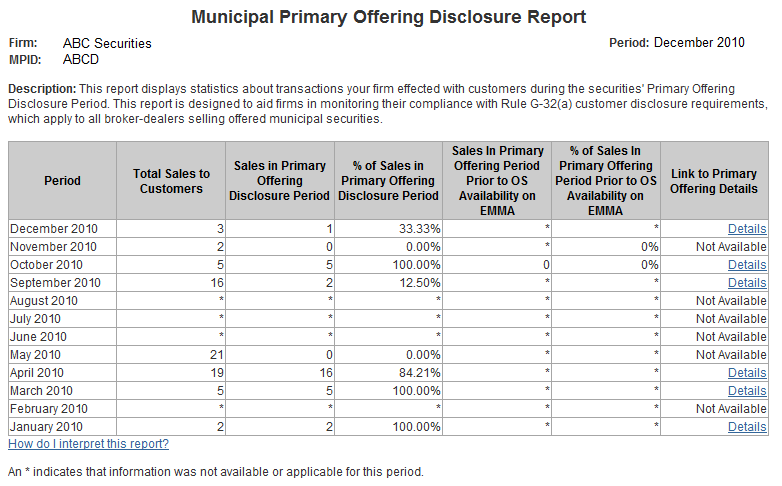

Municipal Primary Offering Disclosure Report

The Municipal Primary Offering Disclosure Report displays statistics about transactions your firm effected with customers during the securities’ Primary Offering Disclosure Period. This report is designed to aid firms in monitoring their compliance with Rule G-32(a) customer disclosure requirements, which apply to all broker-dealers selling offered municipal securities. Rule G-32 requires that firms must provide their customers copy of the official statement for an offering if a transaction occurs within the primary offering disclosure period (defined as the period beginning when the first order is submitted to the underwriter or the date the underwriter purchases the securities from the issuer and ending 25 calendar days following the settlement date of the offering). This requirement applies to secondary market transactions as well as to primary market transactions, as long as they occur during the primary offering disclosure period.

This report does not provide any indication of whether or not your firm provided the required documentation to the customer. It simply helps you identify the transactions executed by your firm during the month in which you sold a municipal bond to a customer during the bond's primary offering disclosure period. Firms can use the report and the associated detail to review the documentation on these transactions, ensure that the appropriate procedures are in place and confirm that they are being followed.

Please note: detail data is available for this report as well, and provides details for all trades included in the Sales in Primary Offering Disclosure Period count.

This report is produced on a monthly basis, approximately 3 weeks after the end of the report month. Users who have a report to view and who have not opted out of notifications will receive an email indicating that new reports have been published.

The table below provides a reference description for all of the elements found in the Municipal Primary Offering Disclosure Report. (See Municipal Primary Offering Disclosure Report for a sample report.)

Summary Report

|

Term |

Description |

|---|---|

| Total Sales to Customers | This is a count of the municipal bond transactions your firm executed during the month (i.e., trade date occurs during the report month) in which your firm sold to a customer (i.e., non broker-dealer). |

| Sales in Primary Offering Disclosure Period | This is a count of the municipal bond transactions your firm executed during the month (i.e., trade date occurs during the report month) in which your firm sold to a customer during the bond's primary offering disclosure period, meaning they are subject to the customer disclosure requirements outlined in MSRB Rule G-32. MSRB Rule G-32 defines the primary offering disclosure period as, "...the period commencing with the first submission to an underwriter of an order for the purchase of offered municipal securities or the purchase of such securities from the issuer, whichever first occurs, and ending 25 days after the final delivery by the issuer or its agent of all securities of the issue to or through the underwriting syndicate or sole underwriter." [MSRB Rule G-32] Therefore, trades included in this count have a trade date that is within 25 days after the closing date of the issue. |

| % of Sales in Primary Offering Disclosure Period | This is the percentage of the total sales to customers during the month that occurred during the primary offering disclosure period. |

| Sales In Primary Offering Period Prior to OS Availability on EMMA | This is a count of the municipal bonds transaction your firm executed during the month in which your firm sold to a customer during the bond’s primary offering disclosure period and the official statement for the issue was not available on EMMA by time of settlement. |

| % of Sales In Primary Offering Period Prior to OS Availability on EMMA | This is the percentage of the total sales to customer during the primary offering disclosure and the official statement for the issue was not available on EMMA. |

| Link to Primary Offering Disclosure Details | If your firm has at least one sale with a customer for the month that occurred during the primary offering disclosure period, a "Details" link will be displayed in this column. Clicking Details allows you to request detail information for the trades included in the Sales in Primary Offering Disclosure Period count. If your firm has a zero in that column, however, there will not be any detailed data to view. |

Municipal Primary Offering Disclosure Report

Detail Data

For any month in which your firm has at least 1 sale with a customer occurring during the Primary Offering Disclosure Period, you can see the details of those transactions by requesting the Detail Data. To access the detail for this report, you can click the Details link at the top of the report, or click the Details link from the row for which you want to view details.

The table below provides a reference description for the elements found in the Municipal Primary Offering Disclosure Report Detail Data.

|

Term |

Description |

|---|---|

| Report MPID | This is the MPID of the firm that reported the trade (i.e., your firm). |

| Execution Date | This is the date on which the trade occurred. |

| Execution Time | This is the time at which the trade occurred. |

| Issuer Name | This is the name of the issuer of the municipal security traded. |

| Managing Underwriter ID | The MSRB Number for the firm that was the managing underwriter for the security traded. |

| CUSIP | This is the CUSIP-9 number for the municipal security traded. |

| Issue Closing Date | This is the date that the issue closed. The Primary Offering Disclosure Period begins on the date the first order is submitted to the underwriter or the date the underwriter purchases the securities from the issuer, and ends 25 calendar days after closing. Trades that appear in this detail have an Execution Date <= Closing Date + 25. |

| Submission Date | This is the date the official statement was submitted to EMMA. |

| Price | This is the dollar price calculated by the MSRB's RTRS system for this trade. |

| Yield | This is the yield provided on the trade report. Please note: This value was changed from the reported yield to the calculated yield value in 2017. |

| Volume | This is the number of bonds traded in this transaction. |

| Transaction Settlement Date | This is the date the transaction was completed, i.e., when final payment for the bonds and transfer of ownership occurred. |

| Dealer Control Number | This is a unique ID assigned to this trade by the MSRB. |

|

OS Availability at Time of Settlement |

This value indicates if the OS for the traded issue was available on EMMA

|