FINRA-Registered Firms

Table of Contents

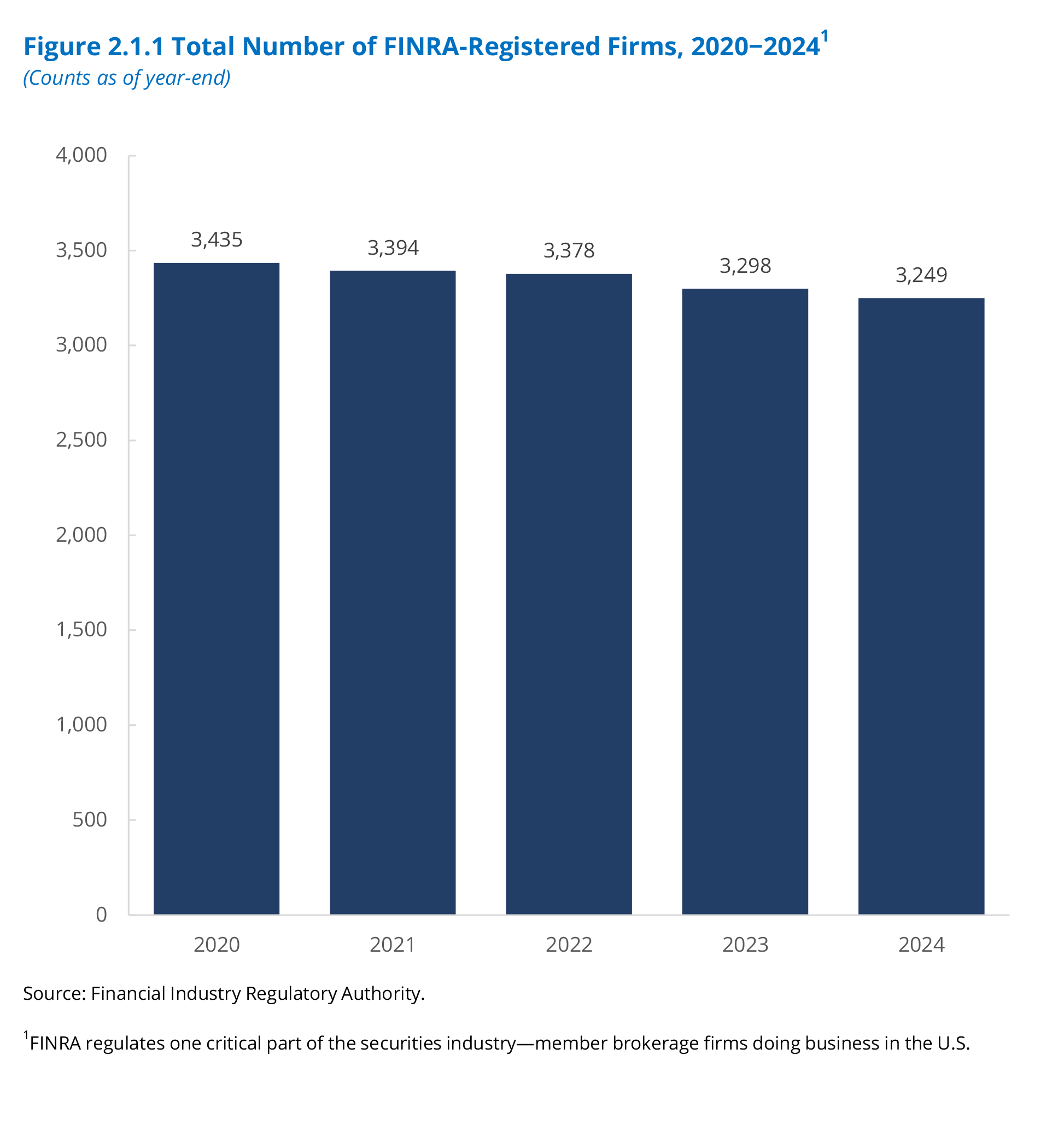

- Figure 2.1.1 Total Number of FINRA-Registered Firms, 2020−2024

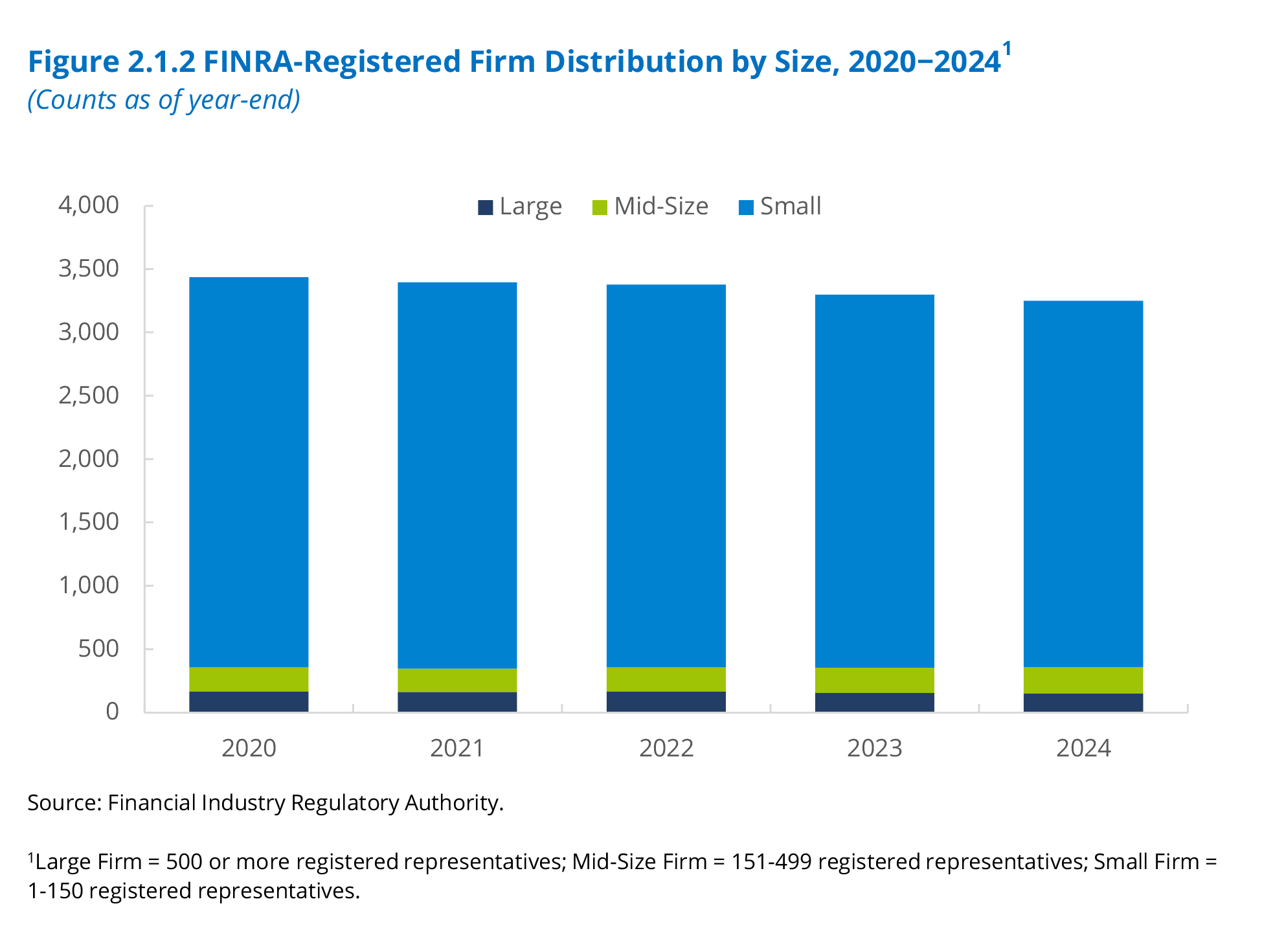

- Figure 2.1.2 FINRA-Registered Firm Distribution by Size, 2020−2024

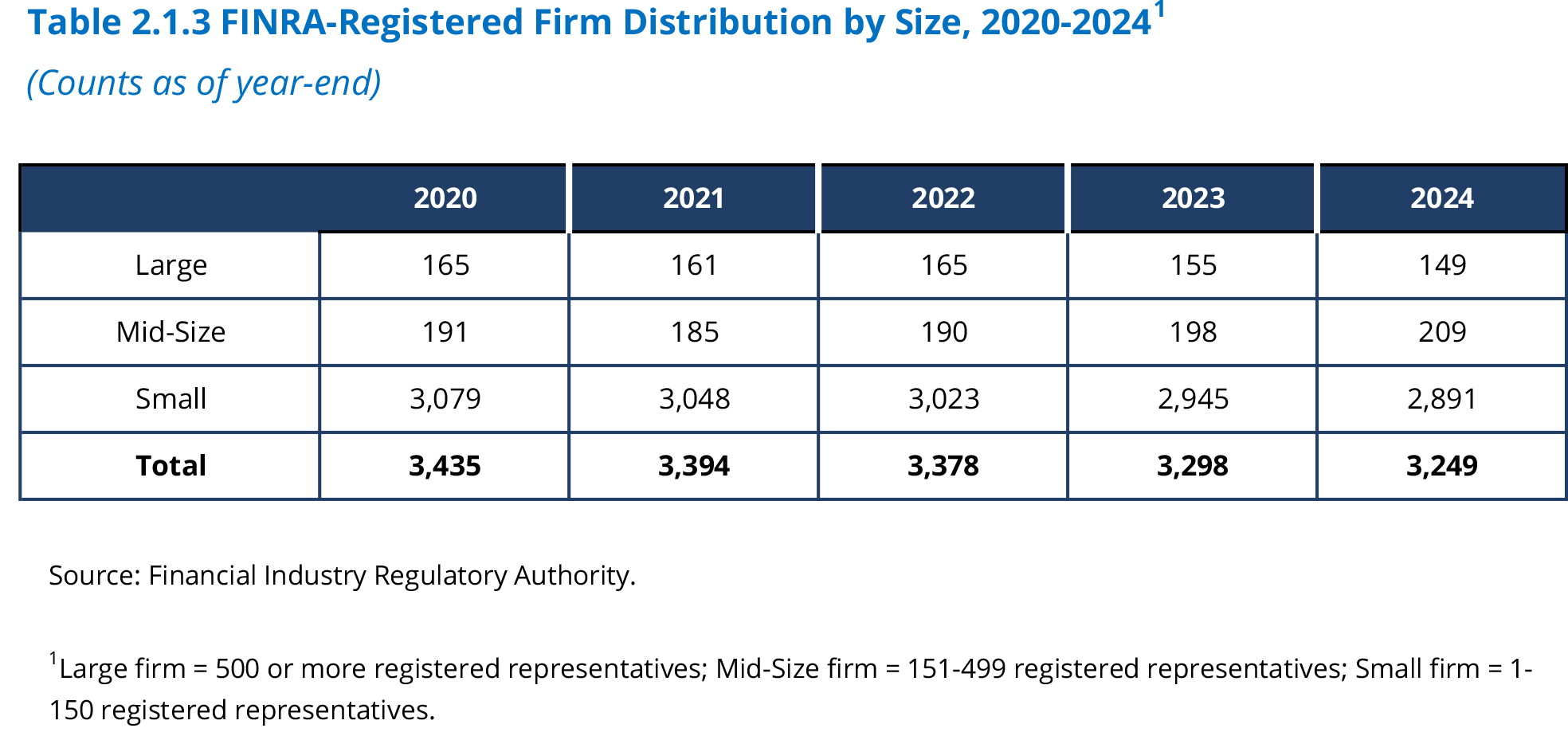

- Table 2.1.3 FINRA-Registered Firm Distribution by Size, 2020−2024

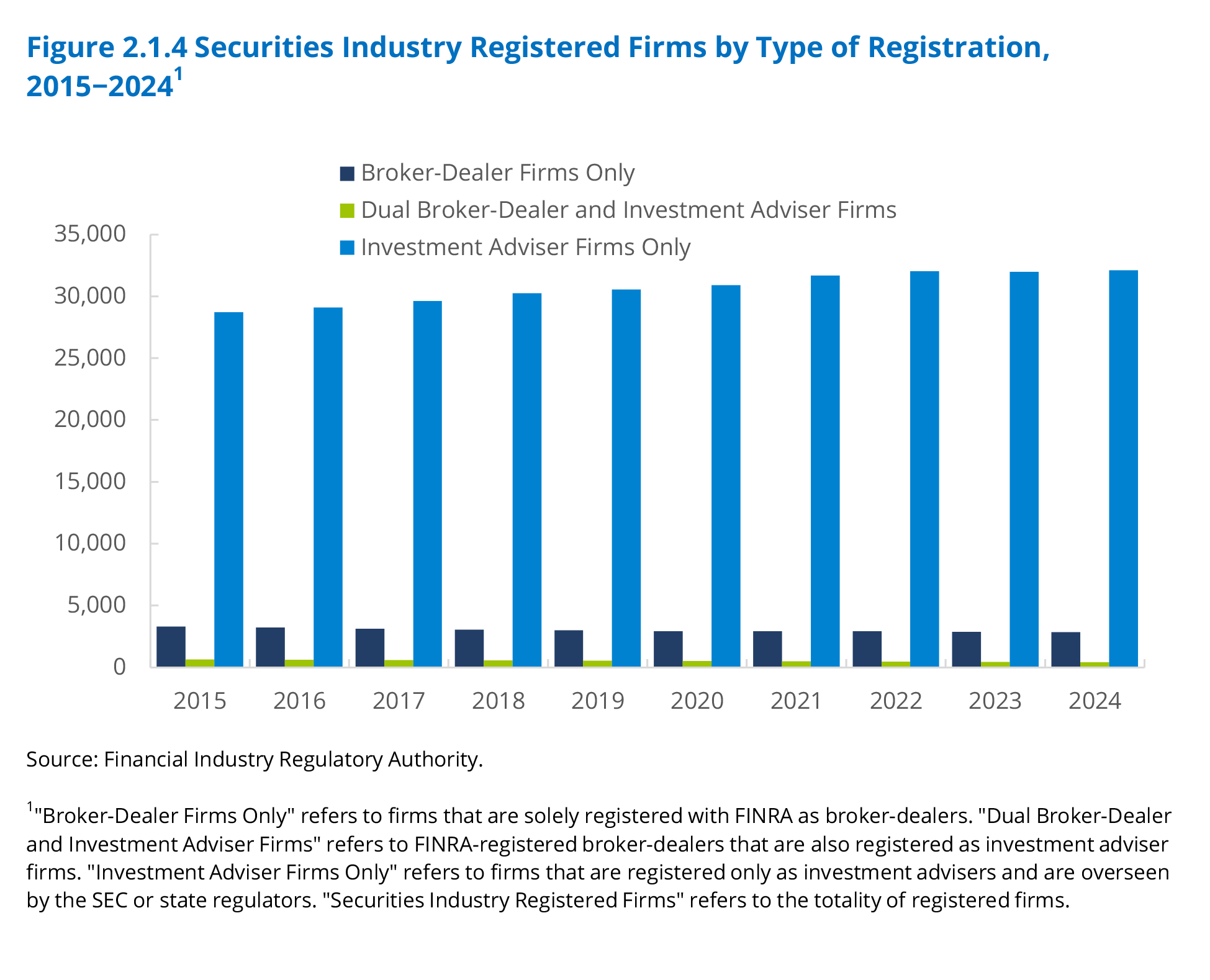

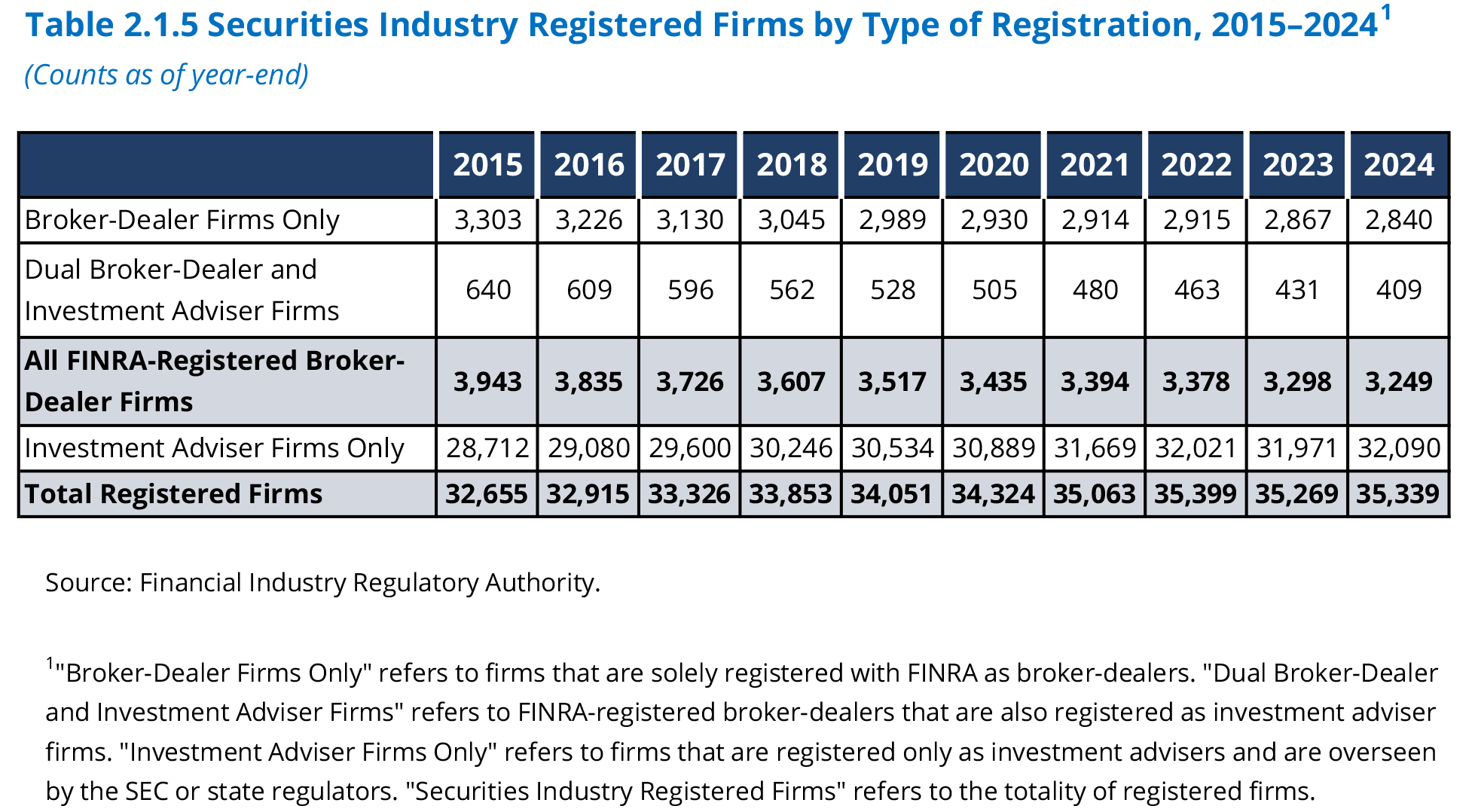

- Figure 2.1.4 Securities Industry Registered Firms by Type of Registration, 2015−2024

- Table 2.1.5 Securities Industry Registered Firms by Type of Registration, 2015−2024

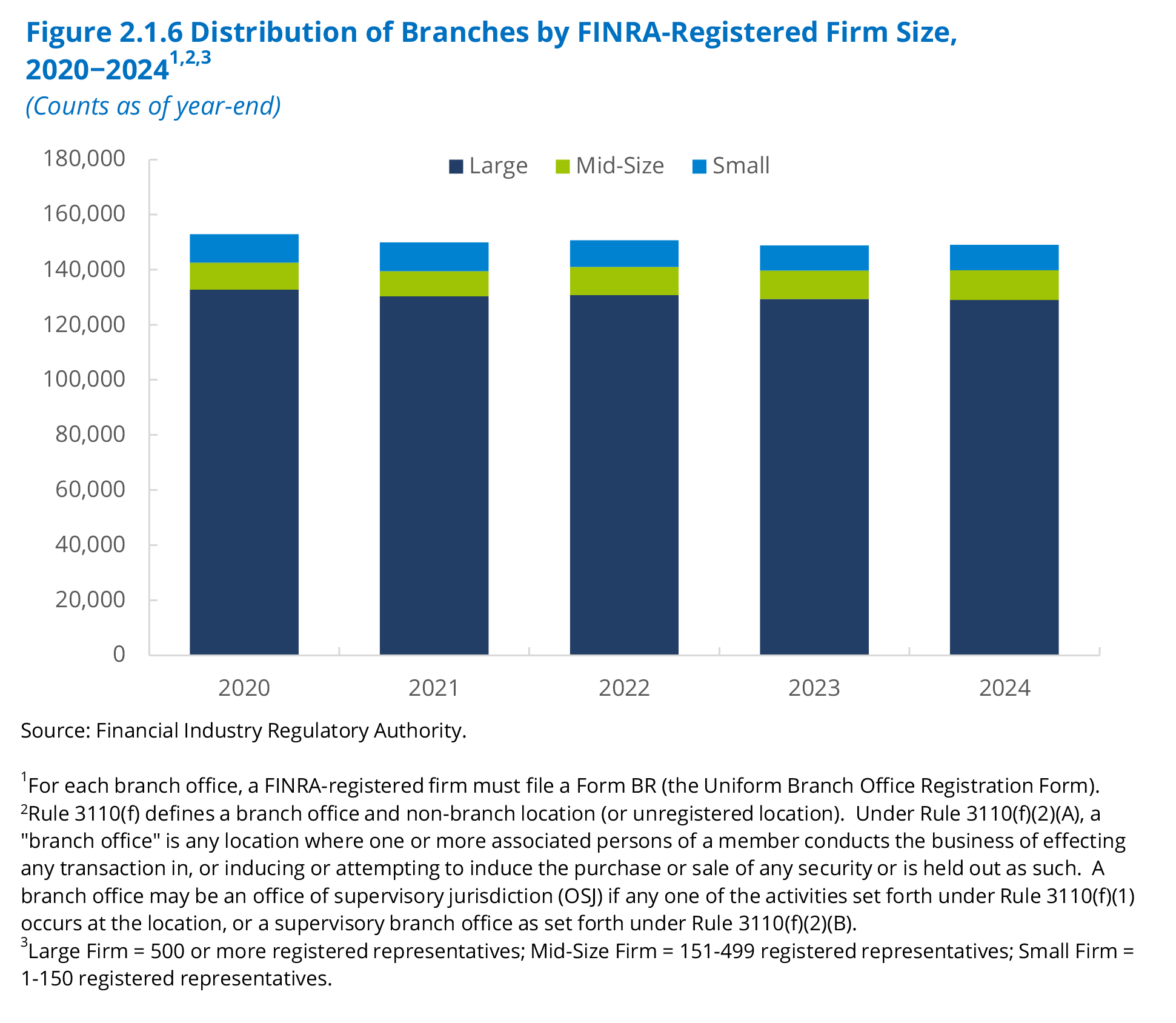

- Figure 2.1.6 Distribution of Branches by FINRA-Registered Firm Size, 2020−2024

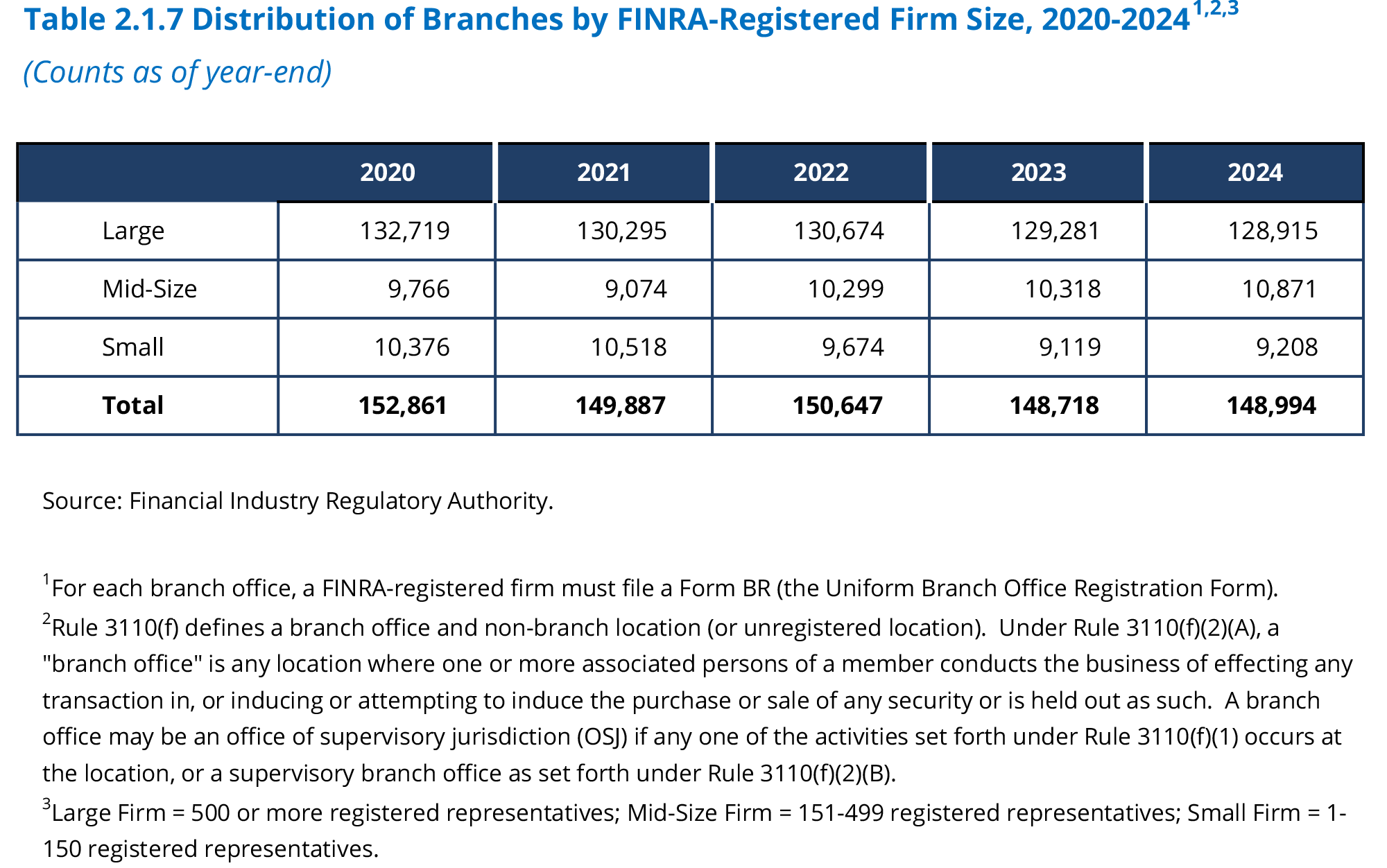

- Table 2.1.7 Distribution of Branches by FINRA-Registered Firm Size, 2020−2024

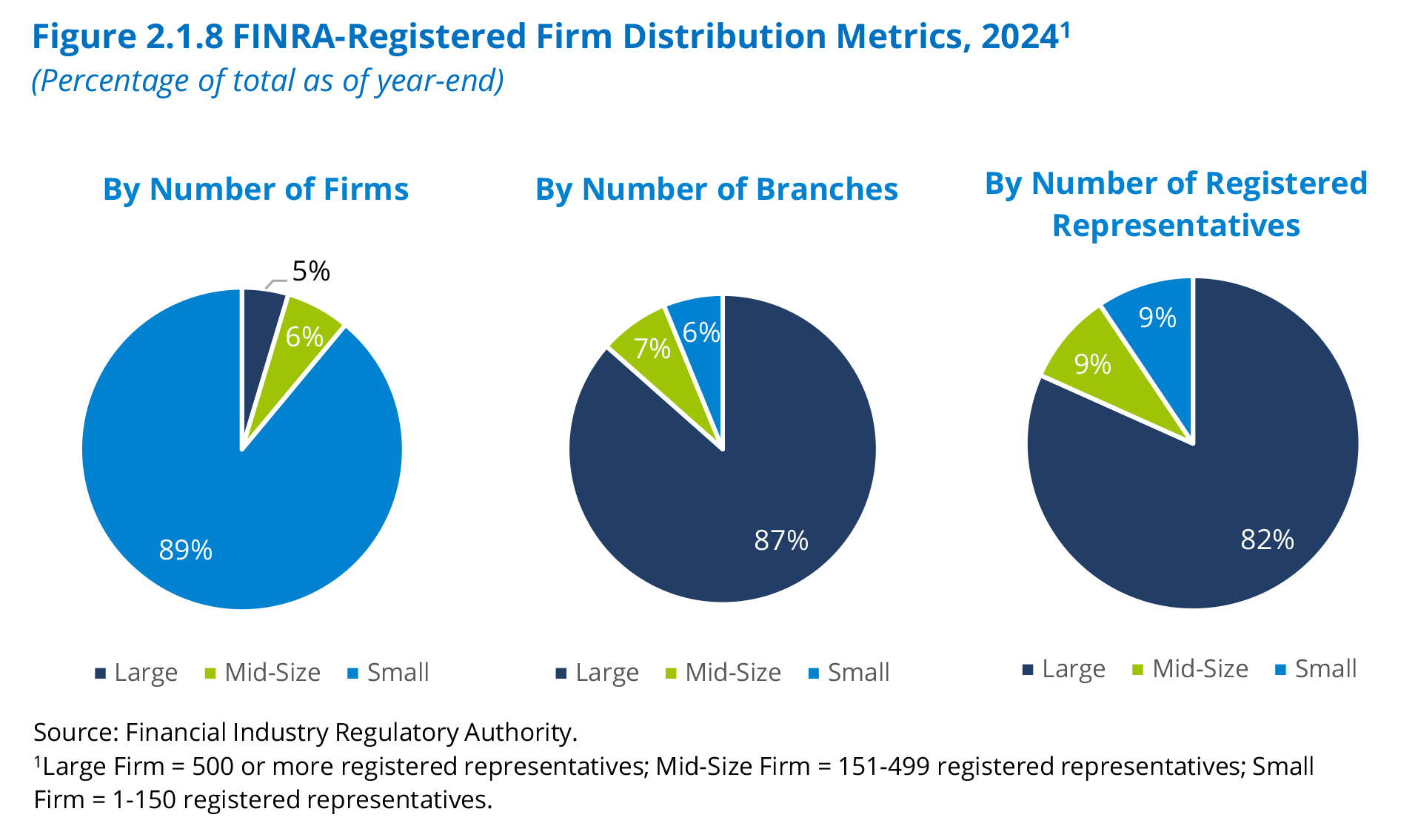

- Figure 2.1.8 FINRA-Registered Firm Distribution Metrics, 2024

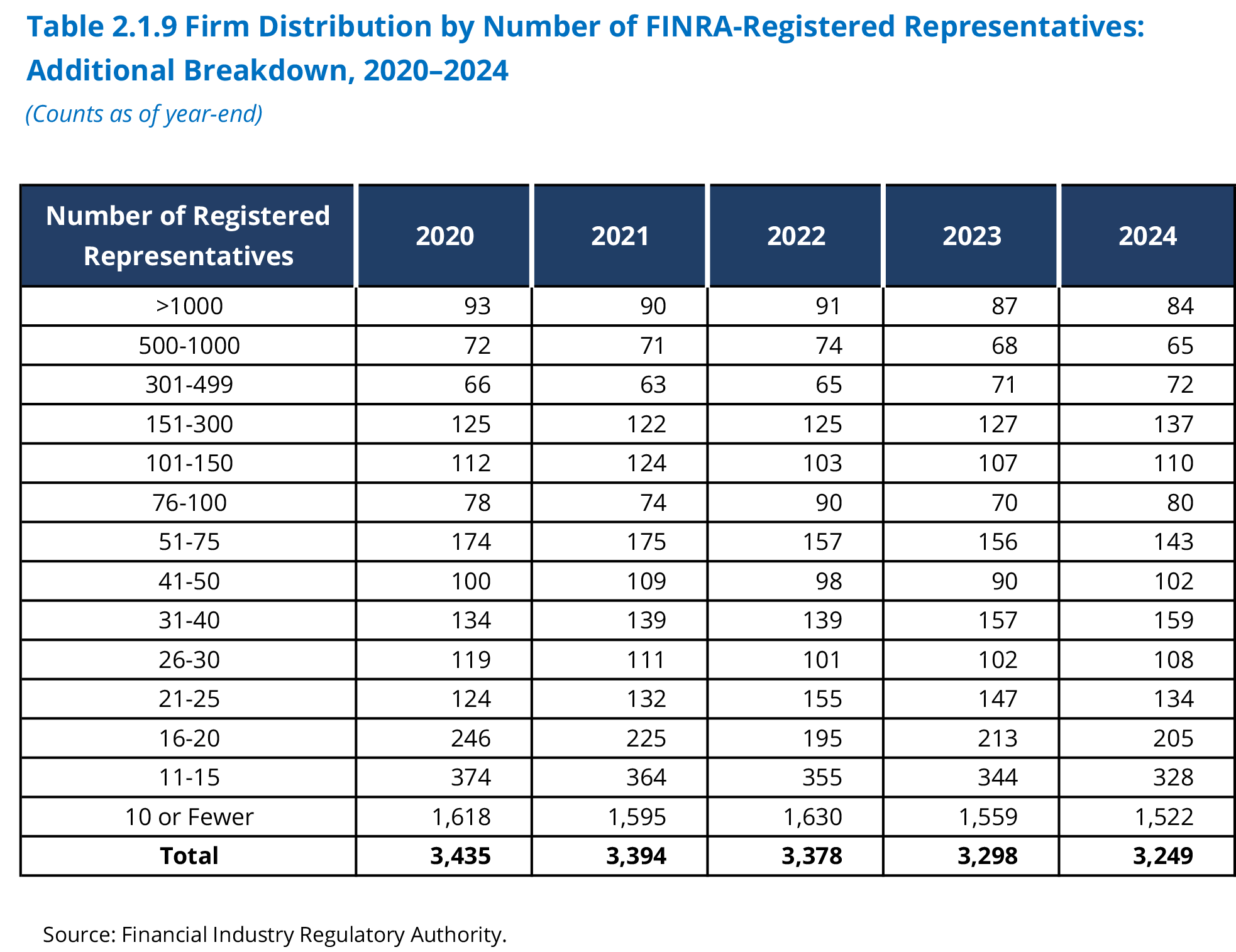

- Table 2.1.9 Firm Distribution by Number of FINRA-Registered Representatives: Additional Breakdown, 2020–2024

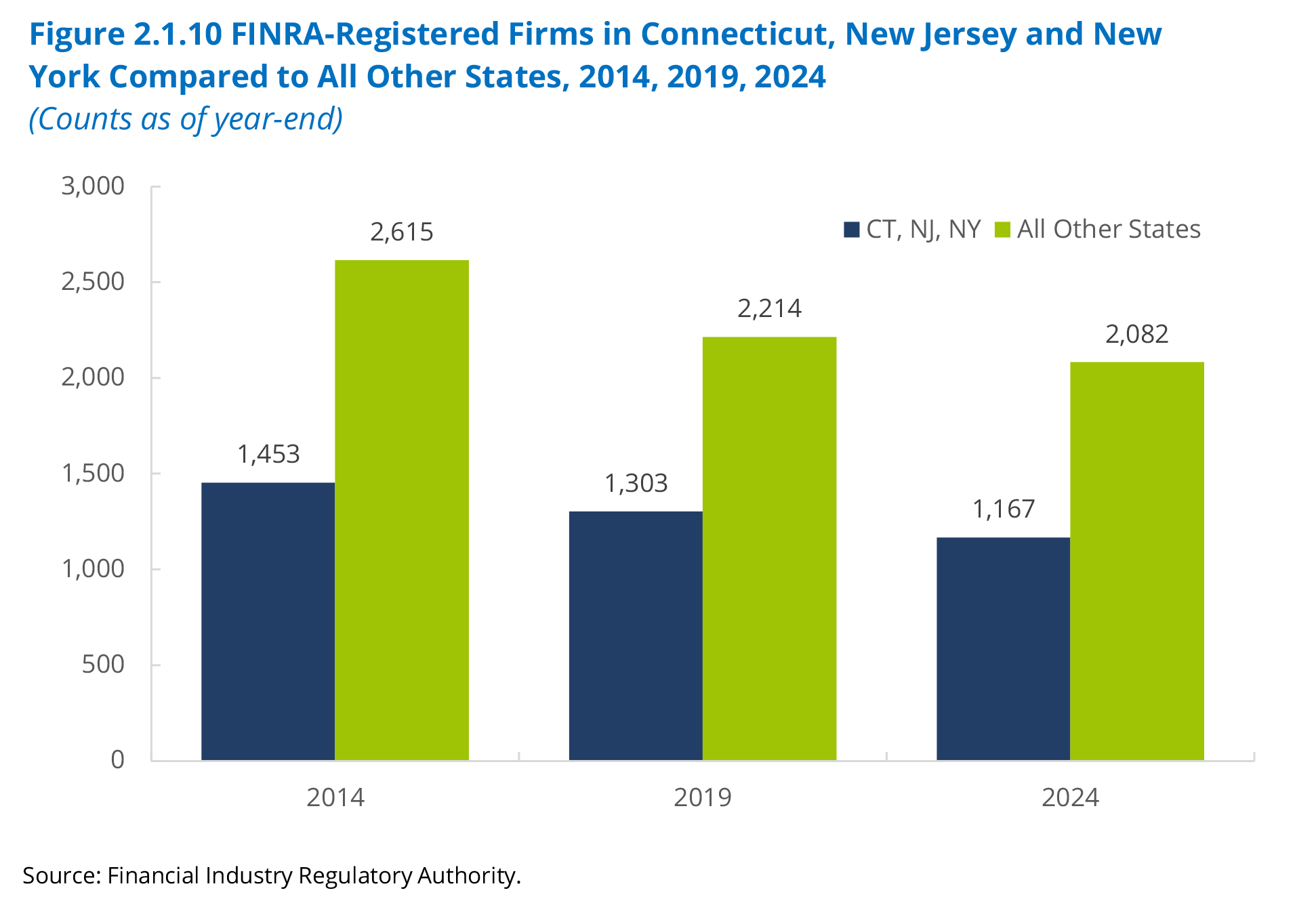

- Figure 2.1.10 FINRA-Registered Firms in Connecticut, New Jersey and New York compared to all other States, 2014, 2019, 2024

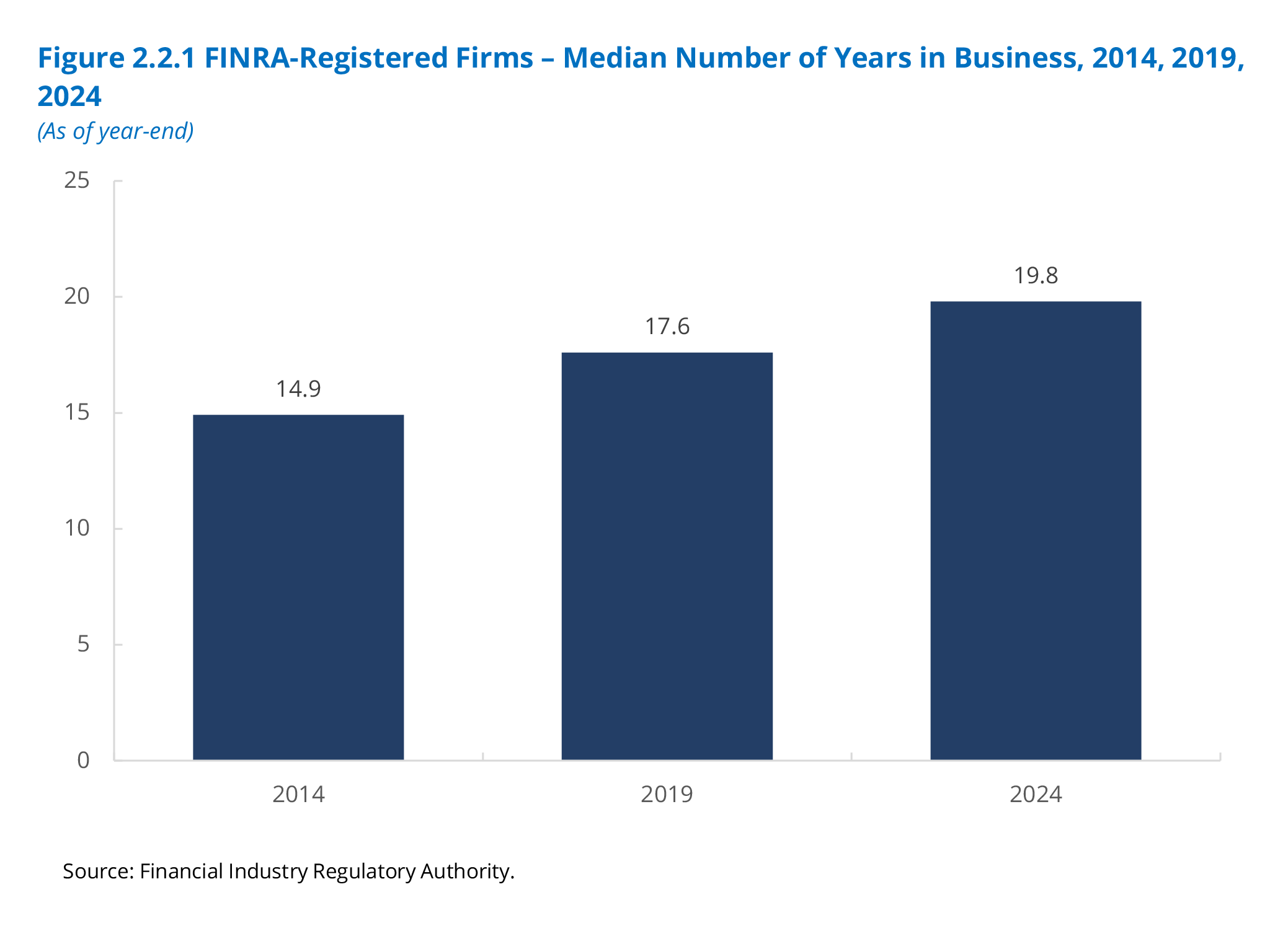

2.2 Entrance and Exit of Firms- Figure 2.2.1 FINRA-Registered Firms – Median Number of Years in Business, 2014, 2019, 2024

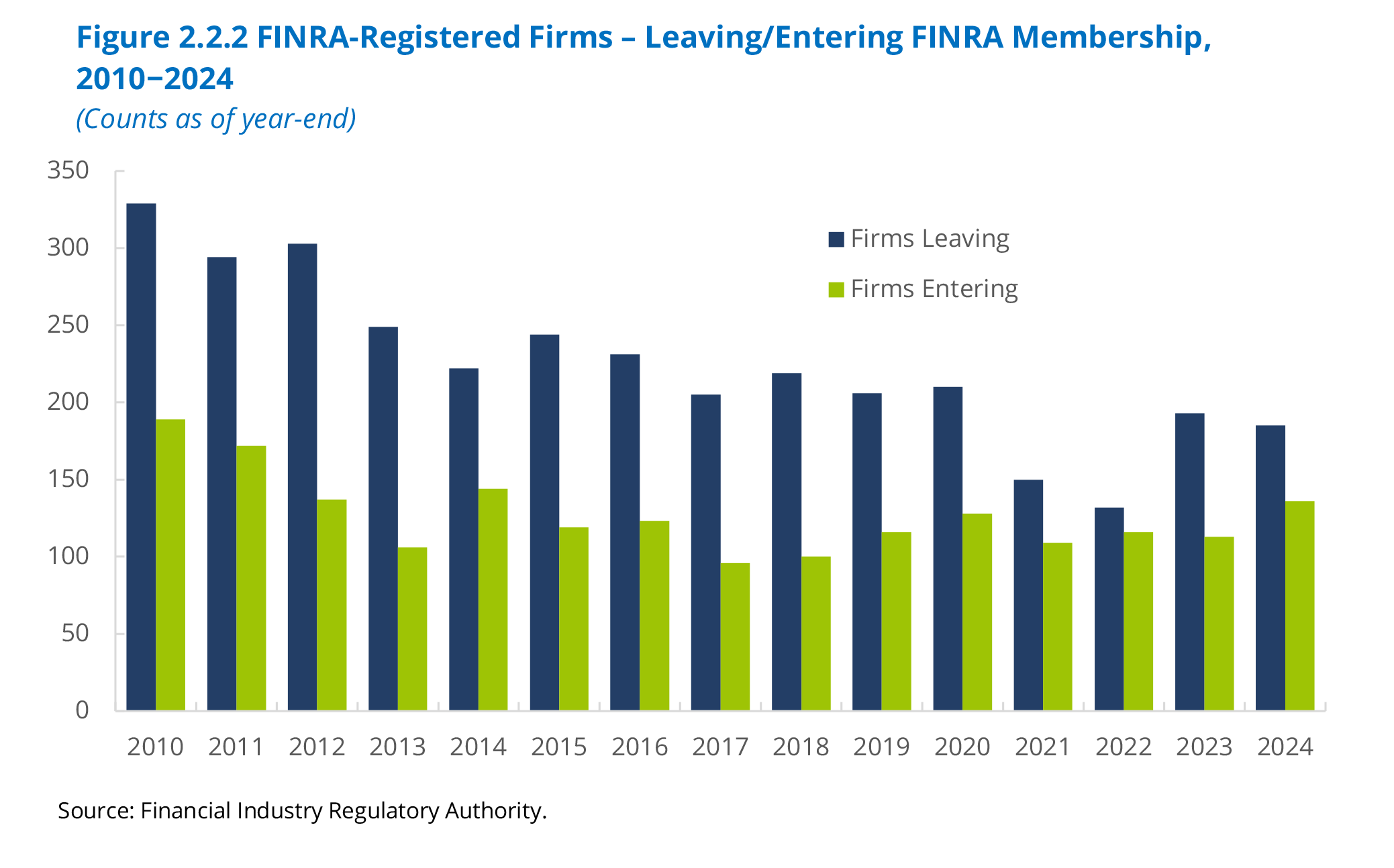

- Figure 2.2.2 FINRA-Registered Firms – Leaving/Entering FINRA Membership, 2010–2024

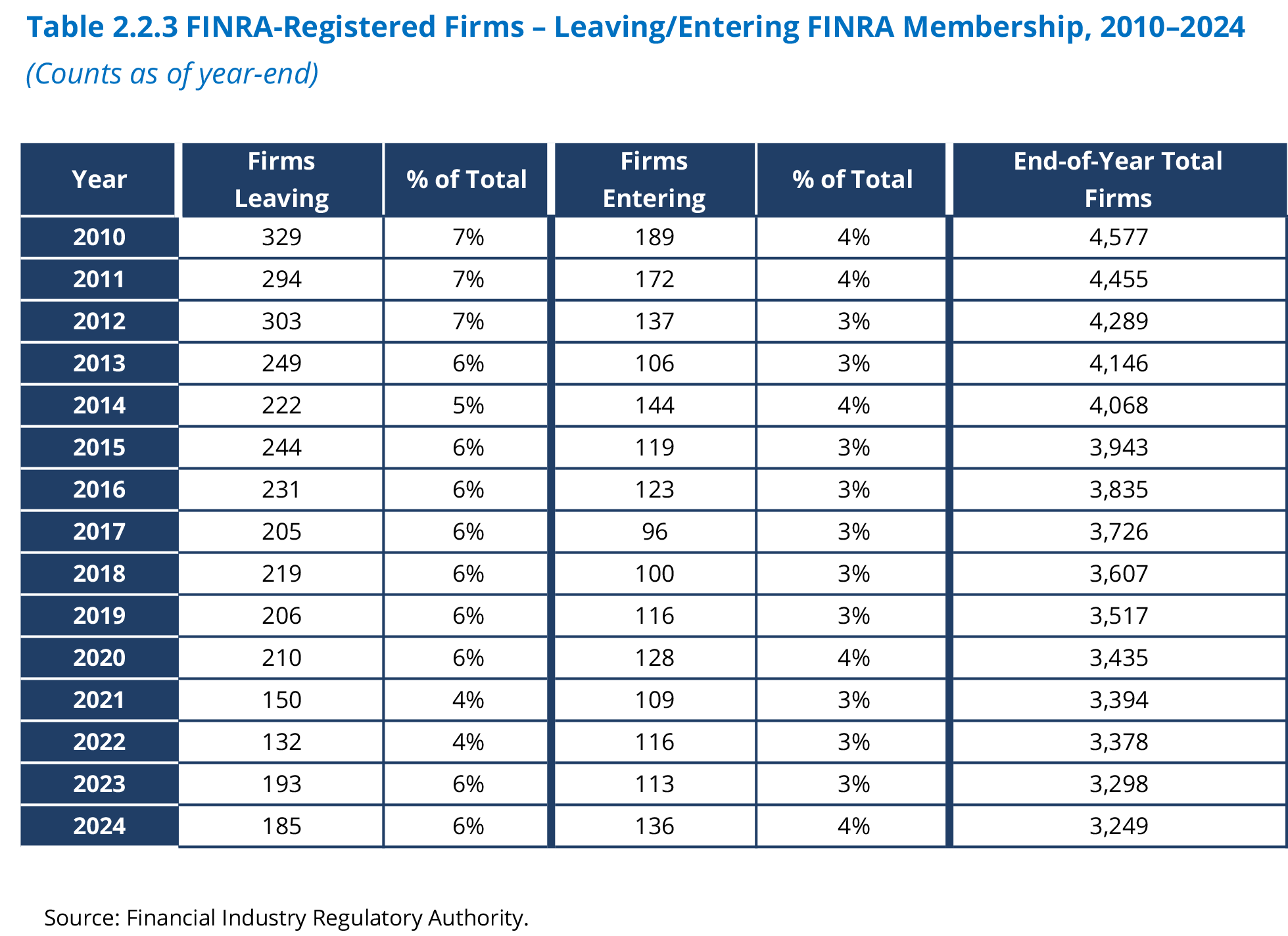

- Table 2.2.3 FINRA-Registered Firms – Leaving/Entering FINRA Membership, 2010–2024

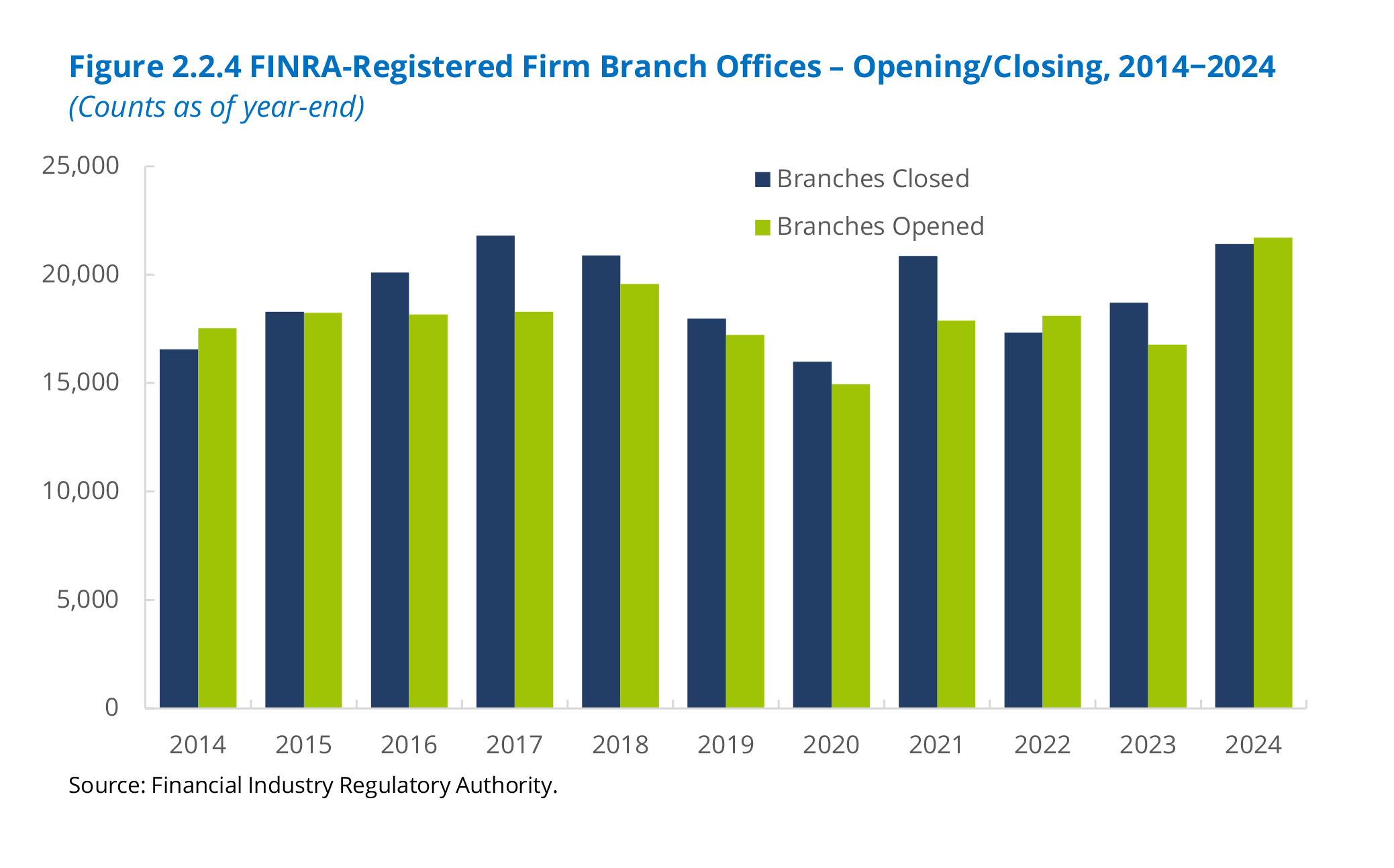

- Figure 2.2.4 FINRA-Registered Firm Branch Offices – Opening/Closing, 2014–2024

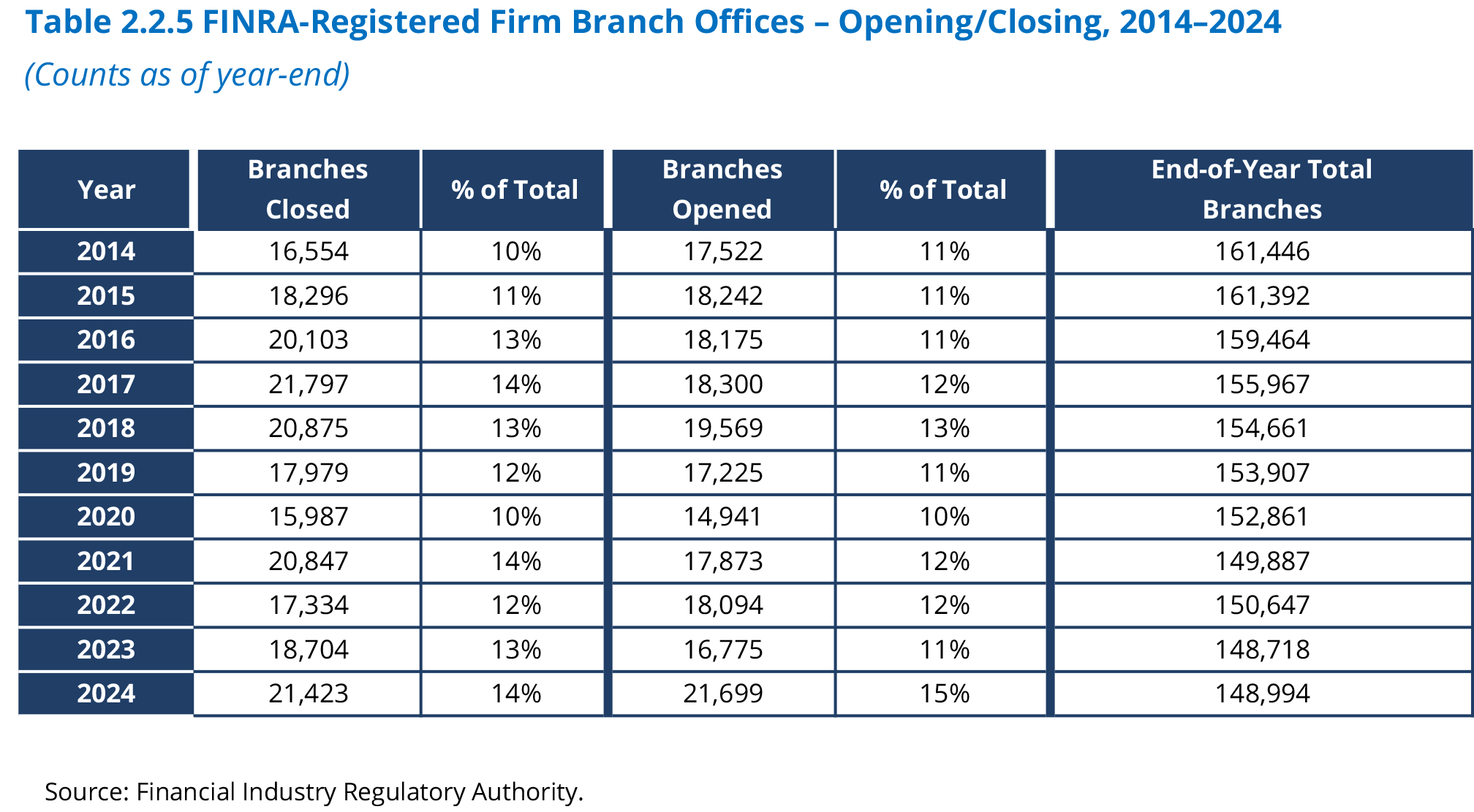

- Table 2.2.5 FINRA-Registered Firm Branch Offices – Opening/Closing, 2014–2024

- Figure 2.3.1 Geographic Distribution of FINRA-Registered Firms by Number of Branches, 2024

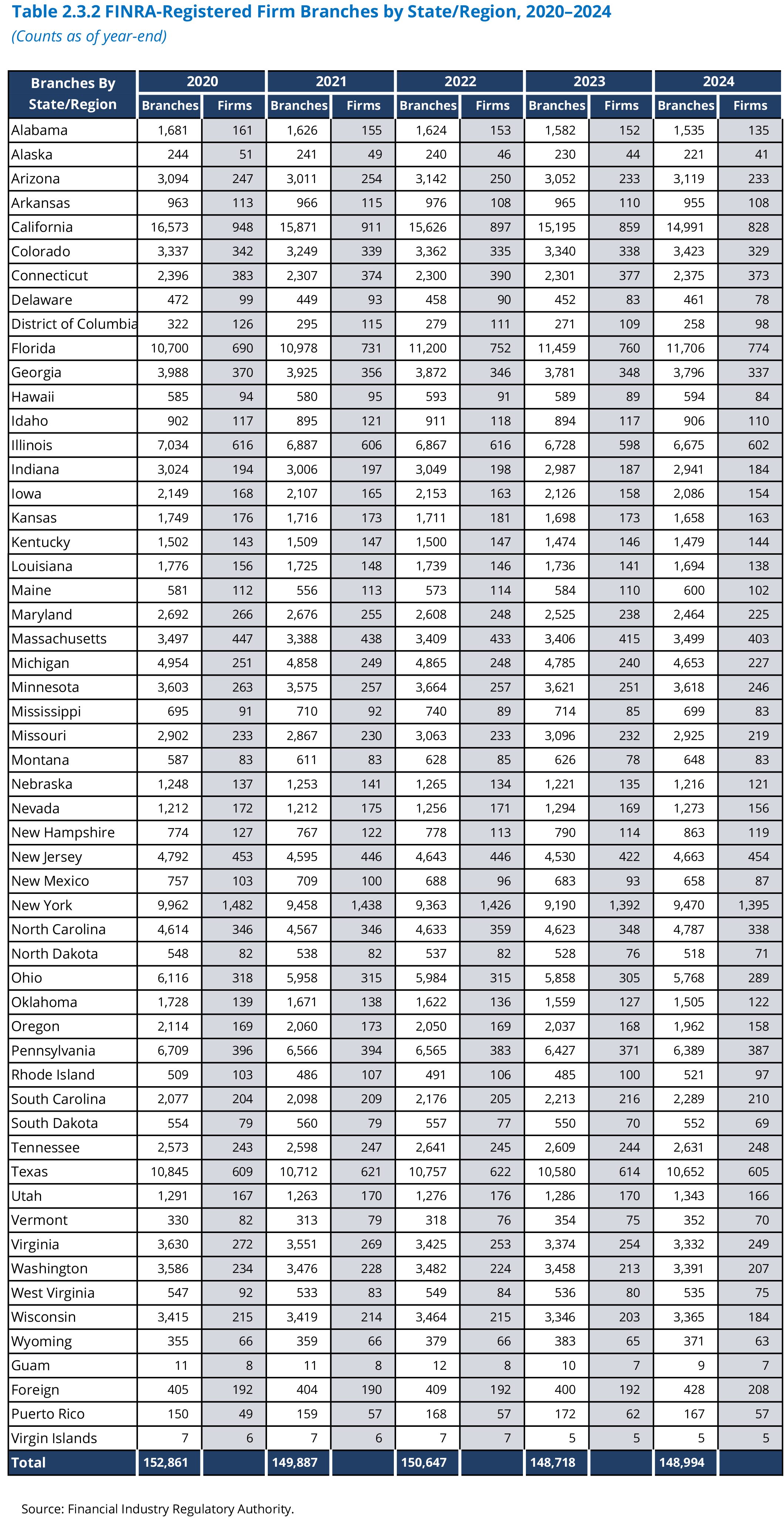

- Table 2.3.2 FINRA-Registered Firm Branches By State/Region, 2020–2024

- Figure 2.3.3 Geographic Distribution of FINRA-Registered Firms by Headquarters, 2024

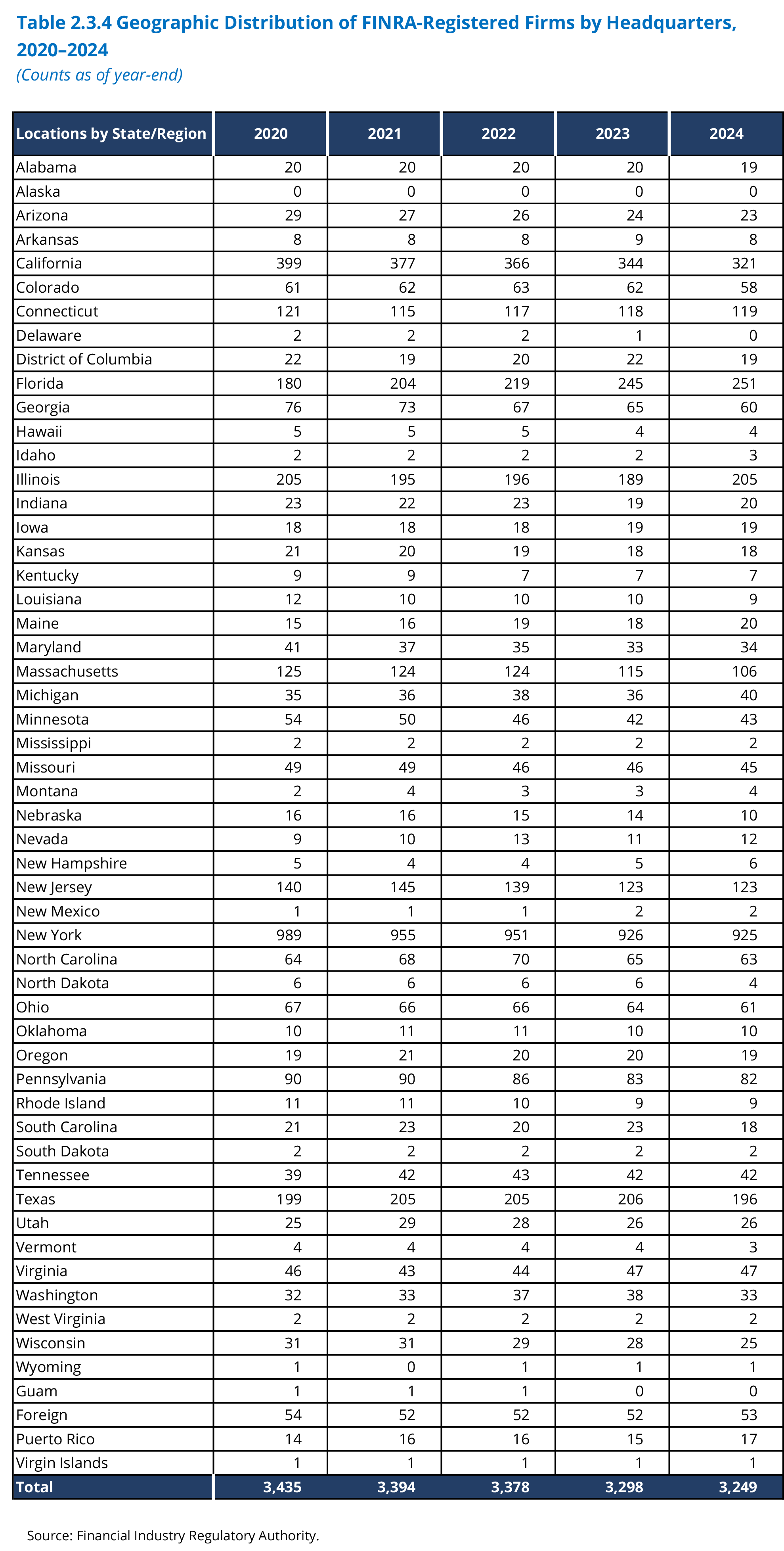

- Table 2.3.4 Geographic Distribution of FINRA-Registered Firms by Headquarters, 2020–2024

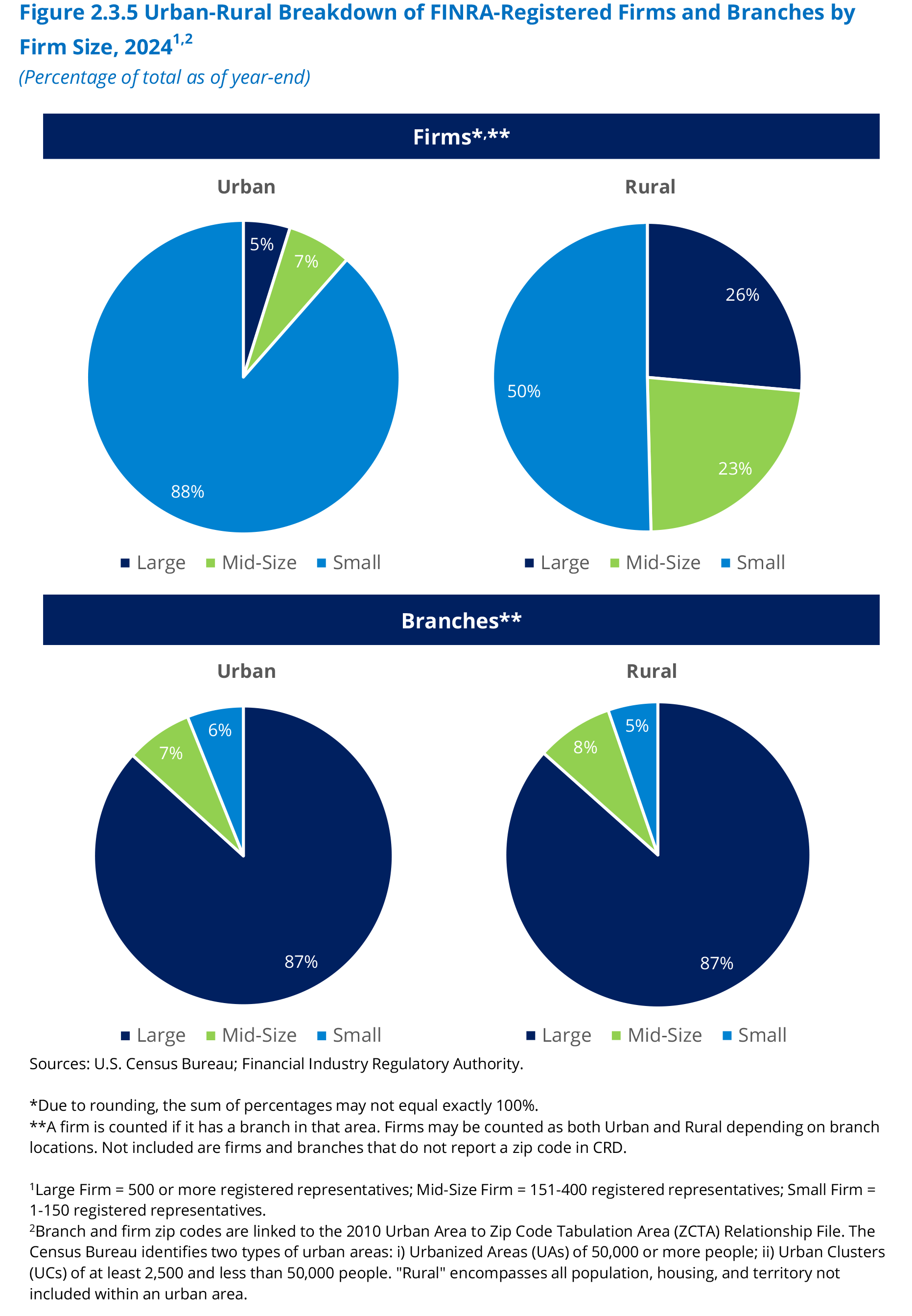

- Figure 2.3.5 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size, 2024

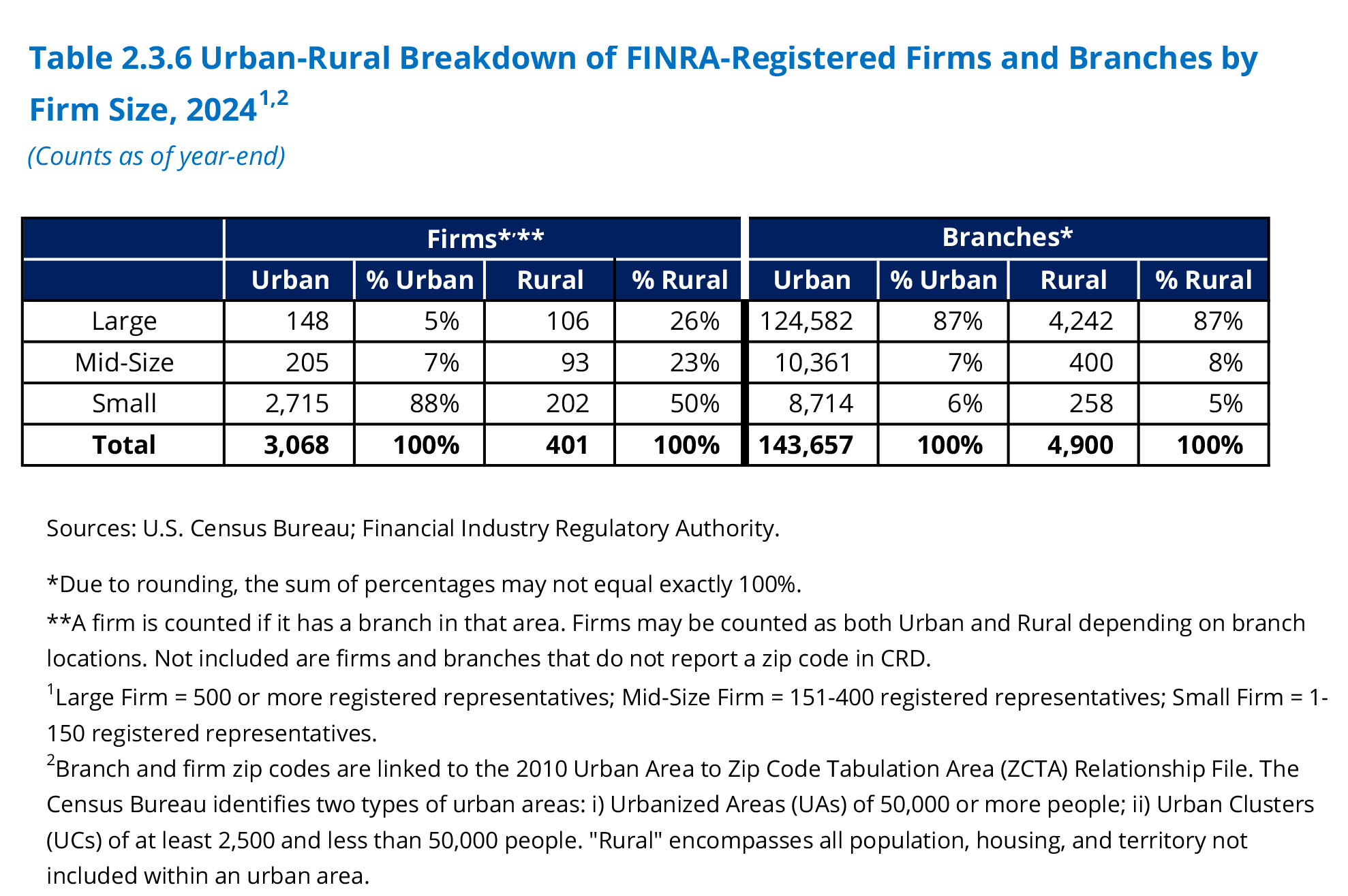

- Table 2.3.6 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size, 2024

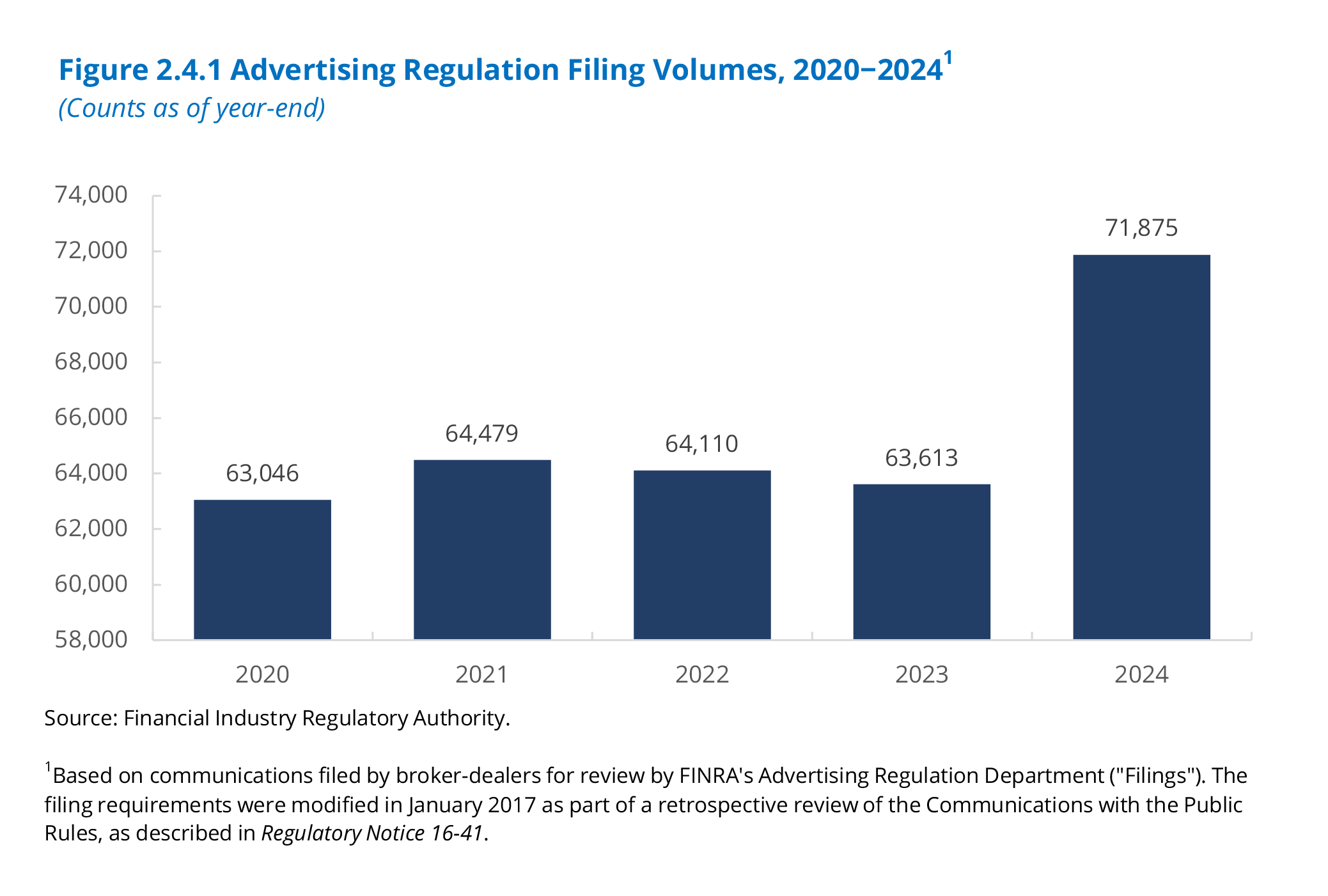

- Figure 2.4.1 Advertising Regulation Filing Volumes, 2020–2024

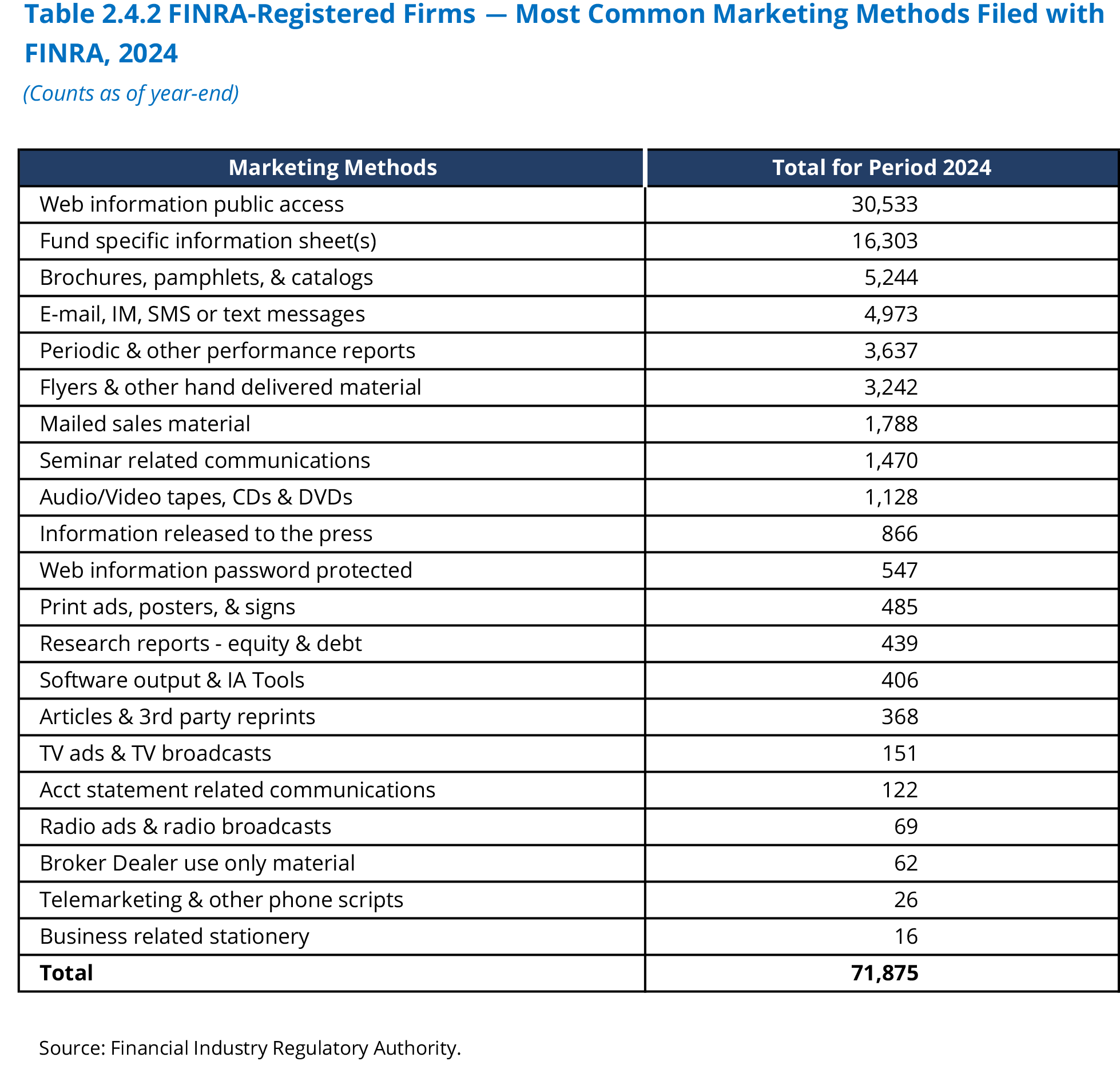

- Table 2.4.2 FINRA-Registered Firms – Most Common Marketing Methods Filed with FINRA, 2024

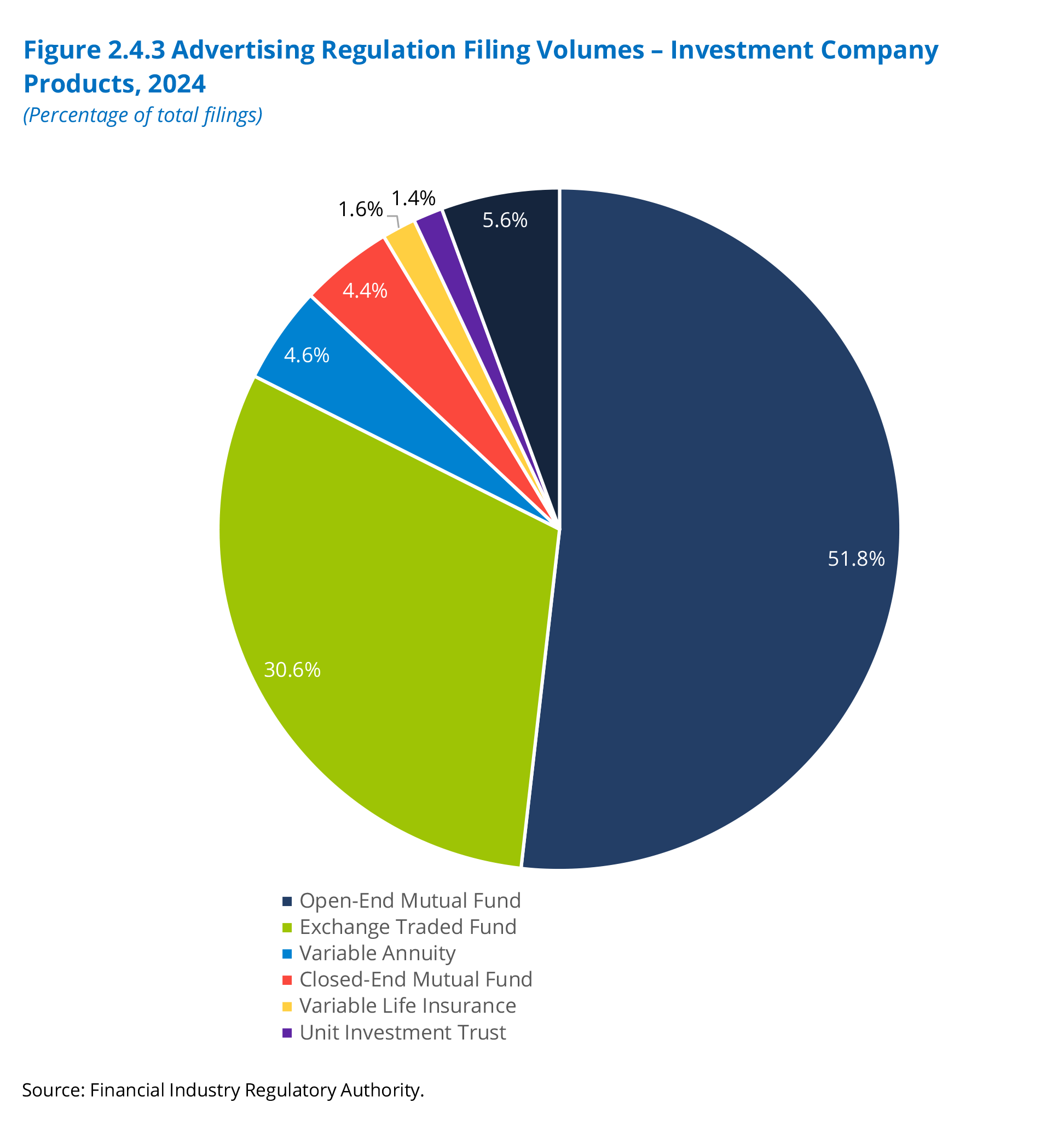

- Figure 2.4.3 Advertising Regulation Filing Volumes – Investment Company Product, 2024

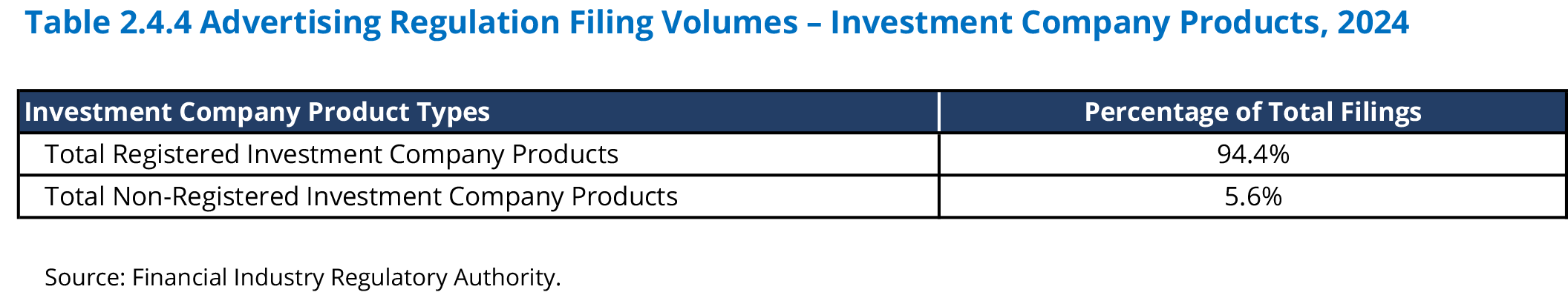

- Table 2.4.4 Advertising Regulation Filing Volumes – Investment Company Product, 2024

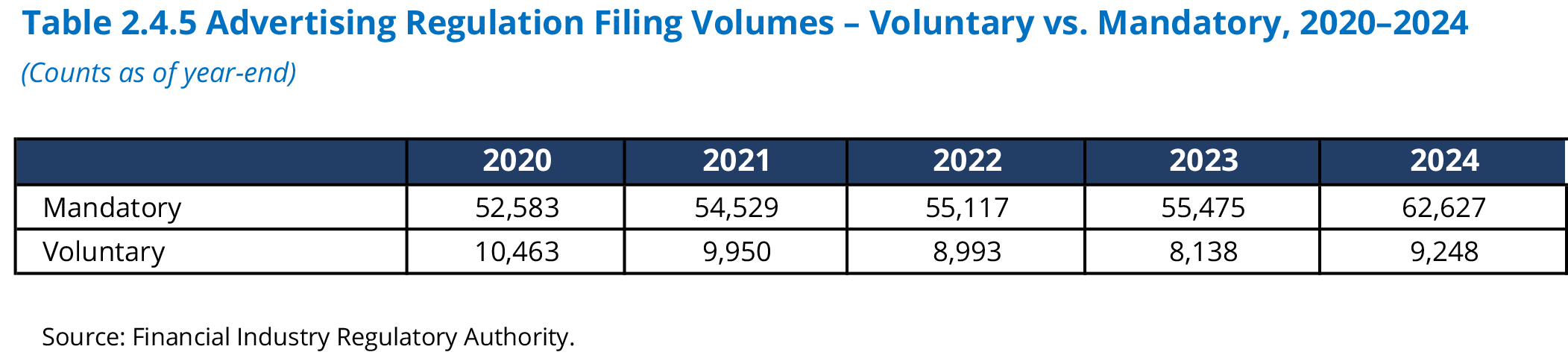

- Table 2.4.5 Advertising Regulation Filing Volumes – Voluntary vs. Mandatory, 2020–2024

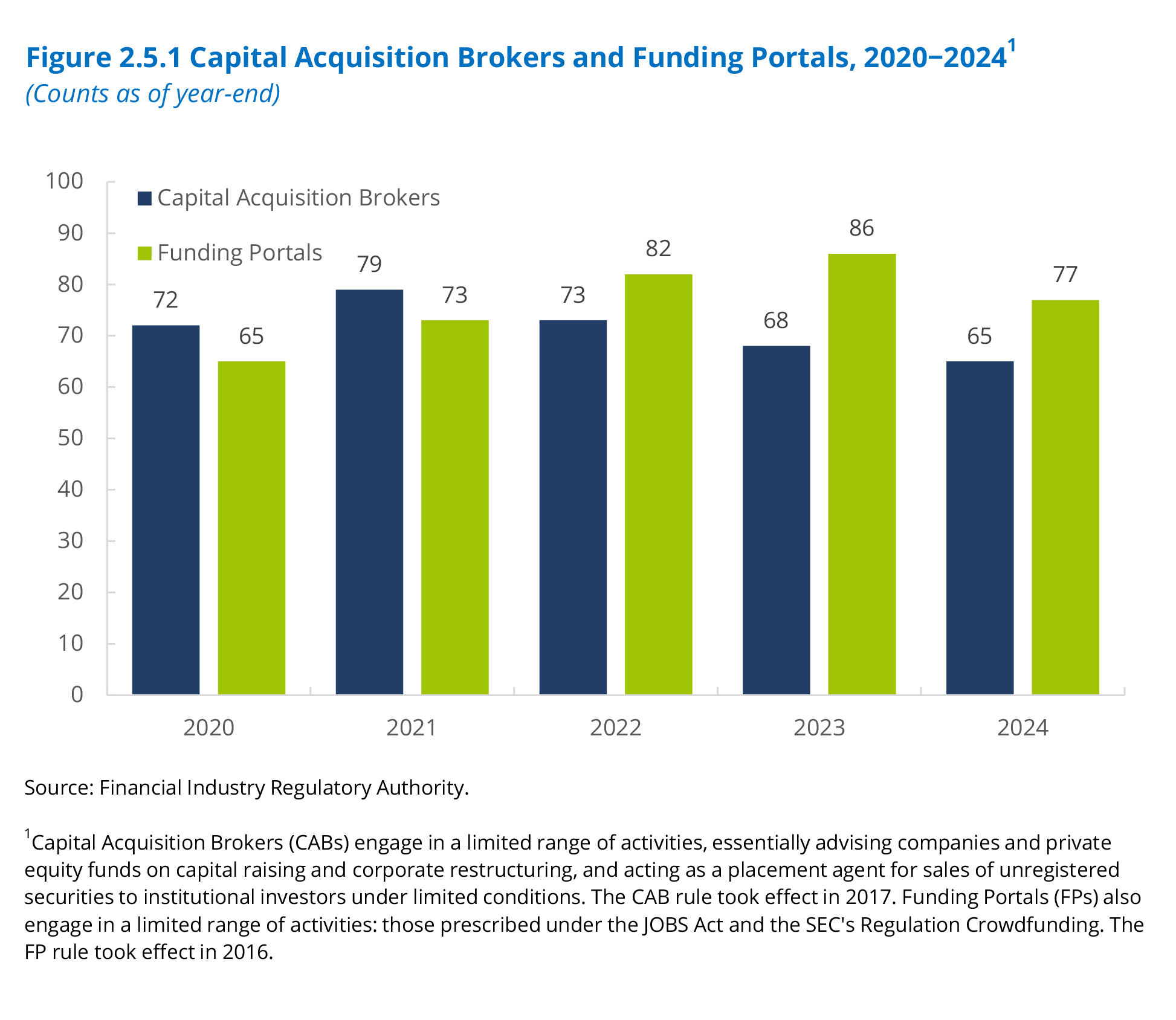

- Figure 2.5.1 Capital Acquisition Brokers and Funding Portals, 2020–2024

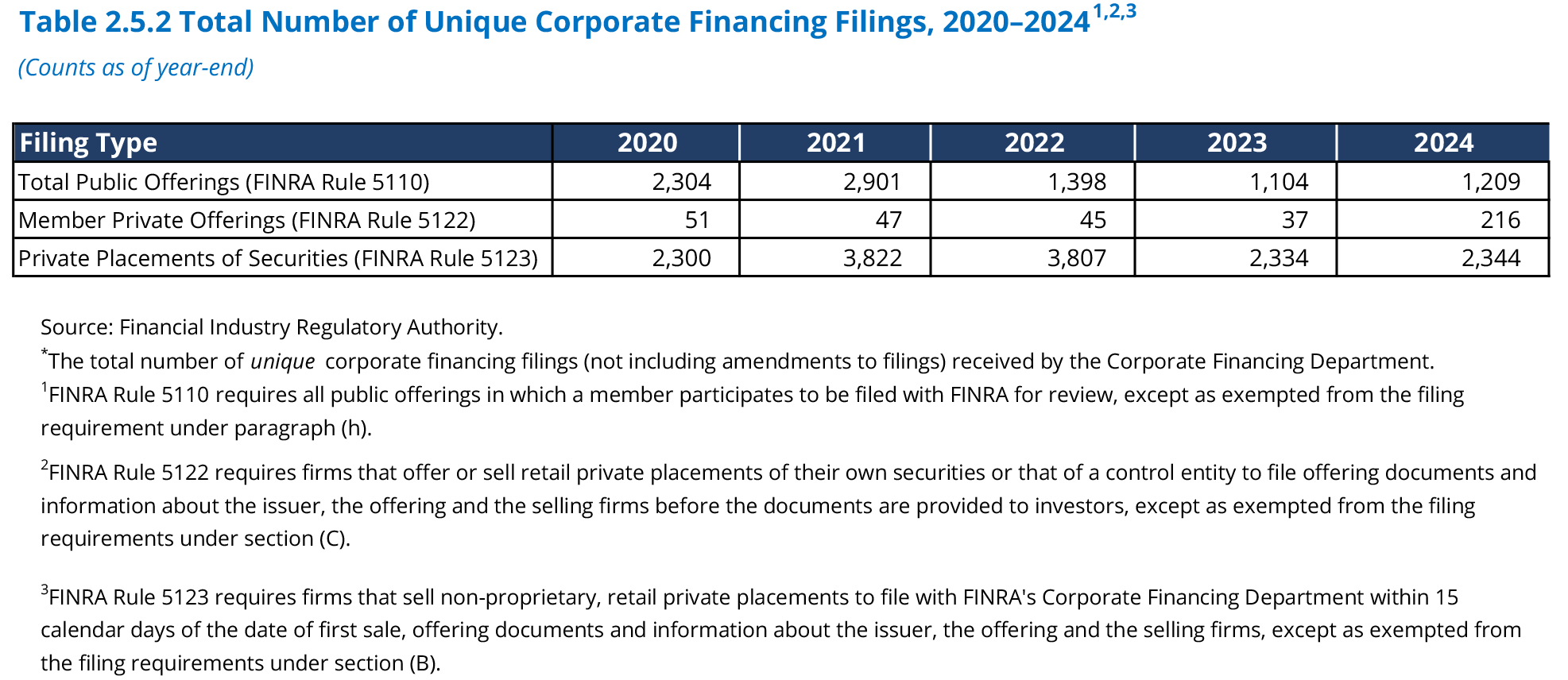

- Table 2.5.2 Total Number of Unique Corporate Financing Filings, 2020–2024

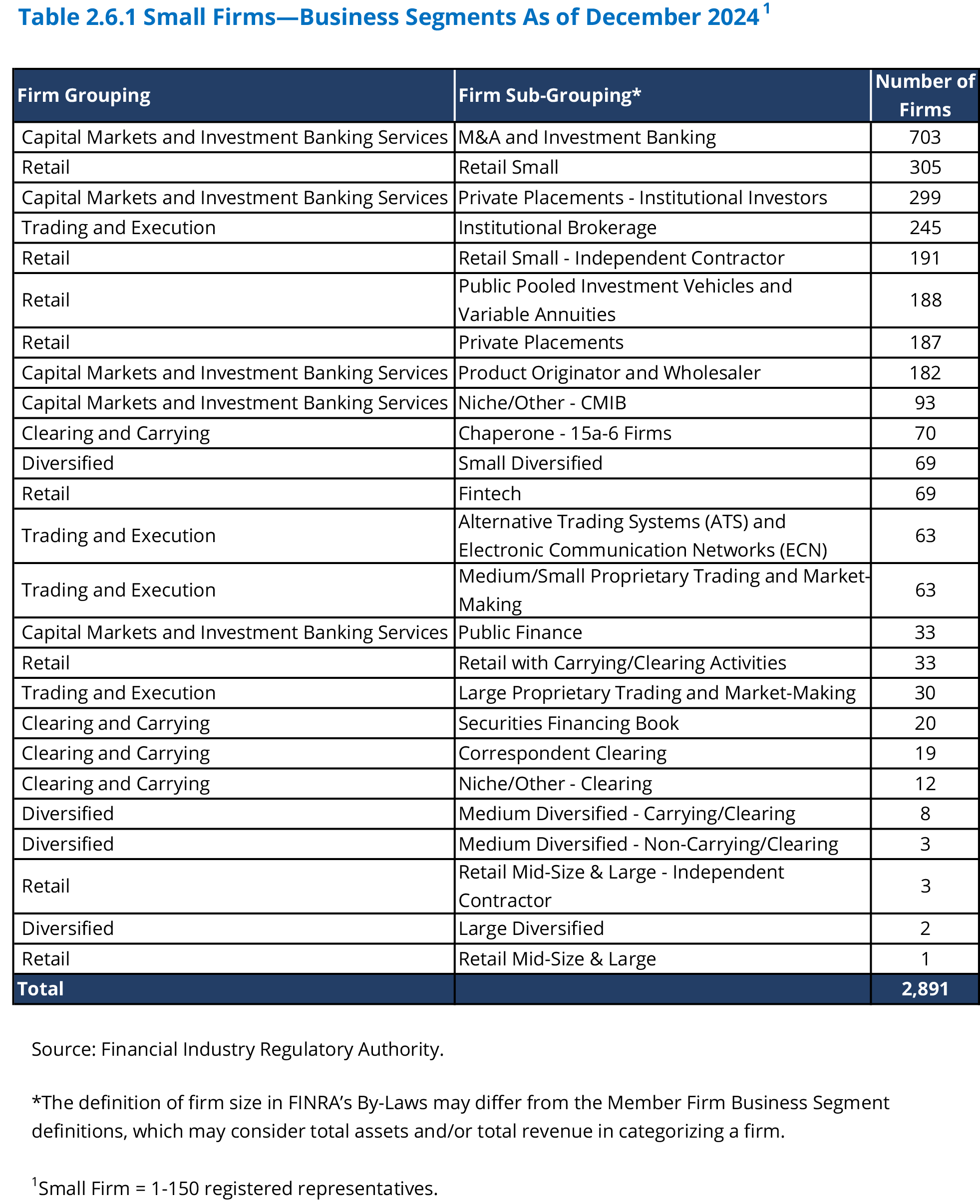

- Table 2.6.1 Small Firms – Business Segments as of December 2024

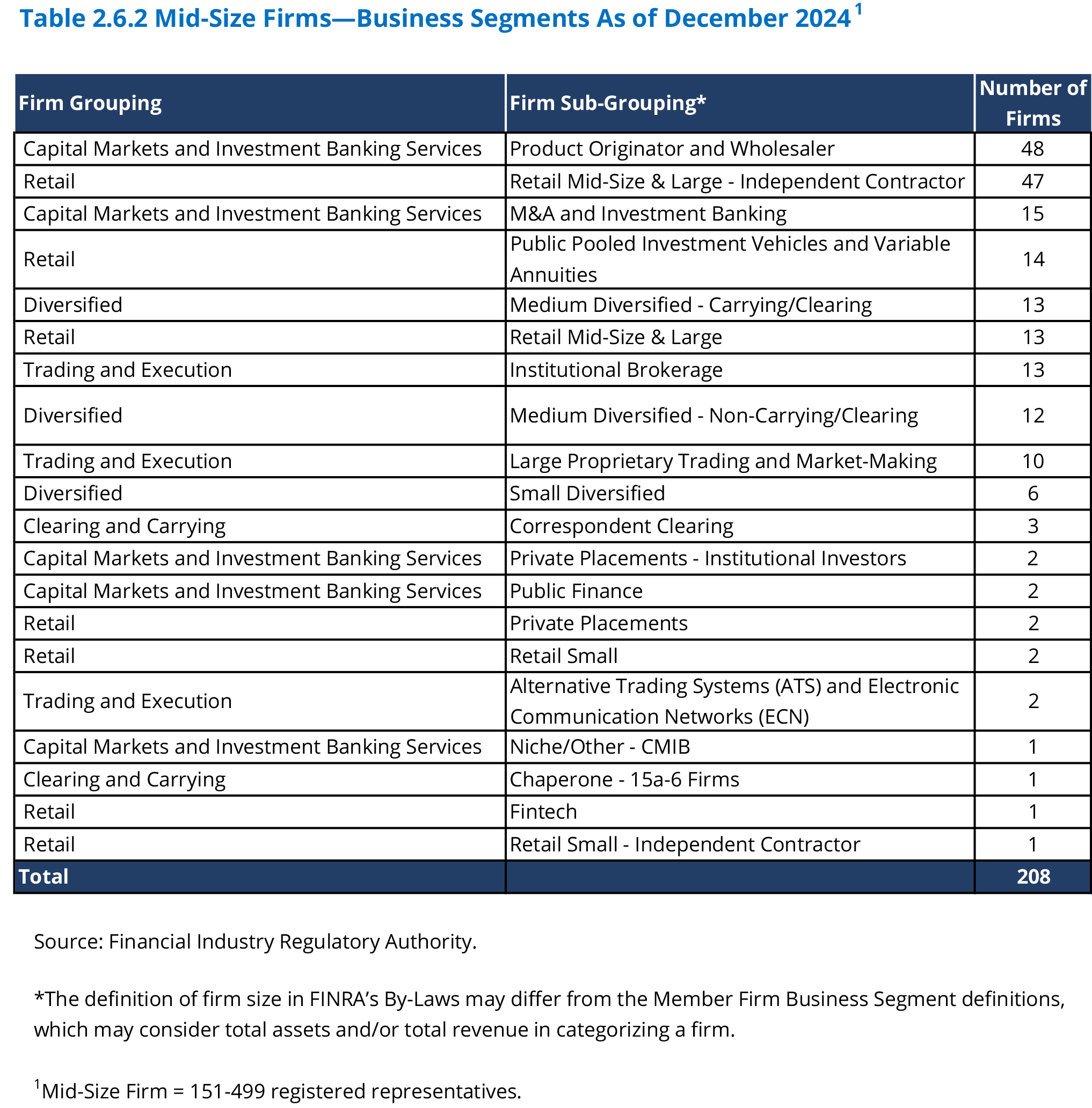

- Table 2.6.2 Mid-Size Firms – Business Segments as of December 2024

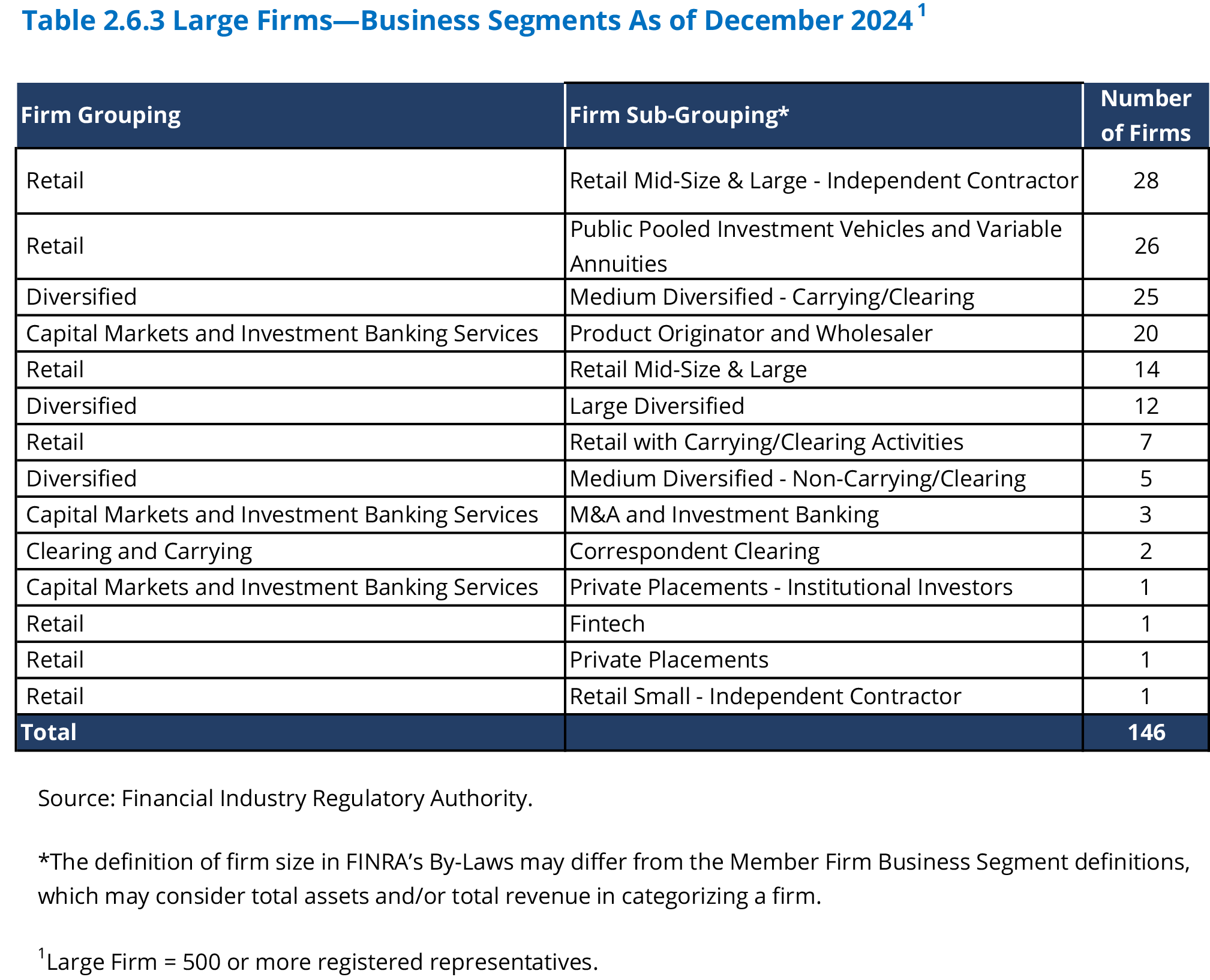

- Table 2.6.3 Large Firms – Business Segments as of December 2024

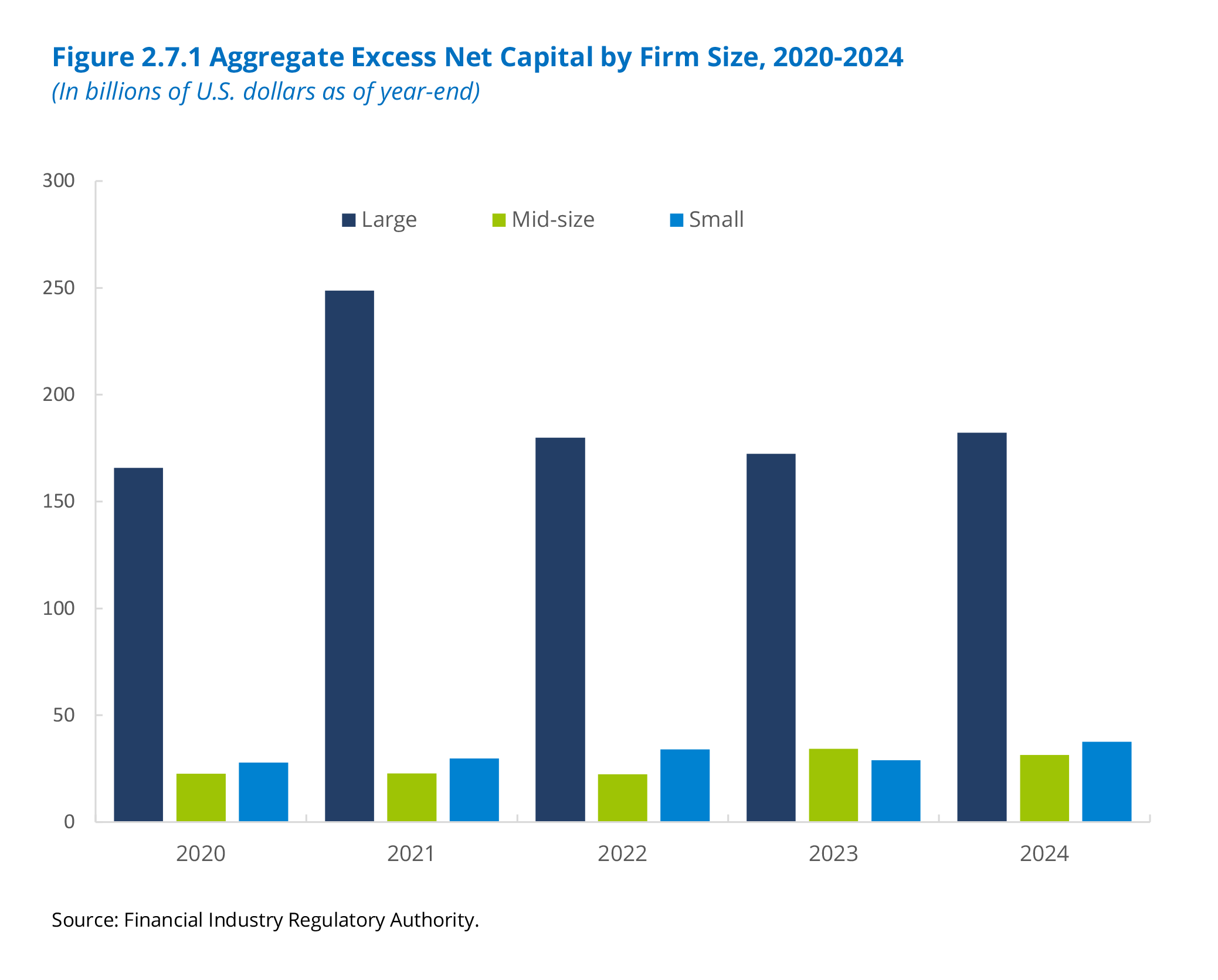

- Figure 2.7.1 Aggregate Excess Net Capital By Firm Size, 2020-2024

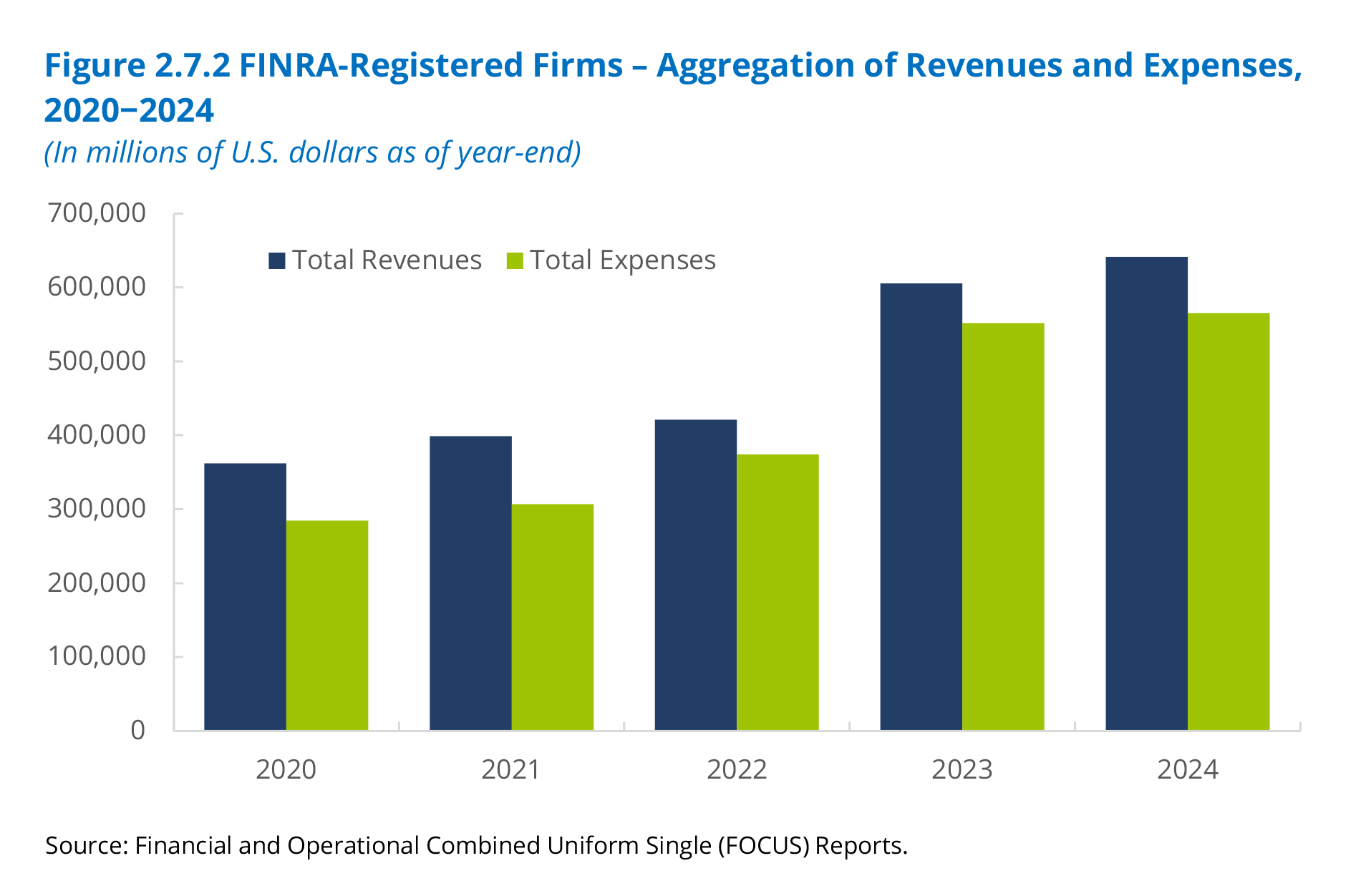

- Figure 2.7.2 FINRA-Registered Firms – Aggregation of Revenues and Expenses, 2020−2024

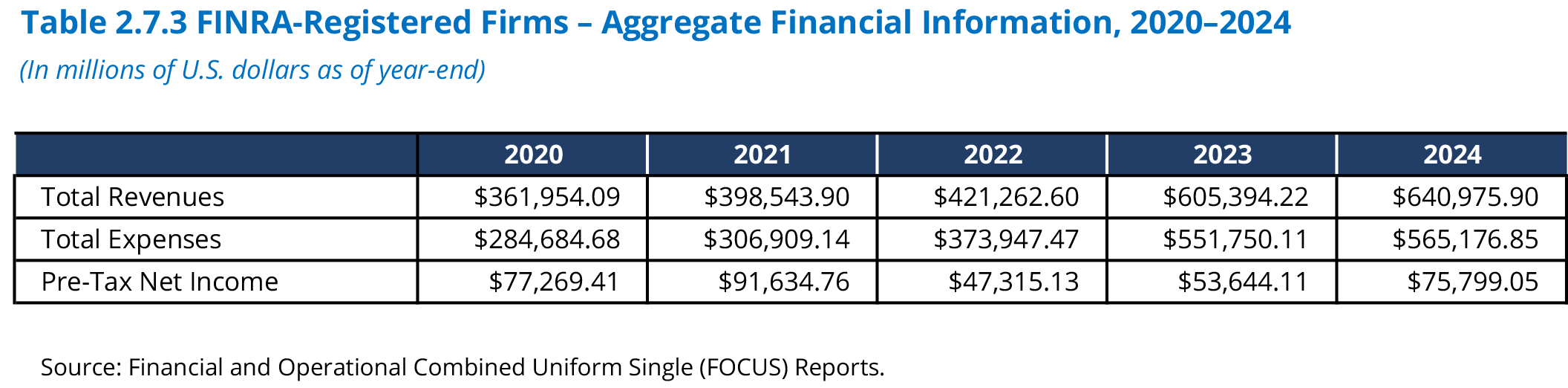

- Table 2.7.3 FINRA-Registered Firms – Aggregate Financial Information, 2020–2024

2.1 Sizes and Counts

FINRA is a not-for-profit organization dedicated to investor protection and market integrity. FINRA regulates one critical part of the securities industry—member brokerage firms doing business in the U.S. FINRA, overseen by the SEC, writes rules, examines for and enforces compliance with FINRA rules and federal securities laws, registers broker-dealer personnel and offers them education and training, and informs the investing public. In addition, FINRA provides surveillance and other regulatory services for equities and options markets, as well as trade reporting and other industry utilities. FINRA also administers a dispute resolution forum for investors and brokerage firms and their registered employees. For more information, visit www.finra.org.

2.2 Entrance and Exit of Firms

2.3 Geographic Distribution

Figure 2.3.1 Geographic Distribution of FINRA-Registered Firms by Number of Branches, 2024

(See linked page)

Figure 2.3.3 Geographic Distribution of FINRA-Registered Firms by Headquarters, 2024

(See linked page)

2.4 Advertising and Products

FINRA Rule 2210 governs member broker-dealers’ communications with the public, including communications with retail and institutional investors. The rule provides standards for the content, approval, recordkeeping and filing of communications with FINRA. FINRA’s Advertising Regulation Department reviews firms’ advertisements and other communications with the public to ensure they are fair, balanced, not misleading and comply with the standards of the SEC, MSRB, SIPC and FINRA advertising rules. FINRA rules do not require all communications to be filed, and the figures presented below therefore represent only a segment of such communication.

2.5 Capital Formation

2.6 Business Segments

On October 1, 2018, FINRA announced that it was moving toward an exam and risk monitoring program structure that is based on the business models of the firms FINRA oversees. FINRA has grouped firms according to the primary business(es) in which they are engaged. The following tables break down business segments by firm size.

2.7 Financials