FINRA Requests Comment on a Proposal to Implement the Recommendations of the CE Council Regarding Enhancements to the Continuing Education Program for Securities Industry Professionals

In response to requests for an extension, the comment period has been extended to June 30, 2020.

Summary

FINRA seeks comment on a proposal to implement the recommendations of the Securities Industry/Regulatory Council on Continuing Education (CE Council) enhancing the continuing education requirements for securities industry professionals.1 The proposal would change the: (1) Regulatory Element to provide annual training, make the content more relevant, incorporate diverse instructional formats, publicize the learning topics in advance and enhance the related management systems; (2) Firm Element to expressly recognize other training requirements, improve the guidance and resources available to firms and establish a content catalog; and (3) Continuing Education Program to enable individuals who terminate their registrations the option of maintaining their qualification by completing continuing education.

The proposed rule text is available in Attachment A.

Questions regarding this Notice should be directed to:

- Afshin Atabaki, Special Advisor and Associate General Counsel, Office of General Counsel, at (202) 728-8902;

- David Scrams, Vice President, Testing and Continuing Education Department, at (240) 386-5950; or

- Patricia Monterosso, Associate Director, Testing and Continuing Education Department, at (212) 858-4086.

Questions concerning the Economic Impact Assessment in this Notice should be directed to:

- Lori Walsh, Deputy Chief Economist, Office of the Chief Economist (OCE), at (202) 728-8323; or

- Dror Y. Kenett, Economist, OCE, at (202) 728-8208.

Action Requested

FINRA encourages all interested parties to comment. Comments must be received by April 20, 2020.

Comments must be submitted through one of the following methods:

- emailing comments to [email protected]; or

- mailing comments in hard copy to:

Jennifer Piorko Mitchell

Office of the Corporate Secretary

FINRA

1735 K Street, NW

Washington, DC 20006-1506

To help FINRA process comments more efficiently, persons should use only one method to comment.

Important Note: All comments received in response to this Notice will be made available to the public on the FINRA website. In general, FINRA will post comments as they are received.2

Before becoming effective, a proposed rule change must be authorized for filing with the Securities and Exchange Commission (SEC or Commission) by the FINRA Board of Governors, and then must be filed with the SEC pursuant to Section 19(b) of the Securities Exchange Act of 1934 (SEA).3

Background and Discussion

The program of continuing education for registered persons of broker-dealers (CE program) was established by the CE Council nearly 25 years ago.4 Registered persons of broker-dealers are required to participate in continuing education consisting of a Regulatory Element and a Firm Element.5 The Regulatory Element is generally delivered every three years and focuses on regulatory requirements and industry standards, while the Firm Element is an annual requirement and focuses on securities products, services and strategies firms offer, firm policies and industry trends.

The CE program has evolved since its inception in 1995, and changes in technology and learning theory have created opportunities for further enhancement.6 For example, technological and test center capacity constraints that existed at program inception resulted in the three-year time frame and the format for administering the Regulatory Element of the CE program. The 2015 transition of the delivery of the Regulatory Element to an online platform (CE Online) removed these constraints and allowed for increased efficiency, such as updating regulatory content in a more timely fashion, eliminating geographic constraints and presenting material in an optimal learning format. Similarly, the Firm Element of the CE program exists in an evolving environment where there are multiple other training programs that could serve as a valuable component of the Firm Element and ensure delivery of an appropriate level of training for registered persons participating in such other training programs.

To address these changes, in September 2018, the CE Council published a document outlining several potential enhancements to the CE program. These enhancements were designed to: (1) ensure that registered persons receive relevant and sufficient Regulatory Element training on an annual basis; (2) provide firms with the guidance and resources necessary to design effective and efficient Firm Element training programs; and (3) provide a path for previously registered individuals to maintain their qualification through continuing education.

In support of the CE Council, FINRA published Regulatory Notice 18-26 requesting feedback on the CE Council’s suggested enhancements. In response to the Notice, FINRA received 22 comment letters that are generally supportive of the potential enhancements the CE Council identified.7 The commenters express overwhelming interest in implementing a mechanism for allowing previously registered individuals to maintain their qualification after the termination of their registrations for longer than the current two-year period. In addition, a majority of commenters see value in moving to an annual Regulatory Element requirement in order to provide registered persons with more timely and relevant education and training. However, many express concern that doing so could increase the administrative and operational burden on both firms and registered persons, particularly for firms with a narrowly focused business model (e.g., the sale of mutual funds and variable annuities). One commenter expresses concern that increasing the frequency of the Regulatory Element may exacerbate the existing burden on those without ready access to a high-speed internet connection, which is currently required for accessing CE Online. Many commenters are in favor of Regulatory Element content that is tailored and specific to each registration category rather than content that applies generally to all registered persons. Some of these commenters question whether there are sufficient regulatory developments occurring annually that would be relevant to individuals with limited registrations, such as registered persons engaged in the sale of mutual funds and variable annuities. Further, commenters widely support the creation of a content catalog thatfirms could leverage for administering education and training for their Firm Element programs. Finally, a number of commenters request more guidance on the Firm Element component, including express guidance that other training requirements (e.g., anti-money laundering (AML) compliance program and annual compliance meeting) may count towards satisfying the Firm Element requirement.8

After reviewing the public comments and further discussions, on September 12, 2019, the CE Council published the following recommendations regarding the CE program:

- transition to an annual Regulatory Element;

- design Regulatory Element content that is more tailored and relevant to each registration category with diverse instructional formats;

- publish the Regulatory Element learning topics for each coming year in advance;

- enhance the functionality of the FINRA systems to facilitate compliance with the Regulatory Element;

- recognize other training requirements for purposes of satisfying the Firm Element;

- improve the guidance and resources provided to firms for conducting the Firm Element annual needs analysis and for planning their respective training;

- develop a content catalog that firms may optionally use for selecting or supplementing Firm Element content; and

- consider rule changes that would enable individuals who were previously registered to maintain their qualification by participating in an annual continuing education program.9

FINRA is publishing this Regulatory Notice to solicit comment on a proposal to implement the CE Council’s recommendations. As discussed in more detail below, FINRA is proposing to amend several of its rules as part of implementing these recommendations.

Regulatory Element

Recommendation: Transition to Annual Requirement

Currently, FINRA Rule 1240(a) (Regulatory Element) requires registered persons to complete the Regulatory Element within prescribed intervals based on their registration anniversary date.10 Specifically, a registered person is required to complete the Regulatory Element initially within 120 days after the person’s second registration anniversary date and, thereafter, within 120 days after every third registration anniversary date.11 In addition, registered persons who become subject to a significant disciplinary action may be required to retake the Regulatory Element within 120 days of the effective date of the disciplinary action, if they remain registered.12 As noted above, the current time frames were established at a time when most individuals had to complete the Regulatory Element at a test center and were designed to address the capacity challenges of the test center-based delivery model. The 2015 transition to CE Online provided individuals the flexibility to complete the content at a location of their choosing, including their private residence, at any time during their 120-day window.

To provide registered persons more timely training on significant regulatory developments, the CE Council recommends that the Regulatory Element be administered annually.

To implement this recommendation, FINRA is proposing to amend Rule 1240(a) to require registered persons to complete the Regulatory Element annually by the end of each calendar year.13 Firms would have the flexibility to require their registered persons to complete the Regulatory Element at any time during the calendar year, which would allow firms to coordinate the timing of the Regulatory Element with other training requirements, including the Firm Element. For example, a member firm may require its registered persons to complete both their Regulatory Element and Firm Element by October 1 of each year.

Individuals who fail to complete their Regulatory Element by the end of each calendar year would be automatically designated as CE inactive in the CRD system on January 15 of the next calendar year. If an individual fails to complete the Regulatory Element by the end of the calendar year but subsequently completes it prior to being designated as CE inactive (that is, prior to January 15 of the next calendar year), the firm with which the individual is associated must document the basis for the individual’s failure to complete the Regulatory Element by the end of the calendar year and retain such documentation. In addition, as currently allowed, a firm may submit a written request, with supporting documentation, to FINRA to extend the time by which a registered person must complete the Regulatory Element. In such cases, for good cause shown, FINRA would grant an extension of time for an individual to complete the required Regulatory Element.

Consistent with current requirements, individuals would be restricted from performing, or receiving compensation for, any activities requiring registration while they remain in a CE inactive status. Individuals who are designated as CE inactive would be required to complete all of their pending and upcoming annual Regulatory Element, including any annual Regulatory Element that becomes due during their CE inactive period, in order for the CE inactive designation to be removed. Finally, if an individual remains CE inactive for a two-year period, the individual would be required to requalify by examination or obtain an examination waiver in order to re-register with a member. Similar to the current process, this two-year period is calculated from the date individuals become CE inactive, and it continues to run regardless of whether they terminate their registrations before the end of the two-year period.

Under the proposal, registered persons would be required on an annual basis to complete approximately one-third of the content that they currently complete. However, individuals with multiple registrations may be subject to more content than individuals with a single registration because, as noted below, they would be required to complete content specific to each registration category that they hold. For example, individuals registered as General Securities Representatives and Securities Traders would be required annually to complete content that is relevant to both representative-level registration categories (sales and trading) and, thus, they would be required to complete more content than individuals registered solely as General Securities Representatives. Similarly, for example, individuals registered as General Securities Representatives and General Securities Principals would be required annually to complete both representative- and principal-level content. The session fee for the annual Regulatory Element will be addressed as part of a separate proposal.

Timing and Frequency of Regulatory Element for Registered Persons

Existing Registrants

All individuals registered with FINRA in a representative or principal registration category immediately prior to the implementation date of the proposal would be required to complete their Regulatory Element for that registration category by the end of the calendar year in which the proposal is implemented and by the end of each calendar year in which they remain registered. For example, if the proposal were implemented on January 1, 2022, an individual registered in the CRD system as a General Securities Representative on December 31, 2021, would be required to complete her annual Regulatory Element for that category by December 31, 2022,14 regardless of whether she had completed the current Regulatory Element requirement in 2021. She would also be required to complete her annual requirement by the end of each following year in which she remains registered (i.e., by December 31, 2023, by December 31, 2024, and so on).15 However, if such individuals obtain a new registration in any given year, their Regulatory Element content would not reflect the new registration category until the beginning of the following calendar year. If, in the example above, the individual registers as a General Securities Principal in 2022, her Regulatory Element content for 2022 would only reflect the General Securities Representative content. Her Regulatory Element content for 2023 would reflect content for both registration categories and would be due by December 31, 2023.

Individuals Registering on or After the Implementation Date

Individuals who are registering with FINRA in a representative or principal registration category for the first time on or after the implementation date of the proposal would be required to complete their Regulatory Element for that registration category by the end of the next calendar year following their registration. For example, if the proposal were implemented on January 1, 2022, an individual registering for the first time in 2022 as a Securities Trader would be required to complete his Regulatory Element for the Securities Trader registration category by December 31, 2023.16 Such individuals would also be required to complete their Regulatory Element by the end of each subsequent calendar year in which they remain registered.17 However, if such individuals obtain a new registration in any given year, their Regulatory Element content would not reflect the new registration category until the beginning of the following calendar year. If, in the example above, the individual subsequently registers as a General Securities Representative in 2024, his Regulatory Element content for 2024 would only reflect the Securities Trader content. His Regulatory Element content for 2025 would reflect content for both registration categories and would be due by December 31, 2025.

Individuals who are re-registering with FINRA in a representative or principal registration category on or after the implementation date of the proposal would also be required to complete their Regulatory Element content for that registration category by the end of the next calendar year following their registration, provided that they have already completed Regulatory Element content for that registration category for the calendar year in which they are re-registering or that they are re-registering by having passed an examination for that registration category or by having obtained an unconditional examination waiver for that registration category.18 Individuals who are re-registering with FINRA in a representative or principal registration category on or after the implementation date of the proposal and who have not satisfied any of the three criteria above would be required to complete the Regulatory Element content for that category by the end of the calendar year in which they re-register.

In addition, if an individual has not completed any Regulatory Element content for a terminated registration category in the calendar year(s) prior to re-registering, FINRA would not approve a registration request for that category until the individual has completed that annual Regulatory Element content, has passed an examination for that category or has obtained an unconditional examination waiver for that category, whichever is applicable. For example, assuming the proposal were implemented on January 1, 2022, if an individual terminates his Investment Banking Representative registration on May 1, 2022, and applies to re-register as an Investment Banking Representative on March 1, 2024, without having completed any Regulatory Element content for that registration category in 2022, 2023 or 2024, FINRA would not approve his registration request until he completes his 2022 and 2023 Regulatory Element content. Further, upon registration, his 2024 Regulatory Element content for the Investment Banking Representative category would be due by December 31, 2024. In this example, if he fails to complete his 2022 and 2023 Regulatory Element by May 1, 2024, his qualification status would lapse, and he would need to requalify by passing the Series 79 examination or by receiving an examination waiver.

Individuals who are re-registering on or after the implementation date of the proposal would also be required to complete their Regulatory Element by the end of each subsequent calendar year in which they remain registered. However, if such individuals obtain a new registration in any given year by passing an examination or obtaining an unconditional examination waiver, their Regulatory Element content would not reflect the new registration category until the beginning of the following calendar year. If, in the example above, the Investment Banking Representative subsequently registers as a General Securities Representative in 2025 by passing the Series 7 examination, his Regulatory Element content for 2025 would only reflect the Investment Banking Representative content. His Regulatory Element content for 2026 would reflect content for both registration categories and would be due by December 31, 2026.

Disciplined Registrants

As described above, currently, registered persons who become subject to a significant disciplinary action may be required to retake the Regulatory Element within 120 days of the effective date of the disciplinary action if they remain registered. FINRA is proposing to amend Rule 1240(a) to provide that such persons may be required to complete assigned continuing education content in a manner specified by FINRA.

Recommendation: Design More Relevant Content With Diverse Instructional Formats

The current Regulatory Element consists of two subprograms: S101 (General Program for Registered Persons); and S201 (Registered Principals and Supervisors). Individuals who maintain solely representative registrations are required to complete the S101 content. Individuals who maintain a principal registration, whether solely or in conjunction with representative registrations, are required to complete the S201 content. Each subprogram includes four training modules. Three of the S101 modules cover general regulatory topics applicable to all representatives.19 The remaining module is a self-selection module, which allows representatives to select specific content relevant to their functions at a firm (e.g., sales, trading, investment banking).20 The four modules of the S201 program cover general regulatory topics applicable to all principals.21

Each module leads individuals through a case that provides a story depicting situations that they may encounter in the course of their work. Each case also contains relevant educational content. Individuals are required to complete one case in each of the four modules. Individuals must review the story content of each case and respond to a series of related questions that assess their understanding of the materials presented. If an individual is unable to answer the questions in a particular case, they will have to retake that case until they can demonstrate proficiency with the subject matter.

While some of the current Regulatory Element content is unique to particular registration categories (i.e., the self-selection module of the S101), most of the content has broad application to representatives and principals. Moreover, the content is presented in a single format. These characteristics are a result of the delivery constraints that existed at program inception, which are no longer at issue since the transition to CE Online.

The CE Council recommends that the Regulatory Element content be redesigned to become more tailored and relevant to the registration categories an individual holds and to incorporate diverse instructional formats.

FINRA will work with the CE Council to: (1) replace the S101 and S201 subprograms with a consolidated Regulatory Element program; (2) identify significant rule changes and other regulatory developments relevant to each registration category;22 and (3) determine the overall amount of learning content needed. FINRA would then work with the CE Council and the CE Content Committee, composed of industry experts, to create tailored content for each registration category. In addition, FINRA is proposing to amend Rule 1240(a) to require registered persons to complete Regulatory Element content relevant to each registration category that they hold.

FINRA will also work with the CE Council to incorporate a variety of instructional formats and not just rely on the current case format. However, regardless of the format, registered persons would continue to be subject to some form of educational assessment to evaluate their understanding of the materials presented.

Recommendation: Publish Learning Topics

The Regulatory Element currently includes a content outline that provides the general regulatory topics covered in the program (e.g., types of communications) and, where applicable, some examples (e.g., email, instant messaging, social media, telemarketing, advertising, seminars). However, the specific learning topics are not available to firms beforehand, which can make it difficult for firms to avoid duplication of topics when developing their Firm Element.

To address this issue, the CE Council recommends that the specific learning topics for the annual Regulatory Element be published in advance of each coming year.

FINRA will work with the CE Council to identify and publish the Regulatory Element learning topics for each coming year in advance. Specifically, by October 1 of each year, FINRA and the CE Council will publish the learning topics for the next year. As noted above, the learning topics will consist of significant rule changes and other regulatory developments relevant to each registration category. Firms and individuals will be able to access the learning topics through the CE Council website or FINRA.org. The learning topics will be listed with the registration category to which they relate. The advance publication of the learning topics will allow firms to review the Regulatory Element topics when developing their Firm Element training plan to avoid unnecessary duplication of topics. In addition, if there are any other critical rule changes or other regulatory developments that arise during the course of a given year, FINRA and the CE Council will work to provide registered persons timely and sufficient training on such rule changes and developments.

Recommendation: Enhance Functionality of FINRA Systems

Currently, firms rely primarily on the CRD system to track and manage completion of the Regulatory Element by their registered persons. The CRD system provides firms with data, reporting and notifications. Further, each registered person currently launches and tracks completion of the program through CE Online.

The CE Council recommends that FINRA enhance the functionality of the CRD system and other systems to facilitate compliance with the proposed changes to the Regulatory Element, including the proposed transition to an annual requirement.

FINRA recognizes that the transition to an annual requirement will increase the number of registered persons who would be subject to the Regulatory Element annually.23 Therefore, to assist compliance with the proposed changes to the Regulatory Element, FINRA would enhance the CRD system to provide firms with additional management and tracking functionality. FINRA would also enhance the FINRA Financial Professional GatewaySM (FinPro) system to enable registered persons to launch and track completion of the program through that system, rather than through CE Online. The FinPro system would send automated email notifications regarding the Regulatory Element requirement directly to registered persons. The system would then continue to send notifications to registered persons until they have completed their Regulatory Element session. In addition, firms could elect to be copied on all system-generated notifications sent to a registered person.

Firm Element

Recommendation: Recognize Other Training Requirements

Unlike other annual training requirements that apply to all registered persons, such as the annual compliance meeting requirement, the Firm Element only applies to certain registered persons. Specifically, FINRA Rule 1240(b) (Firm Element) currently requires each firm to develop and administer an annual Firm Element training program for covered registered persons. A “covered registered person” is defined as any registered person who has direct contact with customers in the conduct of a member firm’s securities sales, trading and investment banking activities, any individual who is registered as an Operations Professional or a Research Analyst, and the immediate supervisors of any such persons.24

To date, other required training, including the training requirements relating to the AML compliance program and those relating to the annual compliance meeting,25 have not been expressly recognized for purposes of satisfying Firm Element training.

The CE Council recommends that other training requirements, including those relating to the AML compliance program and annual compliance meeting, be expressly recognized in determining whether individuals have satisfied the Firm Element requirement.

FINRA is proposing to amend Rule 1240(b) to provide that member firms may consider training relating to the AML compliance program and annual compliance meeting towards satisfying an individual’s annual Firm Element requirement.26

In conjunction with this proposed change, FINRA is also proposing to amend Rule 1240(b) to extend Firm Element training to all registered persons, including individuals who maintain solely a permissive registration consistent with FINRA Rule 1210.02 (Permissive Registrations), thereby aligning the Firm Element requirement with other broadly based training requirements, such as the annual compliance meeting requirement. However, given the proposed recognition of other training requirements towards satisfying the Firm Element requirement, registered persons may find that they do not have to complete any additional training beyond what they are required to complete today. For example, with respect to a registered person working on AML compliance at a firm, the firm may determine that the individual has satisfied the annual Firm Element requirement for a given year by completing AML training for that year and participating in the annual compliance meeting. As another example, with respect to a permissively registered person working in a clerical or administrative capacity for a firm, the firm may determine that the individual has satisfied the annual Firm Element requirement for a given year by participating in the firm-wide annual compliance meeting.

Recommendation: Improve Guidance and Resources

The CE Council currently publishes a quarterly Firm Element Advisory (FEA), which identifies and recommends pertinent regulatory and sales practice issues for firms to consider including in their Firm Element training plans. The FEA also provides general guidance on conducting an annual needs analysis, access to reports summarizing a firm’s performance on the Regulatory Element and a number of regulator-provided training resources on the topics covered in the FEA. Archived and updated FEAs are available on the CE Council website.

The CE Council recommends that the Firm Element guidance and resources provided to firms, including the material provided through the FEA, be improved to better assist firms in planning their respective programs.

FINRA and the CE Council will work towards improving the guidance and resources available to firms to develop effective Firm Element training programs, such as updated templates for documenting training plans and specific principles for conducting the required annual needs analysis. In addition, as discussed below, FINRA and the CE Council will work on developing a content catalog to provide firms additional optional sources from which to select or supplement their Firm Element content.

Recommendation: Develop Content Catalog

Currently, each firm may select the content to be covered in the annual Firm Element from a variety of sources, including from content that is developed internally by the firm, or externally by a third party or an SRO. However, firms are not provided a centralized location from which to select relevant content for Firm Element training, which may make it more difficult for some firms to find relevant content for their respective training programs.

The CE Council recommends the development of a content catalog that would serve as an optional resource from which firms could select or supplement their Firm Element content.

FINRA and the CE Council will work to develop a catalog of continuing education content that would serve as an optional resource for firms to select relevant Firm Element content and create learning plans for their registered persons. The catalog would include content developed by third-party training providers, FINRA and the other SROs participating in the CE program. Firms would have the option of using the content in the catalog for purposes of their Firm Element training—they would not be obligated to select content from the catalog. Therefore, firms would continue to have the option of developing their own content for use in their Firm Element training or working directly with third-party training providers to develop content.

The catalog would also serve other purposes. As discussed below, individuals who opt in to the proposed program to maintain their qualification following the termination of a registration category would be subject to annual continuing education, a portion of which would include content selected by FINRA and the CE Council from the content catalog.

Maintaining Qualification

Recommendation: Consider Rule Changes Enabling Previously Registered Individuals to Maintain Qualification Through Continuing Education

Registered persons of broker-dealers may terminate one or more of their registrations for a variety of reasons, such as life events, career changes or business reorganizations. Currently, individuals whose registrations as representatives or principals have been terminated for two or more years may re-register as representatives or principals only if they requalify by retaking and passing the applicable representative- or principal-level examination or if they obtain a waiver of such examination(s), regardless of having satisfied their continuing education requirements throughout their careers.27 Waivers are granted either on a case-by-case basis or under FSAWP, which includes a Regulatory Element requirement and other eligibility conditions.28

While registered persons of broker-dealers are subject to continuing education, they are unable to extend that continuing education in order to maintain their qualification following the termination of any of their registrations. The same is not true for other professionals who are required to complete continuing education,29 including lawyers and accountants. Such other professionals may maintain their qualification to work in their respective fields during a period of absence from their careers by satisfying continuing education requirements for their credential.

To address this issue, the CE Council recommends that FINRA, and the other SROs participating in the CE program, consider rule changes that would enable previously registered individuals to maintain their qualification for their terminated registration categories by participating in an annual continuing education program.

In response, FINRA is proposing to amend Rule 1240 to establish a continuing education program that would allow individuals who were previously registered in a representative or principal registration category to maintain their qualification for a terminated registration category.30 As discussed more fully below, subject to specified eligibility criteria, the proposal would provide such individuals the option of maintaining their qualification beyond the current two-year limitation by satisfying an annual continuing education requirement.31 The proposed program would be available to eligible individuals who terminate any of their representative or principal registration categories and wish to maintain their qualification for any of the terminated categories.32 FINRA is proposing to make conforming changes to Rule 1210.08 to reflect the proposed program.

To be eligible, among other criteria, individuals must have been registered in the terminated registration category for a minimum time period immediately prior to the termination of that category. Eligible individuals would have the option of participating in the proposed program for a specified amount of time following the termination of that registration category.33 In addition, individuals may regain eligibility to participate in the program each time they satisfy the eligibility criteria. Therefore, individuals could participate in the program multiple times during the course of their careers and each time up to the specified amount of time permitted. Eligible individuals who decide not to opt in to the proposed program would continue to be subject to the current two-year limitation on their qualification.34

By enabling individuals the option of maintaining their qualification in such a manner, the proposal would achieve a number of goals. It would provide them with flexibility to address life and career events and necessary absences from registered functions without the added challenge of having to requalify each time. It would also incentivize them to stay current on their respective securities industry knowledge following the termination of any of their registration categories. Further, if they choose to participate in the program, they would be subject to a continuing education standard that would be as rigorous as the standard to which registered persons are subject, which promotes investor protection.

Eligibility Criteria

The following individuals would be eligible to opt in to the program:

- Individuals who terminate any of their registration categories on or after the implementation date of the proposed program, provided that they were registered in that registration category for at least one year immediately prior to the termination of that registration category, they were not subject to a statutory disqualification during the applicable registration period, and they were not CE inactive for two consecutive years (New Participants);

- Individuals who terminated any of their registration categories within two years immediately prior to the implementation date of the proposed program, provided that they were registered in that registration category for at least one year immediately prior to the termination of that registration category, they were not subject to a statutory disqualification during the applicable registration period, and they were not CE inactive for two consecutive years (Transition Participants);35 and

- Individuals participating in FSAWP immediately prior to the implementation date of the proposed program (FSAWP Participants).36

Notification and Opt-In Period

FINRA would notify New Participants of their eligibility to participate in the proposed program following their Form U5 (Uniform Termination Notice for Securities Industry Registration) submission. New Participants would then have to decide whether to join the program. New Participants would have the option of joining the program either at the time of their Form U5 submission or at another time within two years of the termination of their registration categories.

FINRA would notify Transition Participants and FSAWP Participants of their eligibility to participate in the proposed program three months prior to the implementation date. Transition Participants and FSAWP Participants would then have to decide whether to join the program by the implementation date. For example, assuming the proposed program were implemented on January 1, 2022, a Transition Participant who terminates a registration category in March 2020 would be notified by October 1, 2021, of his eligibility to participate in the program, and he would need to decide whether to join the program by January 1, 2022.

FINRA would enhance the FinPro system to notify previously registered individuals of their eligibility to participate in the program, enable them to affirmatively opt in and notify them of their annual continuing education requirement if they opt in.

Participation Time Period

New Participants and Transition Participants would be eligible to participate in the program for a terminated registration category for up to seven years following the termination of that category, which is generally consistent with the current participation time period under FSAWP. The proposed program is intended to complement an individual’s experience in a particular registration category and to address life events and economic downturns that may necessitate a period of absence from registered functions. The participation time period for FSAWP Participants who decide to join the proposed program would be up to seven years following the termination of their registrations as part of FSAWP.

With respect to Transition Participants and FSAWP Participants who decide to join the proposed program, FINRA would retroactively adjust their participation time period by deducting the amount of time that such individuals were unregistered prior to the implementation date because such individuals would not have been subject to annual continuing education prior to that date. For example, if the proposed program were implemented on January 1, 2022, the participation time period for an FSAWP Participant who joins the proposed program and who terminated his registration with FINRA on January 1, 2020, as reflected on his Form U5, would end on January 1, 2027 (i.e., seven years from the date he terminated his registration with FINRA). This time period adjustment would only impact the initial participation time period of these individuals. It would not impact any subsequent participation time period if these individuals become re-eligible to participate in the program after the implementation date. Transition Participants and FSAWP Participants who become re-eligible to participate in the program at some point after the implementation date would be considered as New Participants if they choose to re-join the program.

Program participants would be able to re-register in the applicable representative or principal registration category at any point during their participation time period without having to retake a qualification examination or obtain an examination waiver, provided that they complete the required annual content while in the program.37 For example, assuming the proposed program were implemented on January 1, 2022, if a New Participant terminates his General Securities Representative registration in 2022 and joins the program that year to maintain his qualification, he could subsequently re-register as a General Securities Representative in 2026 without having to retake the Series 7 examination or obtain an unconditional waiver of the examination, provided that he completed the required annual content while in the program, including his 2025 annual content. In addition, once such individuals re-register a registration category, they would be required to complete their annual Regulatory Element content for that category by the end of the calendar year in which they re-register, unless they already completed their annual Regulatory Element content for that registration category as program participants. Therefore, in the example above, the New Participant would be required to complete his 2026 Regulatory Element content as a General Securities Representative by December 31, 2026, unless he already completed his 2026 annual content as a program participant prior to re-registering.

In addition, individuals may regain eligibility to participate in the program each time they remain registered in a registration category for at least one year immediately prior to the termination of that registration category without being subject to a statutory disqualification or a two-year CE inactive status, as noted above. Therefore, individuals could participate in the program multiple times during the course of their careers and each time up to seven years.

Content of Program

The annual continuing education under the proposed program would consist of a combination of Regulatory Element content and content selected by FINRA and the CE Council from the Firm Element content catalog discussed above. The content would correspond to the registration category for which an individual wishes to maintain his or her qualification. The content would include an educational assessment, which would require participants to demonstrate proficiency with the subject matter.

Timing and Frequency of Continuing Education

New Participants who decide to join the program would be required to complete their annual content for a terminated registration category by the end of the calendar year in which they terminate that category, unless they already completed their annual Regulatory Element content for that year. New Participants who have completed their annual Regulatory Element content for the year in which they terminate a registration category would be required to complete their annual content under the program by the end of the calendar year following the termination of that category. For example, if the proposal were implemented on January 1, 2022, a New Participant who terminates a registration category on May 1, 2022, and joins the proposed program at that time, after completing her 2022 Regulatory Element content for that category, would be required to complete her annual content under the program by December 31, 2023. As previously noted, New Participants have the option of joining the program on a later date following their Form U5 submission but within two years of the termination of their registration categories. New Participants who decide to join the program on a later date following their Form U5 submission would be required to complete any annual content that they missed in the interim period between the date of their Form U5 submission and the later date on which they joined the program. Such individuals would have to complete any missed annual content within two years of the termination of their registration categories. In the example above, if the New Participant decides to join the program on January 1, 2024, she would be required to complete the annual content that was due by December 31, 2023, by May 1, 2024.

Transition Participants and FSAWP Participants who decide to join the program would be required to complete their annual content under the program by the end of the calendar year in which the program is implemented. For example, if the proposal were implemented on January 1, 2022, a Transition Participant who decides to join the program for a registration category that was terminated in 2021 would be required to complete his annual content for that category under the program by December 31, 2022.

Program participants would also be required to complete their annual content by the end of each subsequent calendar year that they remain in the proposed program. A program participant may submit a written request, with supporting documentation, to FINRA to extend the time by which the participant must complete the continuing education under the program. For good cause shown, FINRA would grant an extension of time for such participants to complete the required annual content.

Impact of CE Inactive Status on Eligibility

Individuals who have been CE inactive for two consecutive years, as noted above, would not be eligible to join the proposed program. Moreover, individuals who join the program and subsequently become CE inactive for two consecutive years with respect to any of their registration categories with FINRA would not be eligible to continue in the proposed program.

New Participants who are in a CE inactive status and who terminate their registrations prior to the end of the two-year period would be eligible to participate in the proposed program, provided that they satisfy all of their outstanding Regulatory Element prior to the end of the two-year period. For example, if the proposal were implemented on January 1, 2022, an individual who terminates his registrations on March 1, 2022, after having been CE inactive since October 1, 2020, would be eligible to participate in the proposed program if he completes his outstanding Regulatory Element prior to October 1, 2022. Transition Participants who are in a CE inactive status and who terminated their registrations prior to the end of the two-year period would be eligible to participate in the proposed program, provided that they have not been CE inactive for two consecutive years and they satisfy all of their outstanding Regulatory Element in a manner specified by FINRA. FINRA would provide such New Participants and Transition Participants a mechanism through which they could complete their outstanding Regulatory Element.

Impact of Statutory Disqualification on Eligibility

As noted above, individuals who are subject to a statutory disqualification prior to the termination of their registrations would not be eligible to join the proposed program. In addition, individuals who become subject to a statutory disqualification after the termination of their registrations would become ineligible to participate in the program. This would include otherwise eligible individuals who become subject to a statutory disqualification while participating in the program. For example, if the proposal were implemented on January 1, 2022, an individual who joins the program on May 1, 2022, and becomes subject to a statutory disqualification on November 1, 2027, would thus become ineligible to participate in the program, regardless of whether she completed the required annual content under the program prior to becoming subject to a statutory disqualification. In this example, she would be required to requalify by retaking the applicable representative- or principal-level examination in order to re-register with a member firm, in addition to satisfying the eligibility conditions for association with a firm.38 An individual is considered to be subject to a statutory disqualification irrespective of any review, appeal or final decision by FINRA or the SEC regarding the individual’s eligibility to associate with a member firm pursuant to the Rule 9520 Series (Eligibility Proceedings).

Failure to Complete

Program participants who fail to complete the required annual content for a registration category would be provided an opportunity to continue in the program by completing any missed content, provided that the registration category has not been terminated for two or more years. Program participants who fail to complete the required annual content for a registration category that has been terminated for two or more years would not be eligible to continue in the program. For example, if the proposal were implemented on January 1, 2022, a program participant who completes the required annual content for the General Securities Representative category in 2022, 2023, 2024 and 2025 but fails to complete the 2026 annual content would not be eligible to continue in the program beyond 2026.

In addition, program participants who fail to complete the required annual content for a registration category could still re-register without having to requalify by examination if they do so within two years following the termination of that registration category. As noted above, however, if an individual has not completed any Regulatory Element content for a terminated registration category in the calendar year(s) prior to re-registering, FINRA would not approve a registration request for that category until the individual has completed that annual Regulatory Element content.

Two-Year Qualification Period

As described above, the proposal would not eliminate the current two-year qualification period. Rather, it would provide eligible individuals that join the proposed program the ability to maintain their qualification beyond the two-year limitation by completing annual continuing education. Accordingly, eligible individuals who decide not to join the proposed program and individuals who are not eligible to participate, other than individuals whose registrations have been revoked pursuant to FINRA Rule 8310 and individuals who have been CE inactive for two or more years,39 could still re-register following the termination of any of their registration categories without having to requalify by examination or having to obtain an unconditional examination waiver if they re-register within two years of the termination of the registration category,40 in addition to satisfying the eligibility conditions for association with a firm.41

Economic Impact of the Proposal

FINRA has undertaken an economic impact assessment, as set forth below, to further analyze the regulatory need for the proposed changes, their potential economic impacts, including anticipated costs, benefits, and distributional and competitive effects, relative to the current baseline, and the alternatives FINRA considered in assessing how best to meet its regulatory objective.

Regulatory Need

FINRA is proposing to make changes to the CE program, including the related FINRA rules, as part of ongoing efforts to address and implement the CE Council’s September 2019 recommendations. FINRA’s efforts are focused on the three main areas emphasized by the CE Council, as described above: (1) ensure that registered persons receive relevant and sufficient Regulatory Element training on an annual basis; (2) provide firms with the guidance and resources necessary to design effective and efficient Firm Element training programs; and (3) provide a path for previously registered individuals to maintain their qualification through continuing education.

The proposed changes are expected to result in a more efficient CE program that addresses relevant regulatory requirements and provides individuals the best tools and resources to understand and comply with such requirements, enhancing investor protection. Moreover, the proposed changes would provide new channels for individuals to maintain their qualification status for a terminated registration category and, in so doing, could increase the likelihood that professionals who need to step away from the industry for a period could return.

Economic Baseline

The economic baseline for the proposed changes is the existing CE program. As described above, registered persons of broker-dealers are required to participate in continuing education consisting of a Regulatory Element and a Firm Element. The Regulatory Element is generally delivered every three years and focuses on regulatory requirements and industry standards, while the Firm Element is an annual requirement and focuses on securities products, services and strategies firms offer, firm policies and industry trends.

As stated above, under the current regime, individuals generally have a two-year window from the termination of their association with a member firm to return to the industry without requalifying by examination or obtaining a waiver. According to FINRA analysis, the total number of registered persons, approximately 630,000, has remained the same, relatively speaking, over the past few years even as individual registered persons regularly change their status by ending and renewing their association with a firm.42 Across this pool of registered persons, approximately 65 percent hold only one registration category (for example either a General Securities Representative registration or an Investment Company and Variable Contracts Products Representative registration), 25 percent hold two registrations (for example a General Securities Representative registration and an Investment Banking Representative registration), and the remainder hold three registrations or more. In recent years, out of the approximately 630,000 registered persons, approximately 90,000 end their registration with all firms they are registered with at some point during the year. Out of these, about half do not renew their registration and are considered to have left the securities industry.

Under the current baseline, registered persons who chose to give up their association with any member firm are given a two-year grace period in which they can return without being required to retake a qualification examination or obtain an examination waiver. Individuals who seek to re-register more than two years after terminating their association are required to requalify by passing an examination or obtaining an examination waiver. Requalification imposes costs in the form of time spent preparing for and taking the examinations, potential limitations to the activities permitted to be conducted until the requalification is completed, and the direct registration costs. FINRA understands anecdotally that these costs do deter some significant portion of the population from re-registering today.

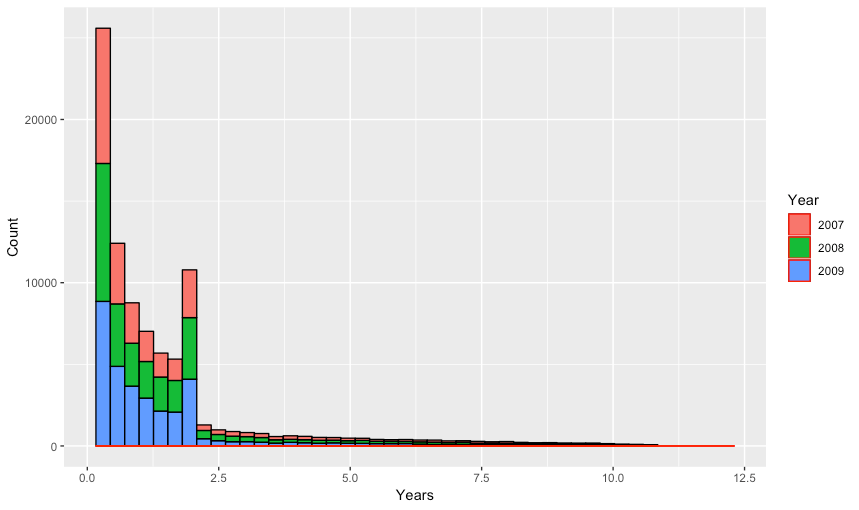

Figure 1, as an example, presents a plot of the number of registered persons that re-register within a given number of years after having terminated their registrations for at least 60 days.43 We focus on registered persons who terminated their registrations in either 2007, 2008 or 2009 and the period of time until they re-register with the same or a different firm.44 Each bar in Figure 1 represents a 100-day period and, roughly speaking, three-and-a-half bars represent one year. As can be observed in Figure 1, for all three origination years, there is an increase in the number of previously registered persons who re-register towards the end of the second year from their date of termination. This is consistent with the incentive in the current rule permitting individuals to re-register without having to requalify by passing an examination or having to obtain an examination waiver and supports the assumption that the requalification process imposes direct and indirect economic costs. After this point, there is a significant drop in the number of individuals who re-register.

Moreover, following the end of the second year after terminating their registrations, the number of individuals re-registering remains low and tapers off slowly. Finally, an analysis of the stage in the Regulatory Element cycle at which registered persons terminate their registrations, on average, across the time period of 2007–2016, suggests that registered persons who terminate their registrations tend to do so approximately 530 days before their next Regulatory Element would be due (i.e., on average in the middle of a current three-year Regulatory Element cycle).

Figure 1: Plot of the number of previously registered persons that re-register within a given number of years after having terminated their registrations for at least 60 days in either 2007, 2008 or 2009. Each bar represents 100 days, and every year is accordingly represented by approximately three-and-a-half bars.

With respect to member firms, the economic baseline is derived from the current processes and procedures used to implement the existing CE program. As discussed above, member firms are responsible for the appropriate monitoring of the compliance of their registered persons with the three-year Regulatory Element cycle, and for administering the annual Firm Element. Further, member firms may experience material negative impact where they are not able to retain qualified experienced persons because of professional and personal events that require them to take a leave of absence from the industry.

Economic Impacts

FINRA believes that economic impacts of the proposed changes would result in both benefits and costs to member firms and registered persons and could potentially benefit the investor community.

Benefits

FINRA believes that the proposed changes would result in two main benefits to registered persons.

First, as discussed above, one of the main recommendations of the CE Council was to transition from a three-year to an annual Regulatory Element requirement. Such an annual requirement is implemented for other professionals, such as Certified Public Accountants (CPAs), Chartered Financial Analysts (CFAs) and lawyers.45 The 2015 transition to CE Online resulted in a more efficient program and added a new dimension of flexibility to the CE program, in terms of the content, timing and availability of the program. The proposed changes would transform the Regulatory Element from the current three-year cycle to an annual cycle. This change would allow the Regulatory Element to focus on current issues and recent regulatory changes and enhance registered persons’ understanding of the changes through more frequent assessments. A transition to an annual cycle is expected to benefit registered persons by ensuring that they have an understanding of recent regulatory changes and are thus able to perform their work in a compliant and effective manner. Under the current program, a regulatory change could take place in the beginning of a three-year Regulatory Element cycle and thus result in some portion of the individuals in that cycle being assessed on their knowledge of the change at a significantly later date.

Second, FINRA believes that a significant benefit of the proposed changes for registered persons would be the increased flexibility in terms of maintaining their qualification for a terminated registration category. As can be observed in Figure 1, there is an increase in the number of individuals who return to the industry towards the end of the two-year period, which is the current grace period for maintaining their qualification status. Extending this period to seven years through the completion of continuing education would provide flexibility to individuals, as well as potentially result in increased retention of expertise in the industry.

With respect to increased flexibility, extending the current two-year period to seven years would allow individuals to manage significant life events, including professional changes and development (such as pursuing educational goals, a career change to a role in the firm that is not part of the broker-dealer, working overseas for an extended period due to a career change or an attempt at a different career path) or personal life events (such as birth or adoption of a child, unexpected loss in the family or relocation due to family needs). Through discussions with industry representatives, FINRA staff has learned that this proposal could potentially lower the barrier to re-entry to the industry. Some firms indicated that a significant benefit can arise in cases where an individual leaves the broker-dealer to gain experience in an affiliate of a parent company, for instance in an affiliated commercial bank, investment adviser or foreign affiliate. Others indicated that the proposal could potentially be relevant for under-represented populations in the securities industry, such as, for example, female registrants.

With respect to member firms, FINRA believes that the proposed changes will result in three main benefits. First, it is expected that the transition to an annual Regulatory Element cycle will reduce member firms’ regulatory risk, as well as enhance compliance and reduce compliance-related costs.

Second, the proposed changes would further enhance and streamline the Firm Element requirement. These changes include an express recognition of existing firm training programs, such as the annual compliance meeting, towards satisfying a registered individual’s Firm Element requirement, potentially saving firms compliance resources currently devoted to developing and implementing different training programs. The proposed changes would also result in the development of a content catalog, managed by FINRA, which would serve as an optional resource from which firms could select or supplement their Firm Element content. Such a catalog could provide firms with a more cost-efficient resource for Firm Element content.

Third, with respect to the extended time period for maintaining a qualification status, FINRA believes that the proposed changes could result in added flexibility for member firms in terms of hiring and reduce search costs in terms of identifying qualified candidates. This could ultimately extend the potential pool of securities industry professionals, and potentially benefit firms regardless of their size. Through discussions with industry representatives, FINRA staff has learned that this could permit firms to better retain skilled professionals, more easily provide individuals with professional development outside the broker-dealer, and facilitate the hiring process for experienced professionals who have required the career flexibility.

Finally, FINRA believes that the investor community will ultimately benefit from the proposed changes. These benefits will stem from the potential increase in the knowledge and ongoing training of registered persons, as well as through the increased flexibility of retention of skill and experience in the industry.

Costs

FINRA believes that, alongside the anticipated benefits discussed above, the proposed changes would also result in costs for both member firms and registered persons.

With respect to registered persons, FINRA anticipates three main costs that may result from the proposed changes. First, the move to an annual Regulatory Element cycle will increase the frequency of the required training and the associated impact of failing to complete the annual content. However, as discussed above, registered persons would be required on an annual basis to complete approximately one-third of the content that they currently complete in a three-year cycle. Further, this anticipated increase in burdens is expected to be smaller for individuals with a single registration category than for individuals with more than one registration category. Individuals with more than one registration category (approximately 35 percent of registered persons) may have more Regulatory Element content (including the associated time commitment) in a given year, in comparison to individuals with only a single registration category. Second, the introduction of Regulatory Element notifications directly to registered persons could shift some of the time management burden to them. Third, the eligibility requirements for maintaining a qualification status for a terminated registration category will require an individual to have been registered with FINRA in that registration category for at least one year, which could limit potential career changes that may occur within a shorter period.

With respect to member firms, FINRA anticipates some costs that may result from the proposed changes. It is anticipated that such costs will be higher in aggregate for larger firms versus smaller firms, as they are expected to be related to the size of member firms, in terms of their personnel. Economies of scale likely exist in the application of the proposed requirements, and large firms may benefit from lower marginal costs. The transition to an annual Regulatory Element requirement could ultimately increase the administrative and operational burden on member firms due to changes to compliance systems. This is anticipated in terms of the resources required to implement and monitor compliance with the program on an annual basis. These resources would also need to be potentially further increased to address the proposed extension of the Firm Element requirement to all registered persons.

Alternatives Considered

FINRA considered a range of alternatives in developing the proposal. These included alternative frequency of the Regulatory Element requirement, alternative time periods for becoming eligible to maintain a qualification status for a terminated registration category and alternative time periods for maintaining a qualification status. The proposed changes reflect a consideration of the various alternatives, and FINRA believes that the proposed changes strike the appropriate balance in addressing the recommendations of the CE Council while preserving the ultimate goals of the CE program, upholding investor protection and ensuring that securities industry professionals remain knowledgeable and compliant.

Request for Comment

FINRA requests comment on all aspects of the proposal. FINRA requests that commenters provide empirical data or other factual support for their comments wherever possible. FINRA specifically requests comment concerning the following issues:

- Does focusing the Regulatory Element on rule changes and significant regulatory issues relevant to each registration category seem appropriate? Would this help distinguish the Regulatory Element from the Firm Element? Are there other topics that should be included within the Regulatory Element?

- Would the transition to an annual Regulatory Element requirement or the focus on rule changes and significant regulatory issues relevant to each registration category disparately impact specific populations? If so, would the introduction of greater diversity in instructional formats and delivery modes alleviate any such potential impacts? Are there any other mitigations that FINRA should consider to address any such potential impacts?

- FINRA is proposing possible enhancements to the CRD system and FinPro system to facilitate the transition to an annual Regulatory Element requirement. Would enhanced reporting and automated notification functions help mitigate the additional efforts required to monitor participation in, and completion of, an annual requirement? What other system enhancements would firms find helpful?

- Are member firms currently requiring all registered persons to complete Firm Element training? Does the express recognition of other training requirements, including the annual compliance meeting, towards satisfying the Firm Element training mitigate the potential burdens associated with extending the Firm Element to all registered persons?

- Are the eligibility criteria for participation in the proposed program to maintain a qualification status for a terminated registration category appropriate? Is a participation time period of seven years sufficient? Should FINRA consider other options for eligibility or the length of time an individual can participate in the program?

- In light of the proposed program to maintain a qualification status for a terminated registration category through continuing education, should FINRA eliminate the two-year qualification period?

- Are there approaches other than the proposed changes that FINRA should consider?

- What other economic impacts, including costs and benefits, might be associated with the proposal? Who might be affected and how? Please provide estimates or estimated ranges for costs and benefits wherever possible.

- Would the proposal impose any other competitive impacts that FINRA has not considered.

Endnotes

- The CE Council is composed of securities industry representatives and representatives of self-regulatory organizations (SROs). The CE Council was formed in 1995 upon a recommendation from the Securities Industry Task Force on Continuing Education and was tasked with facilitating the development of uniform continuing education requirements for registered persons of broker-dealers.

- Persons submitting comments are cautioned that FINRA does not redact or edit personal identifying information, such as names or email addresses, from comment submissions. Persons should submit only information that they wish to make publicly available. See Notice to Members 03-73 (November 2003) for more information.

- See SEA Section 19 and rules thereunder. After a proposed rule change is filed with the SEC, the proposed rule change generally is published for public comment in the Federal Register. Certain limited types of proposed rule changes take effect upon filing with the SEC. See SEA Section 19(b)(3) and SEA Rule 19b-4.

- The CE program is codified under SRO rules. See, e.g., FINRA Rule 1240 (Continuing Education Requirements).

- These are baseline requirements—firms can offer additional training to individuals, and individuals can receive additional training on their own.

- The Regulatory Element of the CE Program was introduced in 1995 with the S101 program for all registration categories. The S201 program for supervisors was introduced in 1998 followed by the S106 program for Investment Company and Variable Contracts Products Representatives in 2001. These programs were redesigned in 2010 to focus on learning and reflect advances in adult learning theory and technology. The S901 program for Operations Professionals was introduced in 2013. The S106 and S901 programs were discontinued in 2018.

- The comment letters are available on FINRA’s website at http://www.finra.org.

- FINRA recently undertook a retrospective review of the annual compliance meeting requirement resulting in a determination to maintain the requirement without change. See Regulatory Notice 19-34 (October 18, 2019).

- The recommendations are available on the CE Council website at http://www.cecouncil.com.

- Individuals participating in the Financial Services Affiliate Waiver Program (FSAWP) under FINRA Rule 1210.09 (Waiver of Examinations for Individuals Working for a Financial Services Industry Affiliate of a Member) are also subject to the Regulatory Element. The Regulatory Element correlates to their most recent registration category, and it must be completed based on the same cycle had they remained registered. An individual’s registration anniversary date is generally the date they initially registered in the Central Registration Depository (CRD®) system. However, an individual’s registration anniversary date would be reset if the individual has been out of the industry for two or more years and is required to requalify by examination, or obtain an examination waiver, in order to re-register. Currently, an individual’s registration anniversary date would also be reset if the individual obtains a conditional examination waiver that requires them to complete the Regulatory Element by a specified date.

- FINRA may extend the time for completion of the Regulatory Element on a case-by-case basis for good cause shown. A registered person who has not completed the Regulatory Element within the prescribed period will have his or her FINRA registrations deemed inactive and designated as “CE inactive” in the CRD system until the requirements of the program have been satisfied. A CE inactive person is prohibited from performing, or being compensated for, any activities requiring registration, including supervision. Moreover, if registered persons remain CE inactive for two consecutive years, they must requalify (or obtain a waiver of the applicable qualification examination(s)) to be re-eligible for registration. This two-year period is calculated from the date such persons become CE inactive, and it continues to run regardless of whether they terminate their registrations before the end of the two-year period. Therefore, if registered persons terminate their registrations while in a CE inactive status, they must satisfy all outstanding Regulatory Element prior to the end of the two-year period in order to re-register with a member without having to requalify by examination or having to obtain an examination waiver. See FINRA Rule 1240(a).

- An individual is subject to a significant disciplinary action under FINRA Rule 1240 if the individual is: (1) subject to any statutory disqualification as defined in SEA Section 3(a)(39); (2) subject to a suspension or the imposition of a fine of $5,000 or more for violation of any provision of any securities law or regulation, or any agreement with or rule or standard of conduct of any securities governmental agency, SRO, or as imposed by any such agency or SRO in connection with a disciplinary proceeding; or (3) ordered as a sanction in a disciplinary action to retake the Regulatory Element by any securities governmental agency or SRO. See FINRA Rule 1240(a)(3) (Disciplinary Actions). Further, if an individual is subject to a significant disciplinary action, the cycle for participation in the Regulatory Element may be adjusted to reflect the effective date of the disciplinary action rather than the individual’s registration anniversary date.

- FINRA Rule 1240(a) currently excludes Foreign Associates from the Regulatory Element requirement. The proposal would continue to exclude them.

- As noted elsewhere in the Notice, firms may require their registered persons to complete the proposed Regulatory Element sooner than December 31.

- See id.

- See id.

- See id.

- See supra note 10 (for description of a conditional examination waiver).

- Module A: Responsibilities to Customers; Module B: Operational Responsibilities; and Module C: Regulatory Responsibilities.

- Module D: Personalized Content – D.1 Series 6 Retail Sales; D.2 Series 7 Retail Sales; D.3 Institutional Sales; D.4 Trading; D.5 Operations; D.6 Investment Banking; and D.7 Research.

- Module A: Supervision and Control; Module B: Handling Customer Accounts, Trade & Settlement Practices; Module C: New and Secondary Offerings and Corporate Finance; and Module D: Product Knowledge and Related Supervisory Considerations.

- However, in any given year, there may be particular content that is relevant to more than one registration category. For instance, if there is a change to FINRA Rule 3270 (Outside Business Activities of Registered Persons) that is substantive enough to warrant coverage in the annual Regulatory Element, the annual Regulatory Element for each registration category would include that topic.

- Today, approximately 200,000 registered persons complete the Regulatory Element annually.

- See FINRA Rule 1240(b)(1).

- See FINRA Rules 3310(e) and 3110(a)(7).

- Firms would continue to have the flexibility to determine how best to meet the Firm Element requirement. In addition, the CE Council will consider issuing best practices and guidance to help firms evaluate other financial industry continuing education programs for purposes of satisfying the Firm Element.

- See FINRA Rule 1210.08 (Lapse of Registration and Expiration of SIE). The two years are calculated from the date the individual terminates his or her registrations and the date FINRA receives a new application for registration. The two-year restriction only applies to the representative- and principal-level examinations, and it does not extend to the Securities Industry Essentials (SIE) examination. The SIE examination is valid for four years, but having a valid SIE examination alone does not qualify an individual for registration as a representative or principal. Further, individuals whose registrations as representatives or principals have been revoked pursuant to FINRA Rule 8310 (Sanctions for Violation of the Rules) are required to requalify by retaking the applicable representative- or principal-level examination in order to re-register as representatives or principals, in addition to satisfying the eligibility conditions for association with a firm (see SEA Sections 3(a)(39) and 15(b)(4) and Article III of the FINRA By-Laws).

- See FINRA Rules 1210.03 (Qualification Examinations and Waivers of Examinations) and 1210.09. See also supra note 10.

- Investment adviser representatives (IARs) are also subject to a two-year limitation to maintain their qualification following the termination of their registrations. However, unlike registered persons of broker-dealers, IARs are not currently required to complete any continuing education.

- Effective October 1, 2018, FINRA eliminated several representative-level registration categories, such as the category for Corporate Securities Representative. See Regulatory Notice 17-30 (October 2017). Individuals registered in these eliminated representative categories would not be eligible to participate in the proposed program. This extends to individuals who are registered in a principal registration category that includes one of these eliminated representative categories as a co-requisite registration.