Calculating Your Investment Returns

Do you want to know how well your investments are doing? The first step is understanding how to calculate your returns, but this isn’t as simple as you might think.

An investment's performance is more than just the amount it’s appreciated since you bought it, whether you're talking stocks, bonds, mutual funds or some other asset. If you want to make informed investment decisions, you should learn how to calculate your return on investment (ROI).

Calculating Return on Investment

The first step in calculating ROI is to determine the total cost of the investment, which includes the price you paid, as well as any investment fees. For stocks and bonds, that might include a commission, advisory fee or markup, while mutual funds typically charge fees and expenses.

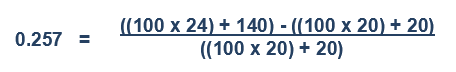

For stocks, you'll also want to ensure that you include dividend payouts and the appreciation of the asset's price, which leaves you with the following formula:

Let's say that you bought 100 shares of stock for $20 a share, paid $10 in commissions to buy the stock and will spend another $10 when you sell. The stock is now trading at $24 a share, and you earned $140 in dividends on the investment over three years. Your ROI calculation will look something like this:

This translates into a total return of about $520 or 25.7 percent.

Calculating Annualized Returns

That number by itself doesn't give you the whole picture. The amount of time you hold any given investment can vary, and it’s often best to compare investment performance by looking at the annualized return.

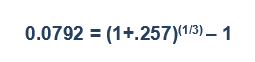

That standard formula for computing annualized return (AR) is:

Continuing with the same example:

You’ll finish by multiplying the answer above by 100 to turn it into a percent, resulting in an annualized return of 7.792 percent for this example.

If you simply divide the total return of 25.7 percent by three years, the result would be 8.57 percent. This inflated view is known as a simple average, which doesn’t take compounding into consideration. Calculating an annualized return gives you a more accurate measure of performance.

If the stock price drops during the period in which you own it and you have a loss instead of a profit, you’d calculate returns the same way, but your return could be negative if income from the investment hasn't offset the loss in value.

Bond Total Returns

Bond returns are calculated somewhat differently than stocks. If you're planning to hold a bond until maturity, you can calculate your total return by adding the bond income you'll receive during the term to the principal that will be paid back at maturity. If you sell the bond before maturity, you'll need to take into account the interest you've been paid, the amount you receive from the sale of the bond, and the price you paid to purchase it.

Don’t Compare Apples to Oranges

While you can calculate the ROI of various investments, this doesn't mean you can simply compare them to make a decision about your portfolio.

Stocks and bonds often don't fulfill the same role in a portfolio, so avoid comparing them based on performance alone. Instead, you'll want to measure the returns of your investments against the standards of other, similar investments. When looking at stocks, you should compare them to other companies in the same industry. FINRA’s Market Data page provides real-time quotes on securities as well as index returns, market news and economic data releases.

With bonds, make sure you’re looking at those issued by the same type of entity—e.g., governments, municipalities or corporations—when making a comparison. FINRA’s Fixed Income Data can help by providing real-time information on fixed-income securities. Or if you own shares of a mutual fund that aims to track a particular index, you can compare the performance of the fund to that particular index, or compare it to other similar funds using FINRA’s Fund Analyzer.

Learn more about investing.