Executing Firm 10 Second Compliance Report Card

The Executing Firm 10 Second Compliance Report Card is a monthly status report for trades that another firm reported on behalf of the market participant. The report contains counts of properly modified late trades, late trades that were not modified, and improperly modified trades.

Executing Firm is defined as the member that receives an order for handling or execution or is presented an order against its quote, does not subsequently re-route the order, and executes the transaction. In a transaction between two members where both members may satisfy the definition of executing party (e.g., manually negotiated transactions via the telephone), the member representing the sell-side shall report the transaction, unless the parties agree otherwise and the member representing the sell-side contemporaneously documents such agreement.

Member firms are required to report trades in accordance with established FINRA rules and regulations. Firms are required to report trades as soon as practicable but no later than 10 seconds after execution. If your firm engages in a pattern or practice of late trade reporting or improperly reporting trades, the firm may be found to be in violation of FINRA Rule 2010 and applicable FINRA trade reporting rules. Firms should make no inference, however, that FINRA staff has or has not determined that the information contained on the Executing Firm 10 Second Compliance Report Card does or does not constitute FINRA rule violations.

For more information about trade reporting, see FINRA's Trade Reporting Frequently Asked Questions.

Report Glossary

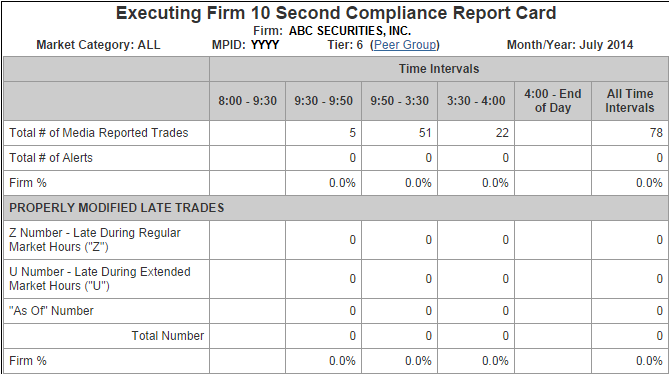

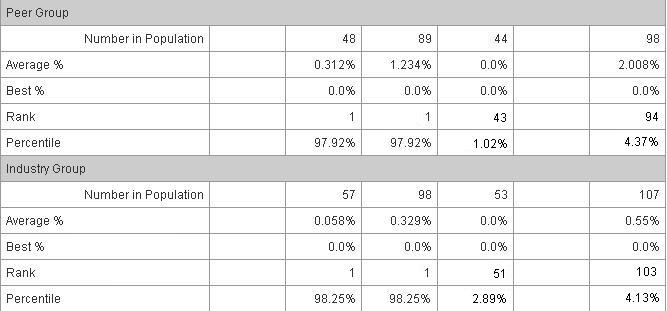

The tables below provides a reference description for all of the data found in the Executing Firm 10 Second Compliance Report Card. (See Executing Firm 10 Second Compliance Report Card Figures 1 - 2 for a sample segment of the report.)

|

Term |

Definition |

|---|---|

| Industry | The industry consists of all market participants who have at least one transaction for the selected month and year. |

| MP | Market Participant |

| Peer Group | A peer group or tier consists of firms within the same predetermined range of transactions, as identified in the table below: |

|

NASDAQ |

CQS |

OTC-Foreign and Other |

All |

||||

|---|---|---|---|---|---|---|---|

| Peer Group/Tier | Number of Transactions | Peer Group/Tier | Number of Transactions | Peer Group/Tier | Number of Transactions | Peer Group/Tier | Number of Transactions |

| 1 | 1,000,000 or more | 1 | 500,000 or more | 1 | 30,000 or more | 1 | 1,000,000 or more |

| 2 | 100,000 to 999,999 | 2 | 30,000 to 499,999 | 2 | 1,000 to 29,999 | 2 | 100,000 to 999,999 |

| 3 | 35,000 to 99,999 | 3 | 1,000 to 29,999 | 3 | 1 to 999 | 3 | 35,000 to 99,999 |

| 4 | 10,000 to 34,999 | 4 | 1 to 999 | Not Applicable | 4 | 10,000 to 34,999 | |

| 5 | 1,000 to 9,999 | Not Applicable | Not Applicable | 5 | 1,000 to 9,999 | ||

| 6 | 1 to 999 | Not Applicable | Not Applicable | 6 | 1 to 999 | ||

|

Term |

Definition |

|---|---|

|

All Time Intervals |

This column contains a total count of all time intervals. For the rows that contain transaction and alert information, this column contains the total number of transactions or alerts for the selected MP for the selected month and year. For the rows that contain the percentages and percentiles, the information contained in this column is derived based on the total alerts and transactions for the executing MP for the selected month and year. (Please refer to the definitions for the percentages and percentile for the algorithms that are used to derive percentages and percentiles.) |

|

Total # of Media Reported Trades |

This is the total number of executing firm media reported trades for the selected MP for the selected month and year for the given time interval. (Total Executing MP Media Reported Trades) |

|

Total # of Alerts |

The total number of alerts (TA) is the sum of the total number of properly modified late trades (MLT), the total number of late trades that were not modified (LTNM), and the total number of improperly modified trades(MT) for the selected MP for the selected month and year in a given time interval. (TA = total MLT + total LTNM+ total MT) |

|

Firm % |

This is the percentage of the total alerts (TA) to total firm media reported trades for the selected MP for the selected month and year in a given time interval. (Firm % = (TA / Total MP Media Reported Trades) x 100) |

Executing Firm 10 Second Compliance Report Card Figure 1

|

Term |

Definition |

|---|---|

|

Properly Modified Late Trades |

|

|

Z Number (Late During Regular Market Hours) |

This is the total number of trades properly modified with a Z modifier (reported more than 10 seconds after execution) for the selected MP for the selected month and year in a given time interval. |

|

U Number (Late During Extended Market Hours) |

This is the total number of trades properly marked U modifier (trade execution time was between 00:00:01 and 07:59:59 and reported after 8:15:09 or trade execution time was reported and trade executed between 08:00 and 09:30 or between 16:00 and End of Day) but reported more than 10 seconds after execution for the selected MP for the selected month and year in a given time interval. |

|

"As-Of" Number |

This is the total number of trades that were reported on a trade date other than the execution date and properly reported as-of for the selected MP for the selected month and year in a given time interval. |

|

Total Number |

This is the total number of properly modified late trades (MLT) for the selected MP for the selected month and year in a given time interval. (Total MLT = Total SLD + Total ST + Total AS-OF) |

|

Firm % |

This is the best (lowest) percentage of properly modified late trades to total executing firm media reported trades among the firms in the selected MP's peer group for the selected month and year in a given time interval. |

|

Peer Group |

|

|

Number in Population |

This is the total number of executing MPs in the peer group for the selected month and year. |

|

Average % |

This is the percentage of properly modified late trades to total executing firm media reported trades among the firms in the selected MP's peer group for the selected month and year in a given time interval. (AVG MLT % = (Total # MLT for All Firms in Peer Group in this Time Interval / Total # Transactions for All Firms in Peer Group in this Time Interval) x 100) |

|

Best % |

This is the best (lowest) percentage of properly modified late trades to total executing firm media reported trades among the firms in the selected MP's peer group for the selected month and year in a given time interval. |

|

Rank |

This is the rank of the selected MP relative to other executing MPs in its peer group based on its percentage of total alerts to total transactions for the selected month and year. The executing MPs are ranked in ascending order from the lowest percentage to the highest percentage. |

|

Percentile |

This is the selected MP's percentile (PERC), relative to its peers, for its percentage of properly modified late trades to total executing firm media reported trades for the selected month and year in a given time interval. This percentile is calculated by sorting or ranking the firms based on percentage of properly modified late trades (MLT %). Once the firms are ranked, the percentile can be determined. A percentile of 100 represents the highest ranking and a percentile of 0 represents the lowest ranking. (MLT PERC = ((Number of Firms in Peer Group - RANK of Firm) / Number of Firms in Peer Group) x 100) |

|

Industry |

|

|

Number in Population |

This is the total number of executing MPs in the industry for the selected month and year. |

|

Average % |

This is the percentage of properly modified late trades to total executing firm media reported trades among the firms in the selected MP's industry group for the selected month and year in a given time interval. (AVG MLT %= (Total # MLT for All Firms in Industry Group in this Time Interval / Total # Transactions for All Firms in Industry Group in this Time Interval) x 100) |

|

Best % |

This is the best (lowest) percentage of properly modified late trades to total executing firm media reported trades among all participating member firms for the selected month and year in a given time interval. |

|

Rank |

This is the rank of the selected MP relative to other executing MPs in the industry based on its percentage of total alerts to total transactions for the selected month and year. The executing MPs are ranked in ascending order from the lowest percentage to the highest percentage. |

|

Percentile |

This is the selected MP's percentile relative to the industry for its percentage of properly modified late trades to total executing firm media reported trades for the selected month and year in a given time interval. This percentile is calculated by sorting or ranking the firms based on percentage of modified late trades (MLT %). Once the firms are ranked, the percentile can be determined. A percentile of 100 represents the highest ranking and a percentile of 0 represents the lowest ranking. (MLT PERC = ((Number of Firms in Industry - RANK of Firm) / Number of Firms in Industry) x 100) |

Executing Firm 10 Second Compliance Report Card Figure 2

|

Term |

Definition |

|---|---|

|

Late Trades That Were Not Modified |

|

|

Z Number |

This is the total number of trades that were reported more than 10 seconds after execution and during normal market hours but were not modified with the Z modifier for the selected MP for the selected month and year in a given time interval. |

|

U Number |

This is the total number of trades with an execution time between 00:00:01 and 07:59:59 and reported after 08:15:01 and not modified with the U modifier. This category also includes trades with an execution time between 08:00 and 09:30, or, between 16:00 and End of Day) but reported more than 10 seconds after execution and not modified with the U modifier for the selected MP for the selected month and year in a given time interval. |

|

Total Number |

This is the total number of late trades that were not modified with the required corresponding modifier (UMLT) for the selected MP for the selected month and year in a given time interval. (Total UMLT = Total UM SLD + Total UM ST) |

|

Firm % |

This is the percentage of late trades that were not modified with the required corresponding modifier to the total executing firm media reported trades for the selected MP for the selected month and year in a given time interval. UMLT % = (Total UMLT / Total Executing MP Media Reported Trades) x 100) |

|

Peer Group |

|

|

Number in Population |

This is the total number of executing MPs in the peer group for the selected month and year. |

|

Average % |

This is the percentage of late trades that were not modified with the required corresponding modifier to the total executing firm media reported trades among the firms in the selected MP's peer group for the selected month and year in a given time interval. (AVG UMLT % = (Total # of UMLT for All Firms in Peer Group in this Time Interval / Total # Transactions for All Firms in Peer Group in this Time Interval) x 100) |

|

Best % |

This is the best (lowest) percentage of late trades that were not modified with the required corresponding modifier to the total executing firm media reported trades among the firms in the selected MP's peer group for the selected month and year in a given time interval. |

|

Rank |

This is the rank of the selected MP relative to other executing MPs in its peer group based on its percentage of total alerts to total transactions for the selected month and year. The executing MPs are ranked in ascending order from the lowest percentage to the highest percentage. |

|

Percentile |

This is the selected MP's percentile relative to its peers for its percentage of late trades that were not modified with the required corresponding modifier to the total executing firm media reported trades for the selected month and year in a given time interval. A percentile of 100 represents the highest ranking and a percentile of 0 represents the lowest ranking. (UMLT PERC = ((Number of Firms in Peer Group - RANK of Firm) / Number of Firms in Peer Group) x 100) |

|

Industry |

|

|

Number in Population |

This is the total number of MPs in the industry for the selected month and year. |

|

Average % |

This is the percentage of late trades that were not modified with the required corresponding modifier to the total executing firm media reported trades among the firms in the selected MP's industry group for the selected month and year in a given time interval. (AVG UMLT %= (Total # of UMLT for All Firms in Industry Group in this Time Interval / Total # Transactions for All Firms in Industry Group in this Time Interval) x 100) |

|

Best % |

This is the best (lowest) percentage of late trades that were not modified with the required corresponding modifier to the total executing firm media reported trades among all participating member firms for the selected month and year in a given time interval. |

|

Rank |

This is the rank of the selected MP relative to other executing MPs in the industry based on its percentage of total alerts to total transactions for the selected month and year. The executing MPs are ranked in ascending order from the lowest percentage to the highest percentage. |

|

Percentile |

This is the selected MP's percentile relative to the industry for its percentage of unmarked late trades that were not modified with the required corresponding modifier to the total executing firm media reported trades for the selected month and year in a given time interval. A percentile of 100 represents the highest ranking and a percentile of 0 represents the lowest ranking. (UMLT PERC = ((Number of Firms in Industry - RANK of Firm) / Number of Firms in Industry) x 100) |

|

Improperly Modified Trades |

|

|

Z Number |

This is the total number of trades improperly modified with the Z modifier, since the trades were reported within 10 seconds of execution during regular market hours, for the selected MP for the selected month and year in a given time interval. |

|

T Number |

This is the total number of trades improperly modified with the T modifier, since the trades were executed during normal market hours, for the selected MP for the selected month and year in a given time interval. |

|

P Number |

This is the total number of trades improperly modified with the P modifier, since the trade were reported within 10 seconds after execution, for the selected MP for the selected month and year in a given time interval. |

|

Z should be T or U Number |

This is the total number of trades improperly modified with the Z modifier since the trades should have been modified with the T or U modifier, since the trades were executed outside normal market hours, for the selected MP for the selected month and year in a given time interval. |

|

T should be Z Number |

This is the total number of improperly modified with the T modifier when the trade should have been modified with the Z modifier (sine the trades were executed during market hours and reported more than 10 seconds after execution) for the selected MP for the selected month and year in a given time interval. |

|

T should be U Number |

This is the total number of trades modified with the T modifier when the trades should have been modified with the U modifier (trade execution time was between 00:00:01 and 07:59:59 and reported after 08:15:01 or trade that was executed between 08:00 and 09:30 or between 16:00 and End of Day) and reported more than 10 seconds after execution for the selected month and year in a given time interval. |

|

U Number |

This is the total number of trades improperly modified with the U modifier, since the trades were reported within 10 seconds of execution, for the selected MP for the selected month and year in a given time interval. |

|

Total Number |

This is the total number of improperly modified trades for the selected MP for the selected month and year in a given time interval. (Total IMP = Total IMP SLD + Total IMP T + Total IMP PRP + Total IMP SLD s/b T + Total IMP T s/b SLD + Total IMP T s/b U + Total IMP ST) |

|

Firm % |

This is the percentage of improperly modified trades to total executing firm media reported trades for the selected MP for the selected month and year in given time interval. (IMP % = (Total IMP / Total Executing MP Media Reported Trades) x 100) |

|

Peer Group |

|

|

Number in Population |

This is the total number of executing MPs in the peer group for the selected month and year. |

|

Average % |

This is the percentage of improperly modified trades to total executing firm media reported trades among the firms in the selected MP's peer group for the selected month and year in a given time interval. (AVG IMP % = (Total # IMP for All Firms in Peer Group in this Time Interval / Total # Transactions for All Firms in Peer Group in this Time Interval) x 100) |

|

Best % |

This is the best (lowest) percentage of improperly modified trades to total executing firm media reported trades among the firms in the selected MP's peer group for the selected month and year in a given time interval. |

|

Rank |

This is the rank of the selected MP relative to other executing MPs in its peer group based on its percentage of total alerts to total transactions for the selected month and year. The executing MPs are ranked in ascending order from the lowest percentage to the highest percentage. |

|

Percentile |

This is the selected MP's percentile relative to its peers for its percentage of improperly modified trades to total executing firm media reported trades for the selected month and year in a given time interval. This percentile is calculated by sorting or ranking the firms based on percentage of improperly marked late trades (IMP %). Once the firms are ranked, the percentile can be determined. (IMP PERC = ((Number of Firms in Peer Group - RANK of Firm) / Number of Firms in Peer Group) x 100) |

|

Industry |

|

|

Number in Population |

This is the total number of MPs in the industry for the selected month and year. |

|

Average % |

This is the percentage of improperly modified trades to total executing firm media reported trades among the firms in the selected MP's industry group for the selected month and year in a given time interval. (AVG IMP % = (Total # IMP for All Firms in Industry Group in this Time Interval / Total # Transactions for All Firms in Industry Group in this Time Interval) x 100) |

|

Best % |

This is the best (lowest) percentage of improperly modified trades to total executing firm media reported trades for the industry for the selected month and year in a given time interval. |

|

Rank |

This is the rank of the selected MP relative to other executing MPs in its industry group based on its percentage of total alerts to total transactions for the selected month and year. The executing MPs are ranked in ascending order from the lowest percentage to the highest percentage. |

|

Percentile |

This is the selected MP's percentile relative to the industry for its percentage of improperly modified trades to total executing firm media reported trades for the selected month and year in a given time interval. This percentile is calculated by sorting or ranking the firms based on percentage of improperly modified trades (IMP %). Once the firms are ranked, the percentile can be determined. (IMP PERC = ((Number of Member Firms - RANK of Firm) / Number of Member Firms) x 100) |

Detail Data

Detail Data for the Executing Firm10 Second Compliance Report Card provides a list of late trade reports or improperly reported trade reports submitted on behalf of your firm.

Member firms are required to report trades in accordance with established FINRA rules and regulations. Firms are required to report trades as soon as practicable but no later than 10 seconds after execution. If your firm engages in a pattern or practice of late trade reporting or improperly reporting trades, the firm may be found to be in violation of FINRA Rule 2010 and applicable FINRA trade reporting rules. The data is the underlying detail of the alerts contained in the monthly Executing Firm 10 Second Compliance Report Card.

Executing Firm is defined as " the member that receives an order for handling or execution or is presented an order against its quote, does not subsequently re-route the order, and executes the transaction. In a transaction between two members where both members may satisfy the definition of executing party (e.g., manually negotiated transactions via the telephone), the member representing the sell-side shall report the transaction, unless the parties agree otherwise and the member representing the sell-side contemporaneously documents such agreement.

The table below provides a reference description for all of the elements found in the Executing Firm 10 Second Compliance Report Card Detail Data.

|

Term |

Definition |

|---|---|

| Market Center ID | Indicates the market center where the trade was reported.

|

| Report Date | Date the trade was reported to a FINRA Trade Reporting Facility. |

| Execution Date | Date the trade was executed. |

| Report Time | Time the trade was submitted to a Trade Reporting Facility |

| Execution Time | Time the trade was executed. |

| Issue Symbol | Symbol representing the stock traded. |

| Market Class | The market classification of the issue symbol.

|

| Primary Reporting Firm | Primary MPID of the firm that reported the Executing Party of the trade. |

| Reporting Firm | MPID of the firm that was the Executing Party of the trade. |

| Primary Executing Firm | Primary MPID of the firm that was the Executing Party of the trade. |

| Executing Firm | MPID of the firm that was the Executing Party of the trade. |

| Executing Firm Capacity | Capacity Code for the Executing Party of the trade. |

| Buy/Sell/Cross | Buy/Sell indicator of the Executing Party of the trade.

|

| Short Sale Code | Code used to identify if the trade is a short sale.

|

| Execution Quantity | Number of shares traded. |

| Execution Price | Price at which the trade was executed. |

| Primary Contra Reporting Firm | Primary MPID of the contra reporting firm. |

| Contra Reporting Firm | MPID of the contra reporting firm of the trade. |

| Contra Executing Firm | MPID of the Contra Executing Party of the trade. |

| Contra Executing Firm Capacity | Capacity Code for the Contra Executing Party of the trade. |

| Accept Time | Time the trade was accepted by the Contra Executing Party of the trade. |

| Decline Time | Time the trade was declined by the Contra Executing party of the trade. |

| Contra Report Time | Time the Contra Executing Party submitted its side of the trade. |

| Contra Execution Time | Time the Contra Executing Party identified when the trade was executed. |

| Assumed Execution Time | This is the earliest time when comparing the trade Execution Time, Contra Report Time, Report Time, and Contra Execution Time. |

| Firm Entered Modifier 1 | Settlement modifier entered by the firm when it reports the trade.

|

| Firm Entered Modifier 2 (Reason for SEC Rule 611 Exception or Exemption) | Trade Through Exemption modifier entered by the firm when it reports the trade.

|

| Firm Entered Modifier 3 (Late / Extended Hours) |

Modifier used to identify when the trade was executed. This modifier can either be entered by the firm when it reports the trade or appended by the Trade Reporting Facility.

|

| Firm Entered Modifier 4 (SRO Required Detail) |

This identifier is a further classification of a trade with regard to SRO Required Detail. This modifier can either be entered by the firm or appended by the system.

|

| Published Trade Modifier 1 (Settlement Type) | Settlement modifier entered by the firm when it reports the trade.

|

| Published Trade Modifier 2 (Reason for SEC Rule 611 Exception or Exemption) | Trade Through Exemption modifier entered by the firm when it reports the trade.

|

| Published Trade Modifier 3 (Late / Extended Hours) | Modifier used to identify when the trade was executed. This modifier can either be entered by the firm when it reports the trade or appended by the Trade Reporting Facility.

|

| Published Trade Modifier 4 (SRO Required Detail) | This identifier is a further classification of a trade with regard to SRO Required Detail. This modifier can either be entered by the firm or appended by the system.

|

| As-Of Flag |

The trade report was entered into the Trade Reporting Facility after execution date.

|

| No/Was Flag | A No/Was transaction is a type of correction to a transaction that prevents a firm from having to do a cancel and re-enter, which sends a second print across the tape.

|

| Related Market Center Code | Code appended to non-media trade reports that identifies the facility or market where the media trade report of the transaction was executed or submitted.

|

| Special Trade Code | Identifies special and step-out trades.

|

| Trade Status | Trade Status Code as assigned by the Trade Reporting Facility.

|

| Media Report Flag | Identifies whether the trade was media reported or not.

|

| Media Report Eligible | Identifies whether the trade is media reportable or not.

|

| Trade Source Code | This is an indicator identifying the electronic system on which the trade was executed or reported through.

|

| Trade Through Exempt Flag | Flag to identify trades that are trade through exempt.

|

| Clearing Flag | Denotes the clearing and matching specifications of the trade.

Trade Reporting Facility only:

|

| Reversal Flag | Denotes whether the trade report is a reversal transaction.

|

| TRF Control Number | Control number used for interaction between Firms and the TRF. |

| ACT Status Time | This is the last time ANY adjustment was made to the report. |

| Price Override | Indicator submitted by the Reporting Firm that acknowledges the price originally submitted is correct even though it is away from the current market. |

| Foreign Flag | This column will be populated if the trade report is for a transaction in a foreign equity security. |

| MM Memo | This is the alphanumeric message appended by the Reporting Firm to the Trade Reporting Facility entry. |

| TRE Sale Condition 3 Code | Identifies the type of Trade Reporting Exception identified based on the Sale Condition 3:

|

| TRE Sale Condition 4 Code | Identifies the type of Trade Reporting Exception identified based on the Sale Condition 4:

|

| TRE As/Of Modifier | Identifies the type of Trade Reporting Exception identified based on the As-Of Flag:

|

| TRE Unmarked Modifier | Identifies the type of Trade Reporting Exception identified based on the difference between the trade's assumed execution and report time, for trades not marked as late:

|

| Original Modifier Code | This is the firm entered modifier. |

| PRP/Stop Stock Reference Time | The time at which the parties agree to the stop stock price or the prior reference time (i.e., the time currently required by FINRA rules). For example, for stop stock transactions, if the parties agree to the stop stock price at 10:00 a.m. and the trade is executed at 11:00 a.m., the trade detail report would reflect a “PRP/Stop Stock Reference Time” of 10:00 a.m. Similarly, for PRP transactions, if a firm executes a market-on-open order at 10:30 a.m., the trade detail report would |