Municipal Continuing Disclosure Report

The Municipal Continuing Disclosure Report displays statistics about transactions that your firm effected with customers. The report provides relevant information about the availability of official statements, annual financial filings, and event filings on the MSRB's Electronic Municipal Market Access system (EMMA) at the time the securities were sold or purchased. Specifically, the report shows counts of transactions with customers for which official statements and/or current annual financial filings were not available on EMMA at the time the transaction occurred. The report also shows transactions with customers in securities for which recent event filings were available on EMMA at the time the transaction occurred. Event filings include those required pursuant to Securities Exchange Act Rule 15c2-12, as well as those made voluntarily by issuers.

Firms have an obligation to fully understand the securities they buy and sell. Additionally, MSRB Rule G-17 requires dealers selling municipal securities to customers to disclose all material facts about a transaction "at the time of trade". (See MSRB Rule G-17 Interpretive Notices from July 14, 2009 and March 20, 2002 for more information.) The MSRB's EMMA system is an important resource for obtaining material information, and the counts provided in the Municipal Continuing Disclosure Report are based on the availability of information on EMMA. However, a dealer's obligation to obtain all material facts about a transaction is not limited to information available through EMMA. To read more about dealers' obligations when selling municipal securities, please see FINRA Regulatory Notice 10-41.

Beginning in March 2014, the Municipal Continuing Disclosure Report was enhanced to include customer transactions where a firm purchased a municipal security from a customer. The enhancement was made based on the MSRB's Notice 2013-04 and Notice 2014-07; which codifies the time of trade disclosure obligation of broker, dealers, and municipal securities dealers currently described in interpretive guidance to MSRB Rule G-17. The codification, effective July 5, 2014, is included in MSRB Rule G-47.

By Default, the Municipal Continuing Disclosure Report shows all transactions with customers (both buys and sells). However, the report can be filtered to show only sales to customer or purchases from customers.

In addition to including purchase from customers, beginning with the March 2014 report the Municipal Continuing Disclosure Report was updated to include peer groups, peer averages, peer ranking, industry averages, and industry ranking. These values were added to provide improved context for the information provided.

Firms should understand that the Municipal Continuing Disclosure Report does not provide any indication of whether your firm disclosed all material facts to the customer as required. Additionally, FINRA is not making a determination that the transactions included in this report should not have been effected with customers. The report is intended as a resource to help raise awareness of potential heightened risk a firm and its purchasing or selling customers may be undertaking based on the availability of information (or lack thereof) on the MSRB's EMMA system. Firms can use the report and the associated detail to review the documentation on these transactions, ensure that the appropriate procedures for collecting and disclosing material information are in place, and confirm that they are being followed.

Please note: Detail data is available for this report. This information includes data elements of the trades included in all counts provided on the report other than the Total Transaction and Customer Transaction counts.

This report is produced on a monthly basis, approximately 3 weeks after the end of the report month. Users who have a report to view and who have not opted out of notifications will receive an email indicating that new reports have been published.

The table below provides a reference description for all of the elements found in the Municipal Continuing Disclosure Report. (See Municipal Continuing Disclosure Report for a sample report.)

Summary Report

|

Term |

Description |

|---|---|

| Total Transactions Count | This is a count of all municipal securities transactions (buy, sell, or both depending on view) of municipal securities executed by your firm during the month, whether with a customer or another broker-dealer. |

| Customers Transaction Count | This is a count of the municipal securities transactions (buy, sell, or both depending on view) your firm executed during the month in which your firm sold to or purchased from a customer (i.e., non broker-dealer). |

| Peer Group | A peer group consists of firms within the same range of transactions. Peer groups for the Municipal Continuing Disclosure Report are based upon firm transaction percentile ranking. Peer groups are as follows:

This number is a hyperlink in the report. Clicking on the hyperlink will open a popup window showing members of the peer group. |

| Peer Rank (Customer Transactions) | This is the rank of the firm relative to all other firms in the same peer group. In the top table of the report, the peer rank is based solely on the number of customer transactions during the month. Firms with a greater number of trades in a given month will have a higher rank. The firm with the greatest number of trade in a given month will be ranked number 1. Peer Rank is specific to each view (i.e. A firm may have one rank for all transactions and a different peer group for purchase and sell transactions). |

| Peer Population | This is a count of the number of firms in the peer group for the time period. Peer Population is specific to each view. |

| Industry Rank (Customer Transactions) | This is the rank of the firm relative to all other firms. In the top table of the report, the industry rank is based solely on the number of customer transactions during the month. Firms with a greater number of trades in a given month will have a higher rank. The firm with the greatest number of trade in a given month will be ranked number 1. Industry Rank is specific to each view (i.e. A firm may have one rank for all transactions and a different peer group for purchase and sell transactions). |

| Industry Population | This is a count of firms with at least one customer transactions (for the view being displayed) during the time period. |

| Transactions for Issues with No OS on EMMA Count | This is a count of all transactions of municipal securities to customers executed by your firm during the month of bonds for which no Official Statement was available on the date that the trade occurred. This count does not include transactions in offerings that are exempt from the requirement to file an OS on EMMA per MSRB Rule G-32. Please note: If the issue closed prior to June 2009 and was exempt from the requirement to submit an OS to the MSRB per MSRB Rule G-36, FINRA may not have the necessary data to identify the bond as exempt. As such, transactions of that bond may be included in the "No OS on EMMA" count. In that case, the firm may wish to make a note for their records that the offering was exempt and the OS is not required to be available on EMMA. |

| Transactions for Issues Lacking Current Financials | The Securities Exchange Act Rule 15c2-12 requires underwriters of most municipal securities to enter into a written agreement or contract with the issuer to ensure that the issuer will provide financial information to EMMA on an annual basis. If the bond that your firm sold to or purchased from a customer closed more than a year ago and no annual or audited financial statement has been submitted to EMMA, your firm's transaction of that bond will be flagged as lacking current financial information. Additionally, if the most recent annual or audited financial information available for the bond on EMMA was submitted more than a year before the transaction, and/or the effective date of the financial data is more than 17 months prior to the transaction, the financial information is no longer considered current. Therefore, sales or purchases of that bond will be flagged as lacking current financial information. Sales and purchases of bonds that are exempt from the financial filing requirements of Rule 15c2-12 are not included in this count. |

| Transactions for Issues with 1 or More Events Filed During Trade Month | This count includes transactions your firm effected with customers in the month for which there were event filings submitted to EMMA during the same month but before the transaction with customers were executed (i.e., the event filings were available on EMMA at the time the transactions were executed). For example, if your firm sold the security to or purchased the security from a customer on December 15, the transaction would be included in this count if an event was filed for that bond between December 1st and December 15th. Events submitted during the same month but after your firm's transaction with a customer are not included in this count. Please note: This count includes sales or purchases that have event filings of any type on EMMA (i.e., Rule 15c2-12 Event Notices as well as any additional/voluntary event-based disclosures). FINRA makes no determination that the event filings are material to the sale or purchase, or for how long an event remains material. |

| Transactions for Issues with 1 or More Events Filed in 1st - 3rd Months Prior to the Trade Month | This count includes transactions your firm effected with customers during the month for which there were event filings submitted to EMMA at any time during the three months prior to the trade month. For example, if your firm sold or purchased the security on December 15, the transaction would be included in this count if an event was filed for that bond at any time in September, October, or November. Please note: This count includes sales or purchases that have event filings of any type on EMMA (i.e., Rule 15c2-12 Event Notices as well as any additional/voluntary event-based disclosures). FINRA makes no determination that the event filings are material to the sale or purchase, or for how long an event remains material. |

| Transactions for Issues with 1 or More Events Filed in 4th - 6th Months Prior to Trade Month | This count includes transactions your firm effected with customers during the month for which there were event filings submitted to EMMA at any time during the fourth, fifth, and sixth months prior to the trade month. For example, if your firm sold or purchased the security on December 15, the transaction would be included in this count if an event was filed for that bond at any time in June, July or August. Please note: This count includes sales or purchases that have event filings of any type on EMMA (i.e., Rule 15c2-12 Event Notices as well as any additional/voluntary event-based disclosures). FINRA makes no determination that the event filings are material to the sale or purchase, or for how long an event remains material. |

| Firm % | For each of the counts listed on the report, the Firm % shows the percentage of transactions of that type to all transactions with customers effected by your firm during the report month. |

| Peer % Mean | This is the average alert percentage for all firms in the firm's peer group for the selected month, year, and view. |

| Peer % Median | This is the middle average of all firms in the peer group for the selected month, year, and view. |

| Peer Rank | For each type of analysis listed, firms in the peer group are ranked in ascending order from the lowest firm percentage of alerts to total valid trade reports to the highest percentage of alerts. |

| Industry % | For each of the counts listed on the report, the Industry % shows the percentage of all customer transactions by broker-dealer firms during the report month that meet the criteria for that count. |

| Industry % Mean | This is the average alert percentage for all firms in the firm's peer group for the selected month, year, and view. |

| Industry % Median | This is the middle average of all firms for the selected month, year, and view. |

| Industry Rank | For each type of analysis listed, firms are ranked in ascending order from the lowest firm percentage of alerts to total valid trade reports to the highest percentage of alerts. |

Detail Data

For any month in which your firm has 1 or more sales or purchases in any of the counts in the report other than the Total Transactions Count or Customers Transaction Count, you can see the details of those transactions by requesting the Detail Data. To access the detail for this report, click the Details link at the top of the report.

The table below provides a reference description for the elements found in the Municipal Continuing Disclosure Report Detail Data.

|

Term |

Description |

|---|---|

| Reporting MPID | This is the MPID of the firm that reported the trade (i.e., your firm). |

| Alerts | This is a code signifying in which of the count(s) on the Summary report the transaction is included. If the transaction falls into multiple counts, all relevant codes will be listed in this column, separated by dashes (e.g., if the trade is for a bond that is lacking current financial information and for which there was an event filing last month, this column will show "LCF-EF1t3". Values are:

|

| Buy/Sell | This indicator identifies if the reported trade was a sale to a customer or a purchase from a customer. Note: This field was added when purchases from customers were included in the Municipal Continuing Disclosure Report. |

| Most Recent Financial Posting Date | This is the date of the annual or audited financial information that was most recently filed on EMMA for this security. If this date is more than 365 days prior to the execution date of the transaction, the transaction will be marked "LCF" (i.e., Lacking Current Financials). Please note: this field will only be populated if this trade has the LCF alert code. However, if the trade has the LCF alert code and no financials have ever been posted for this bond, no date will be displayed. |

| Most Recent Financial Effective Date | This is the most recent effective date of the annual or audited financial information available on EMMA for this security. For transactions marked "LCF" (i.e., Lacking Current Financials), this date will either be more than 17 months prior to the execution date of the transaction or absent. Please note: this field will only be populated if this trade has the LCF alert code. However, if the trade has the LCF alert code and no financials have ever been posted for this bond, no date will be displayed. |

| Count of Events Filed w/in Last 6 Months | This is a count of the number of event filings submitted to EMMA for a security within the 6 months before that security was sold to or purchased from a customer. You can access more information about the event filings available for this security on EMMA. Please note: For this purposes of this count, the 6 month timeframe includes the entire 6 calendar months before the trade month as well as the days of the trade month prior to the execution date. |

| Type(s) of Disclosure | If there are any event filings included in the above count, this column contains information about what type(s) of events were filed. If more than one type of disclosure has been filed within the last 6 months, the types of disclosure will be separated by dashes. The first fifteen disclosure types listed below are required to be submitted per Securities Exchange Act Rule 15c2-12. The remaining disclosure types are permitted by EMMA but submitted on a voluntary basis. Values are:

|

| Execution Date | This is the date on which the trade occurred. |

| Execution Time | This is the time at which the trade occurred. |

| Issuer | This is the name of the issuer of the municipal security traded. This field is only populated for bonds for which the primary market disclosure information has been submitted to EMMA pursuant to MSRB Rule G-32 (Rule G-32 became effective on June 1, 2009). |

| CUSIP | This is the CUSIP-9 number for the municipal security traded. |

| Issue Closing Date | This is the date that the issue closed. |

| Issue Maturity Date | The maturity dates of the securities. |

| Price | This is the dollar price calculated by the MSRB's RTRS system for this trade. |

| Yield | This is the yield provided on the trade report. Please note: This value was changed from the reported yield to the calculated yield value in 2017. |

| Volume | This is the number of bonds traded in this transaction. |

| Transaction Settlement Date | This is the date the transaction was completed, i.e., when final payment for the bonds and transfer of ownership occurred. |

| Dealer Control Number | This is a unique ID assigned to this trade by the MSRB. |

Query Tool

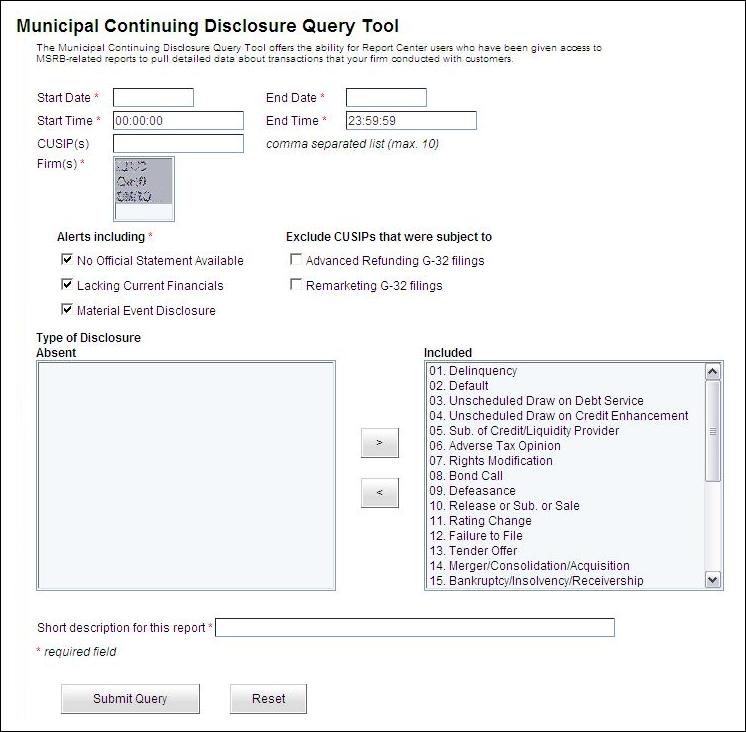

The Municipal Continuing Disclosure Query Tool offers the ability for Report Center users who have been given access to MSRB-related reports to pull detailed data about transactions that your firm conducted with customers. You can customize the time frames; select particular MPIDs, CUSIPs, Transaction Types (buy/sell), and/or alerts types to further refine the details associated with FINRA’s Municipal Continuing Disclosure report. The query results provide relevant information about the availability of official statements, annual financial filings, and event filings on the MSRB's Electronic Municipal Market Access system (EMMA) at the time the securities were sold. Event filings include those required pursuant to Securities Exchange Act Rule 15c2-12, as well as those made voluntarily by issuers.

Just like the standard detail data associated with the Municipal Continuing Disclosure Report, firms can use the query results to review the documentation on these transactions, ensure that the appropriate procedures for collecting and disclosing material information are in place, and confirm that they are being followed.

Once submitted, your query will be visible in the Report Center’s Detail Data Pick-Up page (which is accessible by clicking on Pick up Detail Data on any tabs of the Report Center). Your request will display a status of Requested, Available or Error.

Report Feature Summary

The table below provides a reference description for all of the elements found in the Municipal Continuing Disclosure Query Tool.

|

Term |

Description |

|---|---|

| Start Date | The first day to be included in your data extract. The selection is conducted through a calendar window or can be typed-in manually using the following format: MM/DD/YYYY. This date cannot be typed manually. The Start Date must always be lesser than the End Date. |

| End Date | The last day to be included in your data extract. The selection is conducted through a calendar window or can be typed-in manually using the following format: MM/DD/YYYY. This date cannot be typed manually. The End Date must always be greater than the Start Date. |

| Start Time | The first moment (of the first day in your query) to be included in your data extract. Time must be typed-in manually using the following format: HH:MM:SS. By default, Start Time is set to the first second of the Start Date. |

| End Time | The last moment (of the last day in your query) to be included in your data extract. Time must be typed-in manually using the following format: HH:MM:SS. By default, End Time is set to the last second of the End Date. |

| CUSIP(s) | In this field you can request up to ten CUSIP numbers (CUSIP6 or CUSIP9). You can request up to ten specific CUSIPs per query. If no CUSIPs are specified, then all available CUSIPs will be included in your query. CUSIP stands for Committee on Uniform Securities Identification Procedures. A CUSIP number identifies most securities, including stocks of all registered U.S. and Canadian companies as well as U.S. government and municipal bonds. The CUSIP system—owned by the American Bankers Association and operated by Standard & Poor’s—facilitates the clearing and settlement process of securities. http://www.sec.gov/answers/cusip.htm |

| Firm(s) | This section displays all the MPID(s) (Market Participant IDs) your have access to, based on the privileges granted to you by your Super-account Administrator. You can select up to ten Firm MPIDs per query. To select multiple MPIDs, hold the Control key down while you click on the MPIDs you want to include in your query. |

| Buy/Sell | You can choose to include transactions where:

By default, all alerts are included. |

| Alerts Including | You can choose to exclude one, two or three of the following disclosure alert types:

By default, all alerts are included. Note: When Material Event Disclosure is selected, it is possible to narrow down your query by types of disclosures by using the Type Of Disclosure section (see below). If Material Event Disclosure is not selected, the Type Of Disclosure section will remain hidden. |

| Exclude CUSIPs that were subject to | You can choose to exclude CUSIPs that were subject to advanced refunding or remarketing.

|

| Type Of Disclosure | Section "Type of Disclosure" is not shown if "Material Event Disclosure" is not selected in the Alerts section (above). This section offers a list of parameters to included or excluded (absent) from your query. Select the elements in the right side column (Included column) and click the leftward pointing arrow to move that element to the Absent column. All elements present in the Absent column will not be pulled when the query runs. To return an element to the Included column, simply highlight that element and click the rightward arrow. By default, all elements are included in a query. |

| Short Description for This Report | Describing the content of your query before the data is extracted will allow you to easily identify it later, especially if you have pulled other queries before or intend to pull other queries in the future. |

| Submit Query | Click this button to send your query parameters to FINRA for processing. A summary of your query parameters will be displayed. Once your request is submitted, you will be returned to the Municipal Continuing Disclosure Query Tool page, allowing you to prepare additional requests. |

| Reset | Restores all fields to their default values. |

Municipal Continuing Disclosure Query

Report Content

For reference description of the elements found in the Municipal Continuing Disclosure Query Tool Data, please see the section in this help document for the Municipal Continuing Disclosure Report Detail Data.