TRACE Corporate Bonds Daily Report Card

Overview

FINRA’s Trade Reporting and Compliance Engine (TRACE) collects, processes, and disseminates transaction data for corporate bonds and other fixed income securities to enhance market transparency and facilitate regulatory oversight. FINRA’s Rules generally require members to report all eligible fixed income transactions to TRACE as soon as practicable but no later than 15 minutes, while ensuring all transaction details are complete and accurate.

Historically, FINRA has provided a monthly report card of member firms’ corporate bonds transactions reported to TRACE. The report card provides key metrics related to trade reporting timeliness and compliance with TRACE requirements, allowing firms to monitor their compliance and identify potential areas of concern. This static report delivers a retrospective summary of the previous month’s transactions.

The new interactive TRACE Corporate Bonds Daily Report Card provides similar insights to the monthly report card but on a daily cadence and with an interactive interface. On a daily delayed basis, users can access and track and trend visualizations on key Corporate Bonds compliance metrics. In addition to interactive visualizations, users can export detailed data directly from the dashboard interface or set up machine-to-machine data sharing to interact with their in-house systems.

How It Works

The TRACE Corporate Bonds Interactive Report Card offers an interactive environment, allowing firms to identify potential issues with timely reporting of corporate bond transactions to TRACE. FINRA evaluates TRACE data by comparing reported transaction times against execution times to identify late reporting, analyzing execution time discrepancies between contra parties’ reports of the same trades, and detecting potential inaccuracies or failures to report that prevent proper trade matching between parties. Within the Interactive Report Card dashboard, a user can view interactive visualizations of their total number of valid corporate bond transactions, late reported trades, and inter-dealer trades. For inter-dealer trades, users can apply a time difference filter to focus on specific inter-dealer transactions based on a discrepancy in the execution times reported by their firm and the contra party in the same trade. The data provided through this Interactive Report Card is designed to assist firms in supervision of their corporate bond transaction reporting.

Each business day, on a delayed – trade date plus four business days (T+4) – basis, firms will be able to click on the Trading Market Code field and view data for all valid trades (“All”) or use filters to review Primary Market ("P1") or Secondary Market ("S1") valid trades reported to TRACE.

Features And Tools

As outlined in detail below, this Interactive Report Card has the following functionality:

- Control Panel Filters

- Track and Trend Visuals

- Export to CSV

- Machine-to-machine Daily Data Capabilities

- Export File Layouts

Control Panel Filters

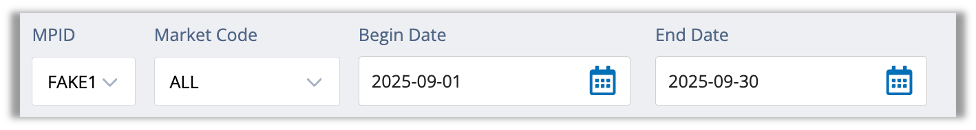

When you enter the TRACE Corporate Bonds Interactive Report Card, the top banner includes two drop-down selector fields (MPID and Trading Market Code) and two configurable date fields (Begin Date and End Date). The values in these fields drive the data available to the visualizations and tools in the remainder of the Interactive Report Card.

Market Participant Identifier (MPID)

The first Control Panel drop-down selector field, MPID, provides the MPID(s) available to the member accessing the Interactive Report Card. Where a member has access to multiple MPIDs associated with the member firm, the MPID drop-down selector will permit the member to select a different MPID

Trading Market Code

The second Control Panel drop-down selector field, Trading Market Code, permits members to narrow their review of TRACE reported trades to Primary Market ("P1") or Secondary Market ("S1"). The field defaults to “All”, which includes both P1 and S1 trades in the Interactive Report Card’s visualizations and tools.

Customizable Date Ranges

To the right of the MPID and Trading Market Code dropdown selectors in the Control Panel, the Interactive Report Card presents members with a selectable Begin Date and End Date. The default Begin Date is the first day of the previous full month and the Default End Date is the current date. For example, a member accessing the Interactive Report Card on Tuesday, October 14, 2025, would see a default Begin Date of September 1, 2025, and a default End Date of October 14, 2025. Members can adjust the date range to span across longer or shorter custom date ranges; this Interactive Report Card has data available back to January 1, 2025. The Begin and End Date dynamically drive the contents of interactive visualizations in the remainder of the Interactive Report Card

Track and Trend Visuals

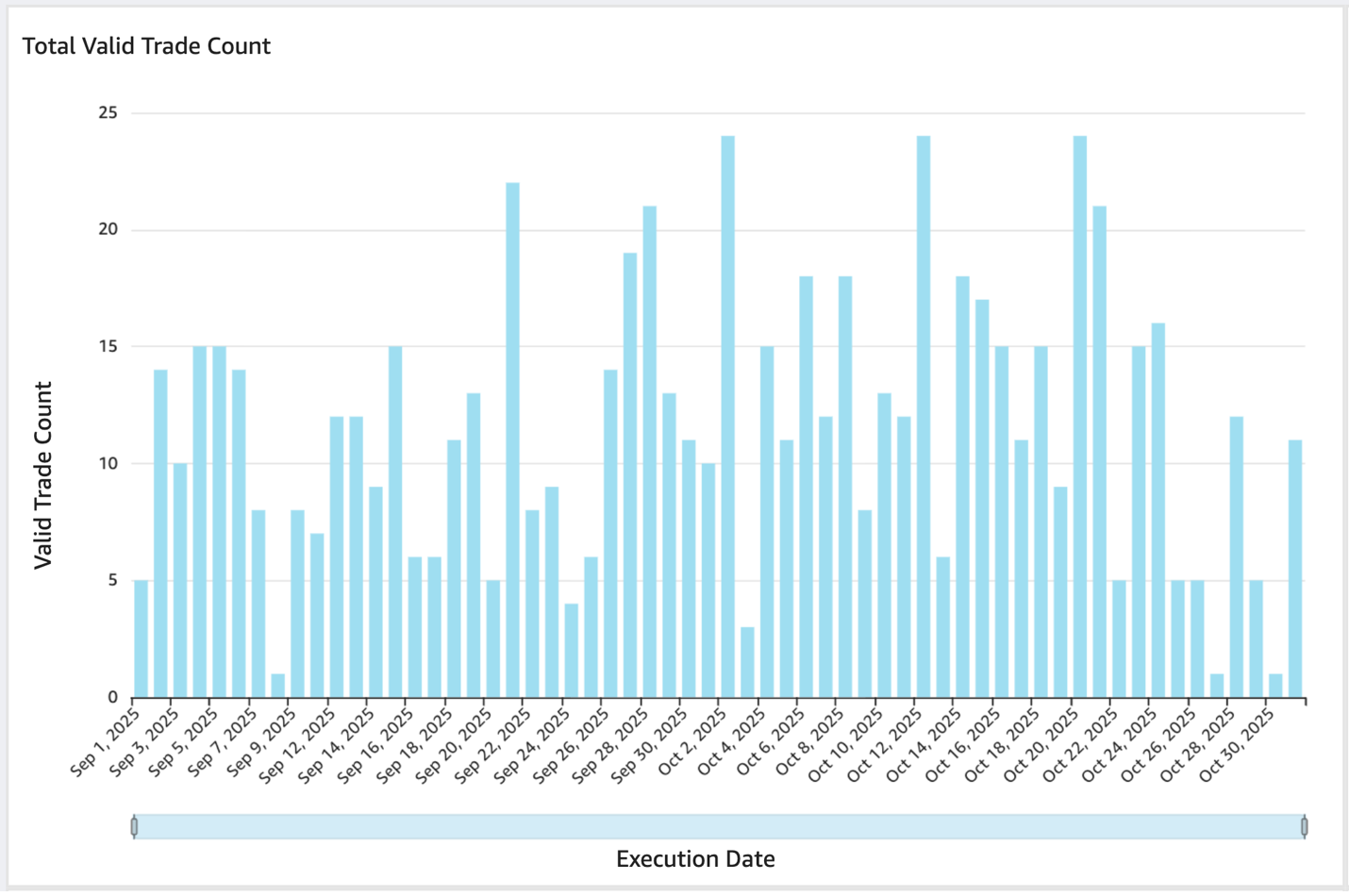

Total Valid Trade Count

The top left visualization under the Control Panel displays the daily total valid trade count for the period selected. In this context, a valid trade is one reported and not cancelled at trade date plus three business days (T+3). Each trade is only represented once in this count; if a trade is submitted during the report month and then corrected once or more during T+3 period, that trade is still only counted once in the Total Valid Trade Counts.

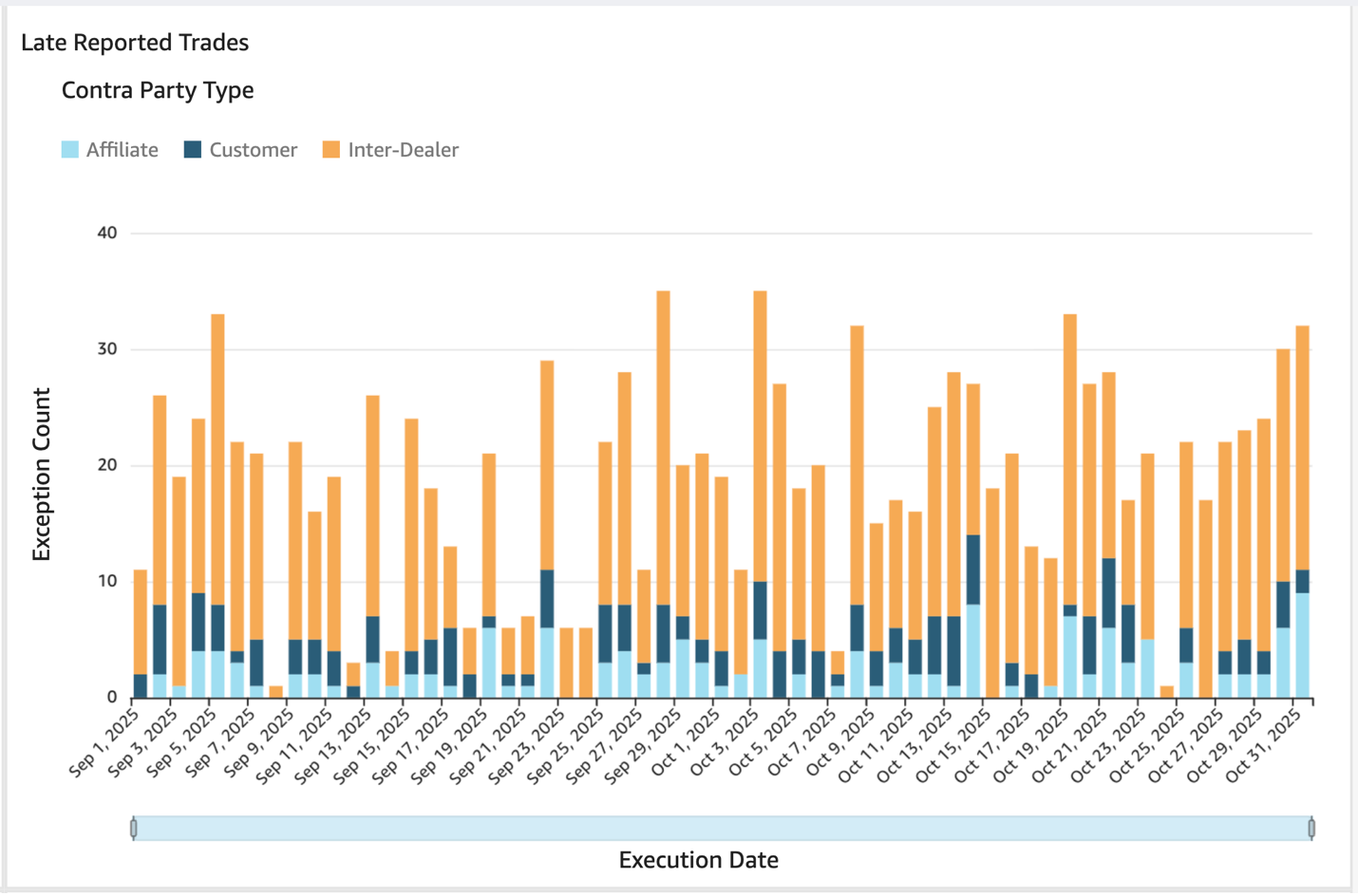

Late Reported Trades

The top right visualization under the Control Panel displays the daily count of transactions that a member executed but reported greater than the allowable time after the time of execution (Late Reported Trades). Only valid trade reports are considered. The visualization also identifies the Contra Party Type: Affiliate; Customer; Inter-dealer.

Inter-dealer Trades

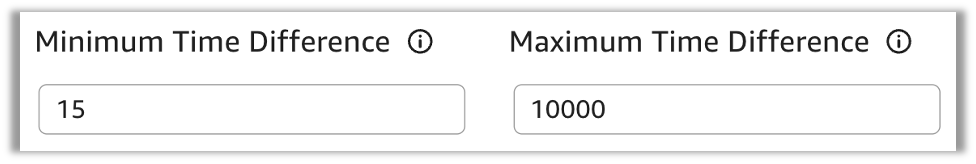

The Interactive Report Card provides insight into execution time differences between the member firms and their contra parties in the same transactions reported to TRACE. As a default, the Interactive Report Card visualizes inter-dealer trades where the execution time reported by a member firm is greater than 15 minutes after the contra party’s execution time in that same transaction reported to TRACE.

The Minimum Time Difference and Maximum Time Difference fields reflect the time difference in minutes between the contra party’s reported execution time and the member’s later reported execution time on the opposite side of the trade. These fields drive the two inter-dealer trade visualizations, one that displays the count of daily instances that meet the parameters and a second that displays the contra parties included in trades that meet the parameters. Based on member feedback, users can change the Minimum and Maximum Time Difference fields to broaden the inter-dealer trades included (e.g., including instances where the member’s execution time was prior to the contra party’s execution time by more than 15 minutes) or narrow the analysis to specific time difference slices (e.g., including instances where the member’s execution times were between 15 and 20 minutes after the contra parties’ execution times).

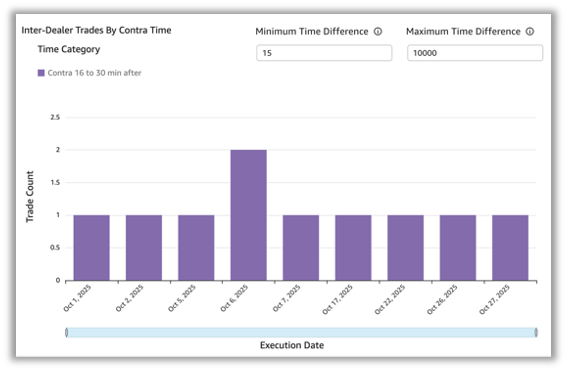

Inter-dealer Trades by Contra Time

The visualization on the left of the inter-dealer trades section shows a daily count of inter-dealer trades that are between the minimum and maximum time difference from the perspective of the member. For example, if a member reports a trade with an execution time that was 13 minutes after the contra party’s execution time, it will not appear in the below chart. If, however, a member reports a trade with an execution time that was 18 minutes after the contra party’s execution time, it will appear in the below chart.

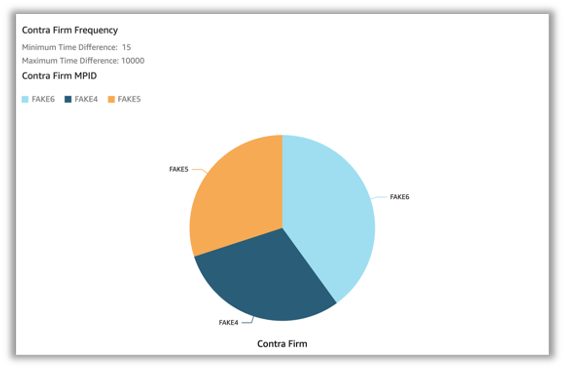

Inter-dealer Trades by Contra Firm Frequency

The visualization on the left of the inter-dealer trades section shows the inter-dealer contra parties as a share of total inter-dealer trades that are between the minimum and maximum time difference from the perspective of the member. This visualization serves to assist members in communicating internally and with contra parties regarding potential delays in their reporting.

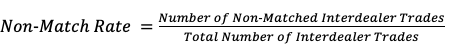

Non-Match Rate

The final visualization in the Interactive Report Card provides insight into the percentage of inter-dealer trades that a member submitted to TRACE that did not match to a corresponding contra party trade report.

The non-match rate visualization shows a line graph with a data point for each day between the Begin and End Date.

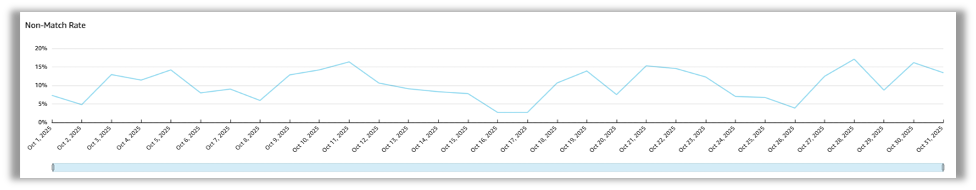

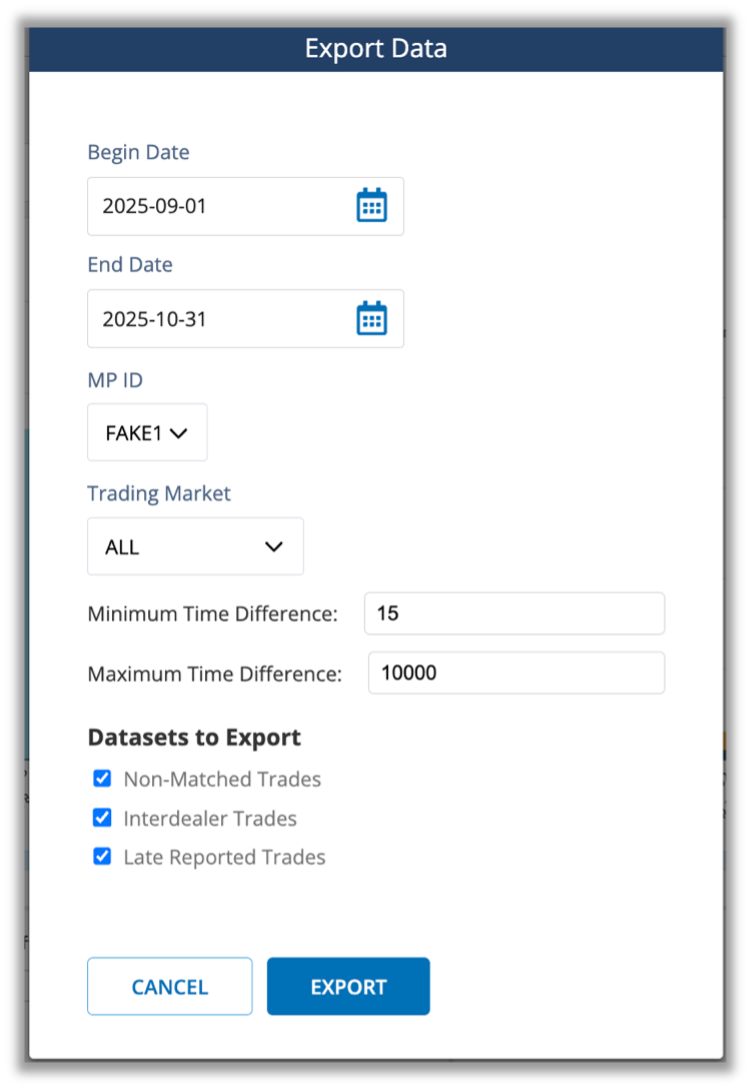

Export to CSV

The Export to CSV function facilitates member firm analysis outside the Interactive Report Card. For example, when facilitating internal root cause analysis or enriching report card data within additional member specific information to facilitate analysis.

To access the export to CSV function, please select the Export to CSV button at the top of the TRACE Corporate Bonds Interactive Report Card.

Once selected, a dialog box will appear showing the selected filters based on your current Control Panel settings. The Export Data dialogue box allows you to refine the data export by changing any of the configurable fields or deselecting individual data sets.

To download the datasets you have selected, click the Export button in the bottom right of the dialog box. You will see an Export Queued dialog in the bottom right of the screen. Once the processing is complete, select download to save a downloadable .zip file to your machine. These files are also available for download in the Exports tab after processing.

The download is a .zip folder that contains Comma Separated Value (CSV) files a “manifest” file that describes the details of the export (e.g., Begin Date, End Date, MPID, Trading Market Code); and files that correspond to the datasets you have selected to export (i.e., Non-Matched Trades, Inter-dealer Trades, Late Reported Trades). Please find the file layouts for these data sets [file layouts].

Machine to Machine Daily Data Capabilities

Member can direct FINRA to make available for automatic download daily data files that contain details regarding member Late Reported, Inter-dealer and Non-Matched trades for the most recently processed day. To facilitate data sharing, FINRA uses a machine-to-machine transfer mechanism called fileX: a centralized, secure file transfer platform where firms can send, track and receive files in one place. Please use the link below to find out more about fileX.

https://www.finra.org/filing-reporting/data-transfer-tools/fileX

To set-up access please review the Entitlement & Access Control section of the of the fileX User Guide and follow the steps associated with gaining access. If you have questions, please contact the Report Center admin at [email protected].

Export File Layouts

| Attribute Name | Attribute Descriptions |

|---|---|

| Begin Date | Extract begin date. |

| End Date | Extract end date. |

| MPID | Market Participant ID (MPID) of extract. |

| Firm CRD ID | The unique number associated with the broker dealer member in FINRA’s Central Registration Depository (CRD) |

| Trading Market Code | Market associated with the information in the extract: Primary Market ("P1") or Secondary Market ("S1") or both (“All”) |

| Minimum Time Difference | For inter-dealer trades, the minimum time difference in minutes between a contra party executing a trade and a member executing a trade from the perspective of the member. |

| Maximum Time Difference | For inter-dealer trades, the maximum time difference in minutes between a contra party executing a trade and a member executing a trade from the perspective of the member. |

Late Reported Trades

| Attribute Name | Attribute Description |

|---|---|

| Reporting Firm | Market Participant ID (MPID) of the reporting party. |

| Execution Date | Execution date entered in the report side trade entry. |

| Execution Time | Execution time entered in the report side trade entry. |

| Trade Report Date | Reporting date of the report side trade entry. |

| Trade Report Time | Reporting time of the report side trade entry. |

| Execution vs Report Time Difference | Number of seconds difference between the reported execution time and report (trade entry) time. |

| Capacity | Role of the reporting party in the trade. |

| Buy/Sell | Report side of the trade. |

| Bond Symbol | Instrument/security identifier. |

| CUSIP | Instrument/security identifier. |

| Reported Price | Trade price reported. |

| Entered Volume | Trade volume reported. |

| Contra Side MPID | Market Participant ID (MPID) of the contra party. |

| Trading Market | Indicates whether the trade was executed in the primary or secondary market. |

| System Control Date | Reflects the date when TRACE received and processed the report side trade entry. |

| System Control Number | Number assigned by TRACE when the report side trade entry was accepted. |

| Branch Sequence ID | The branch office code sequence number from the reporting party input message, if one was entered. |

Inter-dealer Trades

| Attribute Name | Attribute Description |

|---|---|

| Report Side Executing MPID - Seller | Market Participant ID (MPID) of the reporting party who is on the Sell side of the execution. |

| System Control Date - Seller | Reflects the date when TRACE received and processed the Sell side trade entry. |

| System Control Number - Seller | Number assigned by TRACE when the Sell side trade entry was accepted. |

| Execution Date - Seller | Execution date entered in the Sell side trade entry. |

| Execution Time - Seller | Execution time entered in the Sell side trade entry. |

| Report Date - Seller | Reporting date of the Sell side trade entry. |

| Report Time - Seller | Reporting time of the Sell side trade entry. |

| Entered Price - Seller | Trade price of the Sell side trade entry. |

| Entered Volume - Seller | Trade volume of the Sell side trade entry. |

| Bond Symbol | Instrument/security identifier. |

| CUSIP | Instrument/security identifier. |

| Execution Time Difference vs Contra Firm | Number of seconds difference between the execution time reported by the Reporting MPID and the execution time reported by the Contra MPID. |

| Report Side Executing MPID - Buyer | Market Participant ID (MPID) of the reporting party who is on the Buy side of the execution. |

| System Control Date - Buyer | Reflects the date when TRACE received and processed the Buy side trade entry. |

| System Control Number - Buyer | Number assigned by TRACE when the Buy side trade entry was accepted. |

| Execution Date - Buyer | Execution date entered in the Buy side trade entry. |

| Execution Time - Buyer | Execution time entered in the Buy side trade entry. |

| Report Date - Buyer | Reporting date of the Buy side trade entry. |

| Report Time - Buyer | Reporting time of the Buy side trade entry. |

| Entered Price - Buyer | Trade price of the Buy side trade entry. |

| Entered Volume - Buyer | Trade volume of the Buy side trade entry. |

| Trading Market | Indicates whether the trade was executed in the primary or secondary market. |

| Branch Sequence ID | The branch office code sequence number from the reporting party input message, if one was entered. |

Non-Matched Trades

| Attribute Name | Attribute Description |

|---|---|

| Reporting Firm | Market Participant ID (MPID) of the reporting party. |

| Trade Execution Date | Execution date entered in the report side trade entry. |

| Trade Execution Time | Execution time entered in the report side trade entry. |

| Trade Report Date | Reporting date of the report side trade entry. |

| Trade Report Time | Reporting time of the report side trade entry. |

| Reporting Capacity Code | Role of the reporting party in the trade. |

| Report Side Code | Report side of the trade. |

| Bond Symbol | Instrument/security identifier. |

| CUSIP | Instrument/security identifier. |

| Reported Price | Trade price reported. |

| Entered Volume Quantity | Trade volume reported. |

| Contra Side Market Participant ID | Market Participant ID (MPID) of the contra party. |

| Trading Market Code | Indicates whether the trade was executed in the primary or secondary market. |

| System Control Date | Reflects the date when TRACE received and processed the report side trade entry. |

| System Control Number | Number assigned by TRACE when the report side trade entry was accepted. |

| Branch Sequence ID | The branch office code sequence number from the reporting party input message, if one was entered. |