Form U5

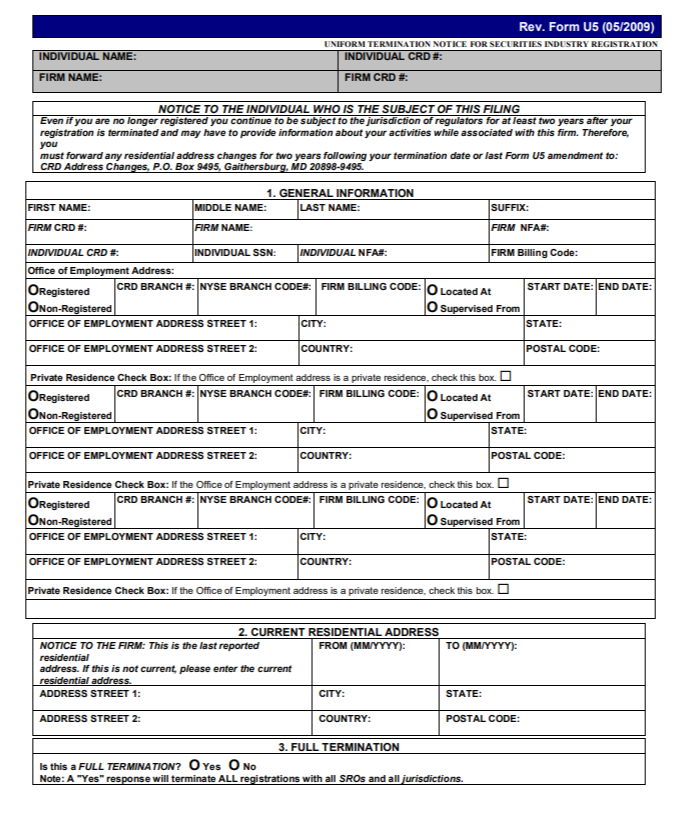

Representatives of broker-dealers, investment advisers or issuers of securities must be registered with the appropriate jurisdictions and/or self-regulatory organizations (SROs). Form U4 is used to establish that registration. FINRA, other self-regulatory organizations (SROs) and jurisdictions use Form U5 (Uniform Termination Notice for Securities Industry Registration) to terminate registration and, if relevant, details why an individual left the firm.

On This Page

- Support Resources

- Who Files a Form U5?

- When Must a Form U5 Be Filed?

- What Kind of U5 Filings Are There?

- What Are an Individual's Obligations After Registration Has Been Terminated?

Support Resources

General

- Form U4 and U5 Interpretive Questions and Answers (PDF)

- Duplicate Disclosure Interpretive Guidance FAQ

- Form Filing for Individuals FAQ

- Form U5 (PDF)

- Form U5 Explanation of Terms (PDF)

- Form U5 Instructions (PDF)

- Form U5 – Related Fees

FINRA Gateway

Financial Professional Gateway (FinPro Gateway™)

Who Files a Form U5?

Entitled system users at broker-dealer and investment adviser firms are required to file Forms U5 on behalf of registered representatives and investment adviser representatives. The form must disclose why an individual left the firm and other certain events.

Firms are under a continuing obligation to amend and update Section 7 (Disclosure Questions) of Form U5 until final disposition, including reportable matters that occur and become known after initial submission of the form.

When Must a Form U5 Be Filed?

A Form U5 must be filed when an individual leaves a firm for any reason. A Form U5 must be submitted within 30 days of the individual’s employment end date and generally must be filed electronically. Firms are also required to provide the individual with a copy of their Form U5 within 30 days.

A late fee may be applied if the firm does not submit Form U5 within the appropriate timeframe.

What Kind of U5 Filings Are There?

There are three types of U5 filings:

- Full Form: A full Form U5 is used when terminating an individual from the firm. Registrations with all SROs and jurisdictions will be terminated.

- Partial Form: A partial Form U5 is used to terminate individuals from selected SROs and jurisdictions. The reason for termination and disclosure questions are not included on partial Form U5 filings. Residential addresses can be updated. Branch office address information cannot be updated on a partial form.

- Amendment Form: An amendment Form U5 is used to update or amend disclosure, date of termination, reason for termination and residential information for an individual previously terminated.

Sample Form U5

|

What Are an Individual’s Obligations After Registration Has Been Terminated?

Individuals continue to be subject to the jurisdiction of the regulators with which they were registered for at least two years after registration is terminated. During that time, individuals may have to provide information about their activities while associated with the firm. Therefore, individuals must report any residential address changes for two years following their termination date or last Form U5 amendment. Please note that a post office box (P.O. Box) is not acceptable as a residential address.

Financial professionals who are no longer registered with a firm, and whose registrations were termed within the last two years, will have a task in their FinPro Gateway task list prompting them to update their residential address.