What We Do

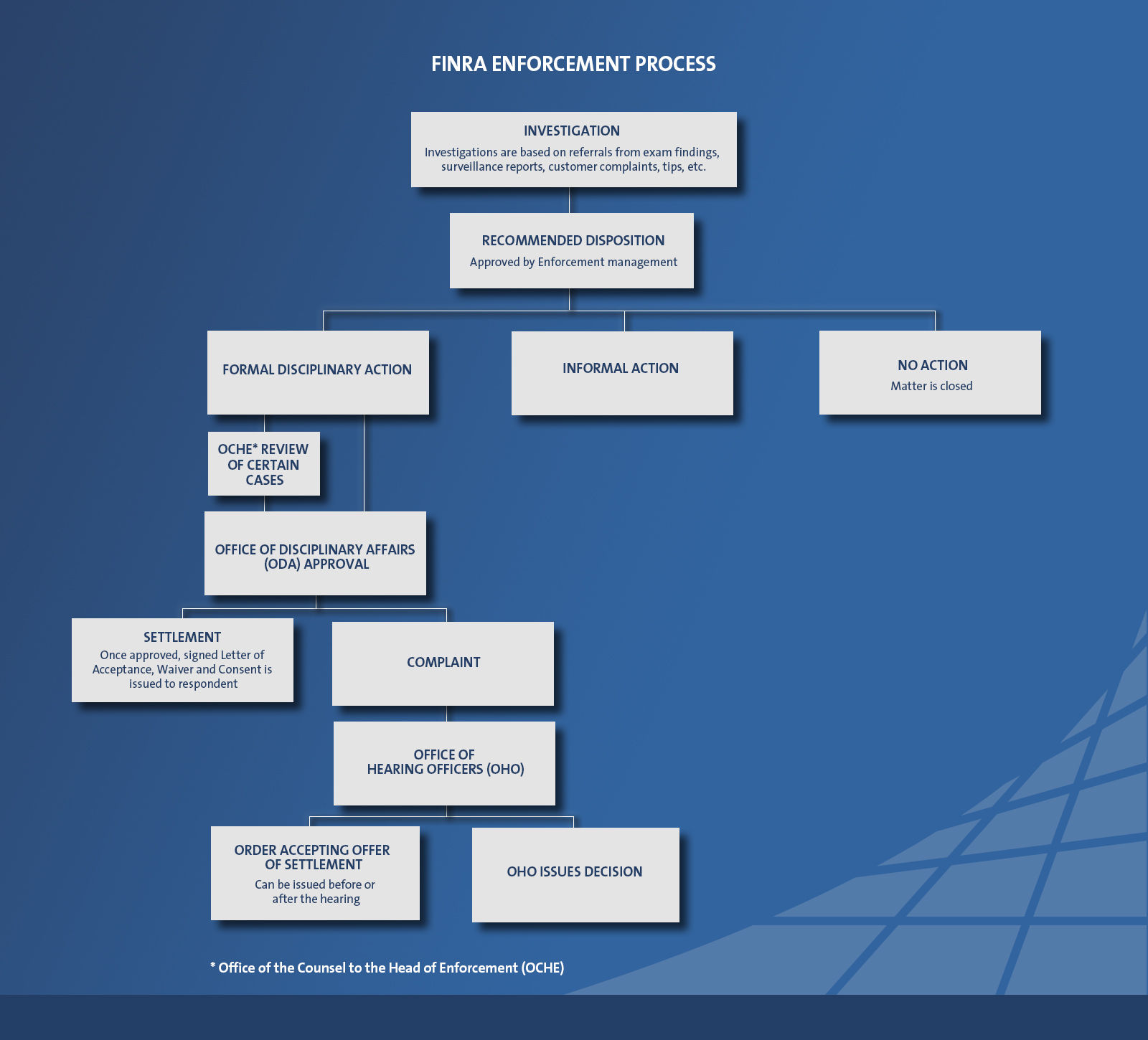

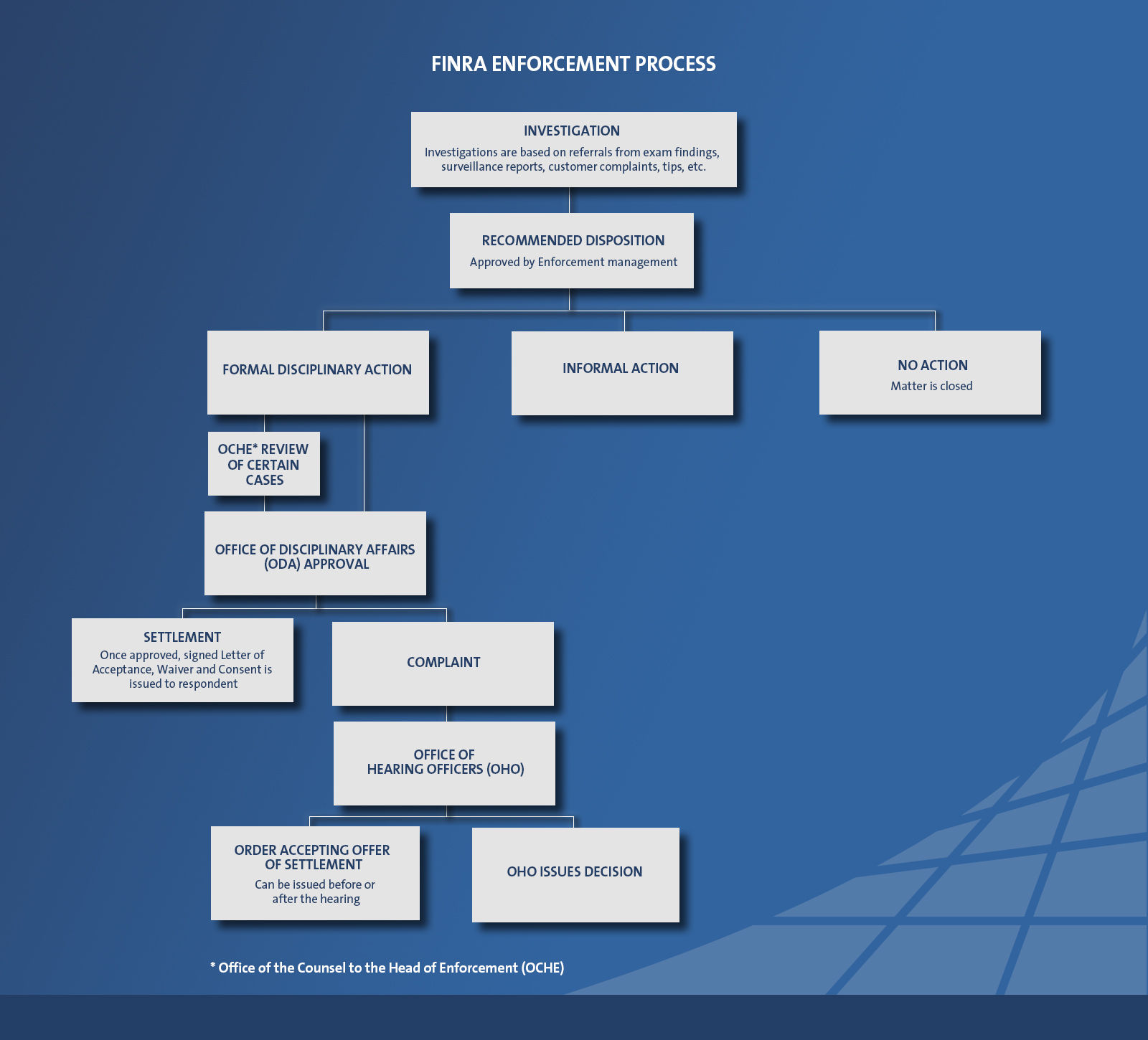

Click to enlarge.

FINRA investigates potential securities violations and, when appropriate, brings formal disciplinary actions against firms and their associated persons. FINRA investigations may be opened from various sources, including automated surveillance reports, examination findings, filings made with FINRA, customer complaints, tips, referrals from other regulators or other FINRA departments and press reports. As a policy, FINRA’s investigations are confidential.

If it appears that rules have been violated, Enforcement will determine whether the conduct merits formal disciplinary action. FINRA can take disciplinary action through two separate procedures: a settlement or a litigated proceeding. With a settlement, the respondent can opt to resolve alleged rule violations early by submitting a Letter of Acceptance, Waiver and Consent (AWC). Otherwise, FINRA may issue a formal complaint to FINRA’s Office of Hearing Officers (OHO). If the respondent does not settle the complaint, the matter proceeds to a contested hearing before OHO, which hears the case and issues a decision.

Bringing Cases on Behalf of Securities Exchanges

Enforcement also brings disciplinary cases on behalf of the securities exchanges with which it has entered into Regulatory Services Agreements (RSAs). These matters may be brought on behalf of a single exchange or, more commonly, may be brought as global settlements on behalf of multiple self-regulatory organizations, sometimes including FINRA.

Sanctions

Sanctions for wrongdoing include fines, suspensions, and, in cases of serious misconduct, bars from FINRA membership. FINRA publishes its Sanction Guidelines so that members, associated persons and their counsel understand the types of disciplinary sanctions that may be applicable to various violations. Whenever possible, Enforcement orders firms and individuals to make restitution to harmed customers.

Other Outcomes

Not all investigations result in formal disciplinary action. For example, if the violation is of a minor nature and there is an absence of customer harm or detrimental market impact, the matter may be resolved with an informal disciplinary action, such as the issuance of a Cautionary Action. While Cautionary Actions are considered by the staff in any future disciplinary matter, these actions do not constitute formal discipline and are not reportable on FINRA's Central Registration Depository (CRD) system or Form BD.

In addition, Enforcement may determine not to recommend formal disciplinary action following an investigation and may close the matter without further action.