MSRB G-32 Report Card

The MSRB G-32 Report Card is a monthly status report to help firms evaluate the timeliness of their required filings under Municipal Securities Rulemaking Board (MSRB) Rule G-32. Amended Rule G-32, which became effective on June 1, 2009, consolidated the filing requirements of former Rule G-36 and the official statement delivery requirements of Rule G-32. The new rule establishes the MSRB's Electronic Municipal Market Access System (EMMA) as the primary market disclosure service, requiring underwriters to submit all primary market disclosure documents and related information to EMMA in electronic format. Under the rule amendments, when municipal securities brokers and dealers effect transactions with customers during a municipal security's new issue disclosure period (as defined by Rule G-32), they will be able to fulfill their obligation to deliver the official statement ("OS") to customers through the "access equals delivery" standard as described in amended Rule G-32. This means that the broker or dealer will be required to provide the purchasing customer either a copy of the OS or written notice that the OS may be accessed via EMMA. The implementation of the "access equals delivery" standard for municipal official statements makes it especially important that firms that have Rule G-32 obligations comply with the Rule's submission requirements and deadlines.

The MSRB G-32 Report Card provides information about the filings submitted to EMMA by your firm. The report card has two views: the Summary view, containing a rolling 12 months of statistics on the number and timeliness of documents, cancellations, and exempt filing notices submitted by your firm, and the Submitted Filing Details view, which shows the details of these submissions. Please note that your firm will not see 12 months of G-32 data until you have been submitting per MSRB Rule G-32 for over 12 months. Also, each monthly report card displays a snapshot of your firm's compliance at a particular point in time and will not be updated to reflect submissions made after the report card is published.

To review MSRB Rule G-32, access http://msrb.org/Rules-and-Interpretations/MSRB-Rules/General/Rule-G-32.aspx on the MSRB's web site.

The information in this report is provided to assist FINRA members in assessing and monitoring compliance with certain reporting obligations. All filing information contained in this report has been provided by the MSRB and its accuracy has not been verified by FINRA. If inaccuracies are discovered or you have questions regarding the content of this specific report, please send an email to the Report Center administrator at [email protected] or contact FINRA Regulatory Operations at (202)728-8011.

Summary View

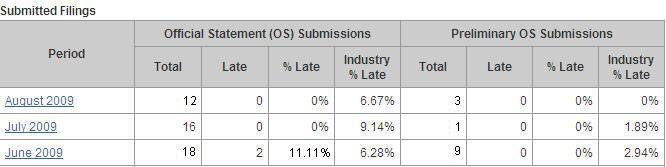

The Summary view of the MSRB G-32 Report Card provides a rolling 12 months of statistics related to submissions to EMMA required by MSRB Rule G-32. To become familiar with the requirements for submission of the types of documents listed on the report card, please review MSRB Rule G-32.

In 2015, the MSRB G-32 Report Card was updated to include new analyses. Specifically, the report was updated to include an all submitted filings table that contains new industry and peer statistics. These new values were included to allow firms better comparisons and provide additional context for their relative performance meeting the G-32 requirements.

The table below provides a reference description for the elements found in the Summary View of the MSRB G-32 Report Card. (See MSRB G-32 Summary Figure 1 for a sample report.)

|

Term |

Description |

|---|---|

| Submitted Filings | |

| All Submitted Filings Total | This is the number of filings submitted to the EMMA during the report period. This count is the sum of the total values for the specific filing types found on the report (Official Statement, Preliminary OS, Remarketing Supplements, OS and Remarketing Amendments, Advanced Refunding Documents, Advanced Refunding Amendments, Municipal Fund Security Disclosures, Municipal Fund Security Disclosure Supplements, 15c2-12 Exempt Filings, Cancellations). |

| Official Statement (OS) Submission Total | This is the number of initial OS documents your firm submitted to EMMA during the report period. This includes OS documents submitted voluntarily. Please note: if the Official Statement for an offering consists of more than 1 file, all files submitted on the same day as the initial OS document are considered part of that document, and are counted as a single document submission. Any documents submitted for that offering on subsequent days are considered amendments to the initial document submission. |

| Preliminary OS Submission Total | This is the number of initial POS documents your firm submitted to EMMA during the report period. Please note: if an offering is exempt from Securities Exchange Act Rule 15c2-12 but a POS is prepared and submitted to EMMA, the filing is counted in the Preliminary OS Submission total and not counted in the "15c2-12 Exempt Filings with No OS or POS Submitted" total. |

| Remarketing Supplements Total | This is the number of initial remarketing supplements your firm submitted to EMMA during the report period. |

| OS and Remarketing Amendments | This is the number of amendments to OS, POS, or Remarketing Supplements your firm submitted to EMMA during the report period. A document is considered an amendment if your firm has submitted the same document type for the same submission ID on a date prior to the date of this submission. |

| Advance Refunding Documents Total | This is the number of advance refunding documents that your firm submitted to EMMA during the report period. |

| Advance Refunding Amendments | This is the number of amendments to Advance Refunding Documents your firm submitted to EMMA during the report period. |

| Municipal Fund Security Disclosures | This is the number of new municipal fund security disclosure documents your firm submitted to EMMA during the report period. Please note: this only includes initial documents for new municipal fund securities; if your firm uploads an updated municipal fund securities document to replace existing documentation available on EMMA for that municipal fund security, the updated document is considered a supplement for the purposes of timeliness, since it is amendment a prior submission. NOTE: initially, firms will not see any data in this category, because EMMA does not currently allow firms to provide a Closing Date for these submissions. As such, they are considered "Unable to Process", since we cannot determine based on the information submitted whether they have been submitted on time. MSRB plans to amend the EMMA system to correct this issue in the future. |

| Municipal Fund Security Disclosure Supplements | This is the number of municipal fund security disclosure supplements your firm submitted to EMMA during the report period. Please note: this count will also include documents your firm labeled as "Municipal Fund Security Disclosure Documents" if they replace existing Municipal Fund Security Disclosure Documents already available on EMMA. |

| 15c2-12 Exempt Filings with No OS or POS Submitted | This is the number of submissions by your firm to EMMA during the report period in which your firm indicated that the offering was exempt from Exchange Act Rule 15c2-12 and no Official Statement or Preliminary Official Statement is produced for the offering. Please note: if the offering is exempt but a Preliminary Official Statement was produced for the offering, the filing would not be included in this count, but would instead be included in the Preliminary OS Submissions count. |

| Cancellations | This is the number of offerings for which your firm submitted a Notice of Cancellation to EMMA during the report period. |

| Late | For each category listed above except for Cancellations, this is the number of filings listed in the Total column that were submitted outside the required timeframe, as prescribed by MSRB Rule G-32. |

| % Late | For each category listed above except for Cancellations, this is the percentage of late filings of that type as compared to total filings of that type submitted during the report period. % Late = (Late filings/Total Filings) * 100 |

| Industry % Late | For each category listed above except for Cancellations, this is the percentage of late filings of that type submitted to total filings of that type submitted by all firms to EMMA during the report period. |

| Industry Weighted % Late | For the All Submitted Filings section, this is the weighted % late for all firms that had at least 1 submission during the report period. This value is the average % late value for all firms. |

| Industry Median % Late | For the All Submitted Filings section, this is the middle % late value of all firms that had at least 1 submission during the report period. |

| Industry Rank | For the All Submitted Filings section, this represents the firm's performance compared to all firms in the industry. The firm with the lowest late % (and ties) is ranked 1. |

| Industry Population | For the All submitted filings section, this is the number of firms with at least 1 submission during the report period. |

| Peer Group | For the All submitted filings section, this number indicates the peer group which the firm is a member. Clicking on the peer group allows the firm to see the other members of the peer group. Peer groups are defined as follows:

|

| Peer % Late | For the All submitted filings section, this is the percentage of late filings of that type submitted to total filings of that type submitted by all firms in the peer group to EMMA during the report period. |

| Peer Weighted % Late | For the All submitted filings section, this is the weighted % late for all firms in the peer group during the report period. This values is the average % late value for all firms in the peer group. |

| Peer Median % Late | For the All submitted filings section, this is the middle % late value of all firms in the peer group during the report period. |

| Peer Rank | For the All submitted filings section, this represents the firms performance compared to all firms in the peer group. The firm with the lowest late % (and ties) is ranked 1. |

| Peer Population | For the All submitted filings section, this is the number of firms in the peer group during the report period. |

| Industry Total | This is the total number of cancellations received by EMMA during the report month. |

G-32 Report Card, Summary View

Details View

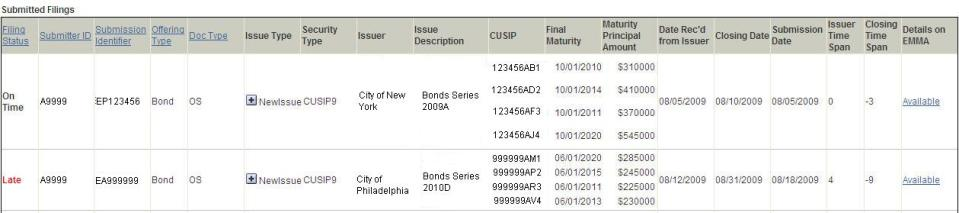

The Submitted Filing Details view of the MSRB G-32 Report Card displays details about the filings included in the Summary counts. To access the details for the Summary counts, the user can click on the month hyperlink in one of the report tables, or use the View drop-down at the top of the report to navigate from the Summary view to the Detail views.

The table below provides a reference description for the elements found in the Submitted Filing Detail Views of the MSRB G-32 Report Card. (See MSRB G-32 Detail Figure 1 for a sample report.)

|

Term |

Description |

|---|---|

| Filing Status | Each filing will have one of the following statuses:

|

| Submitter ID | This is the MSRB ID of the entity that submitted the filing to EMMA. If your firm has not designated an agent to submit to EMMA on your behalf, your firm's MSRB ID appears here. If a designated agent is submitting some or all of the firm’s filings, the agent’s MSRB ID is listed for the filings it submitted for your firm. |

| Submission Identifier | This is the unique identifier assigned by EMMA at the time of the first submission of data related to this offering. The same Submission Identifier should be used for all submission events (data submission, document submission, amendment submissions and/or cancellation) related to a single offering. |

| Offering Type | This column indicates whether the filing is for a bond or municipal fund security offering. |

| Doc Type | This column displays the type of document submitted. If the offering is exempt and neither an OS nor a POS is being submitted for this offering, this column identifies the type of exemption that applies. |

| Issue Type | This column indicates whether the filing is for a new issue or issues, an issue or issues being remarketed, or an issue or issues being refunded. This field is null for municipal fund submissions. |

| Security Type | This column indicates whether nine-digit CUSIP numbers are assigned to the securities in the issue(s) (CUSIP9), no CUSIP numbers are assigned to the securities in the issue(s) (Non-CUSIP), or only a six-digit CUSIP has been submitted for the issue(s) (Commercial Paper). |

| Issuer | This is the name of the issuer of this offering. |

| Issue Description | This is the description of the issue(s) included in the offering. |

| CUSIP | This field contains the CUSIPs for the offering. The CUSIPs displayed depend on the type of offering, issue and security:

|

| Final Maturity | This contains the maturity dates of the securities in the offering. This field is mandatory if the issue is ineligible for CUSIP number assignment, but may not be provided otherwise. |

| Maturity Principal Amount | This contains the principal amounts at maturity of the securities in the offering. This field is blank for commercial paper issues and municipal fund submissions. |

| Date Rec'd from Issuer | This is the date your firm indicated it received the document from the issuer. If your firm submits a document as separate files with different dates received from the issuer, FINRA displays the earliest date received from issuer provided by your firm, and uses that date to calculate the issuer time span (see below). |

| Closing Date | This is the date your firm indicates the issue is expected to settle. If this offering contains several issues and those issues have different closing dates, the report card displays the earliest closing date provided and uses that to calculate the closing time span (see below). |

| Submission Date | This is the date your firm submitted the document, notice of cancellation, or notice of exemption to EMMA. |

| Issuer Time Span | This is the number of business days between the date your firm indicated it received the document from the issuer and the date your firm submitted the document to EMMA. Per MSRB Rule G-32, Official Statements, Remarketing Supplements, Municipal Fund Security Disclosure Documents and Supplements, and amendments should be received within 1 day of receipt of the document from the issuer; therefore if this value is greater than 1 for any of those document types, the document will have a Filing Status of Late. |

| Closing Time Span | This is the number of business days between the date the issue settled and the date your firm submitted the document to EMMA. Per MSRB Rule G-32, Official Statements, Preliminary Official Statements (where applicable), Remarketing Supplements, and Municipal Fund Security Disclosure Documents must be submitted no later than the date of closing, therefore if this value is greater than 0 for any of these document types, the document will have a filing status of Late. Advance Refunding Disclosures are required to be submitted no later than 5 business days after closing, so if the doc type is ARD and this value is greater than 5, the document will have a filing status of Late. |

| Details on EMMA | If the filing is not a cancellation, this field will contain an Available link, which allows you to link into EMMA so that you can review the documents and further information. For offerings with CUSIPs, the link takes you directly to the documents available for that offering. If there are no CUSIPs associated with the Offering, the link is to the EMMA homepage, where you can input the necessary search information to locate the documents available for that offering. In the case of an exempt filing for a limited offering for which the OS is prepared but not submitted to the underwriter, if no contact information for OS requests has been provided with the exempt submission, a message will be included here indicating "No Contact Info Provided". |

Submitted Filing Details