Web CRD® Late Filing Fee Report

The Web CRD Late Filing Fee Report is a monthly analysis of FINRA firms' ability to meet certain filing obligations. In accordance with FINRA rules, firms are required to submit information related to registered representatives. This report displays a firm's performance in submitting certain U4 and U5 filings in the required time frame.

The information in this report is provided to assist FINRA members in assessing and monitoring compliance with certain reporting obligations under FINRA By-Laws and rules. Provision of this report does not relieve a firm from complying with obligations imposed under FINRA By-Laws and rules and does not limit or prevent FINRA from taking appropriate regulatory or disciplinary action against a firm or associated person. Firms should continue to rely on Web CRD for actual charges and assessments.

The table below provides a reference description for all of the elements found in the Web CRD Late Filing Fee Report. (See Web CRD Late Filing Fee Report Figures 1 - 7 for a sample report.)

On This Page

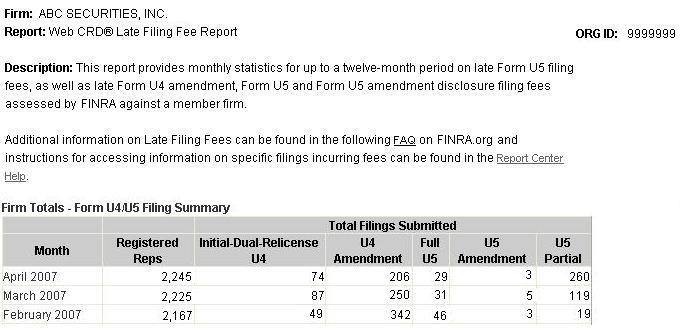

Firm Totals - Form U4/U5 Filing Summary

|

Term |

Description |

|---|---|

| Month | This is the month and year from which the underlying data was retrieved. |

| Registered Reps | This is the number of actively registered individuals with the firm as of the date the data was retrieved from Web CRD. Data retrieval generally takes place several weeks after the end of the month, so this count is just an approximation of the actual registered individual count during the respective month. |

| Total Filings Submitted Initial-Dual-Relicense U4 | This is the number of Initial, Dual, and Relicense U4 filings submitted by the firm to Web CRD during the respective month. |

| Total Filings Submitted U4 Amendment | This is the number of Form U4 Amendment filings submitted by the firm to Web CRD during the respective month. |

| Total Filings Submitted Full U5 | This is the number of Full Form U5 filings submitted by the firm to Web CRD during the respective month. |

| Total Filings Submitted U5 Amendment | This is the number of Form U5 Amendment filings submitted by the firm to Web CRD during the respective month. |

| Total Filings Submitted Partial U5 | This is the number of Partial Form U5 filings submitted by the firm to Web CRD during the respective month. |

Web CRD Late Filing Fee Report Figure 1

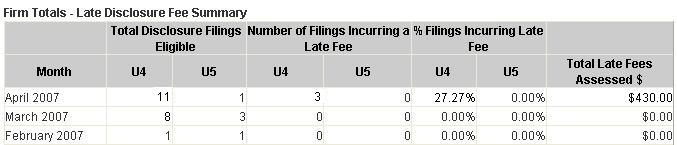

Web CRD Late Filing Fee Report Figure 2

Firm Totals - Late Disclosure Fee Summary

|

Term |

Definition |

|---|---|

| Month | This is the month and year from which the underlying data was retrieved. |

| Total Disclosure Filings Eligible U4 | This is the number of Form U4 Amendment filings submitted by the firm to CRD during the respective month that included at least one Disclosure Reporting Page (DRP). |

| Total Disclosure Filings Eligible U5 | This is the number of Full Form U5 filings and Form U5 Amendment filings submitted by the firm to CRD during the respective month that included at least one DRP. |

| Filings Incurring a Late Fee U4 | This is the number of Form U4 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee. |

| Filings Incurring a Late Fee U5 | This is the number of Full Form U5 filings and Form U5 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee. |

| % Filings Incurring a Late Fee U4 | This is the percentage of eligible Form U4 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee. |

| % Filings Incurring a Late Fee U5 | This is the percentage of eligible Full Form U5 filings and Form U5 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee. |

| Total Late Fees Assessed | This is the dollar amount of Late Disclosure Fees assessed to the firm for filings submitted by the firm during the respective month. |

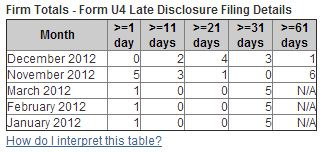

Firm Totals - U4 Late Disclosure Filing Details

|

Term |

Definition |

|---|---|

| Month | This is the month and year from which the underlying data was retrieved. |

| >= 1 Day Late | This is the number of Form U4 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was between 1 and 10 days late. |

| >= 11 Days Late | This is the number of Form U4 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was between 11 and 20 days late. |

| >= 21 Days Late | This is the number of Form U4 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was between 21 and 30 days late. |

| >= 31 Days Late | This is the number of Form U4 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was between 31 and 60 days late. Prior to 2013, this field contained the number of Form U4 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was more than 30 days late (with no maximum number of days late). |

| >= 61 Days Late | This field contained the number of Form U4 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was more than 60 days late. This field was added in January 2013 |

Web CRD Late Filing Fee Report Figure 3

Web CRD Late Filing Fee Report Figure 4

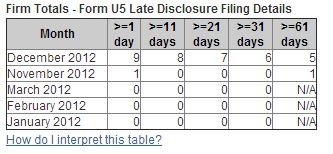

Firm Totals - U5 Late Disclosure Filing Details

|

Term |

Definition |

|---|---|

| Month | This is the month and year from which the underlying data was retrieved. |

| >= 1 Day Late | This is the number of Form U5 filings and Form U5 Amendment Filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was between 1 and 10 days late. |

| >= 11 Day Late | This is the number of Form U5 filings and Form U5 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was between 11 and 20 days late. |

| >= 21 Day Late | This is the number of Form U5 filings and Form U5 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was between 21 and 30 days late. |

| >= 31 Day Late | This is the number of Form U5 filings and Form U5 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was between 31 and 60 days late. Prior to 2013, this field contained the number of Form U5 filings and Form U5 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was more than 30 days late (with no maximum number of days late). |

| >= 61 Day Late | This field contained the number of Form U5 filings and Form U5 Amendment filings submitted by the firm to CRD during the respective month that incurred a Late Disclosure Fee for disclosure that was more than 60 days late. This field was added in January 2013. |

Web CRD Late Filing Fee Report Figure 5

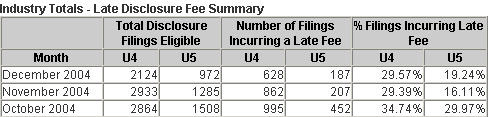

Industry Totals - Late Disclosure Fee Summary

|

Term |

Definition |

|---|---|

| Month | This is the month and year from which the underlying data was retrieved. |

| Total Disclosure Filings Eligible U4 | This is the number of Form U4 Amendment filings submitted by the industry to Web CRD during the respective month that included at least one Disclosure Reporting Page (DRP). |

| Total Disclosure Filings Eligible U5 | This is the number of Full Form U5 filings and Form U5 Amendment filings submitted by the industry to Web CRD during the respective month that included at least one DRP. |

| Filings Incurring a Late Fee U4 | This is the number of Form U4 Amendment filings submitted by the industry to Web CRD during the respective month that incurred a Late Disclosure Fee. |

| Filings Incurring a Late Fee U5 | This is the number of Full Form U5 filings and Form U5 Amendment filings submitted by the industry to Web CRD during the respective month that incurred a Late Disclosure Fee. |

| % Filings Incurring a Fee U4 | This is the percentage of eligible Form U4 Amendment filings submitted by the industry to Web CRD during the respective month that incurred a Late Disclosure Fee. |

| % Filings Incurring a Fee U5 | This is the percentage of eligible Full Form U5 filings and Form U5 Amendment filings submitted by the industry to Web CRD during the respective month that incurred a Late Disclosure Fee. |

Web CRD Late Filing Fee Report Figure 6

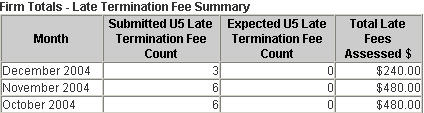

Firm Totals - Late Termination Fee Summary

|

Term |

Definition |

|---|---|

| Month | This is the month and year from which the underlying data was retrieved. |

| Submitted U5 Late Termination Fee Count | This is the number of Full Form U5 filings submitted by the firm to Web CRD during the respective month that were assessed a Late Termination Fee. |

| Expected U5 Late Termination Fee Count | This is the number of Late Termination Fees assessed to the firm during the respective month prior to submission of a Full Form U5, based upon the receipt of a Relicense Form U4 from another firm. The firm is assessed a fee in this circumstance because another member submitted a Relicense Form U4 to Web CRD indicating that a Registered Representative will not maintain a dual registration, and after 30 days, the terminating firm has not filed a Full Form U5 to affect the termination. |

| Total Late Fees Assessed | This is the dollar amount of Late Termination Fees assessed to the firm during the respective month. |

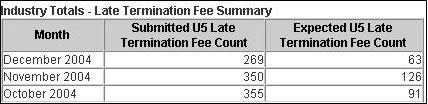

Industry Totals - Late Termination Fee Summary

|

Term |

Definition |

|---|---|

| Month | This is the month and year from which the underlying data was retrieved. |

| Submitted U5 Late Termination Fee Count | This is the number of Full Form U5 filings submitted by the industry to Web CRD during the respective month that were assessed a Late Termination Fee. |

| Expected U5 Late Termination Fee Count | This is the number of Late Termination Fees assessed to the industry during the respective month prior to a submission of a Full Form U5. The firm is assessed a fee in this circumstance because another firm submitted a Relicense Form U4 to Web CRD indicating that the Registered Representative will not maintain dual registration, and after 30 days, the terminating firm has not yet filed a Full Form U5 to affect the termination. |

Web CRD Late Filing Fee Report Figure 7

Accessing Additional Information about a Late Filing Fee

The Web CRD® Late Filing Fee Report provides the number of Form U4 and U5 filings that incurred late disclosure fees, as well as the number of Form U5 filings submitted or expected to be late. There are two methods that can be used to learn which individuals' filings incurred late fees. In order to use one of these methods, a user must have access to either the Reports or Accounting functionality in Web CRD. To request access to Web CRD, a user should contact the firm's Web CRD Account Administrator.

Method 1: Firm Accounting Download Report

After successfully logging into CRD:

- Click the Reports tab on the CRD Site Map.

- Click the Accounting-Firm Accounting Download report hyperlink.

- Enter the first day of the month in the Start Date field and the last day of the month in the End Date field.

- Enter the requester's initials in the User Initials field.

- Click Submit.

- Click View Report.

Once the report has been generated, the Accounting-Firm Accounting Download report will appear in the View Reports queue.

- Click the report name to open the report.

- Click Open in the File Download dialog box.

The Zip file opens. The Zip file compresses the size of the file(s), allowing for faster downloading. A compression program such as WinZip is necessary to "unzip" the file. WinZip may be downloaded for free from many sites on the Internet. Contact the firm's technology department for assistance.

- Unzip the file and save it to the computer.

- Open Microsoft Excel.

- Click File, Open.

- At the bottom of the dialogue box, change the Files of Type to All Files.

- Select the saved file.

- Click Open.

- When the Text Import Wizard appears, select the Delimited option.

- Verify that the import is set to start at row 1.

- Click Next.

- Check the Other box under Delimiters (no other options should be checked).

- Type a pipe, "|", in the text box next to Other. (Note: To type a pipe, hold the shift key down while selecting the key above the Enter key on the keyboard.)

- Click Next.

- Set the Column Data Format to General.

- Click Finish.

The data will now be arranged into columns.

The columns will not be labeled, but they are, as follows:

|

Column |

Description |

|---|---|

| B, Row 2 | 100 appears if the firm has a balance in the account |

| B, Row 3 on | Accounting Code (500 = Transaction) |

| C, Row 1 | Firm CRD # |

| C, Row 2 on | Post Date |

| D, Row 1 | Start Date of Report |

| D, Row 2 on | Transaction Number |

| E, Row 1 | End Date of Report |

| E, Row 2 on | Type of Action |

| F | Firm Billing Code |

| G | Applicable Regulator |

| H | Fee Description |

| I | Branch CRD Number |

| J | CRD Number of Individual Incurring Fee |

| K | Name of Individual Incurring Fee |

| L | Product Category Code |

| M | Transaction Amount |

To identify all individuals incurring U4 or U5 Disclosure Review Late Fees and Late Termination Fees, sort the Excel spreadsheet by Column H: Fee Description.

To sort Excel information:

- Click Ctrl-A to select all data on the spreadsheet.

- Click Data, Sort from the drop-down menu.

- Select Column H in the Sort By field.

- Click OK.

After the sort, all fees of the same type will be grouped together. To go directly to all fees of that description, click Ctrl-F and type the Fee Description into the Find field.

Method 2: Accounting Transaction Detail

After successfully logging into CRD:

- Click the Accounting tab on the CRD Site Map.

- Select Transaction Detail from the Navigation Bar on the left of the screen.

- Enter the first day of the month in question in the From Post Date field and the last day of the month in the Thru Post Date field.

- Click Search.

The system returns a list of all charges incurred by the firm during the specified month.

|

Web CRD® Late Filing Fee Report |

Transaction Detail from Web CRD |

|---|---|

| Number of Filings Incurring a Late Fee - U4 | Total # of filings with the following description: FINRA U4 Late Disclosure Fee -<#> Days |

| Number of Filings Incurring a Late Fee - U5 | Total # of filings with the following description: FINRA U5 Late Disclosure Fee -<#> Days |

| Submitted U5 Late Termination Fee Count + Expected U5 Late Termination Fee Count | Total # of filings with description: FINRA Late Termination Fee |

The number of days in the description of a Late Disclosure Fee in the Transaction Detail indicates where the filing will be counted in the Form U4 or Form U5 Late Disclosure Filing Details table on the Web CRD Late Filing Fee Report.