TRACE Quality of Markets Report Cards - Securitized Products

The TRACE Quality of Markets Report Card for Securitized Products is a monthly status report for the reporting of transactions in Asset Backed Securities, Mortgage Backed Securities and other similar securities, collectively defined as "Securitized Products", to the Trade Reporting and Compliance Engine (TRACE). Firms are required to report trades in accordance with established FINRA rules and regulations. Firms should make no inference that the staff of FINRA has or has not determined that the information contained on the TRACE Quality of Markets Report Cards does or does not constitute rule violations.

These reports are posted no later than the 13th business day of the month. Users who have not opted-out of notifications will receive an email indicating that new reports have been published.

The tables below provide a reference description for all of the elements found in all views of the TRACE Quality of Markets Report Card for Securitized Products.

|

Term |

Definition |

|---|---|

|

Firm Activity Total |

|

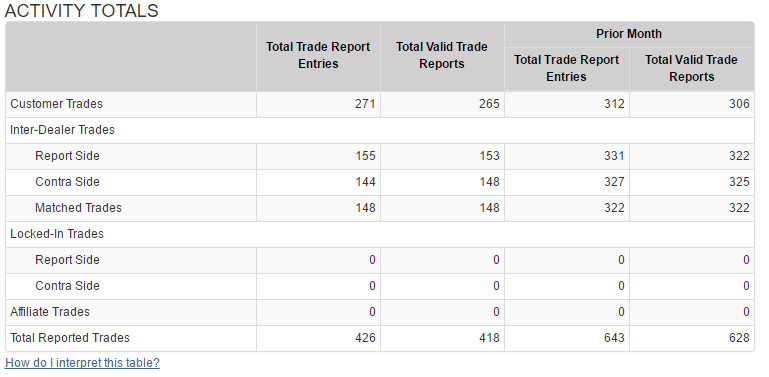

| Trade Report Entries | This is the total number of transaction reports submitted by your firm during the month, including trades that were canceled or reversed during the month, for the type of transaction in that view. This also includes locked-in transaction reports where your firm was a party to the transaction, whether your firm was listed as report or contra, since a single locked-in trade report represents reporting by both sides. This count includes all T records (Newly Reported Trades) submitted during the month and all Y records (Reversals) submitted during the month. Each trade is only counted once in this count, regardless of the number of times it may have been corrected during the month. |

| Valid Trade Reports | This is the number of transaction reports submitted by your firm that were not subsequently canceled during the report month or in the first three business days of the following month (i.e., before the report cards for the month have been run). Each transaction is only represented once in this count; if a trade is submitted during the report month and then corrected once or more during the report month, that trade is still only counted once in the Valid Trade Reports count. This count includes all T records (Newly Reported Trades) submitted during the month that were not subsequently canceled or corrected during the report month, plus the latest R record (Corrected portion of a cancel/correction) for any trade that was submitted and then corrected during the month or during the first three days of the subsequent month. The All view includes transactions for:

|

| Customer Trades | These are transactions with a non-broker-dealer customer. |

| Inter-Dealer Trades | These are transactions with another broker-dealer. |

| Matched Trades | For the purposes of this report, the Matched Trades count includes trades that were evaluated for an Execution Time Difference, meaning they matched during the report month. For trades that were bulk matched (where one or more trade reports on one side are matched to more than 1 trade report on the other side), this count only includes one trade report from each side of the matched set. Please note: trades that match across months (i.e., where one side came in at the end of month A and the other side came in during the beginning of month B) are not evaluated for this report card count. |

| ATS Trades | This field is a count of trades identified as an ATS execution (the trade was executed on an ATS’s platform) by entering the ATS’ MPID. An ATS may or may not be a party (RP or CP) in these transactions. CPID of (C or A) are not allowed on ATS Executions. |

| Locked-In Trades | These are transactions executed pursuant to a Uniform Service Agreement and that are locked in. |

| Affiliate Trades | These are transactions with a non-member affiliate |

TRACE Quality of Markets Report Card- Securitized Products Figure 1

Securitized Products Peer Groups (by number of Valid Transactions)

| Peer Group Categories | All | ABS | ABSX | CMO | MBS | TBA |

|---|---|---|---|---|---|---|

| 1 | 12,650 or more | 200 or more | 200 or more | 1,250 or more | 2,000 or more | 9,000 or more |

| 2 | 3,100 - 12,649 | 50 - 199 | 50 - 199 | 500 - 1,249 | 500 - 1,999 | 2,000 - 8,999 |

| 3 | 350 - 3,099 | 1 - 49 | 1 - 49 | 100 - 499 | 1 - 499 | 250 - 1,999 |

| 4 | 1 - 349 | Not Applicable | Not Applicable | 1 - 99 | Not Applicable | 1 - 249 |

TRACE Quality of Markets Report Card- Securitized Products Figure 2

|

Term |

Definition |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TRACE Reporting Peer Group | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peer Group | A peer group or tier consists of firms within the same predetermined range of transactions. All View:

ABS View:March 2017 forward

Prior to March 2017

ABSX View:

CMO View:

MBS View:

TBA View:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Firms in Peer Group | This is the number of firms that were included in a particular peer group based on its number of total transaction reports for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rank in Peer Group |

This is the rank of the selected Market Participant (MP) relative to other MPs in its peer group. In this section of the report, this rank is based solely on number of trade reports submitted by the firm during the month. This rank does not indicate whether or not the firm’s reporting was timely or accurate. MPs with a greater number of trade reports in a given month will have a higher rank. The firm with the greatest number of trade reports will be ranked number 1. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Late Trades | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

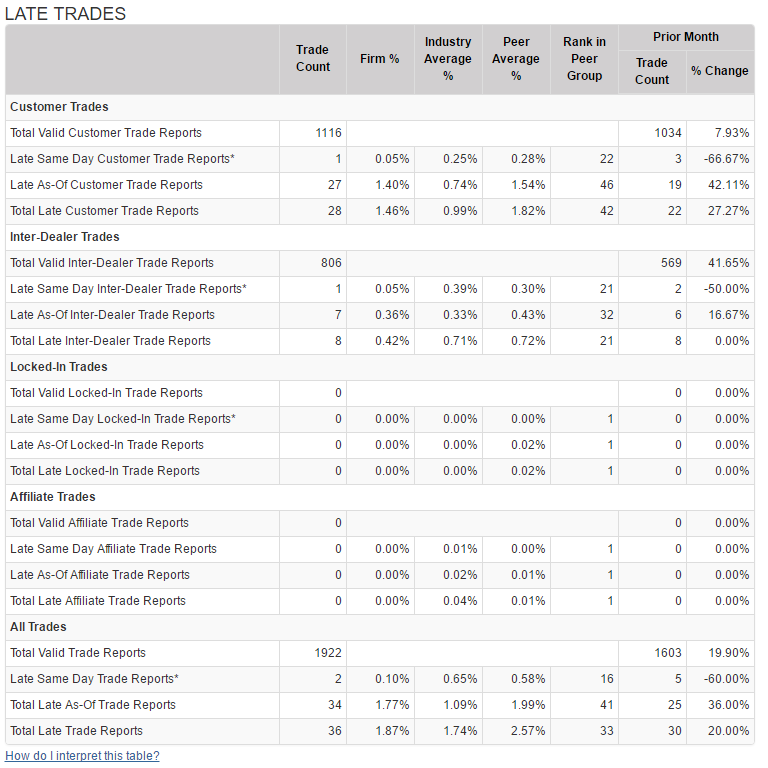

| Late Same Day Trade Reports | These are trades that were submitted on the day they were executed, but reported greater than the allowable time after the time of execution. MBS and TBA trades are currently considered for this count (ABS and CMO trades are not required to be reported within a prescribed number of minutes after execution). Please see FINRA Rule 6730 for detailed requirements for MBS and TBA securities. Only valid trade reports are included in this count. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Late As-Of Trade Reports | This is the number of trades reported as-of and also late. Please see FINRA Rule 6730 for detailed reporting requirements. Only valid trade reports are included in this count - however, it is possible that the valid trade report was included in the report card for the prior month. For example, if a trade report is submitted during Month A and then corrected during Month B and the correction is late, the trade will be counted in the Valid Trade Count for Month A, but in the appropriate Late As-Of Trade Reports count for Month B. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Late Reports | This is the total number of valid late trades (Late Same Day + Late As-Of) for the selected MP for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Firm % | This is the percentage of late trades to total valid trade reports for the firm for the selected month, year, and view (LT %= Total LT/ Total Valid MP Reported Trades). Only valid trade reports are considered. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Industry Average % | This is the percentage of alerts to total valid trade reports for all firms having at least one valid trade for the selected month, year, and view. Data is representative of all trades of that type by the industry, not as an average of all industry participants. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peer Average % | This is the percentage of alerts to total valid trade reports for all firms in the firm's peer group for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rank in Peer Group | For each value provided in the late trades table, the rank is based on the percentage of total alerts of that type listed to total valid trade reports for the selected view, month and year. Firms are ranked in ascending order from the lowest percentage of alerts to total valid trade reports to the highest percentage of alerts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trade Reporting Analysis | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

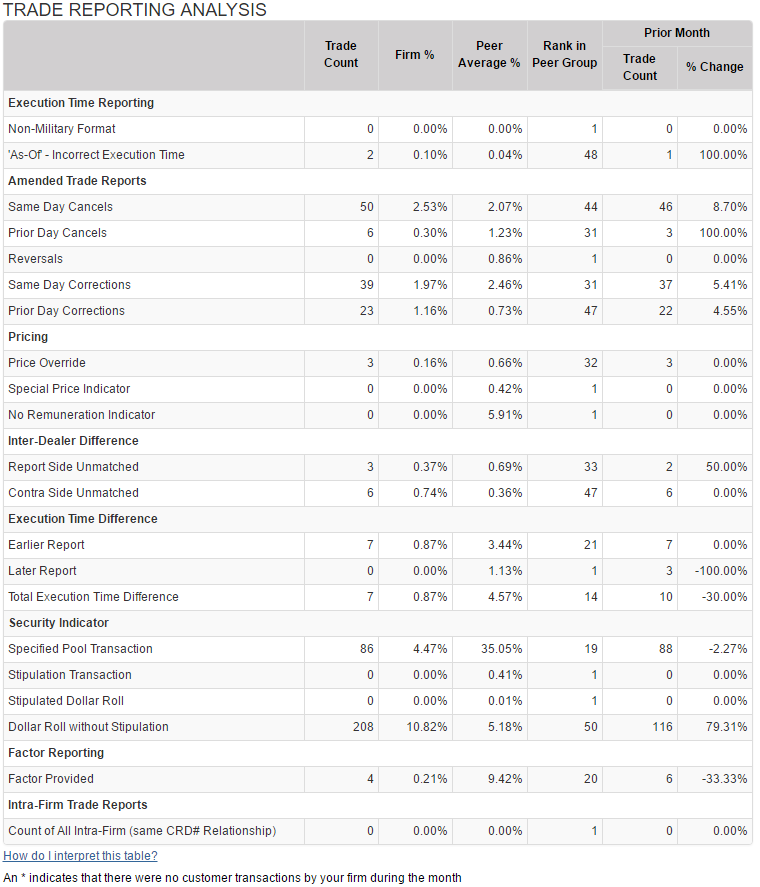

| Non-military Format | This is the number of reports that were potentially entered whereby the execution time was reported without the use of military time format (i.e. 0200 vs. 1400). Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'As-Of' - Incorrect Execution Time | This is a count of reports that were potentially entered with a system-generated execution time, rather than the original execution time of the transaction. This is determined by the commonality of the execution time to the time of the report. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Same Day Cancels | This is a count of reports that were canceled on the same day they were reported. Trades that are canceled on the same day are included in the firm’s total trade count, but not included in the firm’s valid trade count. These reports are not indicative of a potential violation, but are provided to allow your firm to monitor their frequency. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prior Day Cancels | This is a count of cancellations submitted one or more days but no more than 20 days after the trade was reported. Trades that are submitted and then subsequently canceled within the report month or within the first three days of the subsequent month (before the report cards are run) are included in the firm’s total trade count, but not included in the firm’s valid trade count. Note: if a trade is submitted to TRACE during Month A and canceled in Month B, the trade will be included in the Prior Day Cancels count for Month B even though the original trade came in during Month A. This means that, for Month B, a firm could have more Cancels than Total Trade Reports. These reports are not indicative of a potential violation, but are provided to allow your firm to monitor their frequency. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reversals | This is a count of cancellations submitted more than 20 days after the trade was reported. These reports are not indicative of a potential violation, but are provided to allow your firm to monitor their frequency. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Same Day Corrections | This is a count of trade reports that correct a trade report submitted earlier the same day. A trade report that is corrected is only counted as one trade in the firm’s Valid Trade Reports count and Total Trade Reports count. These reports are not indicative of a potential violation, but are provided to allow your firm to monitor their frequency. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prior Day Corrections | This is a count of trade reports that correct a trade report submitted on a previous day. A trade report that is corrected is only counted as one trade in the firm’s Valid Trade Reports count and Total Trade Reports count. If the original trade came in during Month A and the correction came in during Month B, the trade would be counted in the Total and Valid Trade Reports counts for Month A and in the Prior Day Corrections count for Month B. This means that, for Month B, a firm could have more Prior Day Corrections than Total or Valid Trade Reports. These reports are not indicative of a potential violation, but are provided to allow your firm to monitor their frequency. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Price Override | This is a count of trade reports on which a Price Override indicator was provided. These reports are not indicative of a potential violation, but are provided as a comparative frequency reference. Please see the specifications for TRACE Securitized Products reporting for information regarding when this indicator should be provided. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Special Price Indicator | This is a count of trade reports on which a special price indicator was provided. These reports are not indicative of a potential violation, but are provided as a comparative frequency reference. Please see the specifications for TRACE Securitized Products reporting for information regarding when this indicator should be provided. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No Remuneration Indicator | This is a count of trade reports on which a No Remuneration Indicator was provided. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Report Side Unmatched | This is a count of inter-dealer trade reports submitted by your firm for which the system could not identify a matching contra report within the system matching window. (Note: the system matches trades automatically for some period of time. If a matching trade report is submitted after the system match window has closed, the trade will be included in the unmatched count on the report). These reports may be the result of misreporting by your firm or by the firm on the other side of the transaction. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Contra Side Unmatched | This is a count of inter-dealer trade reports submitted by another firm listing your firm as contra, for which the system could not identify a matching report by your firm within the system matching window. (Note: the system matches trades automatically for some period of time. If a matching trade report is submitted after the system match window has closed, the trade will be included in the unmatched count on the report.) These reports may be the result of misreporting by your firm or by the firm on the other side of the transaction. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Execution Time Difference Earlier Report | This is a count of inter-dealer trade reports submitted by your firm which were able to be matched, but for which the execution time submitted by your firm was more than 15 minutes before the execution time submitted by the contra firm. These reports may be the result of misreporting by your firm or by the firm on the other side of the transaction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Execution Time Difference Later Report | This is a count of inter-dealer trade reports submitted by your firm which were able to be matched, but for which the execution time submitted by your firm was more than 15 minutes after the execution time submitted by the contra firm. These reports may be the result of misreporting by your firm or by the firm on the other side of the transaction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Execution Time Difference | This is a count of inter-dealer trade reports submitted by your firm which were able to be matched during the report month, but for which the execution time submitted by your firm was 15 minutes or more before or after the execution time submitted by the contra firm. These reports may be the result of misreporting by your firm or by the firm on the other side of the transaction. Please note: trades that match across months (i.e., where one side came in at the end of month A and the other side came in during the beginning of month B) are not evaluated for this report card count. Only valid trade reports are considered for inclusion in this count. When viewing the detail data for trades included in this count, firms will be able to see the trade reports for both sides of the match (their trade report as well as the trade report submitted by the contra firm that matched their trade report but for which the execution time was 15 or more minutes before or after the execution time their firm reported). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Specified Pool Transaction | This is a count of trade reports on which a Specified Pool Transaction modifier was provided. These reports are not indicative of a potential violation, but are provided as a comparative frequency reference. Please see the specifications for TRACE Securitized Products reporting for information regarding when this modifier should be provided. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stipulation Transaction | This is a count of trade reports on which a Stipulation Transaction modifier was provided. These reports are not indicative of a potential violation, but are provided as a comparative frequency reference. Please see the specifications for TRACE Securitized Products reporting for information regarding when this modifier should be provided. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stipulated Dollar Roll | This is a count of trade reports on which a Stipulated Dollar Roll modifier was provided. These reports are not indicative of a potential violation, but are provided as a comparative frequency reference. Please see the specifications for TRACE Securitized Products reporting for information regarding when this indicator should be provided. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar Roll without Stipulation | This is a count of trade reports on which a Dollar Roll without Stipulation modifier was provided. These reports are not indicative of a potential violation, but are provided as a comparative frequency reference. Please see the specifications for TRACE Securitized Products reporting for information regarding when this modifier should be provided. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Factor Provided | This is a count of trade reports on which a Factor was provided. The factor is required if a percentage other than the latest published factor was used. These reports are not indicative of a potential violation, but are provided as a comparative frequency reference. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Count of All Intra-Firm Trade Reports |

This is a count of trade reports where the "same" firm is both the reporting and contra party. This analyses looks for MPIDS which are associated with the same Broker-Dealer CRD #. This analysis may indicate trade reports where there was no beneficial change of ownership. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ATS Unmatched Trades | This is a count of inter-dealer ATS trade reports submitted by your firm for which the system could not identify an ATS matching contra report within the system matching window. (Note: the system matches trades automatically for some period of time. If a matching trade report is submitted after the system match window has closed, the trade will be included in the unmatched count on the report). These reports may be the result of misreporting by your firm or by the firm on the other side of the transaction. Only valid trade reports are considered for inclusion in this count. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Firm % | This is the percentage of alerts to total valid trade reports (Execution Time Reporting, Pricing, Inter-Dealer Difference, Security Indicator, and Factor Reporting sections), total trade reports (Amended Trade Reports section), total report side or contra side inter-dealer trade reports (Report Side Unmatched, contra Side Unmatched counts), or matched trade reports (Execution Time Difference count) for the firm for the selected month, year and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peer Average % | This is the percentage of alerts to total valid trade reports (Execution Time Reporting, Pricing, Inter-Dealer Difference, Security Indicator, and Factor Reporting sections), total trade reports (Amended Trade Reports section), total report side or contra side inter-dealer trade reports (Report Side Unmatched, contra Side Unmatched counts), or matched trade reports (Execution Time Difference count) for all firms in the firm's peer group for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rank in Peer Group | For each type of alert listed, firms in the peer group are ranked in ascending order from the lowest firm percentage of alerts to total valid trade reports to the highest percentage of alerts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trade Submission Statistics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | This is the total number of valid trade reports submitted by your firm for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CTCI | This is the total number of valid trade reports submitted by your firm through a Computer to Computer Interface (CTCI) linkage for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FIX | This is the total number of valid trade reports submitted by your firm via the FIX protocol for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Web | This is the total number of valid trade reports submitted by your firm to the TRACE for Securitized Products website for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Same Day Trade Reports (T) | This is the total number of valid trade reports submitted on the same day as the trade was executed for the selected month, year, and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Next Day Trade Reports (T+1) | This is the total number of valid trade reports submitted one business day after the day the trade was executed for the selected month, year, and view. In some circumstances (i.e., certain CMO transactions), trade reports submitted T+1 may considered on time. See FINRA Rule 6730 for transaction reporting requirements. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| > T+1 Trade Reports | This is the total number of valid trade reports submitted more than one business day after the day the trade was executed for the selected month, year, and view. In some circumstances (i.e., certain CMO transactions), trade reports submitted > T + 1 may be considered on time. See FINRA Rule 6730 for transaction reporting requirements. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Firm % | This is the percentage of each type of trade report to total valid trade reports for the firm for the selected month, year and view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

TRACE Quality of Markets Report Card- Securitized Products Figure 3

TRACE Quality of Markets Report Card- Securitized Products Figure 4

Detail Data

The TRACE Detail Data is designed to accompany the TRACE Quality of Markets Report Card for Securitized Products as a tool to help a firm analyze and improve its compliance-related activities associated with reporting securitized products transactions via TRACE.

The following table describes the content of the detail data file:

|

Term |

Definition |

|---|---|

| Alert Type | This is an abbreviation for the exception category on the report card in which this transaction was counted. Users can sort this file by the Alert Type to group transactions by alert. A list of the alert types and corresponding categories in the TRACE Quality of Markets Report Card is included below. |

| Execution Date | This is the date the transaction was executed. |

| Execution Time | This is the time the transaction was executed. |

| Report Date | This is the date the transaction was reported to TRACE. |

| Report Time | This is the time the transaction was reported to TRACE. |

| Settlement Date | This is the date the transaction settled. |

| Trade Report Effective Date | This is the date when trades of this security can first be reported. |

| Reporting Executing Firm | This is the MPID of your firm, i.e., the executing party with reporting responsibility for this transaction. Note: if this trade was submitted pursuant to a give-up agreement, the firm that reported the trade on your firm’s behalf will appear in the Reporting Party field. |

| Report Firm Cap | This indicates whether the firm executed the trade for its own account (P for Principal) or for at third party (A for Agent). |

| Report Clearing ID | This is the Clearing ID of the firm clearing the trade. This field is not required. |

| Contra Firm | This is the party on the other side of the trade. Contra parties that are non-FINRA members will be identified with the letter "C" (for customer). Contra parties that are non-member Affiliates will be identified with the letter "A" (for affiliate). |

| ATS Execution MPID | |

| ATS Contra Firm | |

| Symbol | This is the TRACE symbol of the bond. |

| Issuer Name | |

| CUSIP | This is the CUSIP of the bond. |

| Buy/Sell | This indicates whether the firm bought (B) or sold (S) the security. |

| Entered Price | This is the price at which the firm reported that the trade was executed. |

| Size | This is the dollar amount of the trade. |

| Factor | This is the factor amount of the trade. This field should only be populated if other than the latest published factor was used. |

| Security Type | This is the sub-product (ABS, ABSX, MBS, TBA or CMO) of the trade. |

| Security Sub-Type | This is the code for the sub-product asset of the trade. In the case of TBA transactions, this field will indicate whether the transaction was subject to the reporting requirements for securities for good delivery (GD) or the reporting requirements for securities not for good delivery (NGD). A list of security sub-types and their related descriptions is provided below. This list is not inclusive of all possible sub-types. |

| Reporting Party | This is the firm that submitted the trade report. If the trade was submitted on behalf of your firm pursuant to a give-up agreement, this will be the MPID of the firm that had the responsibility to report the trade on your firm's behalf. |

| Submitting Firm | This is the entity that entered the trade. The trade may be entered by the responsible party, a give-up firm, a firm you have an agreement with, or a service bureau. This value will be different from Reporting Party when a Service Bureau submits the trade on the Reporting Party's behalf. |

| Seller Commission | This is the dollar amount charged as commission on the sell side. This field is not required, and is only viewable if your firm is on the sell side of the transaction. |

| Buyer Commission | This is the dollar amount charged as commission on the buy side. This field is not required, and is only viewable if your firm is on the buy side of the transaction. |

| Modifier 3 | This field pertains to Extended Hours/Late Sale Conditions. Possible values are:

|

| Modifier 4 | This field should be provided when the transaction meets certain conditions, as described in the specifications for TRACE Securitized Products reporting. Possible values are:

|

| Price Ovrd | An O in this column indicates that the firm set the Override flag when reporting this transaction. |

| Special Price Indicator | A Y in this column indicates that the firm set the Special Price flag when reporting this transaction. |

| Special Price Memo | This is a required memo field when Special Price = Y, and is used to describe the reason for the special price. |

| Source | This indicates the source of the TRACE submission. Values are:

|

| Trade Status Code | This indicates the status of the transaction. Possible values are:

|

| As-Of | A Y in this column indicates that the trade was reported as an as-of report. A R in this column indicates that the trade report was reversed. |

| Reversal | A Y in this column indicates that the trade report was a reversal. |

| TRACE Control ID | This is a system-applied identifier for this transaction, provided by TRACE. A trade is uniquely identified by Control ID + Control Date. |

| Control Date | This is the date the trade was reported. A trade is uniquely identified by Control ID + Control Date. In the case of a cancelation or correction, this is the date the cancelation or correction was reported, and prior trade control date will contain the date the trade being canceled or corrected was originally submitted. |

| Client Trade ID | This is an optional user-defined trade reference number which may be used by firms to perform trade management. |

| Prior Trade Control ID | This is the reference number of the prior trade. This will be populated on cancellations and corrections. |

| Prior Trade Control Date | This will be populated on cancellations and corrections, and is the date the trade being canceled or corrected was originally submitted. A trade is uniquely identified by Control ID + Control Date. |

| Memo Text | This field may be used for internal purposes by the reporting firm. On Reversal submissions, firms are required to enter the TRACE Control Number of the original trade report in this field. |

| Branch Seq Num | This is an in-house reference number assigned to the trade by the Reporting Party. |

| Locked-In Indicator | A Y in this column indicates that the trade is locked-in and satisfies both sides (Buy and Sell) of the trade reporting requirement. |

| Trading Mkt Indicator | This indicates whether the trade was submitted as P1 or S1. This field will not initially apply to Securitized Products, but may be utilized in the future. |

| Match Identifier | This field is provided for detail records where Alert Type = ExTimeDiff. The Match Identifier and Match Date will be the same on the Report and Contra side trades that matched. |

| Match Date | This is the date that TRACE matched the trades. This field is provided for detail records where Alert Type = ExTimeDiff. The Match Identifier and Match Date will be the same on the Report and Contra side trades that matched. |

The following table contains a list of the Report Card Alerts and their corresponding categories in the TRACE Quality of Markets Report Card.

|

Term |

Term |

Description |

|---|---|---|

| LSDCust | Late Same Day - Customer | Late same day trade report with a customer as contra |

| AsOfCust | Late As-Of - Customer | Late as-of trade report with a customer as contra |

| LSDDealer | Late Same Day – Inter-Dealer | Late same day trade report with a dealer as contra |

| AsOfDealer | Late As-Of - Inter-Dealer | Late as-of report with a dealer as contra |

| LSDLockIn | Late Same Day – Locked-In | Late same day locked-in trade report |

| AsOfLockIn | Late As-Of - Locked-In | Late as-of trade report that was locked-in |

| LSDAffiliate | Late Same Day – Affiliate | Late same day trade report with a customer as affiliate |

| AsOfAffiliate | Late As-Of - Affiliate | Late As-of report with a customer as affiliate |

| NonMilitary | Non-military Execution Time | Potential occurrence of execution time submitted without military time format |

| AsOfExTime | As-Of Execution Time | Execution time (from 1+ days earlier) same as report time |

| CancelSD | Same Day Cancel | Cancelation on the day the trade was reported |

| CancelPD | Prior Day Cancel | Cancelation between 1 and 20 days after the trade was reported |

| Reversal | Reversal | Cancelation more than 20 days after the trade was reported |

| CorrectSD | Same Day Correction | Correction on the day the trade was reported |

| CorrectPD | Prior Day Correction | Correction one or more days after the trade was reported |

| Override | Price Override | Price override indicator provided on the report |

| SpecialPrice | Special Price Indicator | Special Price Indicator provided on trade report |

| NoRemuneration | No Remuneration Indicator | No Remuneration Indicator provided on trade report |

| UnmatchR | Report Side Unmatched | Inter-Dealer trade submitted by the report firm for which no matching trade report was identified |

| UnmatchC | Contra Side Unmatched | Inter-Dealer trade submitted by another firm listing this firm as contra for which no matching trade report was identified |

| ExTimeDiffEarlier | Execution Time Difference Earlier Report | Inter-Dealer trade report in which the report matched with a contra firm’s trade report but the execution time submitted by the report firm was more than 15 minutes before the execution time submitted by the contra firm. |

| ExTimeDiffLater | Execution Time Difference Later Report | Inter-Dealer trade report in which the report matched with a contra firm’s trade report but the execution time submitted by the report firm was more than 15 minutes after the execution time submitted by the contra firm. |

| IntraFirm | Intra Firm Trade Report | Inter-Dealer or Locked-in trade report in which the reporting and contra parties (as identified by their MPID) are related to the same broker-dealer (mapping to the same Firm CRD #) |

| SpecifiedPool | Specified Pool Transaction | Trade reported with a trade modifier of O in Trade Modifier 4 field. |

| Stipulation | Stipulation Transaction | Trade reported with a trade modifier of N in Trade Modifier 4 field. |

| DollarRollStip | Stipulated Dollar Roll | Trade reported with a trade modifier of L in Trade Modifier 4 field. |

| DollarRollNoStip | Dollar Roll without Stipulation | Trade reported with a trade modifier of D in Trade Modifier 4 field. |

| Factor | Factor Provided | Trade reported with a Factor |

The following table contains a list of possible Security Sub-Types for securitized products reporting. This list may grow/change over time, and may not contain all possible values.

|

Term |

Definition |

|---|---|

|

HLOC |

Home Equity Lines of Credit |

|

HOME |

Home Equity Loan |

|

STUD |

Student Loan |

|

AFLP |

Auto Floorplan/Wholesale Loan |

|

BIKE |

Motorcycle Lease |

|

AUTO |

Auto/Installment Loan |

|

ALEA |

Auto Lease Loan |

|

RECR |

Recreational Vehicle Loan |

|

CARD |

Credit Card Receivables |

|

AIRL |

Airline Lease |

|

BOAT |

Marine Loan |

|

BUSL |

ABS Business Loan |

|

CNSL |

Consumer Loan |

|

EQIP |

Equipment Backed Loan |

|

EXIM |

Export/Import Bank Loan |

|

MANU |

Manufactured Housing Loan |

|

NIM |

Net Interest Margin Securities |

|

OTHR |

Asset Backed Traunches |

|

RVMG |

Reverse Mortgage |

|

UTIL |

Utility Stranded Cost Securitizations |

|

CBO |

Collateralized Bond Obligation |

|

CDO |

Collateralized Debt Obligation |

|

CFO |

Collateralized Fund Obligation |

|

CLO |

Collateralized Loan Obligation |

|

CMBS |

Commercial Mortgage Backed Security |

|

AGRI |

CMO Agricultural MBS |

|

TRAN |

CMO Tranches |

|

WHLN |

CMO Whole Loan |

|

SBA |

Small Business Administration |

|

GD |

For Good Delivery |

|

NGD |

Not for Good Delivery |