Municipal Trades Below Minimum Denomination Report

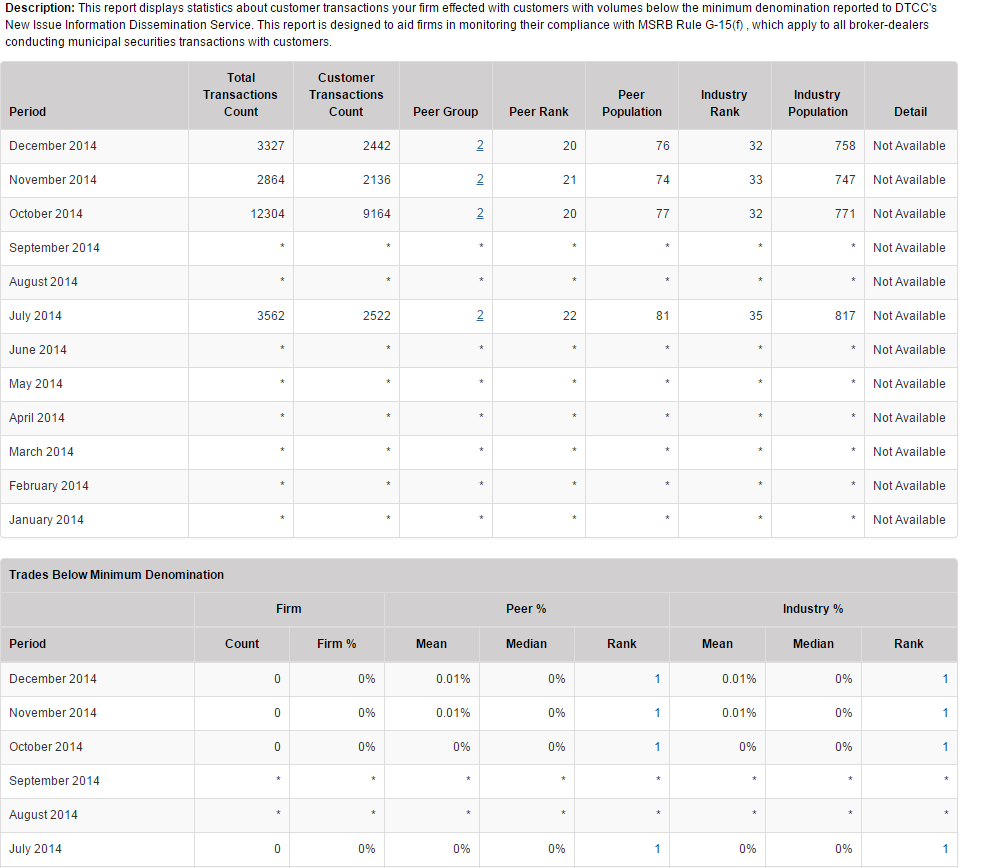

The Municipal Trades Below Minimum Denomination Report displays statistics about transactions your firm effected with customers where the denomination was below the minimum denomination provided to DTCC’s New Issue Information Dissemination Service (NIIDS) and/or reference data obtained from Thomson Reuters. This report is designed to aid firms in monitoring their compliance with MSRB Rule G-15(f). MSRB Rule G-15 (f) requires, with some exceptions, that firms should not effect a customer transaction in an amount lower than the minimum denomination to the issue.

By Default, the Municipal Trades Below Minimum Denomination Report shows all transactions with customers (both buys and sells). However, the report can be filtered to show only sales to customer or purchases from customers.

Please note: Prior to March 2017, the Municipal Trades Below Minimum Denomination Report was named the MSRB Rule G-15(f) Trades Below Minimum Denomination Report. Additionally prior to March 2017, this report card only evaluated customer transactions utilizing reference data provided by DTCC's New Issue Information Dissemination Service (NIIDS). Subsequent reports utilize both NIIDS and reference data provided by Thomson Reuters.

Summary View

The table below provides a reference description for all of the elements found in the Municipal Trades Below Minimum Denomination Report. (See Municipal Trades Below Minimum Denomination Summary Report Figure 1 for a sample report.)

|

Term |

Description |

|---|---|

| Total Transaction Count | This is a count of all municipal securities transactions (buy, sell, or both depending on view) of municipal securities executed by your firm during the month, whether with a customer or another broker-dealer. |

| Customer Transactions Count | This is a count of the municipal securities transactions (buy, sell, or both depending on your view) your firm executed during the month in which your firm sold or purchased from a customer (i.e. non broker-dealer). |

| Peer Group | A peer group consists of firms within the same range of transactions. Peer groups for the MSRB G-15(f) Trades Below Minimum Denomination Report are based upon transaction percentile ranking. Peer groups are as follows:

Peer groups are specific to each view (i.e.. A firm may be in one group for all transactions and a different peer group for purchases and sell transactions). This number if a hyperlink in the report. Clicking on the hyperlink will open a popup window showing members of the peer group. |

| Peer Rank | This is the rank for the firm relative to all other firms in the same peer group. In the top table of the report, the peer rank is based solely on the number of customer transactions during the month. Firms with a greater number of trades in a given month will have a higher rank. The firm with the greatest number of trades in a given month will be ranked number 1. Peer Rank is specific to each view (i.e. A firm may have one rank for all transactions and a different peer group for purchase and sell transactions). |

| Peer Population | This is a count of the number of firms in the peer group for the time period. Peer Population is specific to each view. |

| Industry Rank | This is the rank of the firm relative to all other firms. IN the top table of the report, the industry rank is based solely on the number of customer transactions during the month. Firms with a great number of trades in a given month will have a higher rank. The firm with the greatest number of trades in a given month will be ranked number 1. |

| Industry Population | This is a count of firms with at least one customer transactions (for the view being displayed) during the time period. |

| Detail | This link is used to obtain the specific trade reports with a par value that was determined to be below the minimum denomination provided to DTCC’s NIIDS. Note: This column was only available prior to March 2017. Details can be obtained by clicking the hyperlink found in the Trades Below Minimum Denomination Unique Trade Count column. |

| Trades Below Minimum Denomination NIIDS Count | This is a count of the number of customer trades with a par value that was below the minimum denomination provided to DTCC’s NIIDS. |

| Trades Below Minimum Denomination TR Count | This is a count of the number of customer trades with a par value that was below the minimum denomination provided by Thomson Reuters. |

| Trades Below Minimum Denomination Unique Trade Count | This is a count of the number of customer trades with a par value that was below the minimum denomination provided to DTCC’s or in Thomson Reuters Data. |

| Trades Below Minimum Denomination Firm % | This is the percentage of the firm’s customer trades that were below the minimum denomination provided to DTCC’s NIIDS and/or Thomson Reuters. |

| Trades Below Minimum Peer Mean % | This is the average Trades Below Minimum Denomination % for all firms in the same peer group. |

| Trades Below Minimum Peer Median % | This is the middle Trades Below Minimum Denomination % for the firms in the same peer group. |

| Trades Below Minimum Peer Rank | This is the relative position of the firm’s performance compared to all other firms in the peer group. The firm with the lowest % (closest to 0) is ranked 1. |

| Trades Below Minimum Industry Mean % | This is the average Trades Below Minimum Denomination % for all firms with at least 1 customer trade during the period. |

| Trades Below Minimum Industry Median % | This is the middle Trades Below Minimum Denomination % for the firms with at least 1 customer trade during the period |

| Trades Below Minimum Industry Rank | This is the relative position of the firm’s performance compared to all other firms with at least 1 customer trade during the period. The firm with the lowest % (closest to 0) is ranked 1. |

Municipal Trades Below Minimum Denomination Summary Report Figure 1

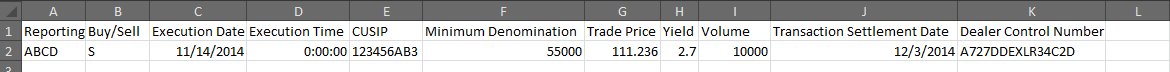

Detail Data

For any month in which your firm has 1 or more trades identified as being below the minimum denomination provide to DTCC’s NIIDS or available from Thomson Reuters reference data, you can see the details of those transactions by requesting the Detail Data. To access the detail for this report, click the Details link at the top of the report.

The Table below provides a reference description for the elements found in the Municipal Trades Below Minimum Denomination Report Detail Data.

|

Term |

Description |

|---|---|

|

Report MPID |

This is the MPID of the firm that reported the trade (i.e. your firm). |

| Buy/Sell | This indicator identifies if the reported trade was a sale to a customer or a purchase from a customer. |

| Execution Date | This is the date on which the trade occurred. |

| Execution Time | This is the time at which the trade occurred. |

| CUSIP | This is the CUSIP-9 number for the municipal security traded. |

| NIIDS Minimum Denomination | This is the minimum denomination value provided to DTCC NIIDS by the underwriter. This field will be blank when information is not available from this service. |

| TR Minimum Denomination | This is the minimum denomination provided to Thomson Reuters reference data. This field will be blank when information is not available from this service. |

| Trade Price | This is the dollar price calculated by the MSRB's RTRS system for this trade. |

| Yield | This is the yield provided on the trade report. Please note: This value was changed from the reported yield to the calculated yield value in 2017. |

| Volume | This is the number of bonds traded in this transaction. |

| Transaction Settlement Date | This is the date the transaction was completed, i.e., when final payment for the bonds and transfer of ownership occurred. |

| Dealer Control Number | This is a unique ID assigned to this trade by the MSRB. |

| Exception Type |

This is an identifier indicating which minimum denomination value triggered the alert.

|

Municipal Trades Below Minimum Denomination Detail Data Figure 1