Market Data

Table of Contents

3.1 National Market System- Table 3.1.1 Shares of National Market Systems (NMS) Stocks Trading Summary, 2018–2022

- Table 3.1.2 National Market Systems (NMS) Stocks Trading by Venue Type, 2019–2022

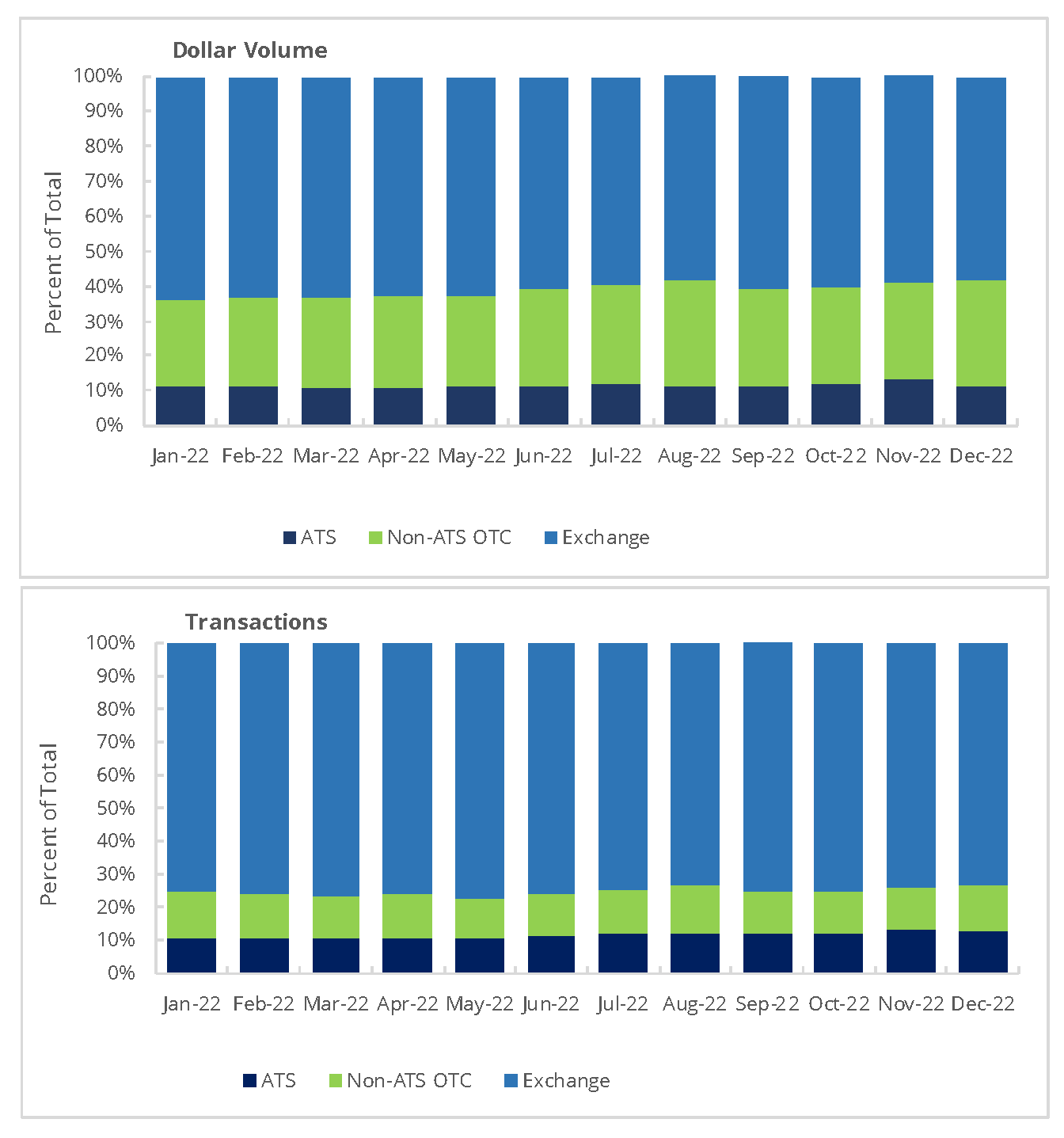

- Figure 3.1.3 Monthly National Market Systems (NMS) Stocks Trading by Venue Type

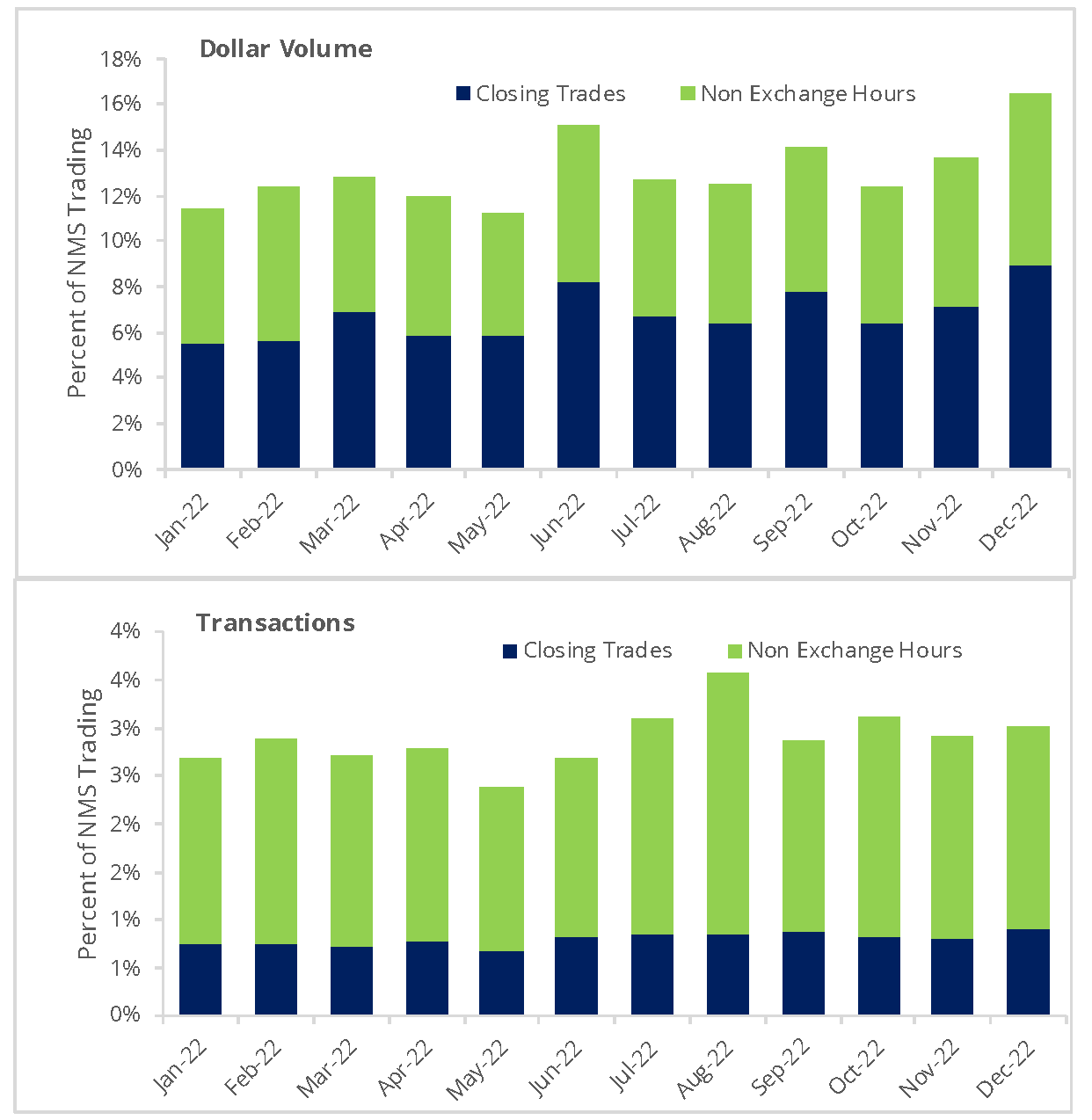

- Figure 3.1.4 Monthly National Market Systems (NMS) Stocks Trading Outside of Normal Hours

- Table 3.1.5 National Market Systems (NMS) Stocks Trading by Product Type, 2022

3.2 OTC Equity- Table 3.2.1 Over-the-Counter (OTC) Equities Market Statistics, 2018–2022

- Figure 3.2.2 Monthly OTC Equities Trading by Venue Type

3.3 Fixed Income Activity- Table 3.3.1 TRACE Reported Fixed Income Activity by Product Type and Venue Type, 2019–2022

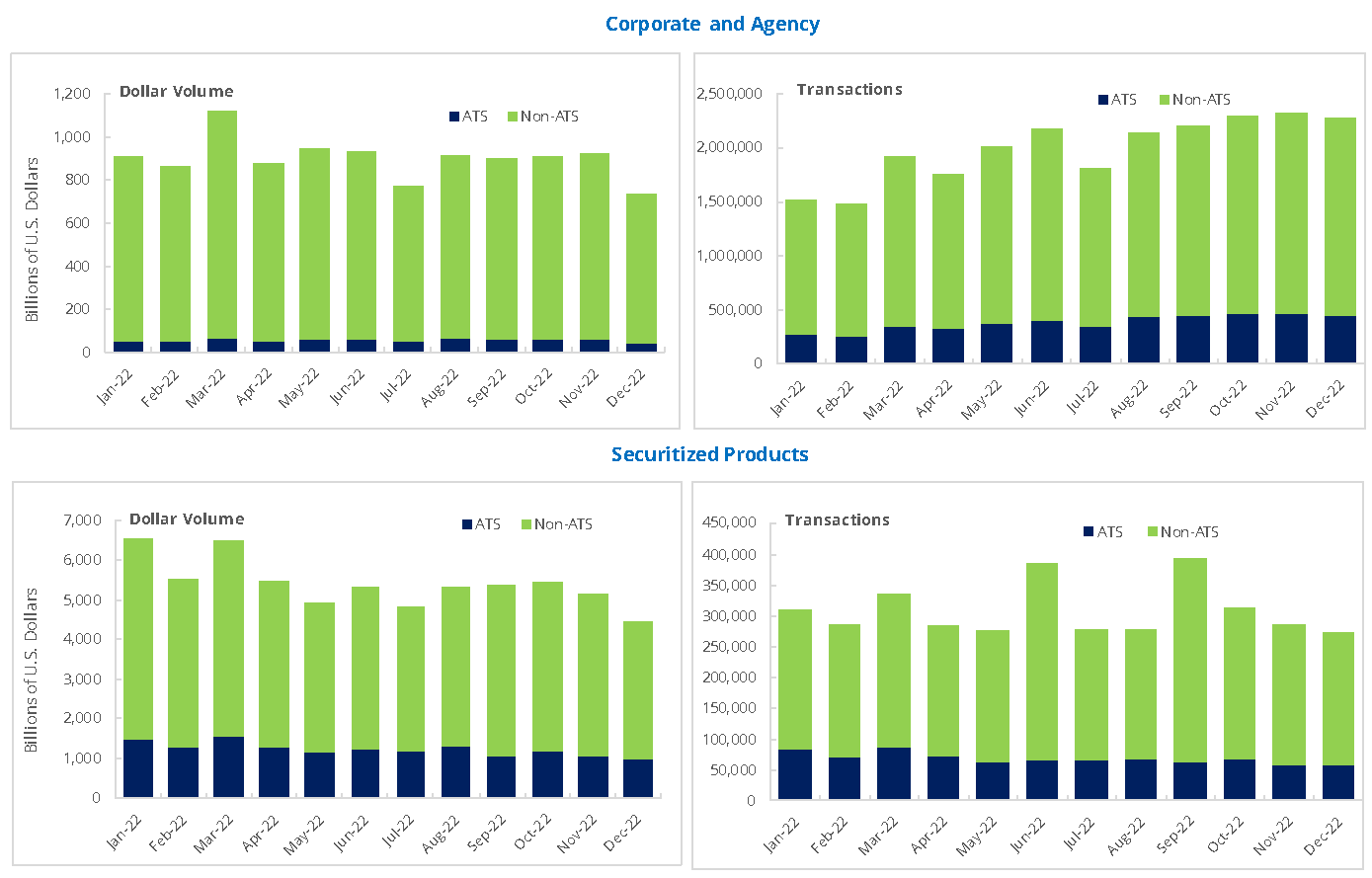

- Figure 3.3.2 Monthly TRACE Reported Fixed Income Activity By Product Type and Venue Type

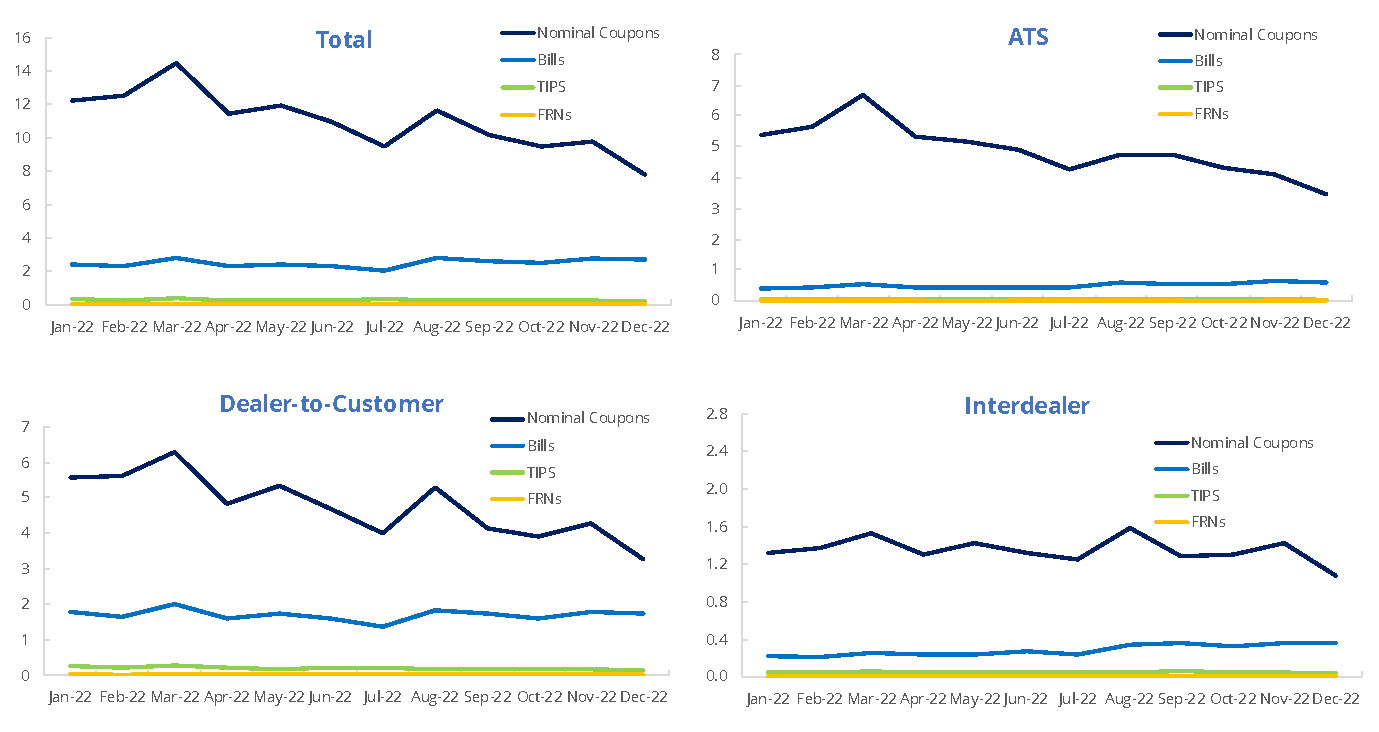

- Figure 3.3.3 Monthly U.S. Treasuries Dollar Volumes by Participant-to-Trade Type and Product Type

- Figure 3.3.4 U.S. Treasuries Dollar Volumes by Product Type and Participant-to-Trade Type, 2022

3.1 National Market System

Table 3.1.1 Shares of National Market Systems (NMS) Stocks Trading Summary, 2018–2022

| Year | Total Consolidated Shares Volume | Total OTC Shares Volume 1 | % OTC |

| 2018 | 1,841,855,556,392 | 668,455,710,212 | 36.3% |

| 2019 | 1,771,096,807,512 | 659,344,146,179 | 37.2% |

| 2020 | 2,773,109,114,496 | 1,150,323,435,489 | 41.5% |

| 2021 | 2,874,893,079,386 | 1,255,101,462,172 | 43.7% |

| 2022 | 2,980,822,029,407 | 1,250,660,913,156 | 42.0% |

Source: UTP Trade Data Feed and Consolidated Tape System. Data as of February 2023.

1 OTC includes all FINRA facilities (the FINRA/Nasdaq TRF, the FINRA/NYSE TRF and the FINRA Alternative Display Facility).

Table 3.1.2 National Market Systems (NMS) Stocks Trading by Venue Type, 2019–2022

| 2019 | 2020 | 2021 | 2022 | ||

| Avg. Daily Transactions | Exchange | 28,318,018 | 43,086,738 | 51,276,383 | 51,447,764 |

| Alternative Trading Systems | 4,421,323 | 6,283,268 | 7,791,035 | 7,866,283 | |

| Non-Alternative Trading Systems OTC | 3,638,730 | 9,282,650 | 13,141,709 | 11,667,571 | |

| Total | 36,378,071 | 58,652,656 | 72,209,126 | 70,981,618 | |

| Avg. Daily Volume (in $ billions) | Exchange | 209.1 | 296.3 | 368.0 | 364.7 |

| Alternative Trading Systems | 39.8 | 54.4 | 65.6 | 67.4 | |

| Non-Alternative Trading Systems OTC | 74.3 | 130.4 | 153.9 | 181.0 | |

| Total | 323.2 | 481.0 | 587.5 | 613.0 |

Source: Financial Industry Regulatory Authority. Data as of February 2023.

1 Data from before H2 2021 was based on OATs data. From H2 2021 onward it was based on trading activity reported to CAT.

Figure 3.1.3 Monthly National Market Systems (NMS) Stocks Trading by Venue Type

(January 3, 2022 − December 30, 2022)

Source: Financial Industry Regulatory Authority. Data as of February 2023.

1 Data is based on trading activity reported to CAT.

2 ATS stands for Alternative Trading Systems.

Figure 3.1.4 Monthly National Market Systems (NMS) Stocks Trading Outside of Normal Hours1

(January 3, 2022 − December 30, 2022)

Source: Financial Industry Regulatory Authority. Data as of February 2023.

1Data is based on trading activity reported to CAT.

2 Closing trades are trades executed in an exchange's closing auction and are timestamped post-close. In the past they have been included in non-exchange hours trades but are now separated out for improved clarity.

Table 3.1.5 National Market Systems (NMS) Stocks Trading by Product Type, 20221,2,3,4

(January 3, 2022 − December 30, 2022)

| Dollar Volumes by Subtype (in $ billions) | ||||

| Month | ADR1 | Common Stock | ETP2 | Other3 |

| January | 535 | 9,172 | 5,256 | 257 |

| February | 416 | 8,426 | 4,480 | 243 |

| March | 693 | 9,804 | 5,088 | 280 |

| April | 418 | 7,679 | 4,059 | 234 |

| May | 408 | 8,417 | 4,778 | 278 |

| June | 460 | 7,308 | 3,786 | 249 |

| July | 338 | 5,907 | 2,977 | 189 |

| August | 391 | 6,893 | 3,039 | 208 |

| September | 323 | 6,612 | 3,602 | 235 |

| October | 354 | 6,484 | 3,600 | 213 |

| November | 383 | 6,620 | 3,297 | 200 |

| December | 343 | 6,007 | 3,153 | 204 |

Source: Financial Industry Regulatory Authority. Data as of February 2023.

1 Data is based on trading activity as reported to CAT and processed by FINRA SRO.

2 ADR stands for American Depository Receipts, and does not include global depository shares.

3 ETP stands for Exchange Traded Products, and includes Exchange Traded Funds, Exchange Traded Notes and debt securities traded on the exchange.

4 “Other” is primarily made up of real estate investment trusts (REITs), closed ended funds, limited partnerships, preferred stocks, warrants and global depository shares.

3.2 OTC Equity

Table 3.2.1 Over-the-Counter (OTC) Equities Market Statistics, 2018–20221

(Counts as of year-end)

| Year | Average Daily OTC Equities Share Volume | Average Daily OTC Equities Dollar Volume ($) | Average Daily OTC Equities Transactions |

| 2018 | 8,406,120,277 | $1,499,965,855 | 207,586 |

| 2019 | 6,013,676,971 | $1,307,456,314 | 177,445 |

| 2020 | 11,559,398,546 | $1,793,274,433 | 319,598 |

| 2021 | 39,554,616,558 | $2,878,628,236 | 623,571 |

| 2022 | 9,156,103,157 | $2,043,960,223 | 304,617 |

Source: FINRA OTCE Market Statistics. Data as of February 2023.

1 Differences in historical series reflect changes in underlying data.

Figure 3.2.2 Monthly OTC Equities Trading by Venue Type

(January 3, 2022 − December 30, 2022)

Source: Financial Industry Regulatory Authority. Data as of February 2023.

3.3 Fixed Income Activity

Table 3.3.1 TRACE Reported Fixed Income Activity by Product Type and Venue Type, 2019–20221

| Corporate and Agency | 2019 | 2020 | 2021 | 2022 | |

| Avg. Daily Transactions | Alternative Trading Systems | 13,884 | 12,427 | 11,724 | 18,241 |

| Non-Alternative Trading Systems | 55,339 | 57,560 | 55,592 | 76,900 | |

| Total | 69,223 | 69,987 | 67,316 | 95,140 | |

| Avg. Daily Volume (in $ billions) | Alternative Trading Systems | 2.1 | 2.9 | 3.6 | 2.7 |

| Non-Alternative Trading Systems | 37.7 | 43.4 | 38.8 | 40.3 | |

| Total | 39.8 | 46.4 | 42.4 | 43.1 | |

| Securitized Products | 2019 | 2020 | 2021 | 2022 | |

| Avg. Daily Transactions | Alternative Trading Systems | 4,744 | 3,960 | 3,267 | 3,251 |

| Non-Alternative Trading Systems | 9,513 | 9,784 | 10,175 | 11,475 | |

| Total | 14,256 | 13,744 | 13,443 | 14,727 | |

| Avg. Daily Volume (in $ billions) | Alternative Trading Systems | 69.0 | 67.9 | 60.7 | 59.3 |

| Non-Alternative Trading Systems | 198.9 | 247.0 | 240.9 | 199.7 | |

| Total | 267.9 | 314.9 | 301.6 | 258.9 | |

Source: Financial Industry Regulatory Authority. Data as of February 2023.

1 The Trade Reporting and Compliance Engine (TRACE) facilitates the mandatory reporting of over-the-counter secondary market transactions in eligible fixed income securities. Differences in historical series reflect changes in underlying data.

Figure 3.3.2 Monthly TRACE Reported Fixed Income Activity By Product Type and Venue Type1

(January 3, 2022 − December 30, 2022)

Source: Financial Industry Regulatory Authority. Data as of February 2023.

1 The Trade Reporting and Compliance Engine (TRACE) facilitates the mandatory reporting of over-the-counter secondary market transactions in eligible fixed income securities.

Figure 3.3.3 Monthly U.S. Treasuries Dollar Volumes by Participant-to-Trade Type and Product Type1,2

(January 3, 2022 − December 30, 2022; In trillions of USD)

Source: Financial Industry Regulatory Authority. Data as of February 2023.

1 The “ATS" and "Interdealer” categories include the sell side of a trade when, respectively, (1) a trade is executed on an ATS (including ATS sales to non-members or non-member affiliates) or (2) a trade is executed between FINRA members outside of an ATS (i.e. dealer-to-dealer trades). These categories exclude a FINRA member sell to an ATS. This approach takes into account multiple reporting of trades where a trade involves an ATS or both sides are FINRA members.

2 The “Dealer-to-Customer” category includes all trades (buys and sells) reported by a FINRA member against non-members or non-member affiliates. The category excludes ATS transactions with non-members and non-member affiliates (those trades are represented in the “ATS" category as noted above).

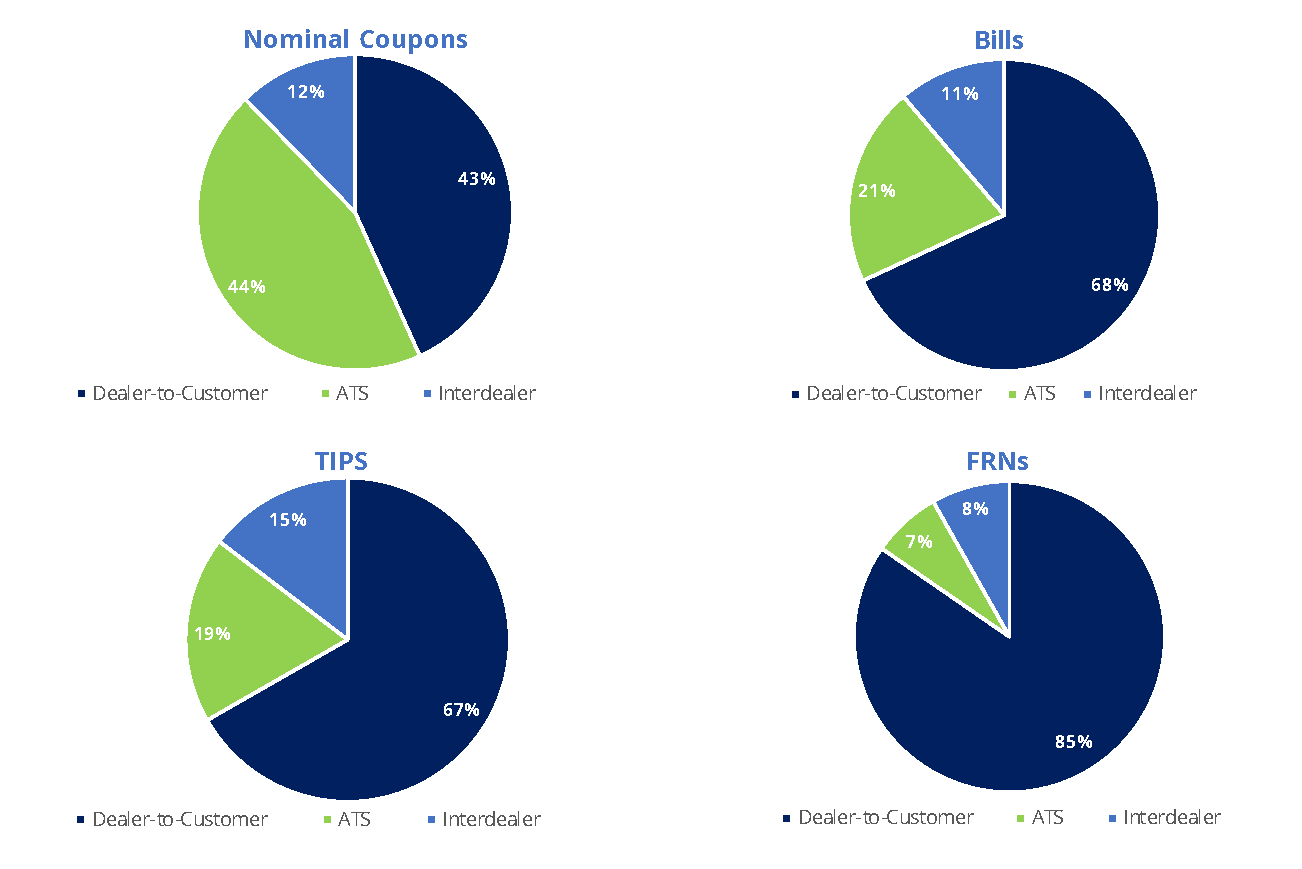

Figure 3.3.4 U.S. Treasuries Dollar Volumes by Product Type and Participant-to-Trade Type, 20221,2

(In percent of product type)

Source: Financial Industry Regulatory Authority. Data as of February 2023.

1 The “ATS" and "Interdealer” categories include the sell side of a trade when, respectively, (1) a trade is executed on an ATS (including ATS sales to non-members or non-member affiliates) or (2) a trade is executed between FINRA members outside of an ATS (i.e. dealer-to-dealer trades). These categories exclude a FINRA member sell to an ATS. This approach takes into account multiple reporting of trades where a trade involves an ATS or both sides are FINRA members.

2 The “Dealer-to-Customer” category includes all trades (buys and sells) reported by a FINRA member against non-members or non-member affiliates. The category excludes ATS transactions with non-members and non-member affiliates (those trades are represented in the “ATS" category as noted above).

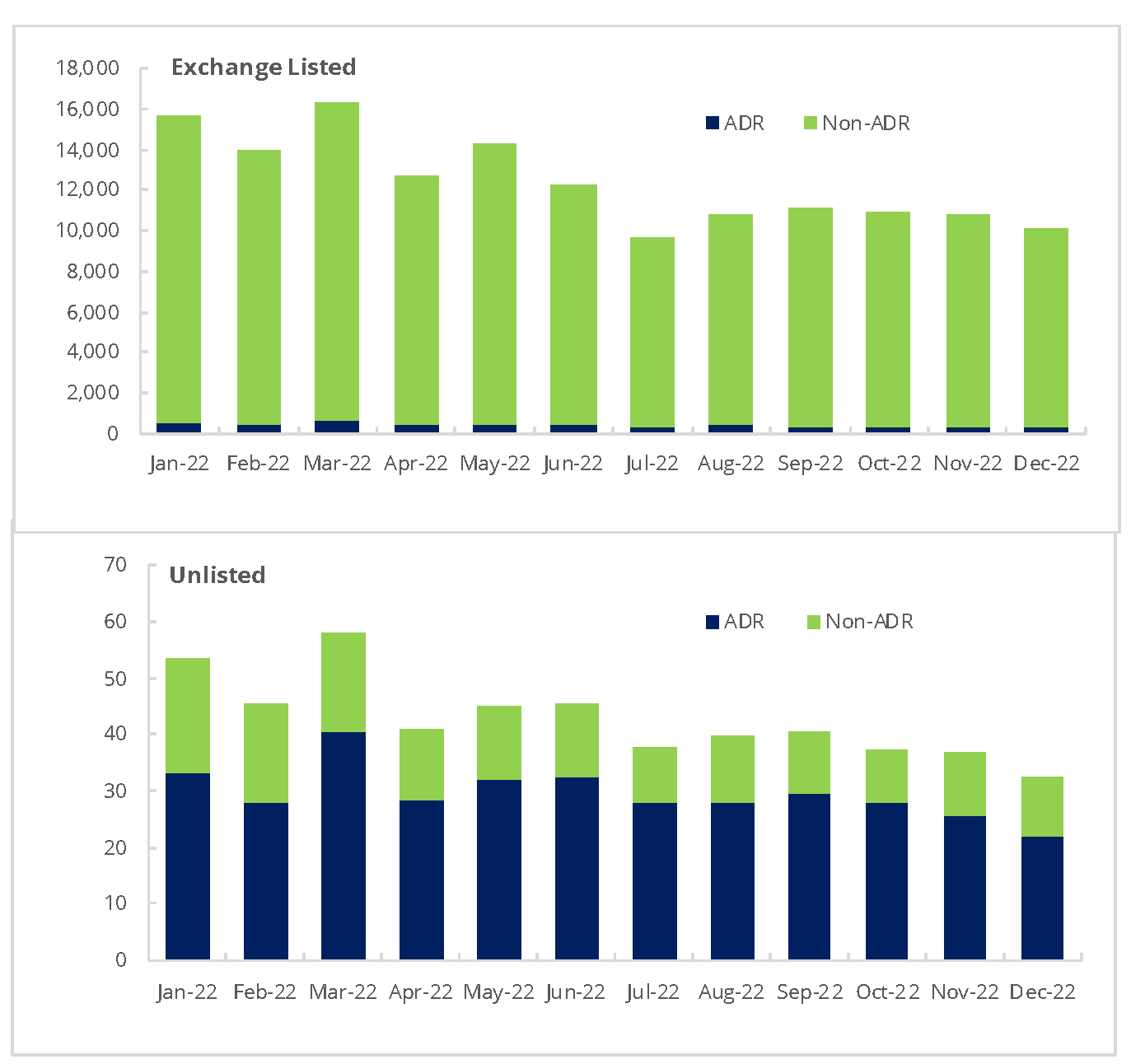

Figure 3.4.1 Monthly Dollar Volume of Equities Traded (ADR vs. Non-ADR) by Listing Status

(January 3, 2022 − December 30, 2022; In billions of USD)

Source: Financial Industry Regulatory Authority. Data as of February 2023.

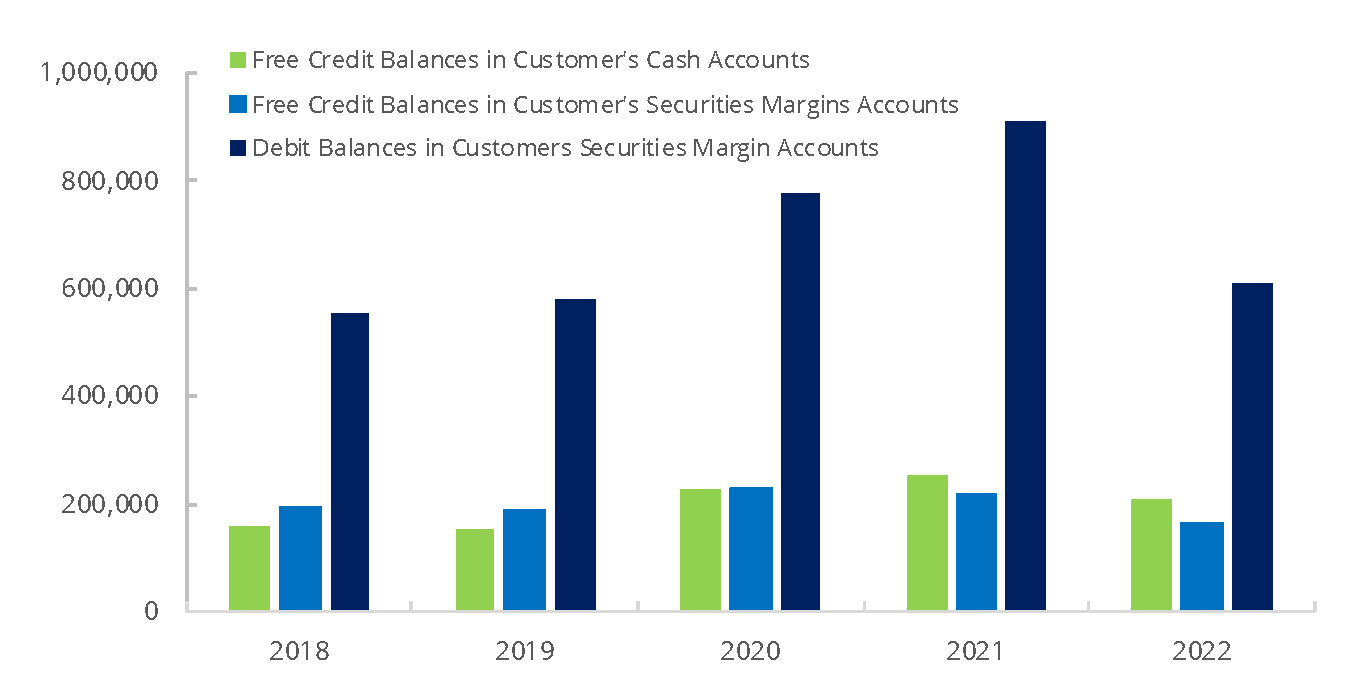

Figure 3.5.1 FINRA-Registered Firms – Customer Margin Balances, 2018−20221,2

(in millions of USD at end of year)

Source: Customer Balance Summary Forms.

1 Pursuant to FINRA Rule 4521(d), FINRA member firms carrying margin accounts for customers are required to submit, on a settlement date basis, as of the last business day of the month, the following customer information: (i) the total of all debit balances in securities margin accounts; and (ii) the total of all free credit balances in all cash accounts and all securities margin accounts.

2 Debit Balances are derived by adding NYSE Debit Balances in Margin Accounts to FINRA Debit Balances in Customers' Cash and Margin Accounts. Credit Balances are derived by adding NYSE Free Credit Balances in Cash and Margin Accounts to FINRA Free and Other Credit Balances in Customers' Securities Accounts.