must use your existing credentials. Do not create a new account. If you accidentally create a new account, you must either merge the account or delete the duplicate account. If you do not have an ID.me account, you must create one when prompted.

Q17: What email should I use when I create an ID.me account?

A17: When creating an ID.me account, use your personal email address rather than a work or organizational email. Here's why:

- Your ID.me account verifies your individual identity and is used for purposes outside your organization

- ID.me uses your registered email for account recovery and credential verification

- Using a personal email ensures you maintain access even if you change organizations

Q18: What is the identity verification process if I already have an ID.me account?

A18: If you have an existing ID.me account, log in to ID.me using your existing ID.me credentials. You will need to confirm account ownership via the multi-factor authentication (MFA) method you previously set up on your ID.me account (e.g., by entering a verification code sent to your phone or by using the ID.me Authenticator app). Next, you will be prompted to upload a selfie to confirm your identity. Once you've completed these steps, you will need to allow ID.me to share your verified information with FINRA. View the Presentation above for more detailed information.

Q19: How can I confirm that my name has been captured correctly in ID.me?

A19: It is important that you take time to review the information that ID.me presents to you during the identity verification process. In rare cases, your name, date of birth (DOB), or other information may be captured incorrectly (e.g., first name and middle name together as first name) as part of populating data from the uploaded evidence.

Multi-Factor Authentication (MFA) for ID.me

Q20: Will I need to install the ID.me Authenticator on my phone before I first verify my identity?

A20: No. The ID.me Authenticator is an app that can be used as an MFA option to complete the MFA requirement to access your ID.me account once it is created. ID.me account verification can also occur via other MFA options such as a text message or phone call. To install the app for iOS devices, go to the App Store. For Android devices, go to the Google Play Store.

Q21: Can a security key that is used for MFA through Duo be used to complete the ID.me MFA requirement?

A21: Yes. The same security key can be used as the MFA option for both Duo and ID.me. Users with an existing security key can add ID.me as the MFA method for their ID.me multi-factor requirement. Any security key used for MFA must be compatible with the WebAuthn/FIDO2 standard.

Data Sharing and Privacy

Q22: Do I need to share my data with FINRA to complete my FINRA verification?

A22: Yes. Once you complete the identity verification process with ID.me, you must allow for sharing specific verification data and verification status with FINRA to complete identity verification for your FINRA Entitlement account.

Q23: What data will be transmitted to FINRA from ID.me when I complete my identity verification and select 'Allow'?

A23: Your name, DOB, and verification timestamp will be transmitted to FINRA when you confirm your identity.

Q24: Do I need to share my date of birth (DOB) with FINRA?

A24: Yes. You will need to provide your DOB to FINRA as it is used to match against the DOB captured and verified through ID.me. FINRA will not store your DOB and will only use it during the identity verification process. You will be required to enter your DOB and then re-enter it to validate accuracy.

Troubleshooting

Q25: I successfully completed my ID.me verification, but why did I receive a message indicating that there is an 'Name Mismatch' on the FINRA Entitlement Platform?

A25: If you completed identity verification through ID.me but received a Name Mismatch error, this means the information in your FINRA Entitlement account does not match what was verified through ID.me.

To resolve this issue:

For DOB mismatch:

- Contact your SAA or AA to unlock your FINRA account; or

- Contact ID.me to verify what DOB they have on file

Note: FINRA does not store your DOB.

For first and/or last name mismatch:

- First, check your FINRA Entitlement account to confirm that your name is correct

- If your name needs to be updated in FINRA, contact your SAA or an AA at your organization to update your name

- If your FINRA Entitlement account name is correct, check your ID.me account

- If your name in ID.me needs to be corrected, contact ID.me for assistance

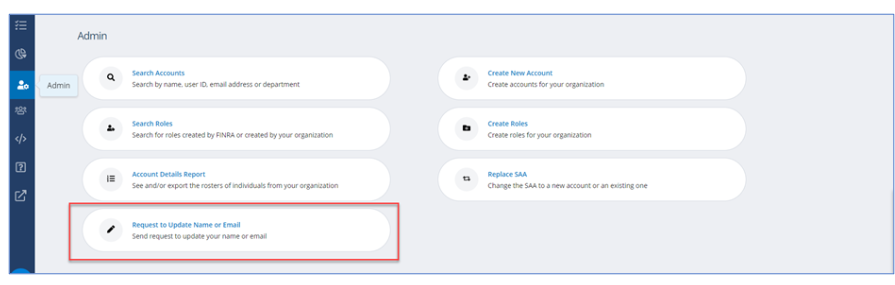

Q26: As an SAA, what is the easiest way to update my name on my FINRA Entitlement account?

A26: SAAs should use the Update/Replace workflow to update their name and/or email address. This workflow guides the SAA step-by-step through the request process. While most requests will process automatically once approved by an Authorized Signatory, there are circumstances that require a request to route to the FINRA Entitlement Group for review, research, and validation prior to fulfillment. The workflow sends a corresponding email to the Requester and Authorized Signatory once it is completed.

Q27: I'm having issues creating or using my ID.me account. Who can I contact for support?

A27: For help with your ID.me account, go to help.id.me or go to Contact Support to chat with ID.me or submit a help request in the "How Can We Help" search bar. ID.me support service is available 24 hours a day, 365 days a year.

Future Enhancements

Q28: Will identity verification expand into other areas of the FINRA Entitlement Program in the future?

A28: Yes. There are plans to expand the use of identity verification in the future. One example is when recovering your account, such as for a password reset. Another example is a name change. More information will be provided when available along with the implementation timeframe.

Need Additional Help?

- For ID.me technical issues: Contact ID.me support at help.id.me (available 24/7/365)

- For FINRA Entitlement account questions: Contact your System Account Administrator (SAA) or Authorized Administrator (AA)