Firm Data

Table of Contents

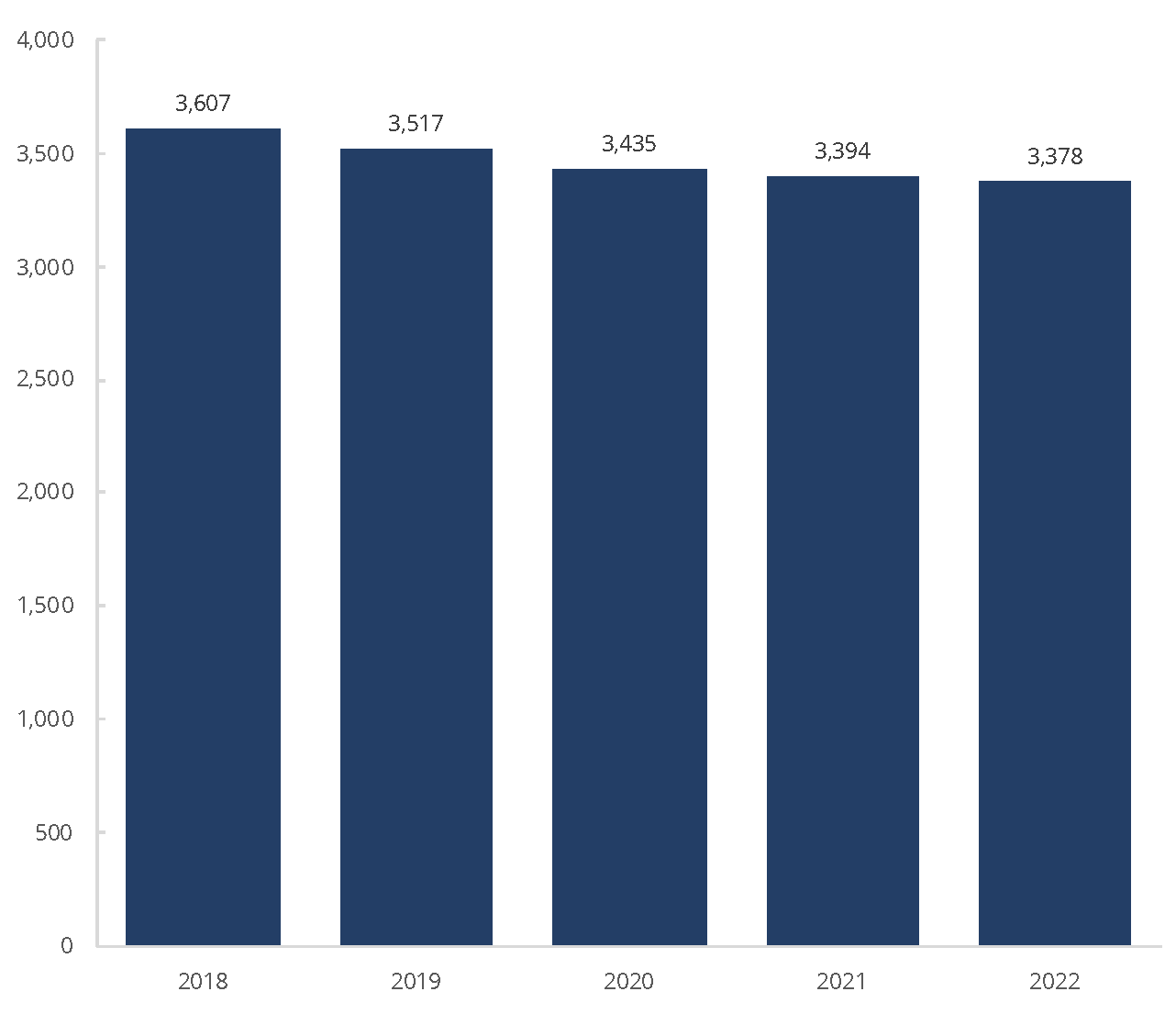

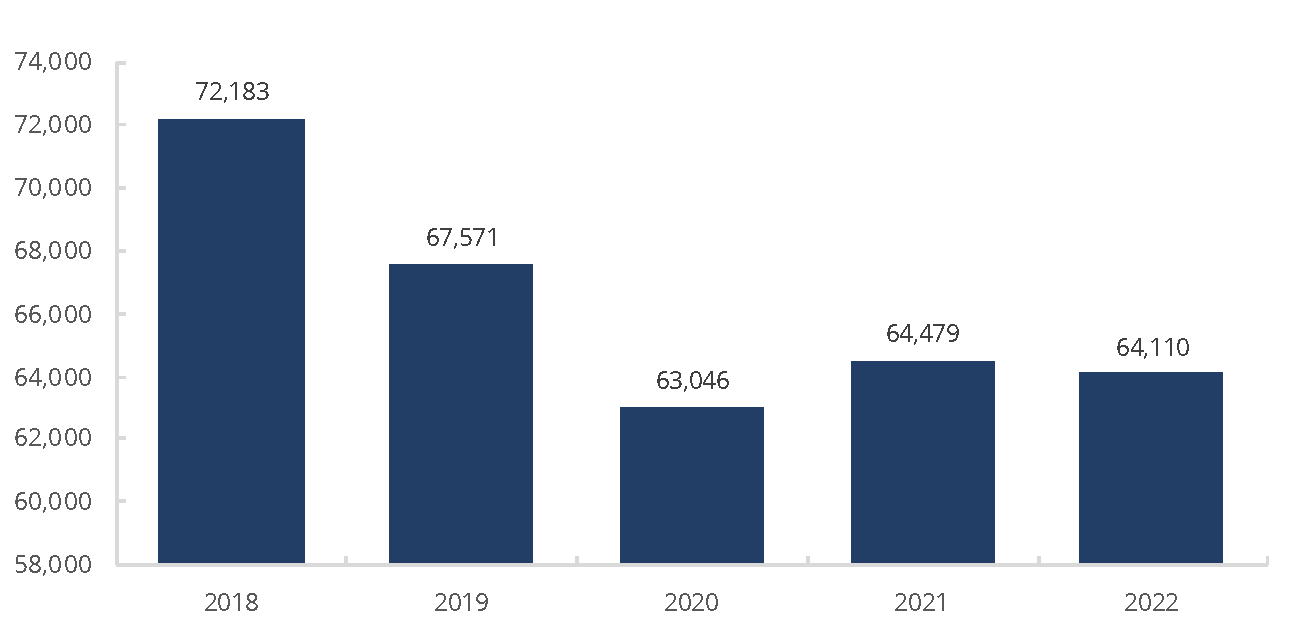

2.1 Sizes and Counts- Figure 2.1.1 Total Number of FINRA-Registered Firms, 2018−2022

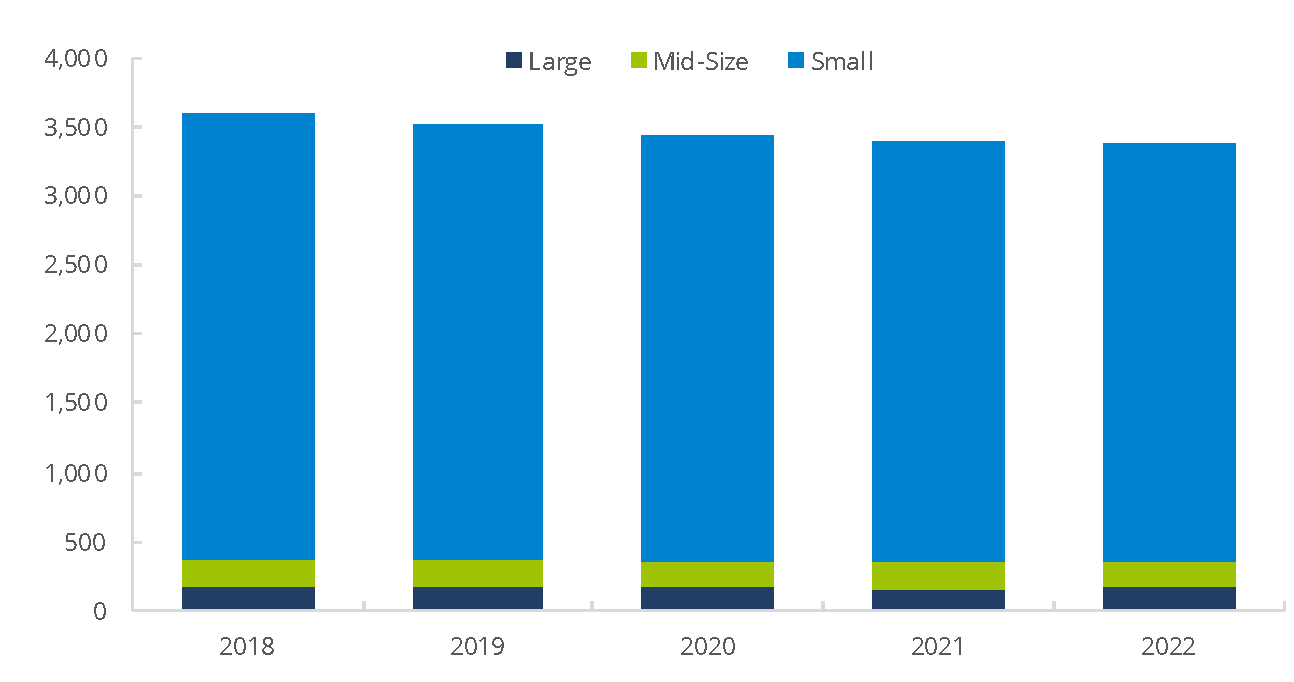

- Figure 2.1.2 Firm Distribution by Size, 2018−2022

- Table 2.1.3 Firm Distribution by Size, 2018−2022

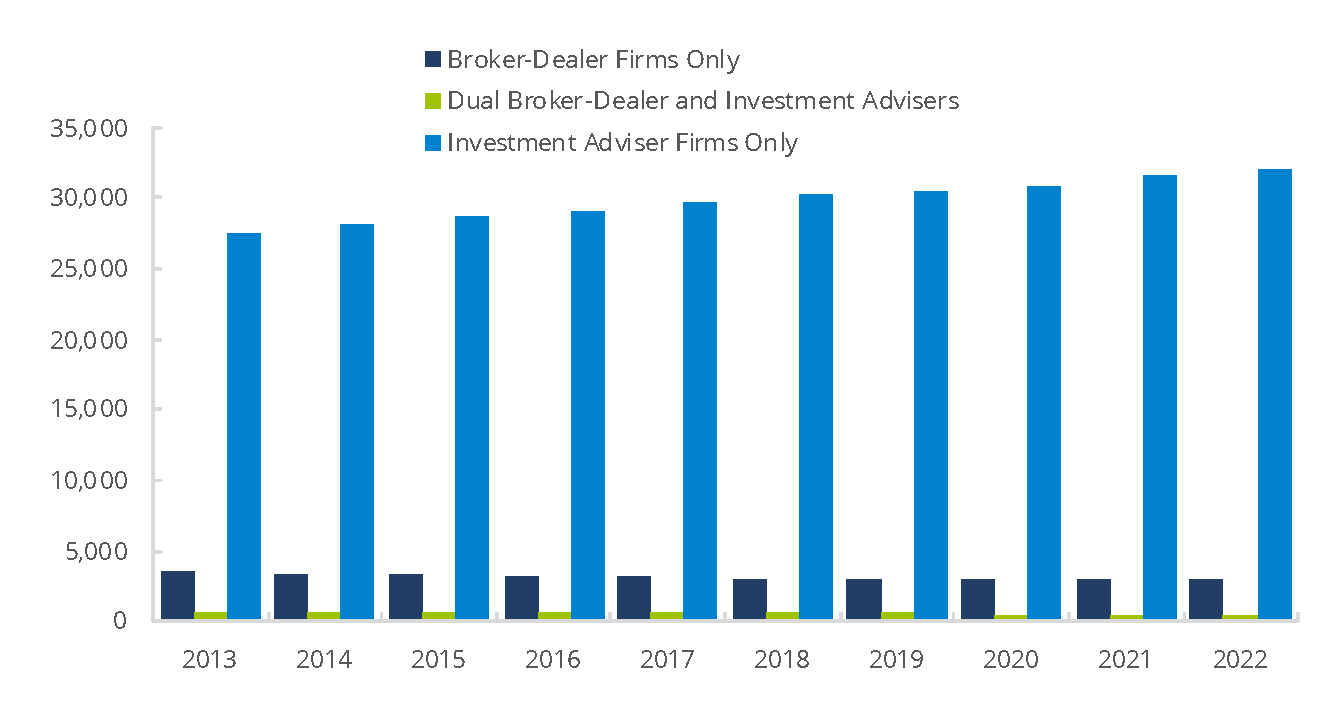

- Figure 2.1.4 Securities Industry Registered Firms by Type of Registration, 2013−2022

- Table 2.1.5 Securities Industry Registered Firms by Type of Registration, 2013−2022

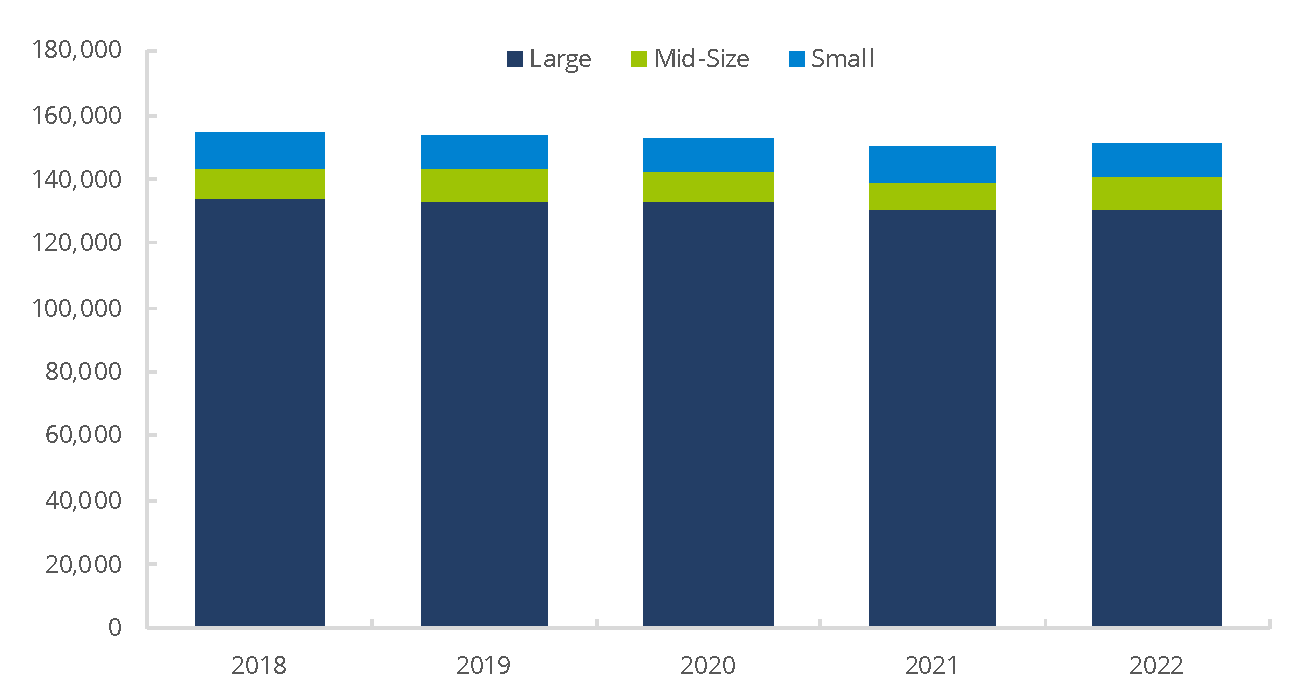

- Figure 2.1.6 Distribution of Branches by Firm Size, 2018−2022

- Table 2.1.7 Distribution of Branches by Firm Size, 2018−2022

- Figure 2.1.8 Firm Distribution by Specified Demographics, 2022

- Table 2.1.9 Firm Distribution by Number of Registered Representatives: Additional Breakdown, 2018–2022

- Figure 2.1.10 10-Year Change in Number of FINRA-Registered Firms, 2012−2022

2.2 Entrance and Exit of Firms- Figure 2.2.1 FINRA-Registered Firms – Median Number of Years in Business, 2012–2022

- Figure 2.2.2 FINRA-Registered Firms – Leaving/Entering the Industry, 2008–2022

- Table 2.2.3 FINRA-Registered Firms – Leaving/Entering the Industry, 2008–2022

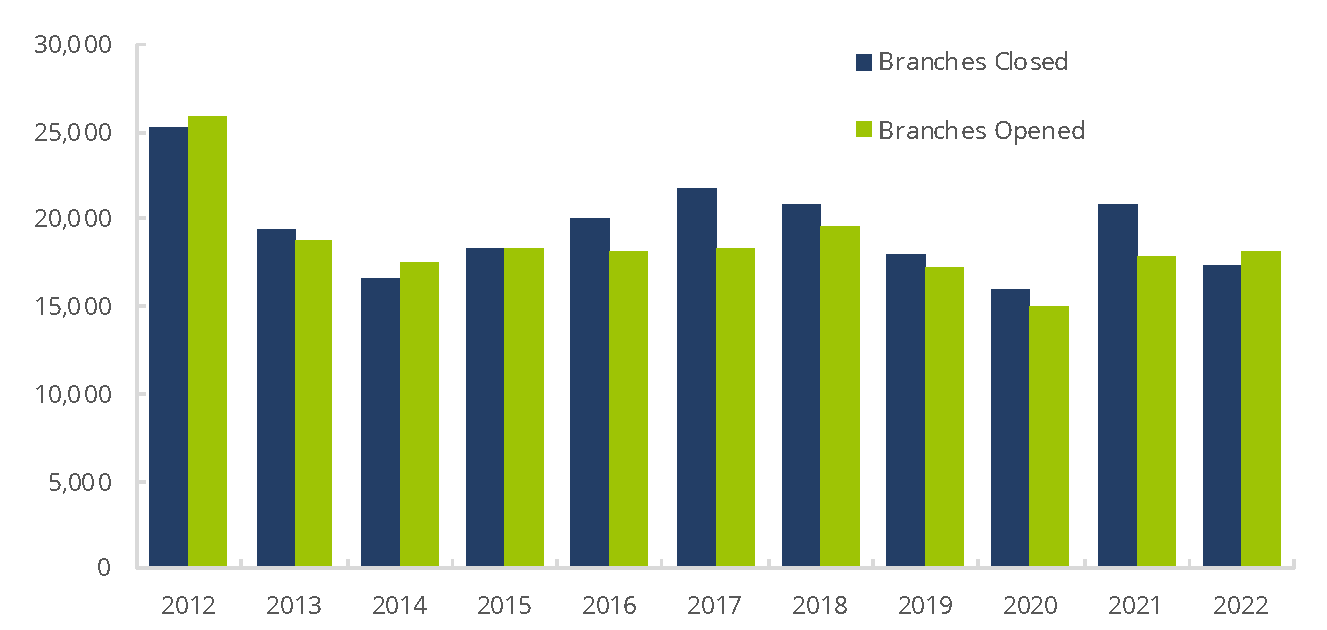

- Figure 2.2.4 FINRA-Registered Firm Branch Offices – Opening/Closing, 2012–2022

- Table 2.2.5 FINRA-Registered Firm Branch Offices – Opening/Closing, 2012–2022

2.3 Geographic Distribution- Figure 2.3.1 Geographic Distribution of Firms by Number of Branches, 2022

- Table 2.3.2 Branches By State/Region, 2018–2022

- Figure 2.3.3 Geographic Distribution of Firms by Headquarters, 2022

- Table 2.3.4 Geographic Distribution of Firms by Headquarters, 2018–2022

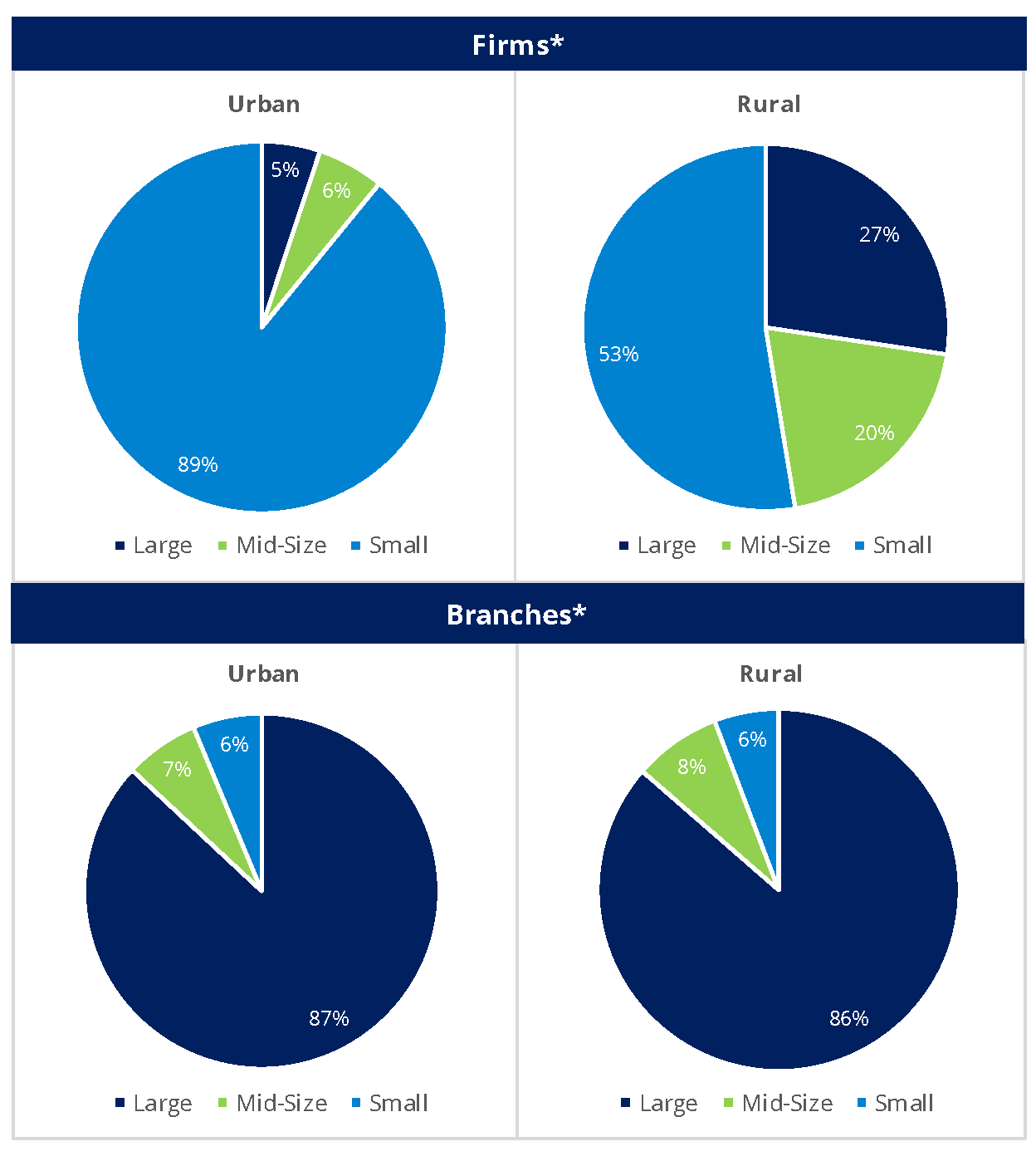

- Figure 2.3.5 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size—2022

- Table 2.3.6 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size—2022

2.4 Advertising and Products- Figure 2.4.1 Advertising Regulation Filing Volumes, 2018–2022

- Table 2.4.2 FINRA-Registered Firms – Most Common Marketing Methods Filed with FINRA, 2022

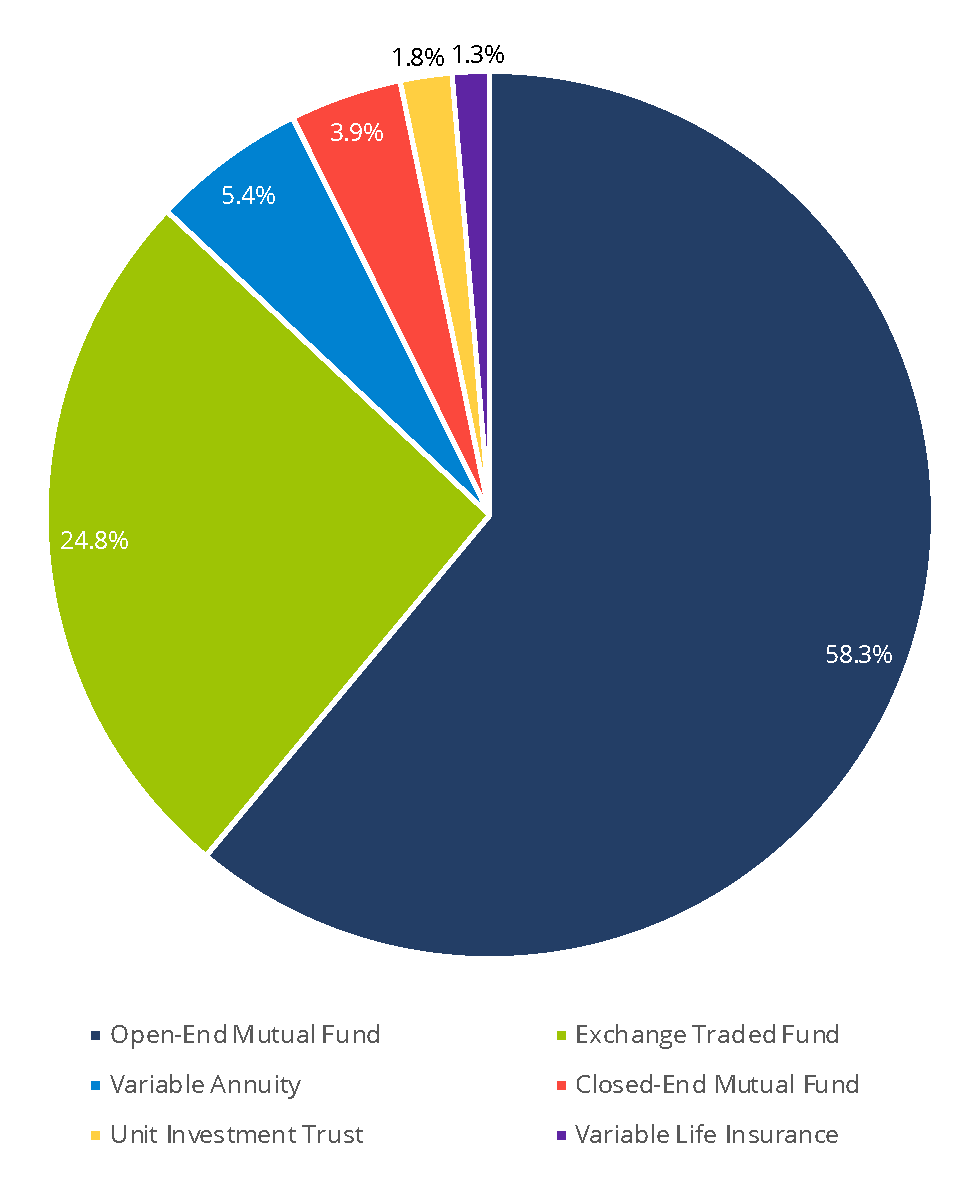

- Figure 2.4.3 Advertising Regulation Filing Volumes – Investment Company Product, 2022

- Table 2.4.4 Advertising Regulation Filing Volumes – Investment Company Product, 2022

- Table 2.4.5 Advertising Regulation Filing Volumes – Voluntary vs. Mandatory, 2018–2022

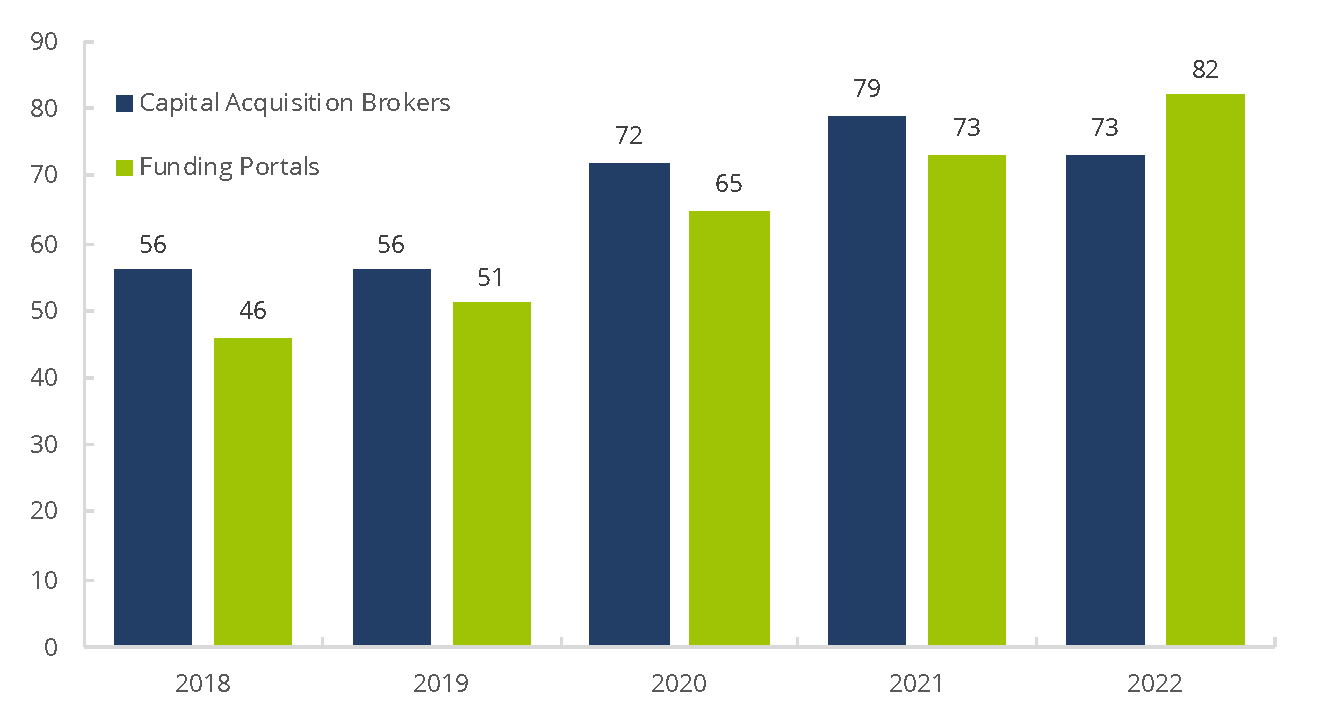

2.5 Capital Formation- Figure 2.5.1 Capital Acquisition Brokers and Funding Portals, 2018–2022

- Table 2.5.2 Total Number of Unique Corporate Financing Filings, 2018–2022

2.6 Business Segments- Table 2.6.1 Small Firms – Business Segments as of December 2022

- Table 2.6.2 Mid-Size Firms – Business Segments as of December 2022

- Table 2.6.3 Large Firms – Business Segments as of December 2022

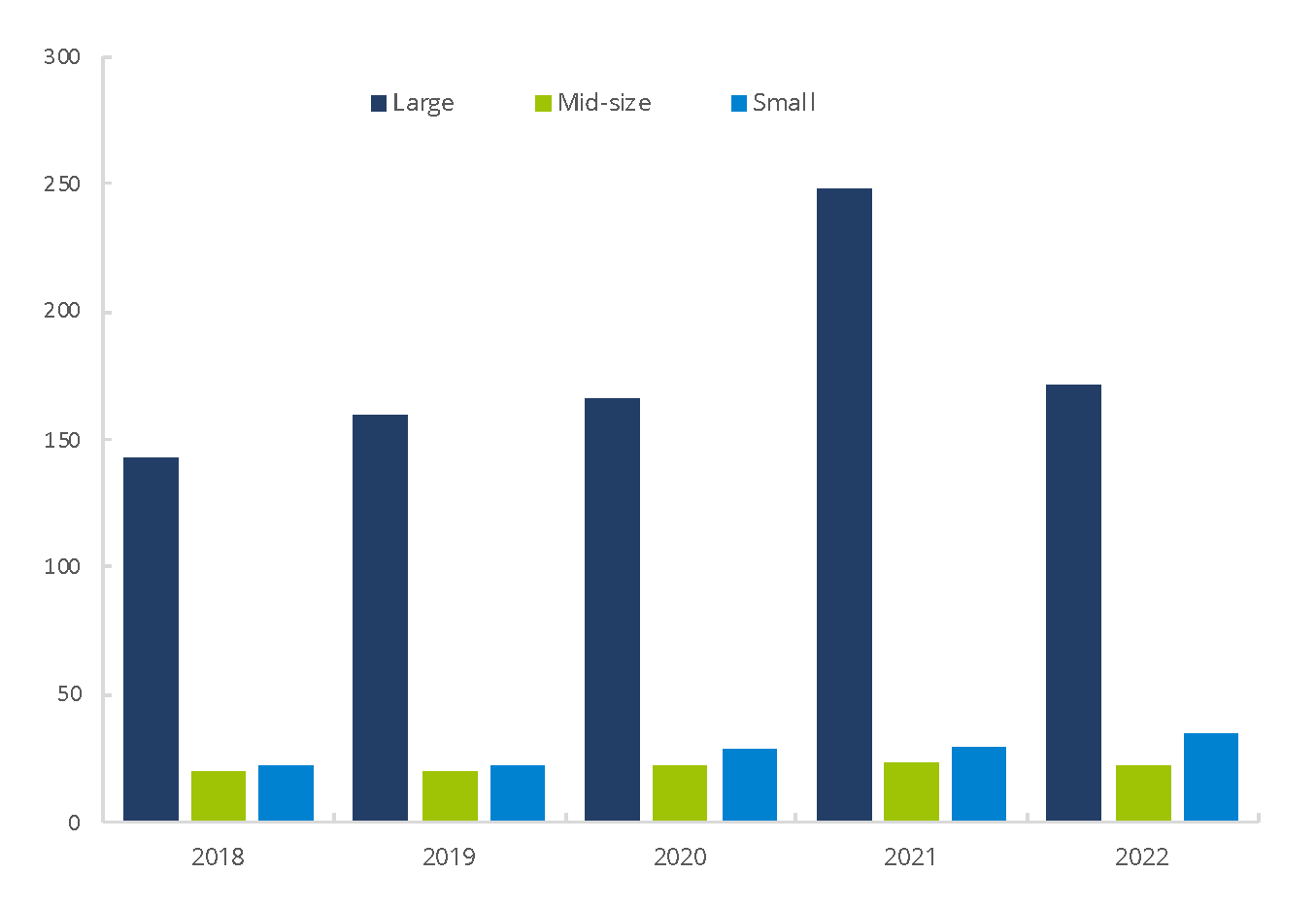

2.7 Financials- Figure 2.7.1 Excess Net Capital By Firm Size, 2018-2022

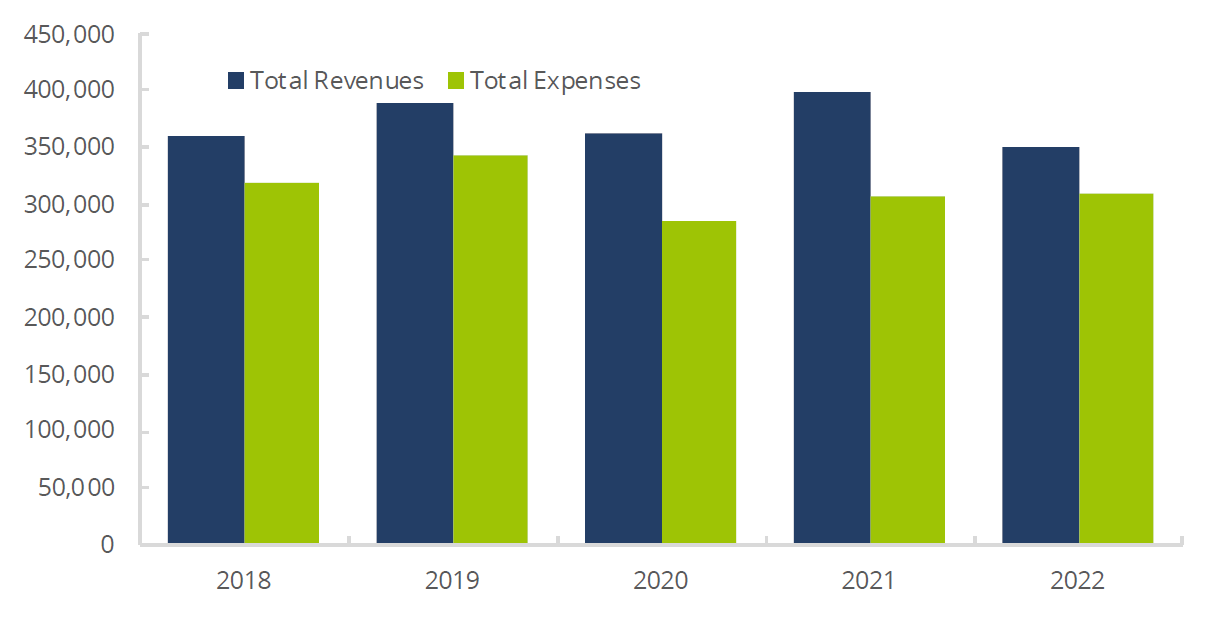

- Figure 2.7.2 FINRA-Registered Firms – Total Revenues and Expenses, 2018−2022

- Table 2.7.3 FINRA-Registered Firms – Aggregate Financial Information, 2018–2022

2.1 Sizes and Counts

Figure 2.1.1 Total Number of FINRA-Registered Firms, 2018−20221

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1 Firms conducting securities transactions and business with the investing public must be registered with FINRA. Firms must meet certain membership standards to attain registration.

Figure 2.1.2 Firm Distribution by Size, 2018−20221

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1 Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150 registered representatives.

Table 2.1.3 Firm Distribution by Size, 2018−20221

(Count as of year-end)

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Large | 173 | 168 | 165 | 161 | 165 |

| Mid-Size | 192 | 198 | 191 | 185 | 192 |

| Small | 3,242 | 3,151 | 3,079 | 3,048 | 3,021 |

| Total | 3,607 | 3,517 | 3,435 | 3,394 | 3,378 |

Source: Financial Industry Regulatory Authority.

1 Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150 registered representatives.

Figure 2.1.4 Securities Industry Registered Firms by Type of Registration, 2013−20221

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1 "Broker-Dealer Firms Only" refers to firms that are solely registered with FINRA as broker-dealers. "Dual Broker-Dealer and Investment-Adviser Firms" refers to FINRA-registered broker-dealers who are also registered as investment adviser firms. "Investment Adviser Firms Only" refers to firms that are registered only as investment advisers and are overseen by the SEC or state regulators. “Securities Industry Registered Firms” refers to the totality of registered firms.

Table 2.1.5 Securities Industry Registered Firms by Type of Registration, 2013−20221

(Counts as of year-end)

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Broker-Dealer Firms Only | 3,449 | 3,391 | 3,303 | 3,226 | 3,130 | 3,045 | 2,989 | 2,930 | 2,914 | 2,915 |

| Dual Broker-Dealer and Investment Advisers | 697 | 677 | 640 | 609 | 596 | 562 | 528 | 505 | 480 | 463 |

| All FINRA-Registered Broker-Dealer Firms | 4,146 | 4,068 | 3,943 | 3,835 | 3,726 | 3,607 | 3,517 | 3,435 | 3,394 | 3,378 |

| Investment Adviser Firms Only | 27,512 | 28,134 | 28,712 | 29,081 | 29,600 | 30,246 | 30,535 | 30,891 | 31,669 | 32,021 |

| Total Registered Firms | 31,658 | 32,202 | 32,655 | 32,916 | 33,326 | 33,853 | 34,052 | 34,326 | 35,063 | 35,399 |

Source: Financial Industry Regulatory Authority.

1 "Broker-Dealer Firms Only" refers to firms that are solely registered with FINRA as broker-dealers. "Dual Broker-Dealer and Investment-Adviser Firms" refers to FINRA-registered broker-dealers who are also registered as investment adviser firms. "Investment Adviser Firms Only" refers to firms that are registered only as investment advisers and are overseen by the SEC or state regulators. “Securities Industry Registered Firms” refers to the totality of registered firms.

Figure 2.1.6 Distribution of Branches by Firm Size, 2018−20221,2,3

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1 For each branch office, a FINRA-registered firm must file a Form BR (the Uniform Branch Office Registration Form).

2 Rule 3110(f) defines a branch office and non-branch location (or unregistered location). Under Rule 3110(f)(2)(A), a “branch office” is any location where one or more associated persons of a member conducts the business of effecting any transaction in, or inducing or attempting to induce the purchase or sale of any security or is held out as such. A branch office may be an office of supervisory jurisdiction (OSJ) if any one of the activities set forth under Rule 3110(f)(1) occurs at the location, or a supervisory branch office as set forth under Rule 3110(f)(2)(B).

3 Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150 registered representatives.

Table 2.1.7 Distribution of Branches by Firm Size, 2018−20221,2,3

(Counts as of year-end)

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Large | 133,760 | 132,758 | 132,719 | 130,295 | 130,674 |

| Mid-Size | 9,837 | 10,660 | 9,766 | 9,074 | 10,299 |

| Small | 11,064 | 10,489 | 10,376 | 10,518 | 9,674 |

| Total | 154,661 | 153,907 | 152,861 | 149,887 | 150,647 |

Source: Financial Industry Regulatory Authority.

1 For each branch office, a FINRA-registered firm must file a Form BR (the Uniform Branch Office Registration Form).

2 Rule 3110(f) defines a branch office and non-branch location (or unregistered location). Under Rule 3110(f)(2)(A), a “branch office” is any location where one or more associated persons of a member conducts the business of effecting any transaction in, or inducing or attempting to induce the purchase or sale of any security or is held out as such. A branch office may be an office of supervisory jurisdiction (OSJ) if any one of the activities set forth under Rule 3110(f)(1) occurs at the location, or a supervisory branch office as set forth under Rule 3110(f)(2)(B).

3 Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150 registered representatives.

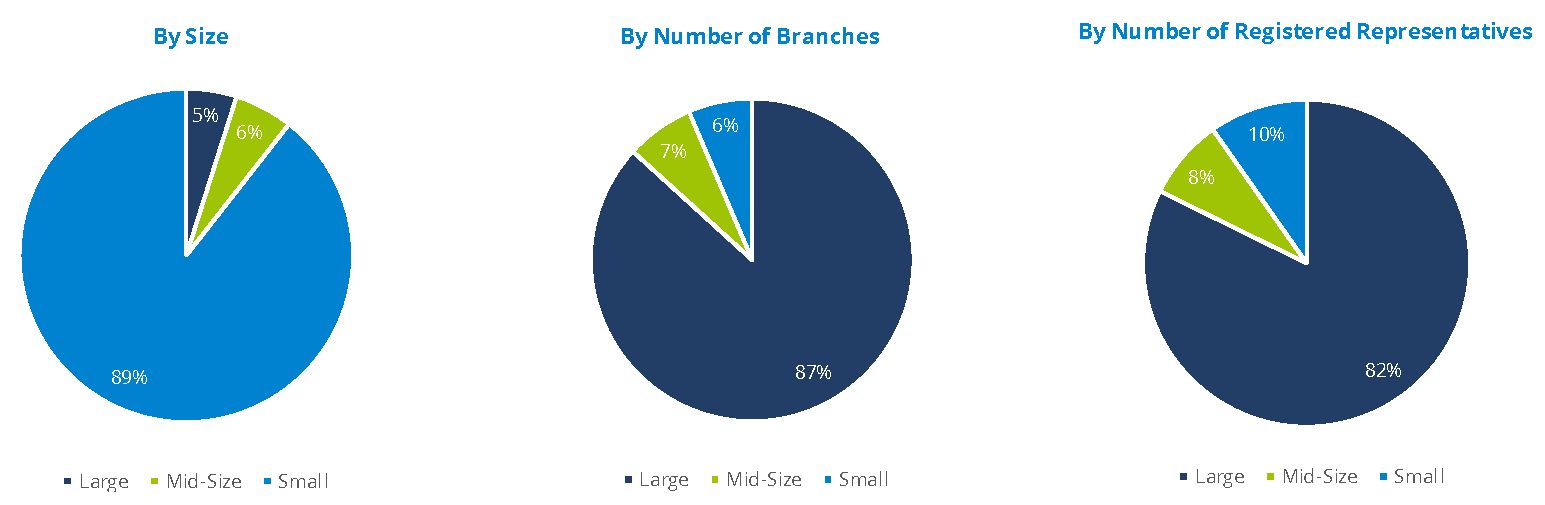

Figure 2.1.8 Firm Distribution by Specified Demographics, 2022

(As of year-end, percent of total)

Source: Financial Industry Regulatory Authority.

Table 2.1.9 Firm Distribution by Number of Registered Representatives: Additional Breakdown, 2018–2022

(Counts as of year-end)

| Number of Registered Representatives | 2018 | 2019 | 2020 | 2021 | 2022 |

| >1000 | 93 | 95 | 93 | 90 | 91 |

| 500-1000 | 80 | 73 | 72 | 71 | 74 |

| 301-499 | 65 | 69 | 66 | 63 | 66 |

| 151-300 | 127 | 129 | 125 | 122 | 126 |

| 101-150 | 101 | 107 | 112 | 125 | 102 |

| 76-100 | 94 | 83 | 78 | 74 | 90 |

| 51-75 | 165 | 157 | 174 | 174 | 158 |

| 41-50 | 100 | 100 | 102 | 109 | 99 |

| 31-40 | 167 | 159 | 133 | 140 | 142 |

| 26-30 | 129 | 114 | 119 | 110 | 102 |

| 21-25 | 155 | 164 | 124 | 133 | 156 |

| 16-20 | 257 | 236 | 248 | 224 | 200 |

| 11-15 | 378 | 370 | 374 | 365 | 361 |

| 10 or Fewer | 1,696 | 1,661 | 1,615 | 1,594 | 1,611 |

| Total | 3,607 | 3,517 | 3,435 | 3,394 | 3,378 |

Source: Financial Industry Regulatory Authority.

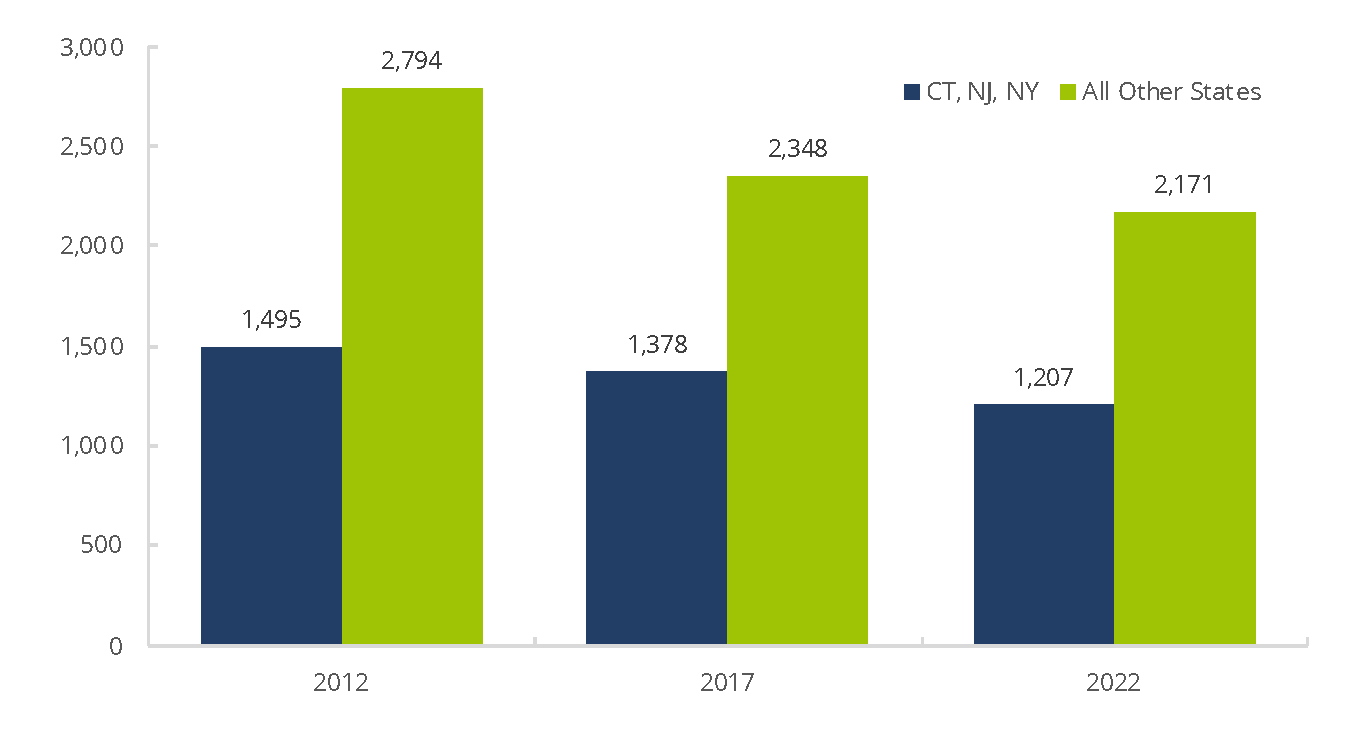

Figure 2.1.10 10-Year Change in Number of FINRA-Registered Firms, 2012−2022

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

2.2 Entrance and Exit of Firms

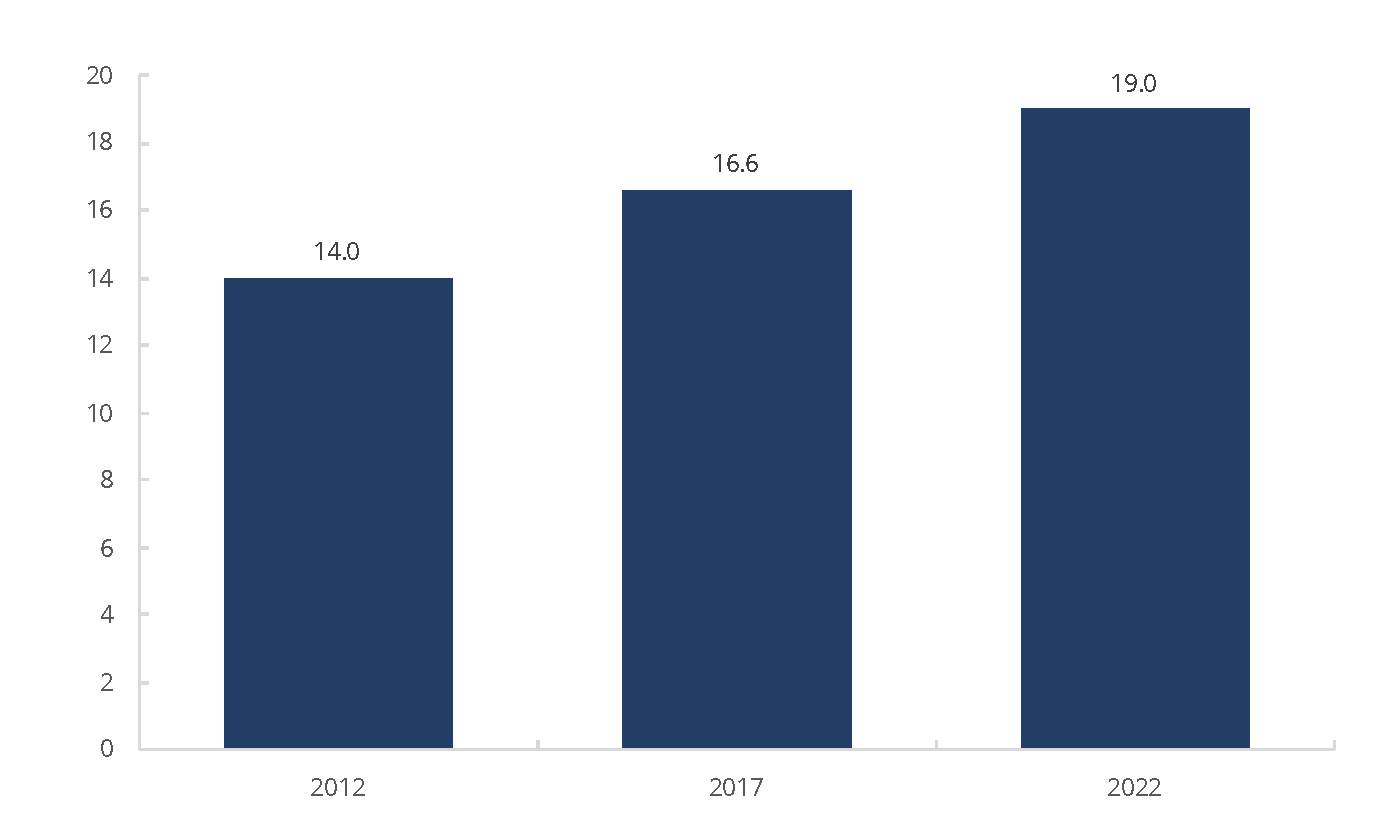

Figure 2.2.1 FINRA-Registered Firms – Median Number of Years in Business, 2012–2022

(As of year-end)

Source: Financial Industry Regulatory Authority.

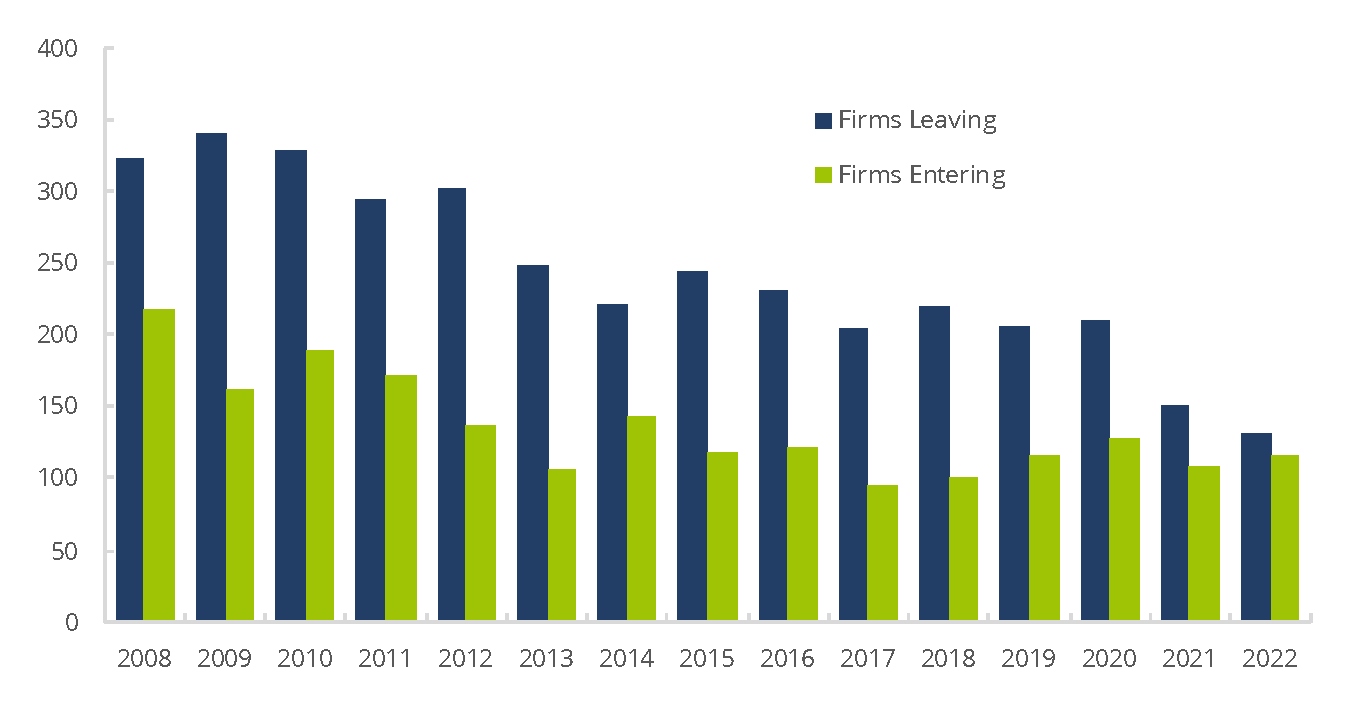

Figure 2.2.2 FINRA-Registered Firms – Leaving/Entering the Industry, 2008–2022

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

Table 2.2.3 FINRA-Registered Firms – Leaving/Entering the Industry, 2008–2022

(Count as of year-end)

| Year | Firms Leaving | Percent of Total | Firms Entering | Percent of Total | End of Year Total Firms |

| 2008 | 324 | 7% | 218 | 4% | 4,896 |

| 2009 | 341 | 7% | 162 | 3% | 4,717 |

| 2010 | 329 | 7% | 189 | 4% | 4,577 |

| 2011 | 294 | 7% | 172 | 4% | 4,455 |

| 2012 | 303 | 7% | 137 | 3% | 4,289 |

| 2013 | 249 | 6% | 106 | 3% | 4,146 |

| 2014 | 222 | 5% | 144 | 4% | 4,068 |

| 2015 | 244 | 6% | 119 | 3% | 3,943 |

| 2016 | 231 | 6% | 123 | 3% | 3,835 |

| 2017 | 205 | 5% | 96 | 3% | 3,726 |

| 2018 | 219 | 6% | 100 | 3% | 3,607 |

| 2019 | 206 | 6% | 116 | 3% | 3,517 |

| 2020 | 210 | 6% | 128 | 4% | 3,435 |

| 2021 | 150 | 4% | 109 | 3% | 3,394 |

| 2022 | 132 | 4% | 116 | 3% | 3,378 |

Source: Financial and Operational Combined Uniform Single (FOCUS) Reports.

Figure 2.2.4 FINRA-Registered Firm Branch Offices – Opening/Closing, 2012–2022

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1 Notes Text 1

Table 2.2.5 FINRA-Registered Firm Branch Offices – Opening/Closing, 2012–2022

(Count as of year-end)

| Year | Branches Closed | Percent of Total | Branches Opened | Percent of Total | End of Year Total Branches |

| 2012 | 25,193 | 16% | 25,939 | 16% | 161,149 |

| 2013 | 19,382 | 12% | 18,711 | 12% | 160,478 |

| 2014 | 16,554 | 10% | 17,522 | 11% | 161,446 |

| 2015 | 18,296 | 11% | 18,242 | 11% | 161,392 |

| 2016 | 20,103 | 13% | 18,175 | 11% | 159,464 |

| 2017 | 21,797 | 14% | 18,300 | 12% | 155,967 |

| 2018 | 20,875 | 14% | 19,569 | 13% | 154,661 |

| 2019 | 17,979 | 12% | 17,225 | 11% | 153,907 |

| 2020 | 15,987 | 10% | 14,941 | 10% | 152,861 |

| 2021 | 20,847 | 14% | 17,873 | 12% | 149,887 |

| 2022 | 17,334 | 12% | 18,094 | 12% | 150,647 |

Source: Financial Industry Regulatory Authority.

2.3 Geographic Distribution

Figure 2.3.1 Geographic Distribution of Firms by Number of Branches, 2022

Table 2.3.2 Branches By State/Region, 2018–2022

Figure 2.3.3 Geographic Distribution of Firms by Headquarters, 20221

Table 2.3.4 Geographic Distribution of Firms by Headquarters, 2018–2022

Figure 2.3.5 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size—20221,2

(Percent of total, as of year-end)

Sources: U.S. Census Bureau; Financial Industry Regulatory Authority.

* A firm is counted if it has a branch in that area. Not included are firms and branches that do not report a zip code in CRD.

1 Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-400 registered representatives; Small Firm = 1-150 registered representatives.

2 Branch and firm zip codes are linked to the 2010 Urban Area to Zip Code Tabulation Area (ZCTA) Relationship File. The Census Bureau identifies two types of urban areas: i) Urbanized Areas (UAs) of 50,000 or more people; ii) Urban Clusters (UCs) of at least 2,500 and less than 50,000 people. "Rural" encompasses all population, housing, and territory not included within an urban area. Zip codes formed since 2010 default to rural status.

Table 2.3.6 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size—20221,2

(Count as of year-end)

| Firms* | Branches* | |||||||

| Urban | % Urban | Rural | % Rural | Urban | % Urban | Rural | % Rural | |

| Large | 164 | 5% | 116 | 27% | 126,457 | 87% | 4,129 | 86% |

| Mid-Size | 188 | 6% | 85 | 20% | 9,829 | 7% | 374 | 8% |

| Small | 2,871 | 89% | 223 | 53% | 9,161 | 6% | 276 | 6% |

| Total | 3,223 | 100% | 424 | 100% | 145,447 | 100% | 4,779 | 100% |

Sources: U.S. Census Bureau; Financial Industry Regulatory Authority.

* A firm is counted if it has a branch in that area. Not included are firms and branches that do not report a zip code in CRD.

1 Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-400 registered representatives; Small Firm = 1-150 registered representatives.

2 Branch and firm zip codes are linked to the 2010 Urban Area to Zip Code Tabulation Area (ZCTA) Relationship File. The Census Bureau identifies two types of urban areas: i) Urbanized Areas (UAs) of 50,000 or more people; ii) Urban Clusters (UCs) of at least 2,500 and less than 50,000 people. "Rural" encompasses all population, housing, and territory not included within an urban area. Zip codes formed since 2010 default to rural status.

3 All the numbers were revised to correct an error. The error was corrected on August 23, 2023.

2.4 Advertising and Products

Figure 2.4.1 Advertising Regulation Filing Volumes, 2018–20221

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1 Based on communications filed by broker-dealers for review by FINRA's Advertising Regulation Department ("Filings"). The filing requirements were modified in January 2017 as part of a retrospective review of the Communications with the Public Rules, as described in Regulatory Notice 16-41.

Table 2.4.2 FINRA-Registered Firms – Most Common Marketing Methods Filed with FINRA, 2022

| Marketing Methods | Total for Period 2022 |

| Acct statement related communications | 120 |

| Articles & 3rd party reprints | 568 |

| Audio/Video tapes, CDs & DVDs | 1,155 |

| Brochures, pamphlets, & catalogs | 4,002 |

| Broker Dealer use only material | 38 |

| Business related stationery | 13 |

| E-mail, IM, SMS or text messages | 3,651 |

| Flyers & other hand delivered material | 3,303 |

| Fund specific information sheet(s) | 14,382 |

| Information released to the press | 800 |

| Mailed sales material | 2,149 |

| Periodic & other performance reports | 3,742 |

| Print ads, posters, & signs | 366 |

| Radio ads & radio broadcasts | 80 |

| Research reports - equity & debt | 520 |

| Seminar related communications | 1,700 |

| Software output & IA Tools | 448 |

| TV ads & TV broadcasts | 119 |

| Telemarketing & other phone scripts | 10 |

| Web information password protected | 608 |

| Web information public access | 26,336 |

| Total | 64,110 |

Source: Financial Industry Regulatory Authority.

Figure 2.4.3 Advertising Regulation Filing Volumes – Investment Company Product, 2022

(Percentage of Total Filings)

Source: Financial Industry Regulatory Authority.

1 Notes Text 1

Table 2.4.4 Advertising Regulation Filing Volumes – Investment Company Product, 2022

| Investment Company Product Types | Percentage of Total Filings |

| Total Registered Investment Company Products | 95.5% |

| Total Non-Registered Investment Company Products | 4.5% |

Source: Financial Industry Regulatory Authority.

Table 2.4.5 Advertising Regulation Filing Volumes – Voluntary vs. Mandatory, 2018–2022

(Count as of year-end)

| Filing Type | 2018 | 2019 | 2020 | 2021 | 2022 |

| Mandatory | 59,833 | 55,211 | 52,583 | 54,529 | 55,117 |

| Voluntary | 12,350 | 12,360 | 10,463 | 9,950 | 8,993 |

Source: Financial Industry Regulatory Authority.

2.5 Capital Formation

Figure 2.5.1 Capital Acquisition Brokers and Funding Portals, 2018–20221

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1 Capital Acquisition Brokers (CABs) engage in a limited range of activities, essentially advising companies and private equity funds on capital raising and corporate restructuring, and acting as a placement agent for sales of unregistered securities to institutional investors under limited conditions. The CAB rule took effect in 2017. Funding Portals (FPs) also engage in a limited range of activities: those prescribed under to JOBS Act and the SEC's Regulation Crowdfunding. The FP rule took effect in 2016.

Table 2.5.2 Total Number of Unique Corporate Financing Filings, 2018–20221,2,3

(Count as of year-end)

| Filing Type | 2018 | 2019 | 2020 | 2021 | 2022 |

| Total Public Offerings (FINRA Rule 5110) | 1,524 | 1,604 | 2,304 | 2,901 | 1,398 |

| Member Private Offerings (FINRA Rule 5122) | 99 | 60 | 51 | 47 | 45 |

| Private Placements of Securities (FINRA Rule 5123) | 2,372 | 2,449 | 2,300 | 3,822 | 3,807 |

Source: Financial Industry Regulatory Authority.

* The total number of unique corporate financing filings (not including amendments to filings) received by the Corporate Financing Department.

1 FINRA Rule 5110 requires all public offerings in which a member participates to be filed with FINRA for review, except as exempted from the filing requirement under paragraph (h).

2 FINRA Rule 5122 requires firms that offer or sell retail private placements of their own securities or that of a control entity to file offering documents and information about the issuer, the offering and the selling firms before the documents are provided to investors, except as exempted from the filing requirements under section (C).

3 FINRA Rule 5123 requires firms that sell non-proprietary, retail private placements to file with FINRA's Corporate Financing Department within 15 calendar days of the date of first sale, offering documents and information about the issuer, the offering and the selling firms, except as exempted from the filing requirements under section (B).

2.6 Business Segments

Table 2.6.1 Small Firms – Business Segments as of December 20221

| Firm Grouping | Firm Sub-Grouping | Number of Firms |

| Capital Markets and Investment Banking Services | M&A and Investment Banking | 719 |

| Capital Markets and Investment Banking Services | Private Placements - Institutional Investors | 319 |

| Capital Markets and Investment Banking Services | Product Originator and Wholesaler | 199 |

| Capital Markets and Investment Banking Services | Niche/Other - CMIB | 101 |

| Capital Markets and Investment Banking Services | Public Finance | 43 |

| Clearing and Carrying | Chaperone - 15a-6 Firms | 75 |

| Clearing and Carrying | Securities Financing Book | 18 |

| Clearing and Carrying | Niche/Other - Clearing | 17 |

| Clearing and Carrying | Correspondent Clearing | 16 |

| Diversified | Small Diversified | 71 |

| Diversified | Medium Diversified - Carrying/Clearing | 13 |

| Diversified | Medium Diversified - Non-Carrying/Clearing | 5 |

| Diversified | Large Diversified | 2 |

| Retail | Retail Small | 350 |

| Retail | Public Pooled Investment Vehicles and Variable Annuities | 218 |

| Retail | Retail Small - Independent Contractor | 201 |

| Retail | Private Placements | 191 |

| Retail | Fintech | 64 |

| Retail | Retail with Carrying/Clearing Activities | 29 |

| Retail | Retail Mid-Size & Large - Independent Contractor | 4 |

| Retail | Retail Mid-Size & Large | 3 |

| Trading and Execution | Institutional Brokerage | 249 |

| Trading and Execution | Medium/Small Proprietary Trading and Market-Making | 58 |

| Trading and Execution | Alternative Trading Systems (ATS's) and Electronic Communication Networks (ECN's) | 43 |

| Trading and Execution | Large Proprietary Trading and Market-Making | 12 |

| Total | 3,020 |

Source: Financial Industry Regulatory Authority.

* The definition of firm size in FINRA’s By-Laws may differ from the Member Firm Business Segment definitions, which may consider total assets and/or total revenue in categorizing a firm.

1 Small Firm = 1-150 registered representatives.

Table 2.6.2 Mid-Size Firms – Business Segments as of December 20221

| Firm Grouping | Firm Sub-Grouping | Number of Firms |

| Capital Markets and Investment Banking Services | Product Originator and Wholesaler | 45 |

| Capital Markets and Investment Banking Services | M&A and Investment Banking | 15 |

| Capital Markets and Investment Banking Services | Niche/Other - CMIB | 1 |

| Capital Markets and Investment Banking Services | Public Finance | 1 |

| Clearing and Carrying | Correspondent Clearing | 2 |

| Clearing and Carrying | Chaperone - 15a-6 Firms | 1 |

| Clearing and Carrying | Niche/Other - Clearing | 1 |

| Diversified | Medium Diversified - Carrying/Clearing | 13 |

| Diversified | Medium Diversified - Non-Carrying/Clearing | 9 |

| Diversified | Small Diversified | 5 |

| Retail | Retail Mid-Size & Large - Independent Contractor | 43 |

| Retail | Retail Mid-Size & Large | 13 |

| Retail | Public Pooled Investment Vehicles and Variable Annuities | 11 |

| Retail | Retail Small - Independent Contractor | 7 |

| Retail | Retail with Carrying/Clearing Activities | 2 |

| Retail | Private Placements | 2 |

| Retail | Fintech | 1 |

| Retail | Retail Small | 1 |

| Trading and Execution | Institutional Brokerage | 12 |

| Trading and Execution | Large Proprietary Trading and Market-Making | 4 |

| Trading and Execution | Medium/Small Proprietary Trading and Market-Making | 3 |

| Total | 192 |

Source: Financial Industry Regulatory Authority.

* The definition of firm size in FINRA’s By-Laws may differ from the Member Firm Business Segment definitions, which may consider total assets and/or total revenue in categorizing a firm.

1 Mid-Size Firm = 151-499 registered representatives.

Table 2.6.3 Large Firms – Business Segments as of December 20221

| Firm Grouping | Firm Sub-Grouping | Number of Firms |

| Capital Markets and Investment Banking Services | Product Originator and Wholesaler | 20 |

| Capital Markets and Investment Banking Services | M&A and Investment Banking | 2 |

| Capital Markets and Investment Banking Services | Private Placements - Institutional Investors | 1 |

| Clearing and Carrying | Correspondent Clearing | 3 |

| Diversified | Medium Diversified - Carrying/Clearing | 24 |

| Diversified | Large Diversified | 13 |

| Diversified | Medium Diversified - Non-Carrying/Clearing | 5 |

| Retail | Retail Mid-Size & Large - Independent Contractor | 38 |

| Retail | Public Pooled Investment Vehicles and Variable Annuities | 29 |

| Retail | Retail Mid-Size & Large | 16 |

| Retail | Retail with Carrying/Clearing Activities | 9 |

| Retail | Fintech | 1 |

| Retail | Private Placements | 1 |

| Trading and Execution | Large Proprietary Trading and Market-Making | 2 |

| Total | 161 |

Source: Financial Industry Regulatory Authority.

* The definition of firm size in FINRA’s By-Laws may differ from the Member Firm Business Segment definitions, which may consider total assets and/or total revenue in categorizing a firm.

1 Large Firm = 500 or more registered representatives.

2.7 Financials

Figure 2.7.1 Excess Net Capital By Firm Size, 2018-2022

(Dollar Volume as of year-end, in billions of U.S. dollars)

Source: Financial Industry Regulatory Authority.

Figure 2.7.2 FINRA-Registered Firms – Total Revenues and Expenses, 2018−2022

(In millions of U.S. dollars)

Source: Financial and Operational Combined Uniform Single (FOCUS) Reports.

1 Notes Text 1

Table 2.7.3 FINRA-Registered Firms – Aggregate Financial Information, 2018–2022

(In millions of U.S. dollars, as of year-end)

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Total Revenues | $361,089.37 | $388,153.64 | $361,954.09 | $398,549.66 | $350,516.97 |

| Total Expenses | $318,309.31 | $344,209.98 | $284,684.68 | $306,908.83 | $308,192.48 |

| Pre-Tax Net Income | $42,780.06 | $43,943.66 | $77,269.41 | $91,640.83 | $42,324.49 |

Source: Financial and Operational Combined Uniform Single (FOCUS) Reports.